Webinar: Expert Talk Series

Success Story: ABN AMRO’s Bond Tokenization on Polygon

Watch the webinar recording

Speaker

Boris Spremo

Head of Tokenization

Speaker

Martijn Siebrand

Digital Assets

Speaker

Greg Cignarella

Head of Americas

Moderator

Shurong Li

Head of Marketing

Speaker

Boris Spremo

Head of Tokenization

Speaker

Martijn Siebrand

Digital Assets

Speaker

Greg Cignarella

Head of Americas

Moderator

Shurong Li

Head of Marketing

ABN AMRO Realized Significant Operational Efficiency via the Bond Tokenization

Martijn Siebrand, Innovation Manager-Digital Assets at ABN AMRO, one of the leading Dutch banks, presented ABN AMRO’s tokenized green bond project, launched in September 2023 to help Vesteda raise capital. It allows ABN AMRO to showcase that using blockchain technology as a shared infrastructure enables the bank to offer more efficient and automated solutions to its clients in the debt capital market.

Martijn comparing traditional bonds to tokenized bonds, highlighted the fragmentation in the traditional capital market, which is plagued by manual processes, settlement delays with interest rate risks, and a lack of automation. He emphasized that tokenization brings efficiency, speed, automation, and convenience for issuers and investors.

Navigating Challenges in Embracing Public Blockchain

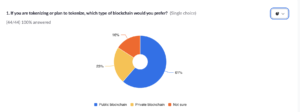

Our poll survey shows that 61% of the audience prefers using public blockchains for tokenizing securities.

Our poll survey shows that 61% of the audience prefers using public blockchains for tokenizing securities.

Boris Spremo, Head of Tokenization at Polygon Labs, explained the key differences between private and public blockchain. He noted that private networks offer compliance and control but suffer from scalability issues as it restricts access and creates silos. Public networks, on the other hand, foster transparency and decentralization but face compliance risks. Martijn mentioned that in addition to compliance risks, public blockchains also face reputational risks. While many market participants like the idea of using public blockchains, skepticism remains because some regulators and institutions are not in favour of them. Thus, the shift to public blockchain requires a change in mindset.

Since one of the major benefits of blockchain in finance is liquidity and market vibrancy, Boris advocates for the use of public networks while easing the risks with a compliance overlay which enables identifying participants and enforcing compliance without sacrificing transparency and accessibility.

The ERC-3643 Standard: Mitigating Risks in Public Blockchain Usage

Our poll survey shows that 68% of the audience believes they can enforce compliance and maintain control over assets on a public blockchain

Innovation is paving the way for compliance and privacy on public blockchains. Boris highlighted the ERC-3643 standard as a primary example. This open source standard utilizes smart contracts to enforce compliance and ensures identity verifications and KYC/AML procedures for transactions. Greg Cignarella, Head of Americas at Tokeny, elaborated on how ERC-3643 builds on top of the ERC-20 standard by incorporating built-in compliance control functions and onchain identity. Additionally, Greg mentioned advancements in homomorphic encryption, allowing data processing without decryption, potentially enhancing privacy on public blockchains.

Martijn once again highlighted the need for a mindset change within the digital asset space to advance innovation. He noted that while there were lots of syndicates in global markets, competitors are often reluctant to collaborate to innovate. Educating market participants and regulators on the risks, benefits, and how smart contract enables controls on public blockchains is crucial to overcoming this reluctance.

Lessons Learned from Successful Tokenization Projects

Martijn shared key takeaways for launching a successful tokenization project stating that companies must first identify the right business sponsor, committed clients for the project, and potential cost savings to determine viability before embarking on a tokenization project. He stressed the need for extensive education to get stakeholders on board, as new technology adoption takes time.

Boris offered a different perspective, urging participants to consider three questions:

- Can we create a new market and undercut incumbents?

- Can we do this in a compliant way on a public blockchain?

- Are we owning the distribution and working to sell the assets we are licensed to issue?

He emphasized that success in tokenization requires companies to actually improve the processes.

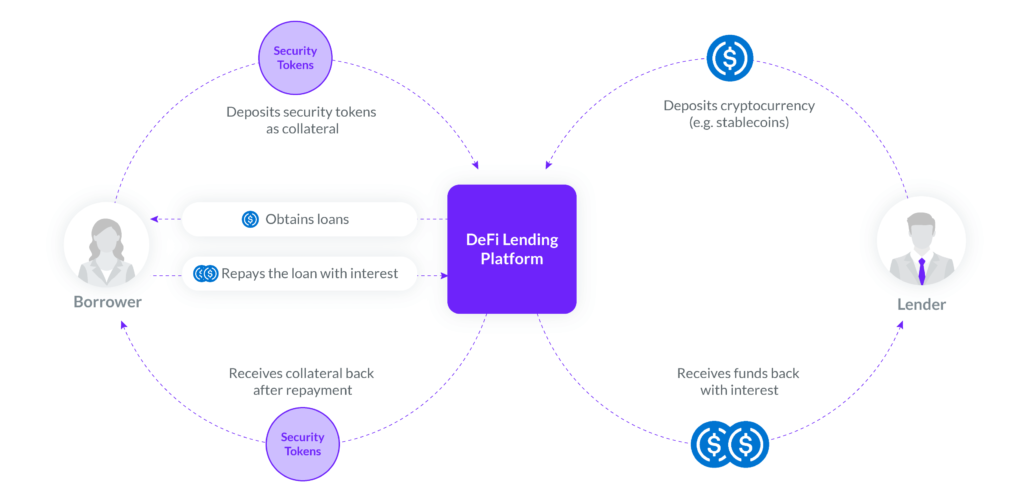

Collateralization: The Next Step in the Tokenization Market

The panel concluded that the future of tokenization lies in its potential for collateralization. They agreed that as technology advances and regulatory frameworks evolve, tokenized bonds and securities will become increasingly integral to the financial ecosystem.