[ez-toc]

Blockchain technology, though in the mainstream for less than a decade, has already seen a meteoric rise. The boom has been reminiscent of previous groundbreaking innovations like the printing press, the lightbulb, and the telephone. What the internet was for information, blockchain is for value. While price fluctuations of crypto and NFTs dominate headlines, the true potential of blockchain lies in its application to RWA (real-world assets) and securities. ERC3643

However, when dealing with RWA and securities, regulatory bodies worldwide have many requirements that must be abided by. But how do we enforce these guidelines while operating on a public blockchain infrastructure? The implementation of ERC3643 solves this problem.

How RWAs are the next stage in the blockchain evolution

In the fledgling years of blockchain, many were led to believe that crypto and NFTs are the most transformational innovations to come out of decentralized technologies.

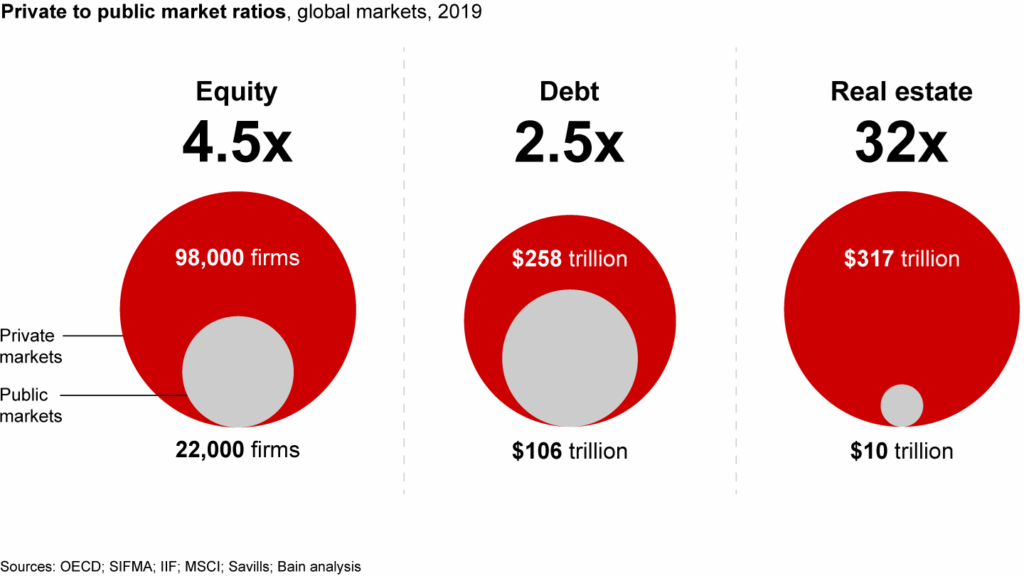

In fact, that couldn’t be further from reality. The reality is it doesn’t even come close to the global market cap of RWAs. According to CoinMarketCap, as of September 1st, 2023, the overall crypto market cap is $1.09T.

To put that into perspective, according to a report titled: “For Digital Assets, Private Markets Offer the Greatest Opportunities” published by Bain and Co, the global real estate market alone exceeds ˜$330T. The overall crypto market size is about 0.3% of this market alone, not to mention the entire capital market.

When combined with all private and public assets worldwide, RWA vastly surpasses the market cap of crypto, NFTs, and other blockchain subsets put together.

Blockchain is a transformative technology with numerous applications. Its potential is immense when tailored to RWA. The primary reason we haven’t unlocked the vast value and potential of these assets yet is their predominantly private nature. The private markets are notably fragmented and opaque. This results in operational inefficiencies, which blockchain aims to eliminate.

The complexities and inefficiencies that exist in the private markets today

Traditionally, for investors in the private sector, addressing liquidity and finding a market for private investments is a critical challenge globally. Despite the potential for higher returns in the private sector, an illiquid investment can be a problem without an active market or willing buyers.

The main reason for this pitfall is the outdated and fragmented infrastructure of the current framework. Due to this limited infrastructure, the buying and selling process of private assets becomes inefficient. This leads to a significant liquidity discount and sometimes even the avoidance of transactions.

Whether you own a real estate property, a limited partner (LP) interest in a fund, or a stake in a private company, the seller has to take some arduous steps in order to find a willing buyer.

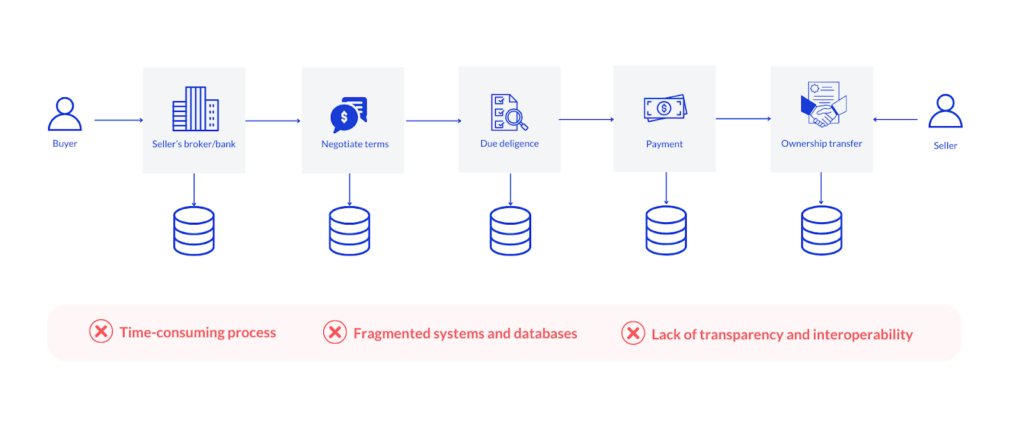

The process includes:

- Sourcing a buyer

- Negotiating the terms of the sale

- Conducting due diligence

- Transfer of ownership

The duration of the process involved in private market transactions can be prolonged. Often, it can span from several weeks to several months and, in some cases, even years. It is a high-cost and time-consuming process that would be improved if conducted on the blockchain.

The good news is in every fragmented market, there is room for innovation and disruption, which is where blockchain comes into play. A suitable blockchain standard must be specifically designed with smart contracts to meet regulatory needs and unlock the vast value of these assets.

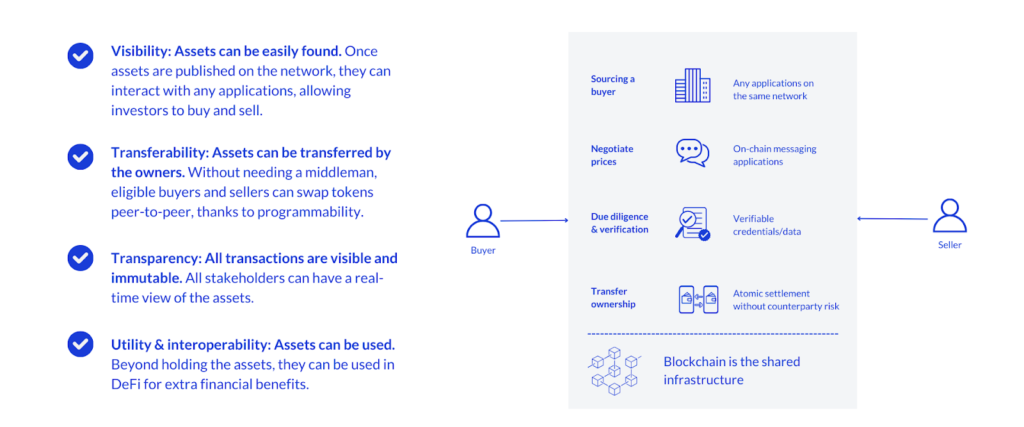

When conducting the same activities on a blockchain-based system, many of these processes previously mentioned steps are achieved in a vastly faster and more efficient manner.

Here is what is different in the four steps mentioned above in the traditional private market, versus when using ERC3643:

- Sourcing a buyer: Personal networks, word of mouth, or by working with an intermediary, such as a broker-dealer or investment bank.

- Negotiating the terms of the sale: This can involve several rounds of discussions and revisions before both parties agree on the terms of the sale.

- Conducting due diligence: This can involve reviewing financial statements, legal documents, contracts, and other company records, as well as the buyer’s eligibility. The entire process requires document sharing via mail, emails, and sometimes even through a fax.

- Transfer of ownership: This is the end of the lifecycle and where the ownership of the asset or security actually changes hands. In many cases, the ownership is contained in Excel sheets. In other cases, there is a clearing process; custodians of buyers and sellers have to ensure payment has arrived before transferring the ownership.

- Sourcing a buyer: Once assets are published on the blockchain network, it is made available to interact with any applications on the same network, allowing asset holders to have direct access to a vastly larger amount of potential counterparties. It could be on a multitude of marketplaces, including centralized exchanges, decentralized exchanges, even using your security as a means for staking or collateralized loans, and more.

- Negotiating terms of the sale: On the trading platforms, the negotiation is up to the market and supply and demand. On the platform, the investor is seeking a counterparty, not so much negotiating with one individual, making it a more streamlined process. For peer-to-peer trading, on-chain or off-chain negotiations can take place to reach an agreement.

- Conducting due diligence: A verifiable due diligence certificate can be made available and embedded into the tokens. Moreover, counterparts’ eligibility can also be verified by smart contracts directly through verifiable credentials. The entire process is streamlined to improve efficiency while ensuring compliance.

- Transfer of ownership: If the payment method is a token (stablecoins, tokenized cash, or crypto), the transfer/swap of tokens is instant without counterparty risk. The ERC3643 smart contract ensures transfers only occur when investor and offering rules are met, enabling peer-to-peer transfers, which was impossible before in the traditional world.

How does RWA tokenization work?

We must ensure compliance since tokenized RWA are securities. In most jurisdictions, RWA must be owned by an investment vehicle, and investors will invest in the financial products that this vehicle structures, such as shares or debt. These financial products are securities that require enforced compliance based on existing regulations. This means that only certain investors can become asset owners (e.g., KYC’d European citizens). In Europe, the MiCA regulation clearly defines security tokens as securities, necessitating adherence to MiFID, the existing securities regulations.

Comparing and contrasting the major token standards

When one uses the term “standard,” it refers to a predefined set of rules or guidelines tailored for a specific purpose. Such standards ensure consistency and uniformity, allowing diverse applications and assets to interact smoothly through the interoperability offered by a blockchain network.

However, standards can bring certain limitations and when trying to utilize them for a specific purpose or use case. Take RWA, for example. A standard is needed that can potentially deal with hundreds of different jurisdictional securities laws for a multitude of parties, all automatically executable on-chain. That is no easy job to do.

Now that one has a good understanding of what a standard is, let’s break down some of the more commonly utilized standards like ERC20 and ERC721.

ERC20 is a permissionless token standard. It is the most commonly known and used standard today and defines a set of simple rules that developers can follow to create their own tokens on the Ethereum blockchain or any EVM-compatible blockchain. This standard relates to fungible tokens, meaning they are identical in both type and value. This feature enables their easy exchange on platforms like trading exchanges and for various similar functions. Any token and platform compatible with ERC20 are interoperable.

Common examples:

- Tokens: WETH, BAT, USDC

- Exchanges: Decentralized exchanges like Uniswap or Sushiswap are compatible with all ERC20 tokens

- Other DeFi governance tokens: Aave, Compound

ERC721 is a popular standard employed in the non-fungible token (NFT) domain. Unlike ERC20 tokens, which are interchangeable with one another, ERC721 tokens are innately unique. Each token issued from the smart contract represents ownership over a specific digital asset. Their unique nature makes them ideal for applications like collectibles or any item that demands distinct representation.

Common examples

- NFTs: Bored Apes, Cryptopunks, etc

- Marketplaces: Opensea, LooksRare

ERC3643 is a standard tailored for permissioned tokens, allowing issuers and users to track the ownership of tokens and to program lifecycle management rules. It makes this standard perfectly suitable for securities tokenization, web3 loyalty programs, or digital payment systems. Given the intricate regulations around securities, this standard is crucial for those aiming to tokenize RWA.

The primary distinction between RWA and ERC20/ERC721 tokens is that they are permissionless tokens and can be transferred to anyone. Moreover, it’s difficult to differentiate the identities of their users. In the securities realm, this is problematic because they can not be transferred to unidentified investors. Users must undergo KYC/AML checks and get qualified by issuers or their compliance agent before making an investment as required by law. Moreover, if RWA were freely traded by anyone on the blockchain, it would permit unrestricted buying and selling globally, which is not allowed in the world of securities.

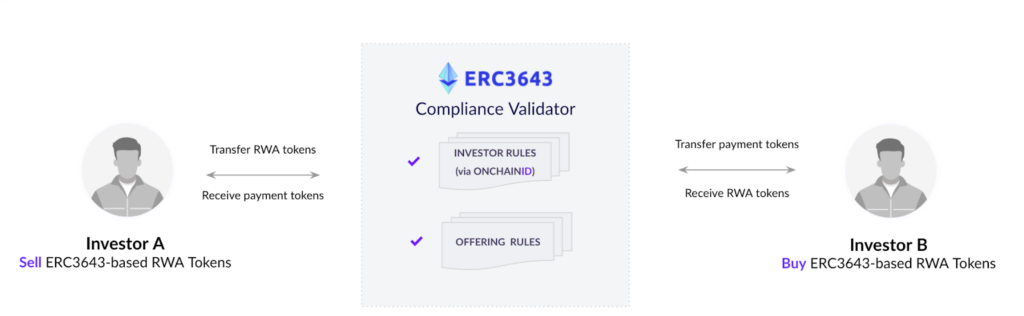

ERC3643 tokens ensure that transfers can only happen when both investor rules and offering rules are met.

Notably, the ERC3643 token is not solely used for compliance. Instead, guarantees the rights and duties of different stakeholders via digital identities. This enables investors to prove their ownership and enforce rights even for offchain assets.

Moreover, securities have an extensive lifecycle, requiring many more functions than what the ERC20 standard provides. In order to accommodate the complexities, the ERC3643 standard provides more than 120 functions — 10 times more than ERC20 tokens — to bring control and automation for post-issuance operations, such as the ability to block or recover tokens. These functions empower issuers to carry out necessary operations and fulfill their regulatory obligations.

So, the question is: “How do we combine the best of both worlds of an open blockchain network and compliance integrated, while protecting the privacy of the users?”

The answer to that is by embedding verifiable digital identities on-chain into the token via ONCHAINID.

Verifiable on-chain digital identities coupled with ERC3643

ONCHAINID is an open-source self-sovereign identity smart contract that enables tokens and applications to identify individuals and organizations, allowing them to enforce automated compliance and access digital assets all on-chain without intermediary intervention.

ERC3643 uses ONCHAINID to verify if users meet eligibility rules token issuers preset. ERC3643 tokens also link token ownership with users’ ONCHAINID instead of wallet addresses.

The eligibility rules are verified through credentials issued by an identifier. Token issuers are the one who decide which identifier they trust. For example, they can appoint a KYC provider ABC to be the identifier to check users’ eligibility A.

Once investors’ documents and information are verified off-chain by KYC provider ABC, a hashed/anonymous credential will be issued as proof of this user fulfilling eligibility A. The ERC3643 token this user invests in and acquires is directly checking their on-chain proof (credentials), determining their permissions.

This on-chain evidence directly correlates with the purchased security. Since everything operates on-chain, the smart contract has embedded rules that are automatically executed or denied.

Consider three investors:

- Investor A: Completed KYC/AML and other onboarding requirements and invested in security X

- Investor B: Same as Investor A

- Investor C: Hasn’t completed onboarding but possesses a self-custody wallet

Now consider these scenarios:

- Scenario 1: Investor A seeks a counterparty on a public blockchain to sell to Investor C. Due to the smart contract’s configuration, since Investor C isn’t verified, the transaction is declined

- Scenario 2: Investor A looks for a counterparty on a public blockchain to sell security X to Investor B. The transaction is authorized and executed by the blockchain, as both Investor A and B comply with the smart contract’s guidelines

Thanks to embedding compliance rules on-chain into the token itself, investors are free to do as they wish with their assets as long as they abide by the rules.

Interoperable securities unlock liquidity

Imagine when RWA tokens can be used just like any other ERC20 while complying with regulations. It can open the door for global distribution to be connected and make peer-to-peer transfers as long as counterparts are verified users. It can also be used in DeFi to earn extra yields or borrow funds. Ultimately, the liquidity of RWA will be unlocked and facilitate financial inclusions.

The future of blockchain

Blockchain is entering a new era where regulation reigns supreme, and if issuers aren’t following any regulatory guidelines, the clock is ticking.

The forthcoming blockchain trend won’t be characterized by dramatic peaks and valleys but by enduring sustainability. Public blockchain networks are poised to revolutionize global capital markets. This transformation will democratize participation and investment while ensuring individuals maintain control over their data and assets.

FAQ

RWA refers to tangible and intangible assets like real estate, securities, or commodities. When tokenized using blockchain, these assets can be represented, traded, or managed on decentralized platforms, combining the benefits of traditional assets with the flexibility and efficiency of blockchain technology.

While ERC20 and ERC721 standards cater to fungible and non-fungible tokens respectively, ERC3643 is tailored for permissioned tokens. This means it’s designed to integrate with real-world regulations and compliance requirements, making it ideal for RWA. It provides over 120 functions to offer control and automation, which are crucial for post-issuance operations of security tokens.

Regulatory compliance ensures the legitimacy and security of tokenized assets, and it is a regulatory obligation of token issuers. Without adhering to regulations, there’s a risk of legal repercussions, loss of trust, and potential misuse or fraud. Especially with RWA, where assets have real-world implications and values, compliance ensures smooth operation and acceptance by traditional financial institutions.

ONCHAINID is a blockchain-based identity system. It provides a method to verify and embed digital identities directly on-chain without disclosing any private information, ensuring that investors and participants meet required regulatory checks without compromising their privacy. When coupled with ERC3643, it offers a comprehensive solution where RWA can be tokenized, traded, and managed on public blockchains while adhering to global securities regulations.

Digital identities, when embedded on-chain, can anonymize user details while retaining necessary compliance attributes. So, while the specific identity of a user might be protected, their eligibility or permission to transact, based on regulatory requirements, is still verifiable on the blockchain. This ensures both user privacy and regulatory compliance.

About the Author

Joachim Lebrun is the Head of Blockchain at Tokeny, a leading tokenization platform backed by Euronext. The company has tokenized $28B in assets over the past 6 years. He is also the creator of ERC3643 and the chairman of the technical working group at ERC3643 Association, helping developers implement ERC3643 easily with necessary tools.