Crisis Resilience: How Tokenization Could Empower Banks

The recent bank crisis has sparked concerns and uncertainty in the financial world. With the takeover of Credit Suisse by UBS, and the collapses of Silvergate Bank, Silicon Valley Bank, and Signature Bank. We want to share some of our views on the role tokenization may play in the future of banking.

Bank Runs: Crisis Calls for Transparency and Trust

Countless bank runs have occurred throughout financial history, as no bank can survive a situation where a large number of depositors demand repayment simultaneously. Banks mostly generate income by lending deposited funds at higher interest rates; they cannot maintain enough cash reserves to cover all deposits at once.

The Twitter-era Bank Crisis Spreads Contagiously Faster Than Ever

Swift information dissemination via social media and mobile banking accelerates the potential for bank runs. In a single day, Silicon Valley Bank’s customers withdrew $42 billion, far exceeding the largest bank run in modern U.S. history, which happened at Washington Mutual in 2008 and totaled $16.7 billion but took 10 days to transpire.

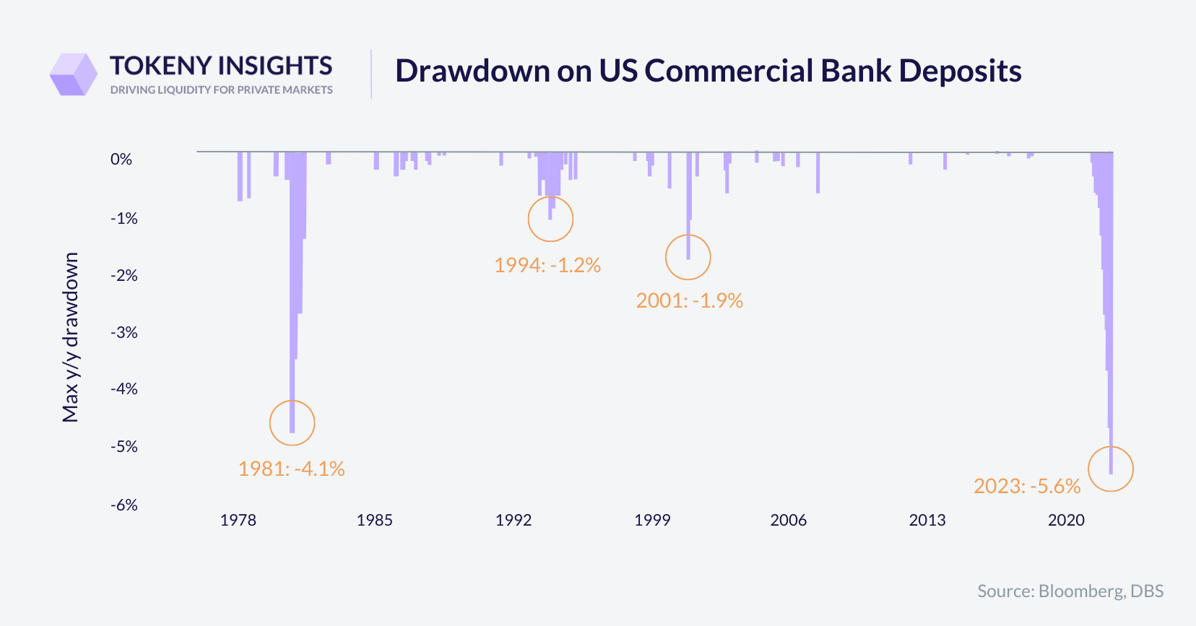

As the banking crisis continues, people are increasingly distrustful of keeping their money in banks, as illustrated by the following chart. According to DBS, in 2023, US commercial banks experienced their largest deposit drop in four decades, surpassing even the 1981 Volcker-era decline. This situation calls for banks to enhance risk management and transparency to regain depositors’ trust.