June 2025

Dubai’s real estate market is breaking records.

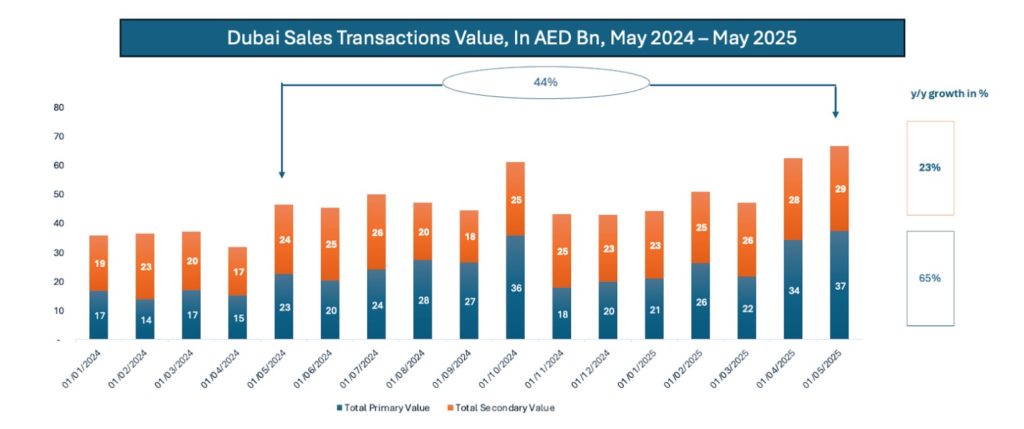

According to data shared by Property Finder, Dubai recorded AED 66.8 billion (~$18.2 billion) in real estate sales across 18,700 transactions in May 2025. That’s a 44% year-on-year surge, driven by both local and international investor demand.

Yet for global asset managers, accessing this market remains complex.

The barriers global asset managers still face

While Dubai’s real estate market is booming, it remains difficult for global asset managers to access directly.

- Legal complexity. Buying real estate in Dubai often requires setting up a local entity or relying on nominee arrangements. These structures are time-consuming, costly, and raise concerns about transparency and control.

- Operational inefficiencies. Servicing investors, tracking ownership, handling subscriptions and redemptions, distributing yields, and maintaining compliance, is still highly manual in most setups. This creates friction, especially for cross-border investors onboarding and ongoing fund administration.

- Limited exit options. Even when fractional shares are available, liquidity is often locked. Without proper secondary market infrastructure, redemption or transfer opportunities are rare, making the asset less attractive for both managers and investors.

How tokenization is changing the game

These barriers are now being removed.

Through tokenization and a local, reputational licensed fund administrator like Apex Group, asset managers can offer Dubai real estate exposure in a fully regulated and digital-native format.

Our solutions, which have now been integrated into the Apex Group’s services, allow asset managers to experience a one-stop shop experience and use the permissioned token standard ERC-3643 to enforce investor eligibility, transfer rules, and compliance logic right into their tokens.

Unlock what wasn’t possible before

- Multi-platform distribution: List real estate tokens across multiple compliant distribution platforms

- Improved liquidity: Enable peer-to-peer secondary market transfers under control

- 24/7 Access: Offer 24/7 subscription and redemption for open-ended real estate funds

- Real-time tracking: Track all activity in real time for full auditability

For asset managers, this means faster launches, broader investor reach, and the ability to offer modern real estate products that meet today’s expectations for accessibility and liquidity.

Market demands are real

On May 1, MultiBank Group, MAG, and Mavryk announced a $3 billion deal to tokenize MAG’s luxury real estate to democratize access to high-end real estate and enable global investors to participate with full legal certainty. Then, on June 11, Dubai saw its second tokenized apartment sell out in 1 minute and 58 seconds, with 149 investors from 35 countries and over 10,700 waitlisted.

Tokenized real estate has found its product-market fit.

Why it’s working now: Clear rules from VARA

On May 19, Dubai’s Virtual Assets Regulatory Authority (VARA) updated its Rulebook to formally regulate tokenized real-world assets (RWAs) under the new Asset-Referenced Virtual Assets (ARVA) classification.

The regulatory clarity is in place. The infrastructure is proven. The demand is there. The future? Real estate tokens will increasingly plug into broader digital finance ecosystems, including lending, automated market making, and 24/7 liquidity via compliant DeFi.

Dubai is showing the way, and we’re ready to help you lead.

Tokeny Spotlight

Apex Group Acquisition

Apex Group announces the acquisition of a majority stake in Tokeny. A major milestone for tokenized finance.

NASDAQ TradeTalks

Our Head of Americas, unpacks the real challenge behind institutional adoption of digital assets.

Press Release

MTCM Securitization Architects partners with Tokeny to launch dual-format issuance framework.

Tokeny Talent

Learn about Thaddee Bousselin, who has been at the forefront of Tokeny’s implementation team.

Tokeny & Apex Celebration

Tokeny and Apex Group celebrate the integration of our technology and team into the Apex family.

Tokenizing Infrastructure

Our partner DitoBanx is bridging the Atlantic and Pacific Oceans with security tokens.

Tokeny & Apex Celebration

Tokeny and Apex Group celebrate the integration of our technology and team into the Apex family.

Press Release

KERDO partners with Tokeny to unlock accessibility in private markets for European professional investors.

Welcome to The Team

Sergi Roca joined us in December as a Blockchain Developer. We’re thrilled to have you with us.

Tokeny Events

ETHcc

June 30th – July 3rd, 2025 | ?? France

Real World Asset Summit

July 1st, 2025 | ?? France

ERC3643 Association Recap

The First ERC3643 Podcast is Live

Dennis O’Connell, and Luc Falempin, come together in the first episode to explain ERC-3643 and share behind-the-scenes insights on how the standard was built and where it’s going.

Watch the Podcast here

The ERC3643 Association Proudly Welcomes 24 Selected New Members Building the Future of Onchain Finance With Us

The momentum for RWA tokenization is growing, fast. With backing from major financial institutions and innovative blockchain builders, the collaboration to bring capital markets onchain is more powerful, and more coordinated, than ever.

Read the full press release here

Subscribe Newsletter

A monthly newsletter designed to give you an overview of the key developments across the asset tokenization industry.