February 2024

Tokenization opens the door for asset managers to gain new capital sources from untapped segments – new regions, and new types of investors such as High Net Worth (HNW) investors and family offices, to meet market demand and gain market shares. Illuminating this potential, EY’s report underscores a significant trend: 61% of HNW investors plan to invest in tokenized assets in 2024. Tokenization enables asset managers to tackle the historical challenges rooted in manual, time-consuming processes, and fragmented systems through programmability and shared infrastructure. It empowers them to acquire the capability to efficiently handle a large number of clients and unlock a potential $400 billion revenue opportunity, according to Bain & Company.

Moreover, PwC’s survey shows that 66% of HNW investors desire increased personalization in their wealth management relationship. This trend towards personalized models is also highlighted in Oliver Wyman’s report “10 Asset Management Trends for 2024,” suggesting opportunities for asset managers to compete with wealth manager home offices. Tokenized securities embed asset data, enabling such customization. By offering tailored tokenized portfolios based on clients’ risk profiles, asset managers can attract and retain clients. Tokenization can even combine with AI to allow AI to analyze, and blockchain to execute, creating another level of personalized experience.

Regarding risk management, thanks to transparency, automation, and availability of asset data, asset managers can automatically rebalance portfolios to migrate risks based on predefined risk conditions. For instance, setting up a smart contract to trigger a sell-off when the risk rating level transitions from AAA to AA.

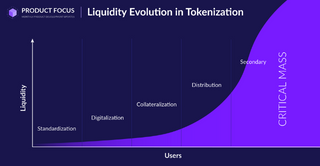

Lastly, as highlighted in Oliver Wyman’s report, a notable trend in the private market is the surge in Limited Partner (LP) secondaries and the emergence of net asset value (NAV-based) lending. These have gained momentum as the return on capital slows, and investors increasingly seek liquidity. Tokenization emerges as a powerful solution, offering diversified products and cultivating liquidity. Tokenized securities, carrying both compliance rules and asset data, enable instant compliant transferability, support peer-to-peer transactions, and integrate seamlessly with third-party trading applications. This enables global and flat distribution. Furthermore, lending smart contracts can be easily launched to allow LPs to pledge their tokenized securities for borrowing.

This emphasis on liquidity is also our primary focus as we build distribution rails to expand the DINO distribution network for tokenized securities, as discussed by Xavi Aznal, our Head of Product, in the last Product Focus newsletter.

We anticipate witnessing the launch of tokenization projects by at least 5 out of 10 of the largest asset managers this year.

Let’s stay tuned for this exciting moment.

Tokeny Spotlight

TALENT INTERVIEW

Already being part of our team for a while, meet Fabio, back-end software engineer.

Tokeny Events

Digital Assets Week Hong Kong

March 7th, 2024 | ?? Hong Kong

ALFI Asset Management Conference

March 19th-20th, 2024 | ?? Luxembourg

Digital Assets Week California

May 21th-22th, 2024 | ?? USA

ERC3643 Association Recap

ERC3643 Association meet-up at ETH Denver

We are calling on attendees of ETH Denver to organize an ERC3643 Association meetup. Are you planning to attend ETH Denver? Let us know, and we will ensure you receive all the details about the gathering.

Webinar: DeFi for the Real World: ERC-3643 Shaping the Future of Regulated RWA Tokenization

Rewatch the webinar by association members Dev.Pro and Tokeny on the transformative potential of DeFi in Real-World Assets Tokenization.

ERC-3643 Tested by Citi

In a recent Proof of Concept, Citi in collaboration with Wellington Management, ABN AMRO, WisdomTree Asset Management, Ava Labs, The DTCC, and Tokeny tested ERC-3643 and its potential to innovate private markets through tokenization.

Subscribe Newsletter

A monthly newsletter designed to give you an overview of the key developments across the asset tokenization industry.

I’m excited to share some exciting news from our side, as we proudly participated in Citi’s tokenization use case to test the ERC-3643 token standard for enforcing compliance on-chain. This showcased how tokenized securities can thrive in a decentralized infrastructure while maintaining compliance and control.

Another noteworthy development is BlackRock’s endorsement of tokenization, heralding it as the logical progression beyond cryptocurrency spot ETFs. In March 2023, just one month after our initial newsletter release, BlackRock made waves by debuting its tokenized asset fund named ‘BUIDL’ on the Ethereum network. This marks a significant milestone for the industry, given BlackRock’s status as one of the world’s largest asset managers, embracing tokenization and a public blockchain. It sets a precedent likely to be emulated throughout the industry.

Now, let’s delve into why asset managers are eagerly embracing tokenization. According to PwC’s research, the top priorities for asset managers in the next two years include accessing new segments and clients, increasing market share, and mitigating risks through product diversification. Below, I will explain how tokenization helps asset managers to achieve these strategic goals.