This week could go down as a watershed moment for the crypto industry. Coinbase, a digital asset marketplace (DAM) for cryptocurrencies, listed on the Nasdaq just yesterday. When Netscape IPO’d in 1995 it was the beginning of the ‘dot-com’ boom, and a spate of other like-minded companies went public. What does this mean for the digital asset industry?

The news is undoubtedly positive for the rest of the blockchain industry, Coinbase was one of the first Digital Asset Marketplaces (DAM) to emerge as a trusted platform. It won’t be the last. Other types of marketplaces have also accelerated recently. As we recently saw with the emergence of NFTs, a number of asset specific marketplaces such as OpenSea and Rarible grew in tandem. Decentralized lending marketplaces have also emerged such as Aave and Compound. The next wave will be for security tokens. Now that the technology is ready, the missing piece is a recognized financial institution launching its own digital asset marketplace.

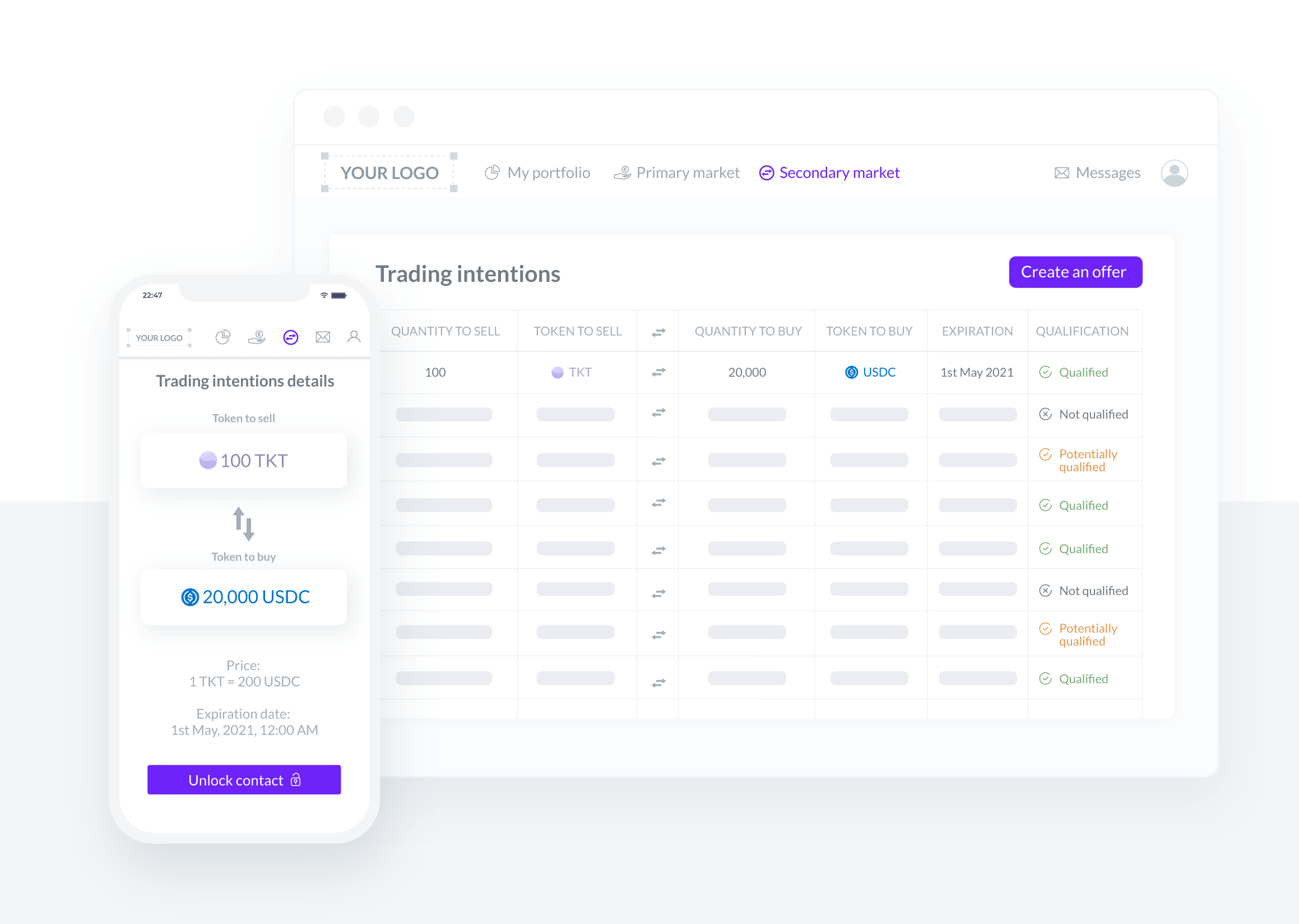

Indeed, the industry needs a credible entity to aggregate an audience of issuers and investors in a trusted and digital environment. These web platforms, powered by banks, asset managers and broker dealers, will help digitize capital markets by facilitating the discovery of investment opportunities. In turn, this will accelerate the qualification and subscription of investors, reducing management costs by digitally controlling securities, and ultimately improving liquidity.

All of this will become possible thanks to the use of a shared IT infrastructure, the blockchain, where all participants can manage and transfer assets digitally, under the control of securities issuers and marketplace operators. Using the same infrastructure creates significant network effects, where entities bringing trust will aggregate the main transactions volumes.

With the Billboard release last week, the first secondary market solution for tokenized securities available in Europe, we now propose an end-to-end solution for marketplace operators.