How Fractionalization of NFTs Enables Co-Ownership

For months, non-fungible tokens (NFTs) are making headlines in the blockchain space. NFTs are supposed to be unique and they usually represent an asset. Most of the time, the asset is digital and embedded in the token, but problems have come to the fore. Firstly, there is no proof that assets have not been duplicated before their tokenization, or that other NFTs will not represent the same asset. Secondly, how can users verify that the NFT creator is the asset owner?

CREDIT: Elliptic

Last month a collector bought a fake Banksy NFT for £244,000. The image, which features a figure smoking in front of industrial chimneys, supposedly commenting on climate change, was a hoax from a scammer. It is one example among many others.

With NFTs, the source and owner of the asset is simply not trackable. On platforms such as OpenSea (now valued at $1.5 billion), the authenticity is reliant on the seller saying they are who they say they are. Sounds a bit light in terms of customer protection from my personal opinion. Considering this, it is easy for me to see the use of NFTs for collectibles, but it is harder to see the benefits for real world asset tokenization.

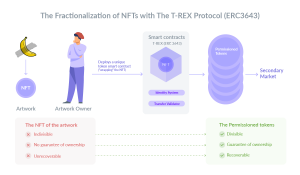

Some NFTs are now becoming very valuable and start to struggle to find liquidity. Therefore, there is a new trend to fractionalize NFTs to enable co-ownership and make them more accessible. In some ways, fractionalizing NFTs is coming back to a use case of standard tokens, except the need to guarantee the ownership of the underlying asset. Moreover, in the traditional world, co-ownership is usually made possible with financial securities to protect owners and apply laws (taxes, inheritance, etc.). How could this be done on the blockchain?

NFTs are unique and indivisible by nature, so how can we fractionalize these assets? We can “wrap” up a NFT into a permissioned token with the T-REX protocol (ERC3643): a unique token smart contract is deployed (representing the asset) by a verified issuer (the asset owner or its custodian). The shares of the asset would be represented by the tokens generated via the smart contract. The asset is now divisible as much as decided by the issuer. The cap table of owners is transparent, automatically updated, and the ownership of these shares is guaranteed by digital identities.

In the same way, and as long as the custodian of the asset can be trusted, it is possible to “wrap” crypto, stablecoins, fiat, real world assets and securities in permissioned tokens. It guarantees the ownership of the underlying asset, and makes the tokens recoverable in case of loss of wallets.