COMPLIANCE

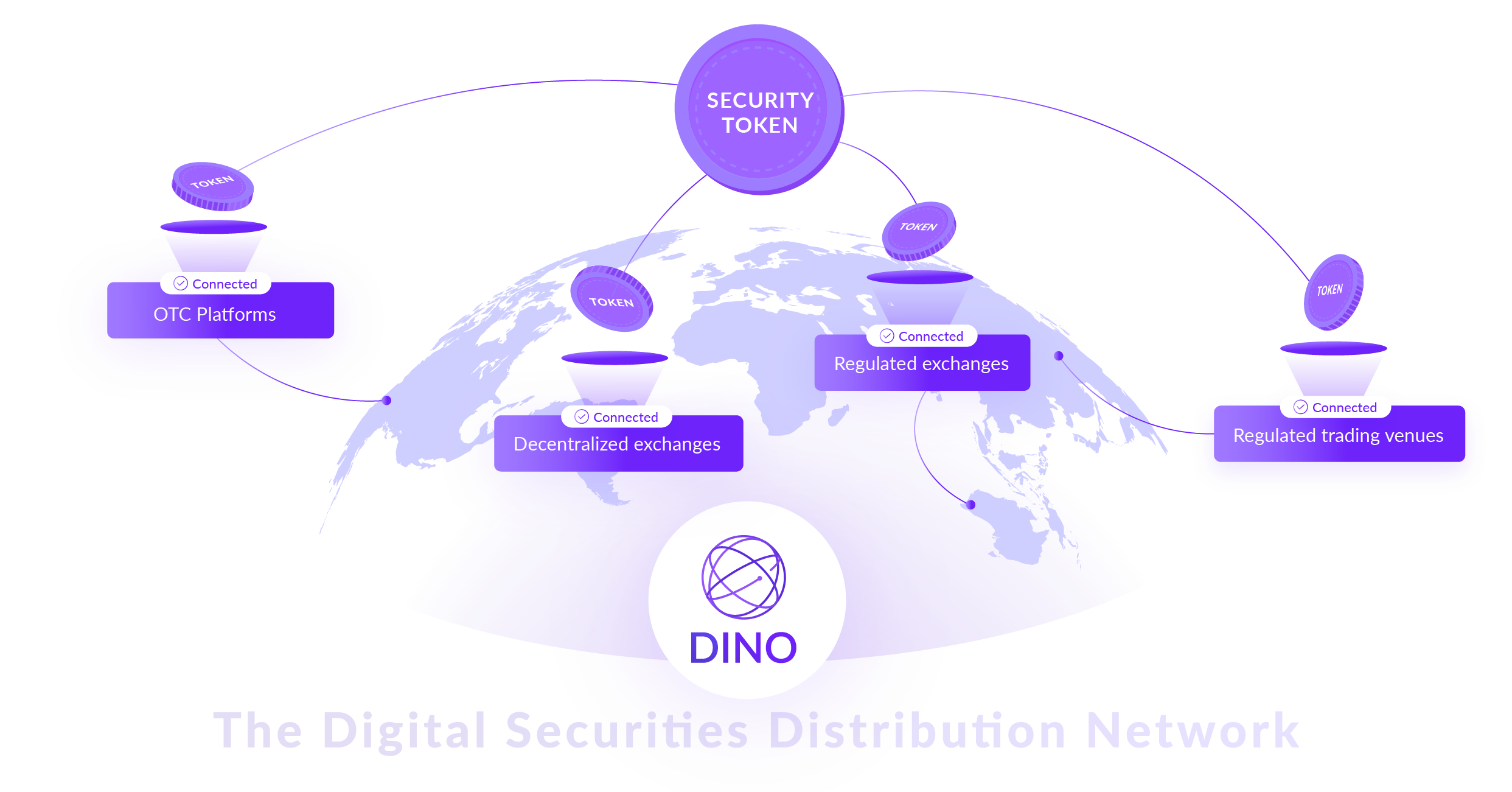

Security tokens are representations of securities issued using a blockchain infrastructure. As they are securities, the typical securities laws from the issuer and investor jurisdictions apply. The global reach provided by the internet and the blockchain enables global compliance, during the issuance and during the lifecycle of the financial instruments.

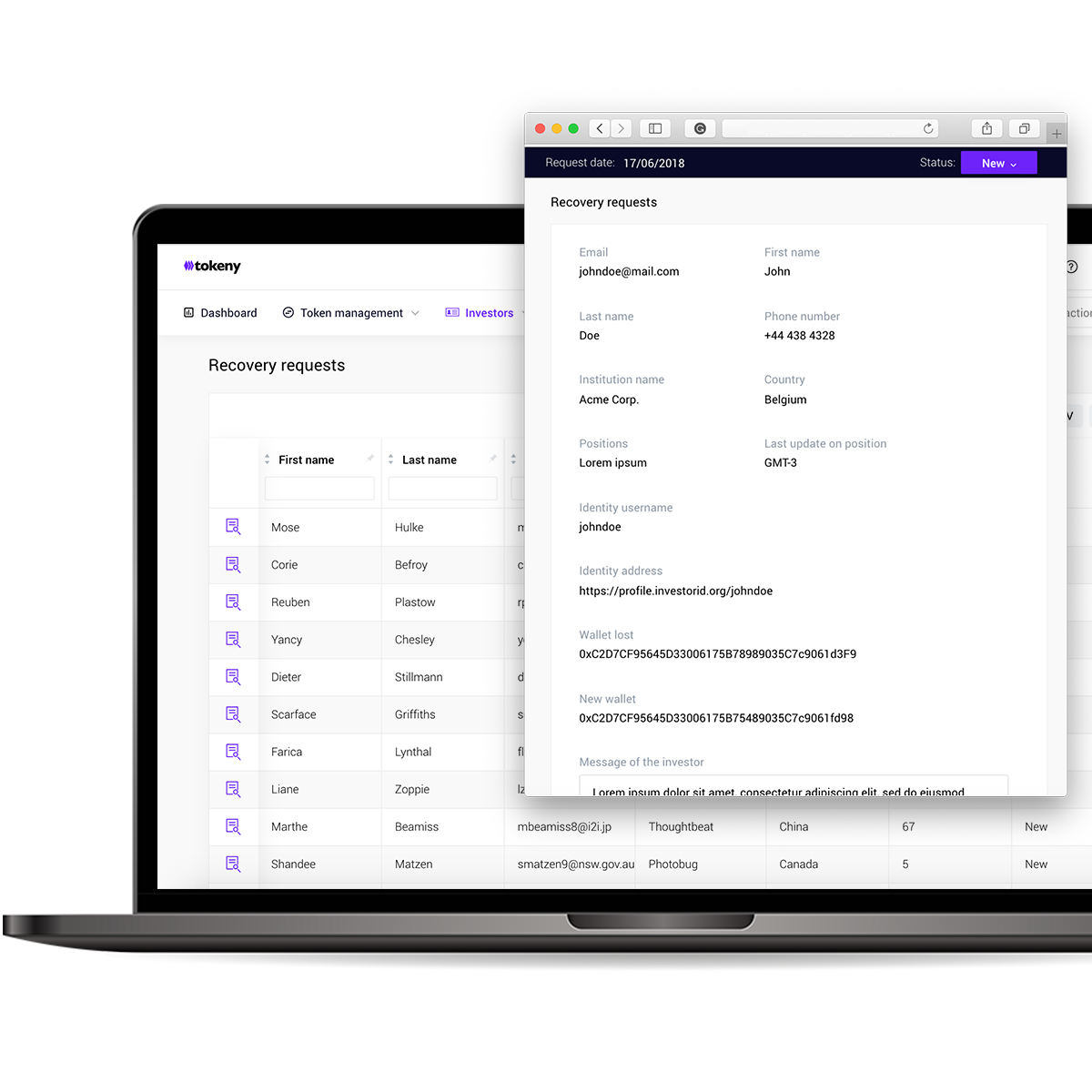

ONCHAIN CUSTODY

Tokenized securities are centralized financial instruments using a decentralized infrastructure. It means issuers are always in control of their token supply and investors cannot lose their securities, even if they lose access to their wallet. Custody fees are drastically reduced for issuers and can totally disappear for investors.

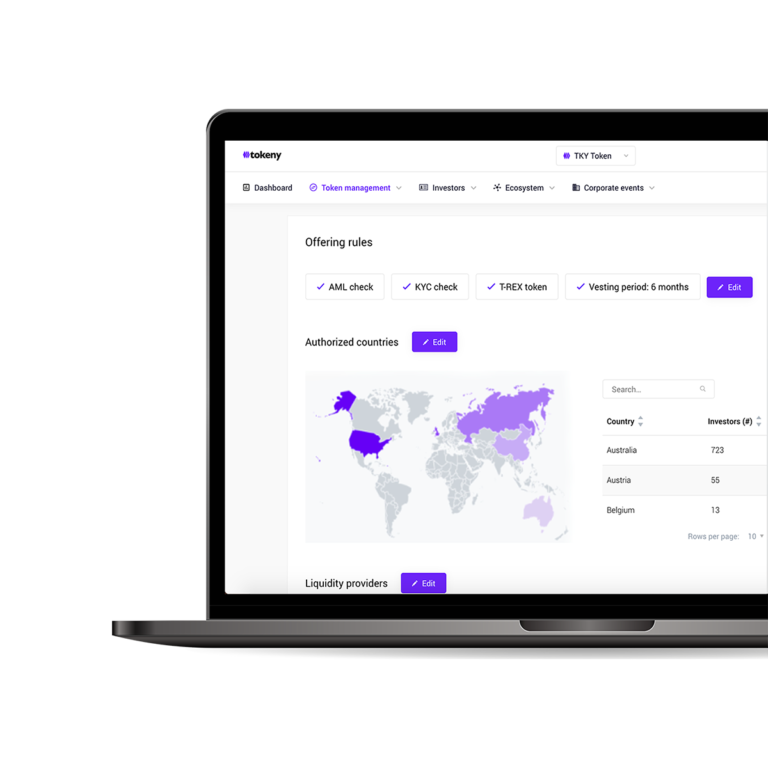

SERVICING FOR ISSUERS

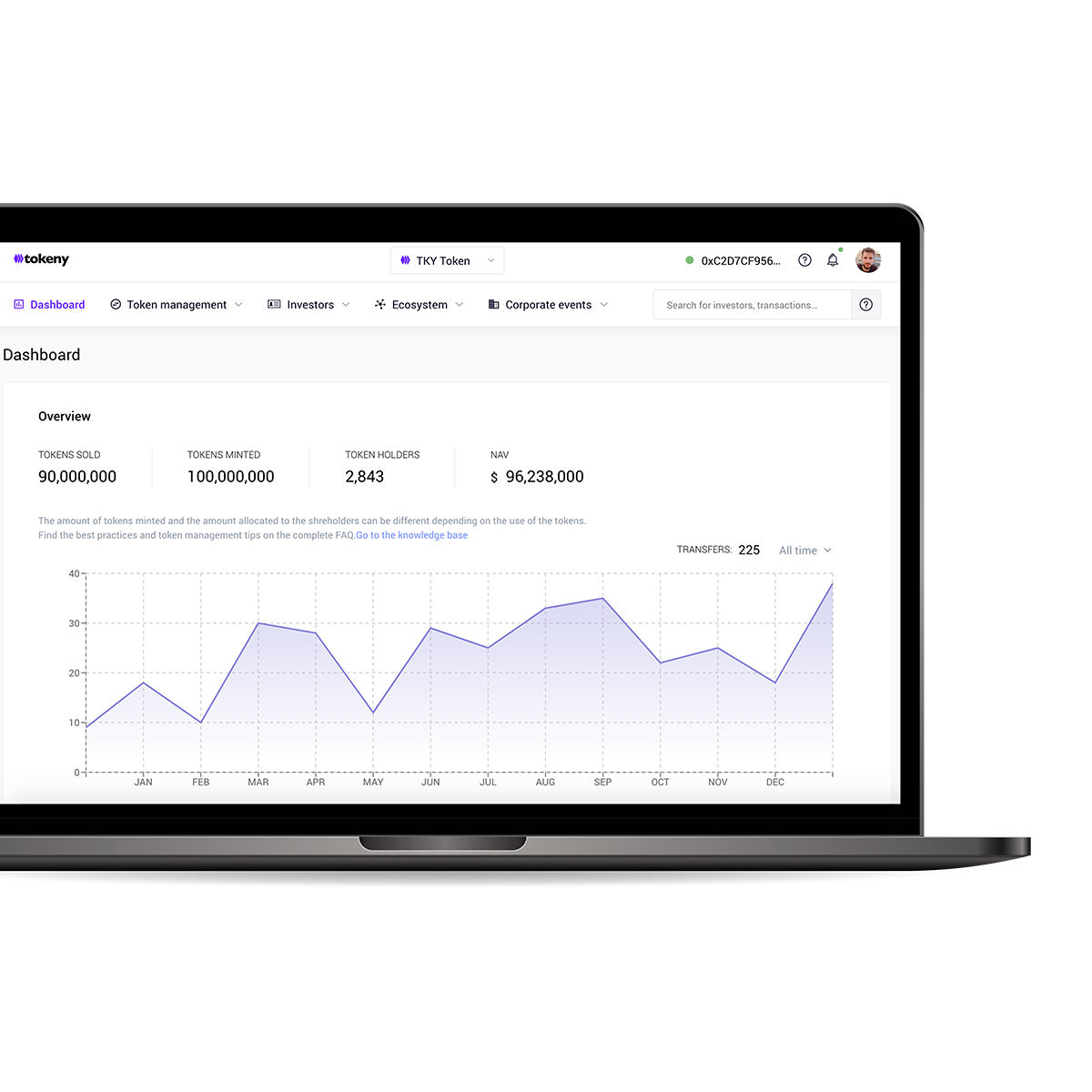

Tokenization will mostly bring its benefits post-issuance. For issuers, operations such as corporate actions and reporting are easily managed. Tokenization increases transparency and operational efficiency. Manage investors effectively through the issuer dashboard:

INVESTOR PORTAL

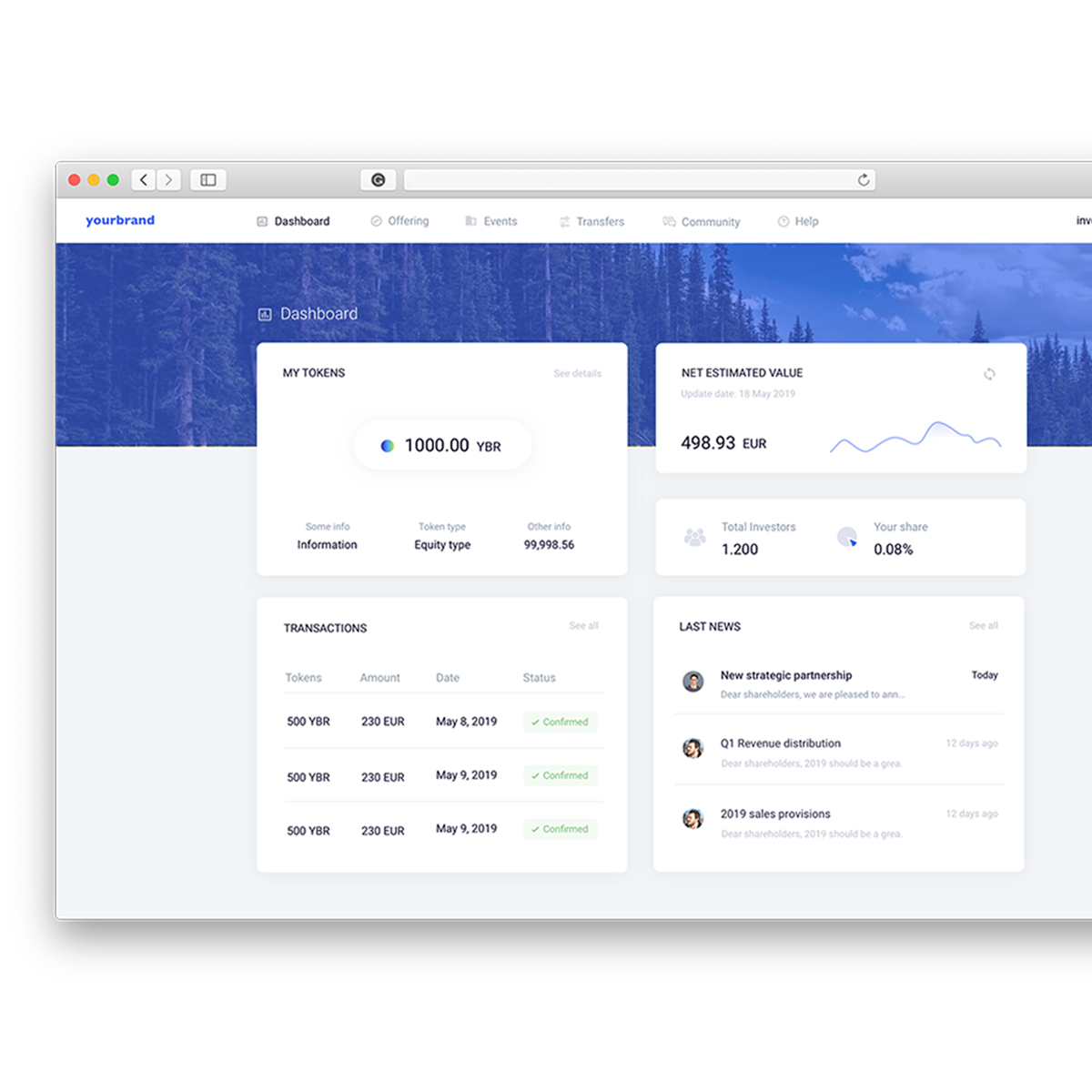

For investors, digital assets can be transferred easily, at low cost and with compliance automatically enforced. Easily manage portfolios through the customisable investor portal: