UPGRADE TO ONCHAIN FINANCE

Streamline Distribution and Cut Costs.

Issue, manage, and distribute assets on blockchain while ensuring compliance

Total Value Tokenized

Satisfied Customers

Blockchain Events Indexed

Trusted by institutions since 2017

UPGRADE TO ONCHAIN FINANCE

Issue, manage, and distribute securities on blockchain while ensuring compliance

Total Value Tokenized

Satisfied Customers

Blockchain Events Indexed

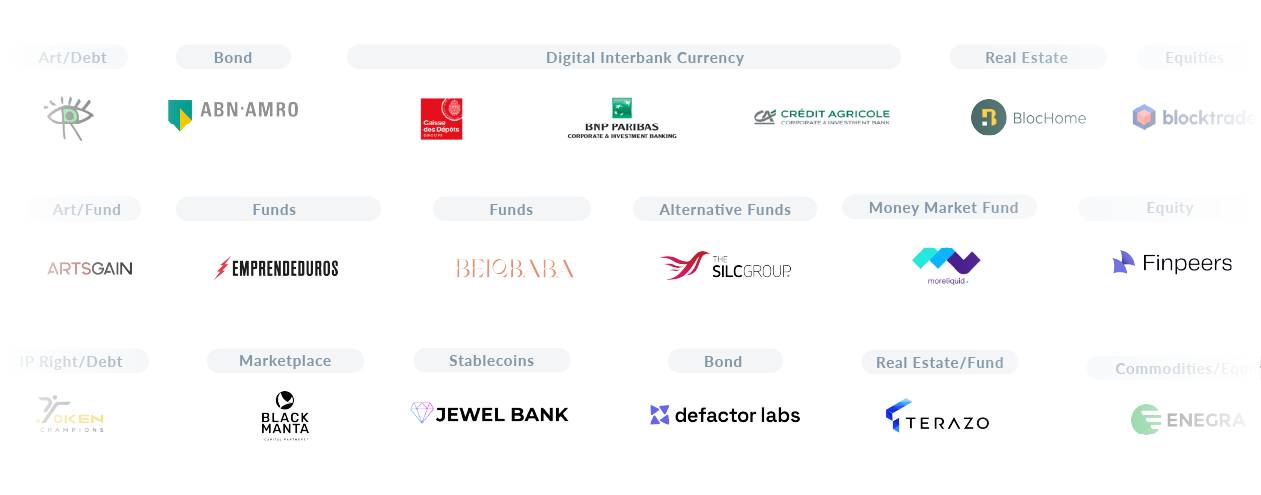

Selected by

Enterprise-Grade Tokenization Made Simple

Enterprise-Grade Tokenization Made Simple

Issue tokenized securities

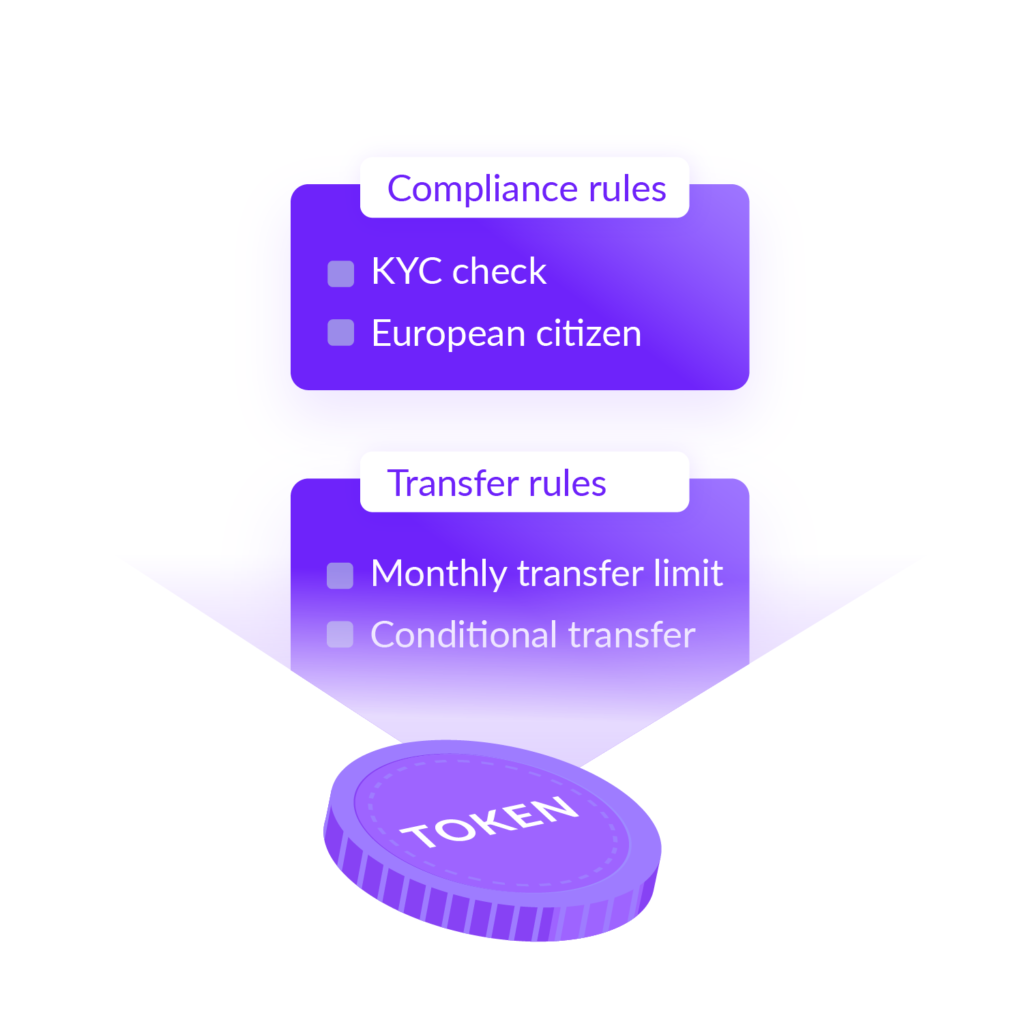

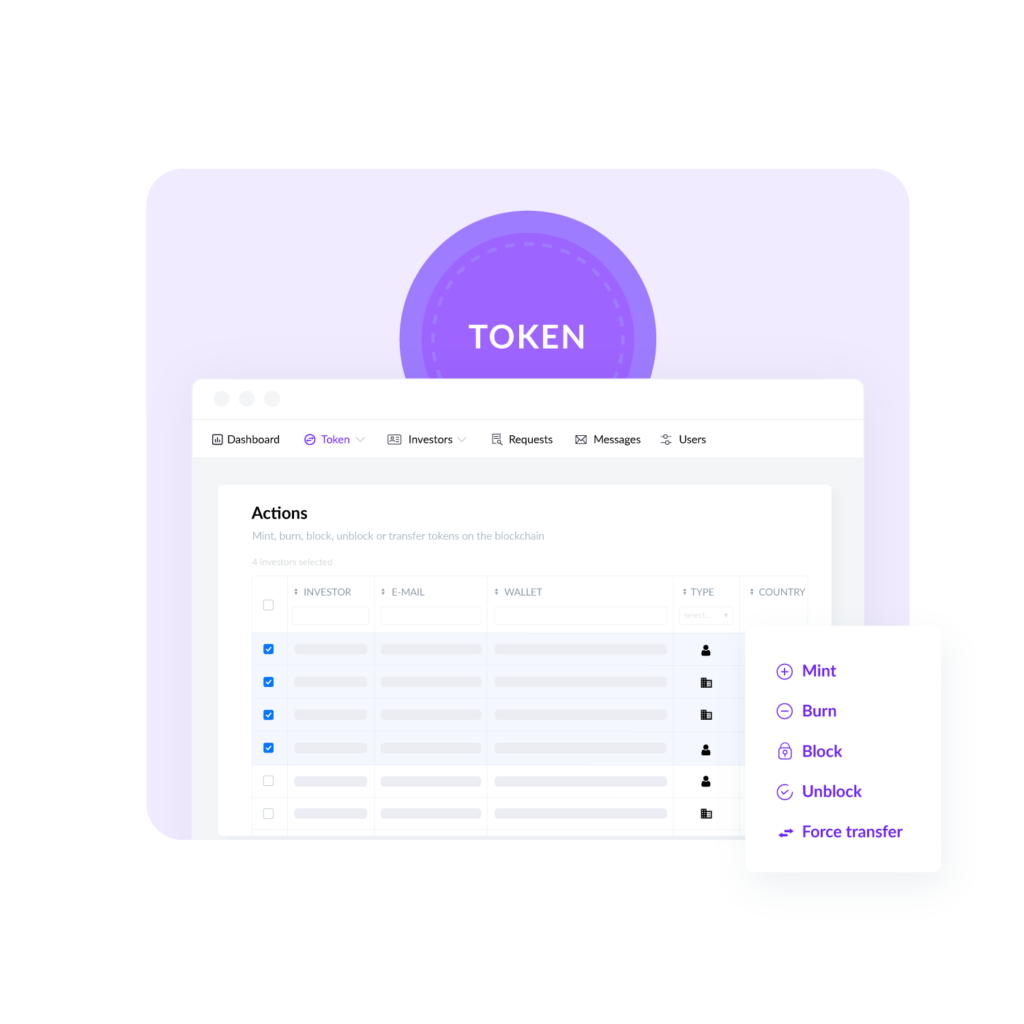

Set up asset information, compliance, supply, and transfer rules while automating token deployment with no-code solutions or APIs.

Manage the lifecycle of securities

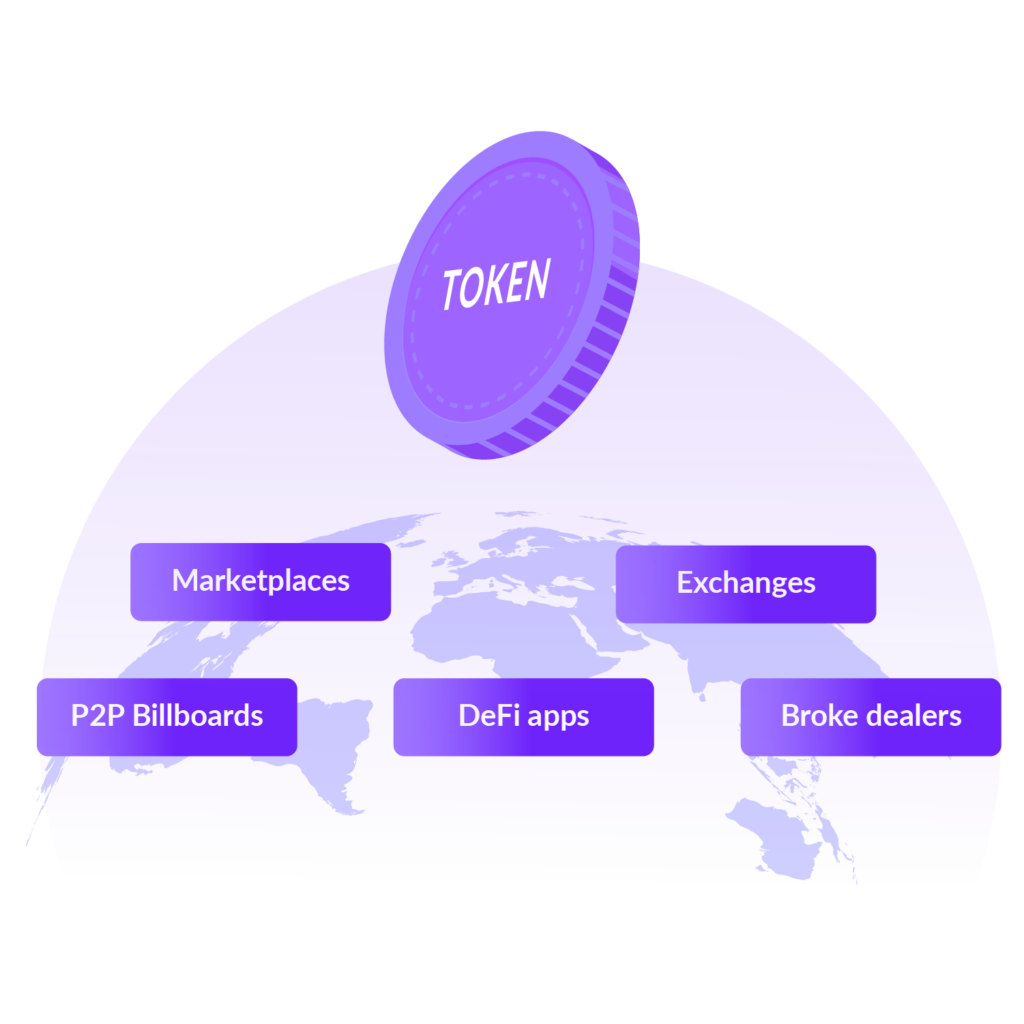

Distribute to open networks

Enable multiple distribution channels and connect to DeFi, all while enforcing compliance in every transaction.

Interoperable and Compliant by Design

Interoperable and Compliant by Design

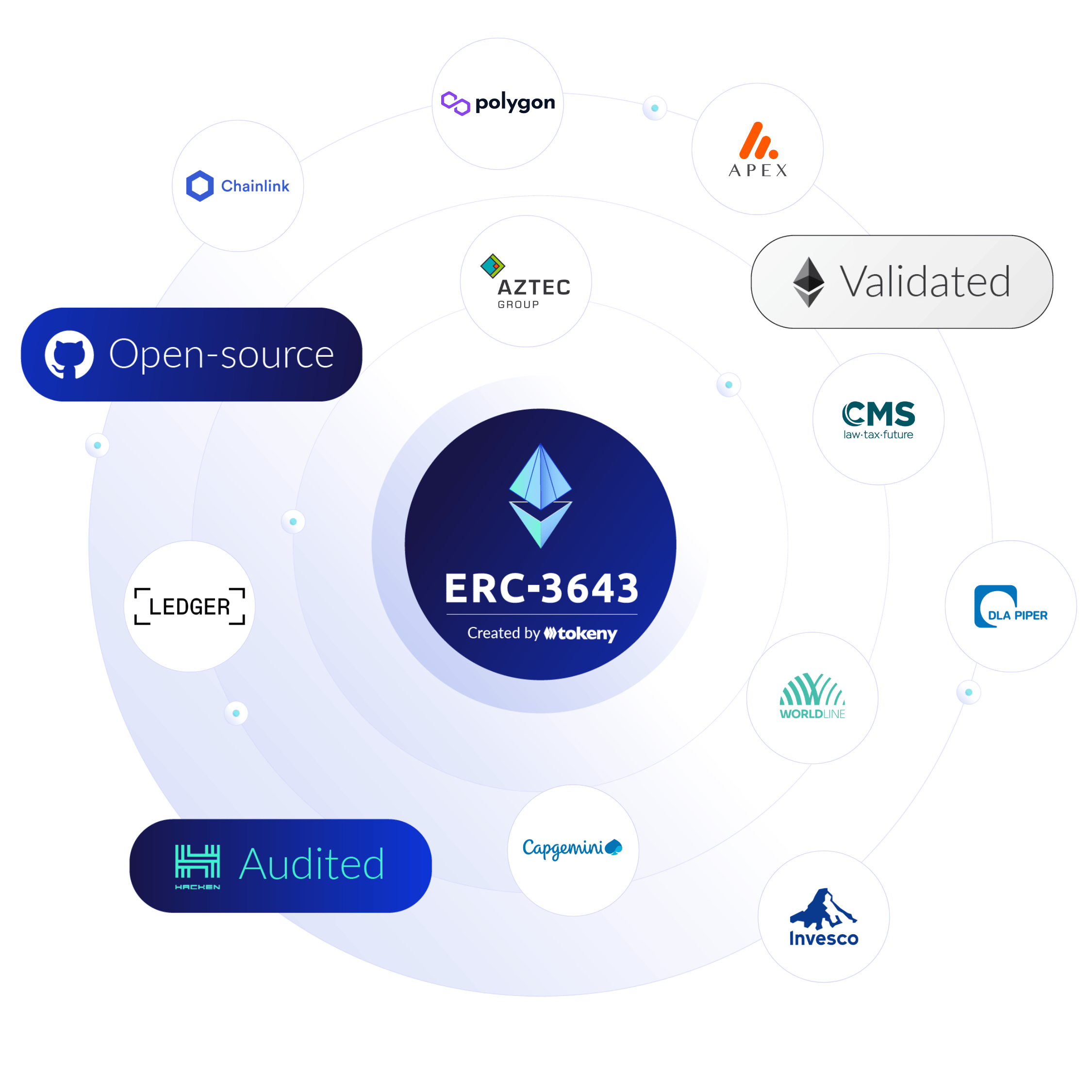

The Pioneer in Compliant Tokenization

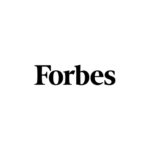

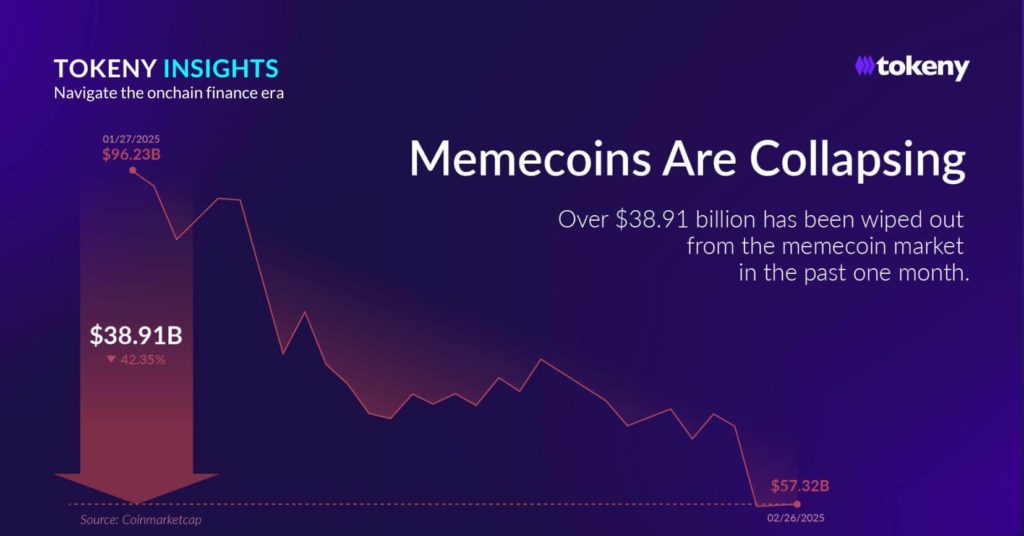

Without a standard, we will recreate silos in the era of tokenization. In 2018, we created the open-source ERC-3643 standard to address this issue. Recognized as the sole official ERC standard for compliant tokenization and audited by Hacken, it is now acknowledged by industry giants as the market standard.

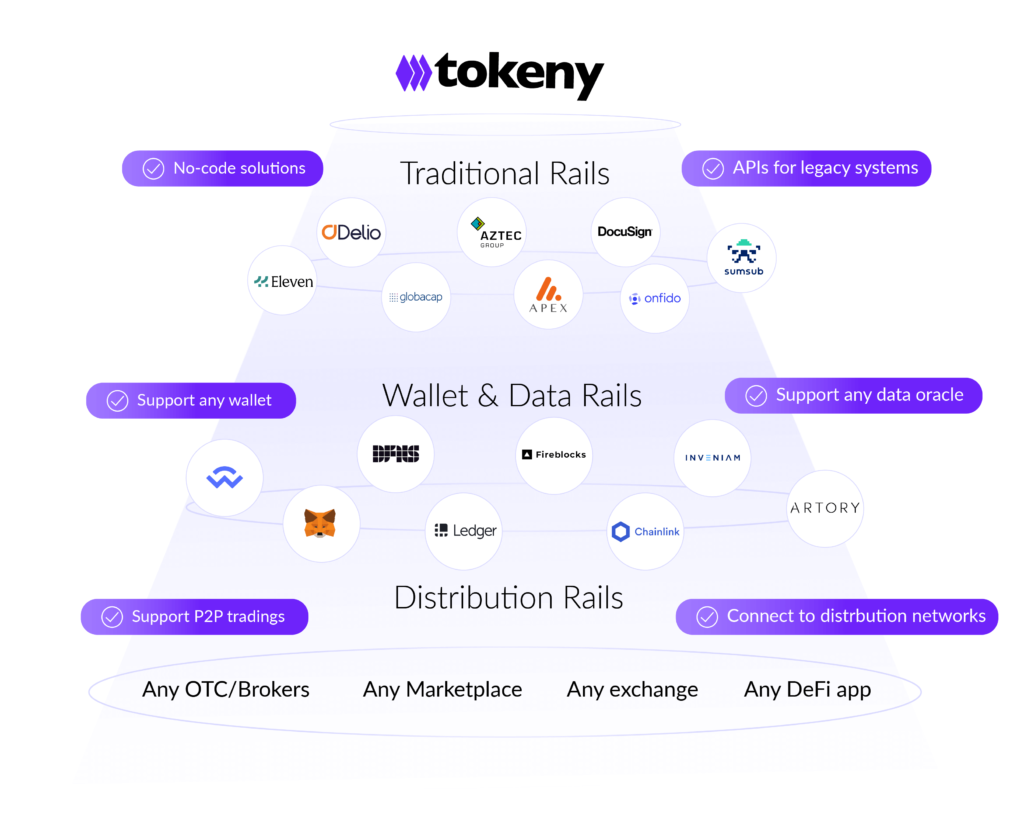

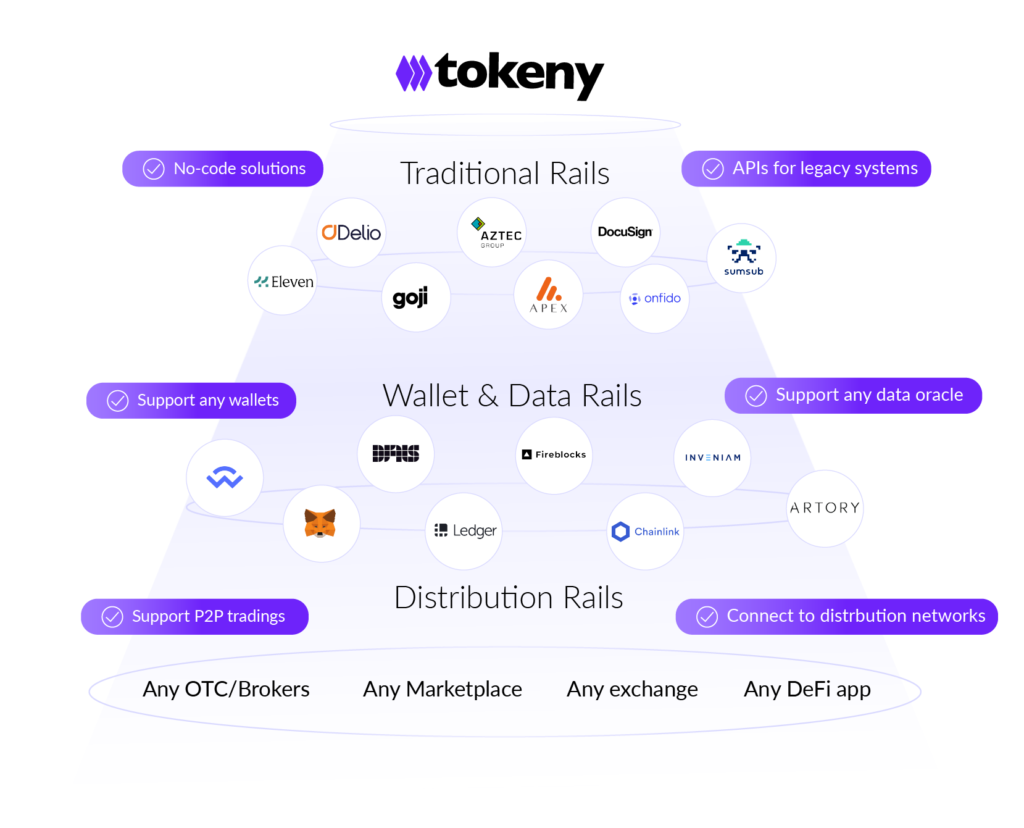

Gain immediate access to a fully integrated ecosystem with an orchestration solution

We navigate you through the complexities of tokenization by partnering with selected industry leaders. With 7 years of experience and over 120 customers, we have integrated with all necessary tools, ensuring a seamless and efficient process.

Gain immediate access to a fully integrated ecosystem with an orchestration solution

We navigate you through the complexities of tokenization by partnering with selected industry leaders. With 7 years of experience and over 120 customers, we have integrated with all necessary tools, ensuring a seamless and efficient process.

Featured on

Expertise forged through tokenizing $28 billion across 120+ successful use cases.

We are confident that our collaboration with Tokeny, a leader in this revolutionary field, will pave the way for innovative, digitized financial solutions that meet the evolving needs of our clients and the market.

With the implementation of the ERC-3643 standard through Tokeny’s sophisticated tokenization platform, we have successfully embedded compliance rules into our digital bonds.

We tokenize assets in a real partnership spirit with the Tokeny team that has a perfect understanding of our business case and is able to provide tailored solutions, allowing us to focus on our core business.

Resources

Learn more about real world asset tokenization with our resources.