December 2024

Last week, Bitcoin hits $100k!

This milestone, fueled by institutional adoption and a promising regulatory shift under new SEC Chair Paul Atkins, sets the stage for a transformative 2025 in onchain finance and tokenization. It is clear that institutional capital is going onchain, it is crucial to start bringing assets onchain now. The tokenization trend is inevitable.

But to reach that tipping point, we must overcome a few critical challenges.

Challenge 1: Lack of Actionable Data

The Problem:

Private assets often lack actionable data that allow all ecosystems to easily read the data of the tokens, such as Net Asset Value (NAV). Without this, other applications like data aggregators, distributors, and other service providers, can not provide accurate data to their audience.

The Solution:

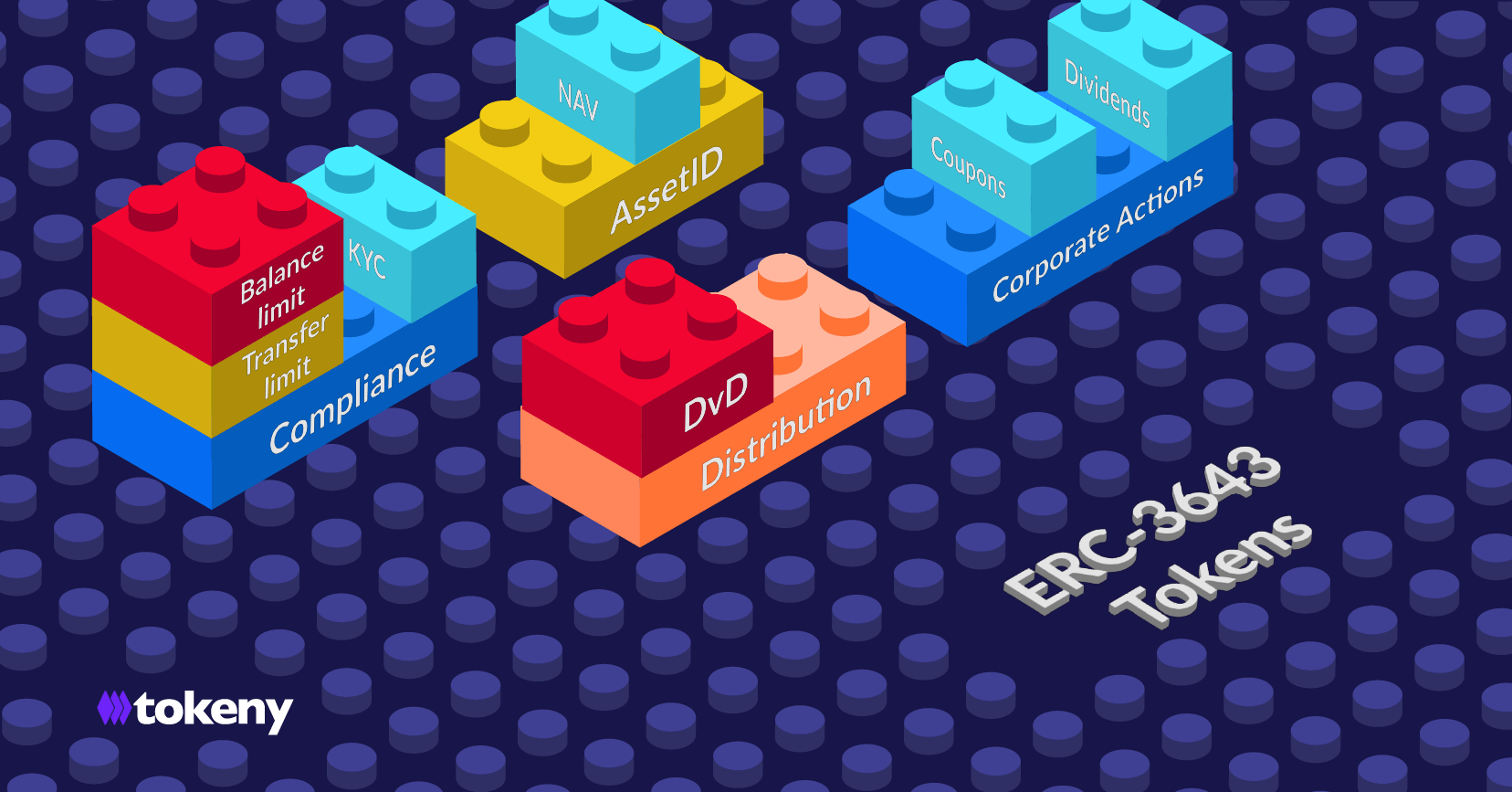

ERC-3643 is designed to solve this. With its built-in AssetID smart contracts, tokenized assets gain a unique onchain identity. Asset data (Asset type, NAV, ISIN, LEI, ESG ratings…) can be verified and directly linked to AssetID. This allows the ecosystem service providers to access verified asset information.

Challenge 2: Limited Accessibility

The Problem:

Despite the promise of tokenized RWAs, they remain out of reach for most investors. Take BlackRock’s tokenized money market fund, BUIDL, as an example. Its $454 million market cap in Ethereum is held by just 23 investors, with 40% owned by a single Web3 company. High minimum investments exclude smaller investors from participating. Many institutions are still hesitating to open their onchain products to retail investors. They are afraid of losing control and fail to enforce compliance.

The Solution:

The ERC-3643 token standard enables issuers to tokenize more accessible financial products while maintaining full control and automated compliance. ERC-3643 tokens are permissioned tokens. They ensure issuers decide who can participate, and under what conditions, and even allow for token freezing or recovery. Issuers can scale by using this token standard and open onchain assets to smaller investors. The protocol has already been used many times to tokenize securities available to retail investors, such as open-ended public funds, or even with prospectus exemptions in Europe.

Challenge 3: Fragmented Liquidity

The Problem:

Secondary markets for RWAs remain siloed. Distributors can only offer assets within their isolated order books, leaving unmatched trades, inactive markets, and frustrated investors.

The Solution:

Shared liquidity. Imagine all distributors leveraging a shared order book while retaining full control of their platforms and investor relationships. In the new era of tokenized assets, trading offers are universal. Investors publish a trading offer on one platform, and it is instantly visible across all others. Smart contracts ensure compliance by design: Onchain identity checks confirm the buyer’s eligibility, enforce transfer restrictions, and verify wallet balances. Unauthorized transactions are denied instantly. The best part is delivery vs payment enabling instant settlements. Trades are completed in seconds without counterparty risk or intermediaries, creating a seamless and risk-free experience.

This vision is no longer theoretical. ERC-3643 tokens, combined with the open liquidity protocol DINO, make it a reality. By sharing an onchain catalog of offers, blockchain has been turned into a giant marketplace.

But unlocking this potential requires collective action.

- For asset issuers: Adopting the open source ERC-3643 standard ensures compliance and future interoperability.

- For asset administrators: Defining their operating models to support seamless onchain operations.

- For distributors: Connecting to the ERC-3643 catalog of tokens and starting managing onchain transactions.

At Tokeny, our mission is to provide the best in class tokenized assets orchestration platform and expertise for all stakeholders to thrive in this financial revolution, empowering institutions to upgrade finance, onchain.

Change is no longer optional, it’s an opportunity, let’s make 2025 a bull market for RWAs!

Tokeny Spotlight

EVENT

DAW Panel with Apex Group on: How will mass customization shape the future of asset management?

EVENT

Attended Applied Blockchain with one clear message: Without standardization, onchain finance will be in silos.

INTERVIEW

Our CEO Luc Falempin interview by NASDAQ to discuss the need for breaking down industry silos.

PODCAST

CCO, Daniel Coheur spoke on the Digital Pound Foundation podcast about: Tokenized MMF.

NEW TEAM MEMBER

Meet Christian Stricker our Digital Marketing Intern. Welcome to the team!

Tokeny Events

Abu Dhabi Finance Week

December 9th – 12th, 2024 | ?? UAE

Luxembourg Blockchain Week

December 9th – 13th, 2024 | ?? Luxembourg

ERC3643 Association Recap

Recognition by MAS

ERC-3643 is recognized as the official standard in the Project Guardian of the Monetary Authority of Singapore (MAS).

Subscribe Newsletter

A monthly newsletter designed to give you an overview of the key developments across the asset tokenization industry.