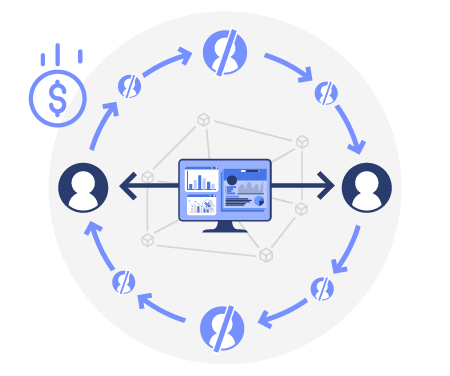

Real Estate investments are currently illiquid, the involvement of middlemen, and lengthy and complex processes result in expensive lending for issuers. Suitable investors are limited and capital formation can be difficult to achieve. Through tokenization, issuers can digitize entire onboarding and KYC processes, automate compliance, and bring liquidity to an asset class that has been starved of it.

How It Works

Tokenization is the process of representing your assets on a digital infrastructure.

Benefits for your investors

Tokenize Your Real Estates

Leave your details below and we’ll get back to you shortly.