Asset tokenization is the process to dematerialize financial instruments on blockchain, and many institutions have already taken actions: The European Investment Bank and Société Générale have tokenized 100 million euro bonds respectively in 2021; SWIFT announced plans to explore tokenized assets this year. HSBC predicted that the market could reach 24 trillion USD by 2027. Not long ago, Luxembourg Stock Exchange admitted security tokens listing.

It is obvious that the institutional adoption of tokenized securities has begun. Decision-makers must act quickly to avoid losing market share. Suitable and secure tokenization platforms will be the catalyst for further growth of the adoption, as both compliance and security come down to coding on the blockchain.

Huge potential to save costs and improve liquidity

Traditional capital markets are underpinned by many fragmented and siloed networks with barely any interoperability between them. This leads to an industry that is slow, inaccurate, and costly.

Over the past few years, most financial institutions have studied how tokenization can change this by using shared and distributed ledgers to create a fully digitized experience for investors, reduce compliance and administrative costs for themselves, and improve the liquidity of assets.

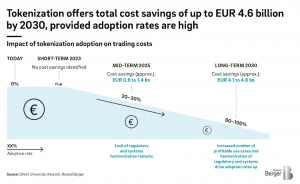

Roland Berger’s study projects that tokenized equity could reduce €4.6 billion on the trading costs by 2030. It accounted for only one asset class, when all other asset classes are taken into account, the cost savings will be much higher.

The technology gap needs to be bridged

While financial professionals have a greater understanding of blockchain technology and its benefits, one question remains: how can they technically tokenize new or already existing securities and still comply with regulations?

As compliance rules are encoded into security tokens, eventually, it becomes a technical matter. Institutions can choose to build their own tokenization platforms, which will take years to develop; or decide instead to find a technology partner, who provides a complete infrastructure with user-friendly interfaces designed for non-blockchain users. The latter option may be preferable since institutions can benefit from the protection of the technical shields provided by experts, freeing financial actors to focus on what they do best: provide high-quality assets and services to investors.

Regardless of their choices, it is essential to ensure compliance rules are well written into security tokens and enforced throughout the lifecycle of asset-backed tokens, as securities regulatory rules must be followed. This can only be achieved by issuing assets as permissioned tokens to set rules and linking them to the digital identities of asset owners.

Code compliance rules through permissioned tokens

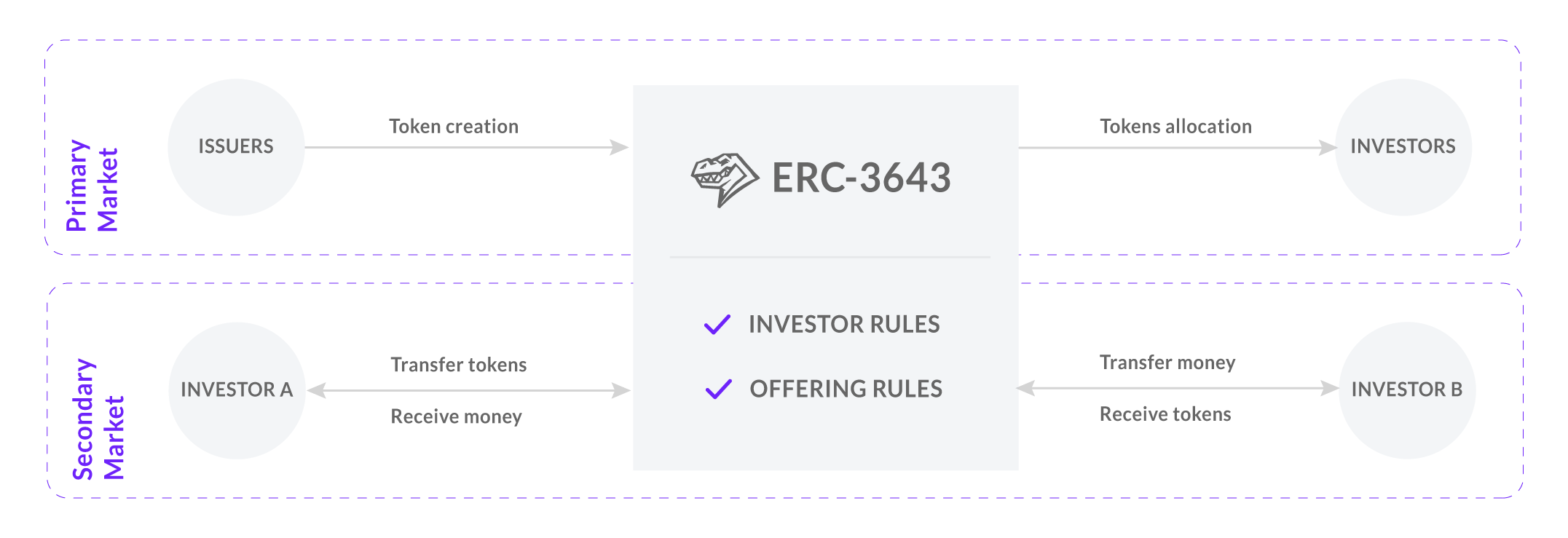

Permissioned tokens act as automated compliance validators, transactions can only be triggered when pre-written eligibility conditions are met. For example, ERC-3643, an official smart contract standard for permissioned tokens, allows issuers to encode investor rules and offering rules into tokens. This assures that token transfers only occur when all conditions have been satisfied in both the primary market and the secondary market.