The New Financial World: AI Meets Tokenization

Artificial Intelligence (AI) and blockchain are two groundbreaking technologies that have the potential to revolutionize various industries, including finance and investment. When combined, they can create powerful synergies that enable more efficient and optimized decision-making processes. The prospect of these two potent and transformative technologies intertwining is thrilling, yet somewhat daunting, given their virtually limitless potentials.

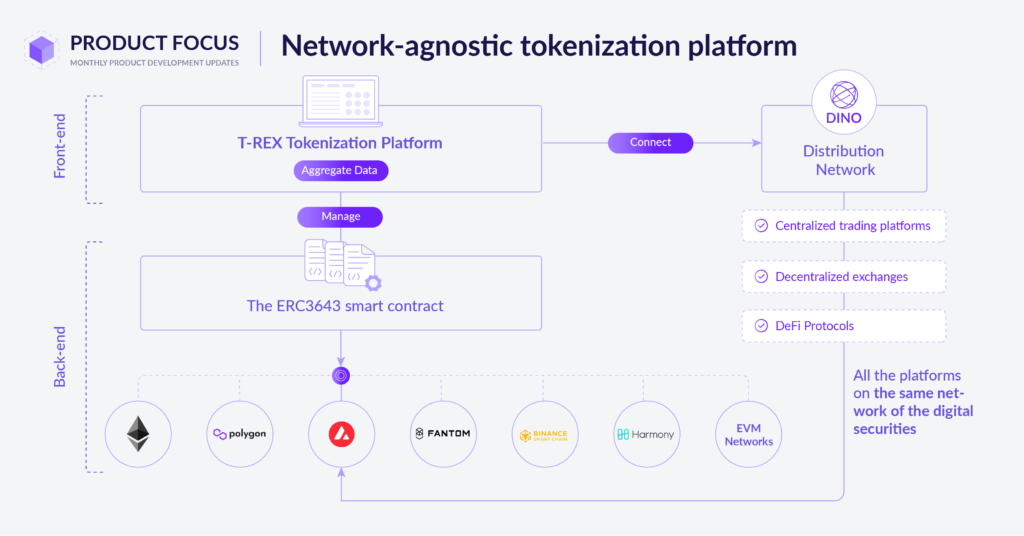

Tokeny has always been at the forefront of technology. In fact, in 2018 we started to bridge AI with tokenization. Identity checks of individual investors are already greatly accelerated by the KYC software solutions that are integrated into our onboarding processes. The software compares investors’ identity documents with the information and “liveness” tests by using AI-powered face scans to verify the user matches the photo on authorized documents. Furthermore, our tokenization platform represents these ID verifications on the blockchain with on-chain identities, which makes these certifications actionable. Token issuers, DeFi protocols, and other relevant users can trust these identity proofs to enforce compliance or filter their participants.

However, this example is just the tip of the iceberg. We believe that AI’s ability to process and analyze vast amounts of data with speed and accuracy is invaluable in the financial realm. It can help investors and financial institutions make better-informed decisions by identifying patterns, trends, and correlations that may go unnoticed by human analysts, or simply take too much time to find. AI algorithms can analyze market data, news articles, social media sentiment, and other relevant information to generate real-time insights and predictions on markets and investment opportunities.

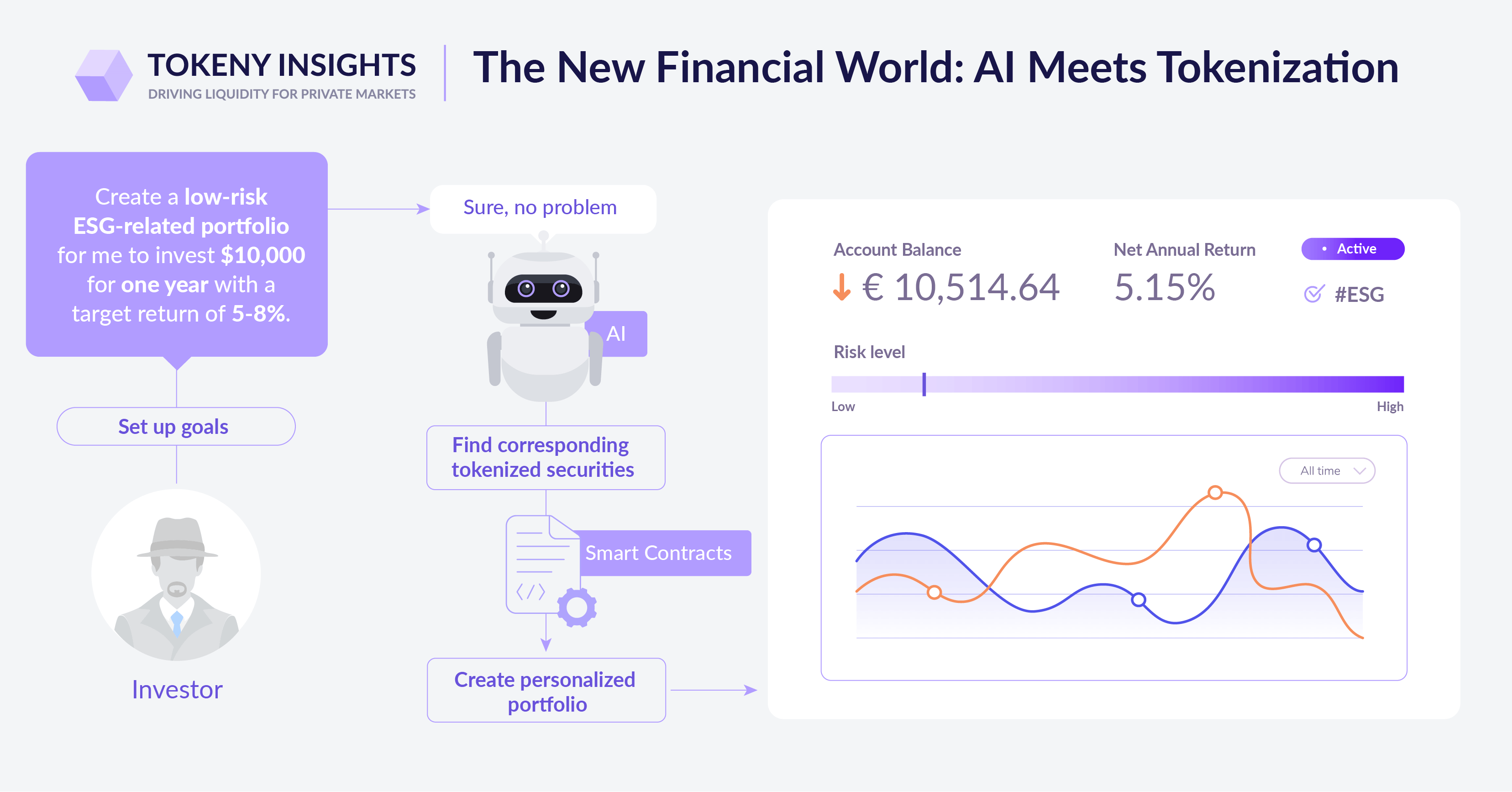

One area where AI excels already is in portfolio optimization. By utilizing advanced algorithms, AI can identify optimal investment strategies based on an investor’s risk tolerance, investment goals, and market conditions. It can analyze historical market data, perform risk assessments, and make dynamic adjustments to portfolios, ensuring they remain aligned with the investor’s objectives. This already exists and is continually evolving at an outrageous speed.

However, without a programmable financial infrastructure, it would be too complex for AI applications to take action based on their conclusions, and achieve the goals requested by its owner. An AI agent cannot easily open a bank account, move money, buy and sell assets, or anything in that nature.

Here is where blockchain technology comes into play: Blockchain networks provide a programmable and secure infrastructure that enhances the transparency, integrity, and trustworthiness of financial transactions, and enables programs to access valuable financial resources. By leveraging blockchain, AI systems can access real-time, tamper-proof market data and execute trades directly on decentralized protocols.

Indeed, smart contracts, a key feature of blockchain technology, enable the automation of financial agreements and transactions. AI algorithms can leverage smart contracts to autonomously execute predefined investment strategies, eliminating the need for intermediaries and reducing transaction costs. Artificial intelligence decides, and the blockchain executes.