October 2024

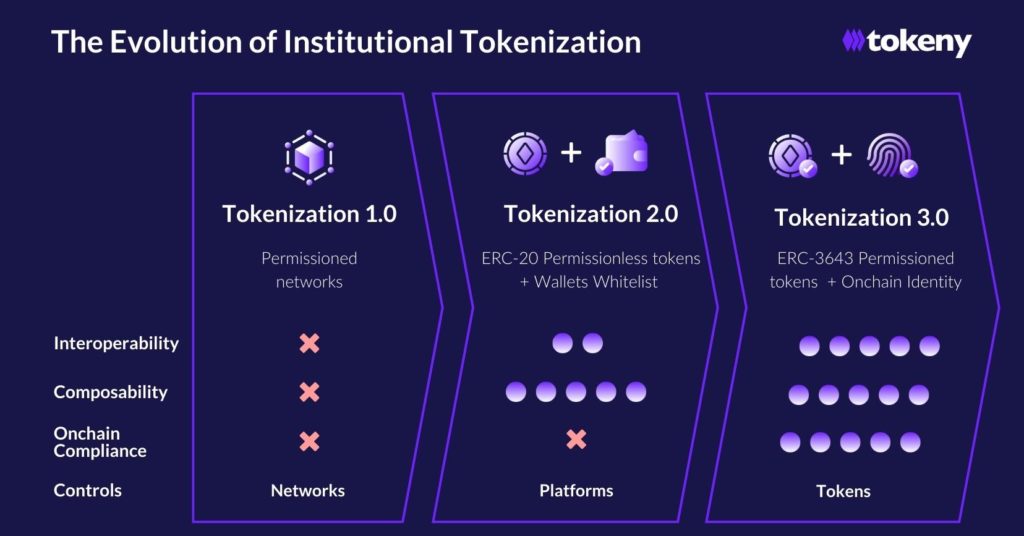

Since Tokeny started building tokenization solutions in 2017, we have seen financial institutions exploring tokenization of assets in many different ways. The evolution has unfolded in three main phases, each addressing the limitations of the previous one.

Tokenization 1.0 – Permissioned networks

Initially, institutions turned to permissioned blockchains for tokenizing assets, prioritizing full control over the network to control tokens. However, this approach quickly exposed limitations in terms of scalability and interoperability, making it difficult for tokens to interact with external applications.

Tokenization 2.0 – ERC-20 Permissionless Tokens + Wallet Whitelists

To solve these issues, institutions started to turn to ERC-20 tokens with wallet whitelists on public blockchains. While this allowed some control over the distribution of tokens, it introduced new compliance and scalability problems: wallets are not linked to identities on the blockchain, so onchain ownership records became unreliable.

It made cross-platform distribution and onchain settlement complex from a compliance perspective because compliance and transfer rules were enforced off-chain, keeping tokens confined within a single platform.

Tokenization 3.0 – ERC-3643, Identity-Based Permissioned Tokens

The open sourcing of ERC-3643 in 2022 introduced identity-based permissioned tokens, ensuring that ownership and compliance remain reliable in every situation.

- Interoperability, Not Competition: A common misconception is that using ERC-3643 means competing with other token standards. However, ERC-3643 is built for interoperability within the blockchain ecosystem. By being fully compatible with ERC-20 tokens, assets tokenized using ERC-3643 can integrate seamlessly with existing wallets, DeFi platforms, and analytics tools.

- Modular and Composable: ERC-3643 allows projects to start with a flexible compliance framework and expand its functionality through composability. This modular approach enables projects to combine additional smart contracts (e.g., automated capital calls, dividend allocation, …) to meet specific needs.

- Eliminating Single Points of Failure: ERC-3643 links token ownership to identity addresses instead of wallets. Authorized parties validate an investor’s eligibility and issue proofs onchain to their identity addresses, ensuring that compliance and ownership records are always tied to a verified identity. Wallets and platforms won’t be the single points of failure as the ownership remains secure and verifiable through the onchain identity.

- Issuer Control, Not Platform Lock-In: As transfer rules are enforced onchain, issuers and their appointed agents maintain control of their tokens. They always have real-time insights on who owns what without relying on distributors’ sub-ledgers. With this approach, issuers are no longer restricted to tokenization platform silos. They represent their assets onchain, appoint agents, and activate distribution channels.

ERC-3643 paves the way for breaking tokenization silos, enabling cross-smart contracts and cross-platform interoperability. Alongside 78 industry leaders, we proudly support the non-profit ERC3643 Association in improving this open market standard. Together, we can drive lasting impact through collaboration.

So, what do you think Tokenization 4.0 will look like?

Tokeny Spotlight

EVENT

Attended DAW with one clear message: The strong need for an interoperable ecosystem built on shared standards.

PRODUCT NEWSLETTER

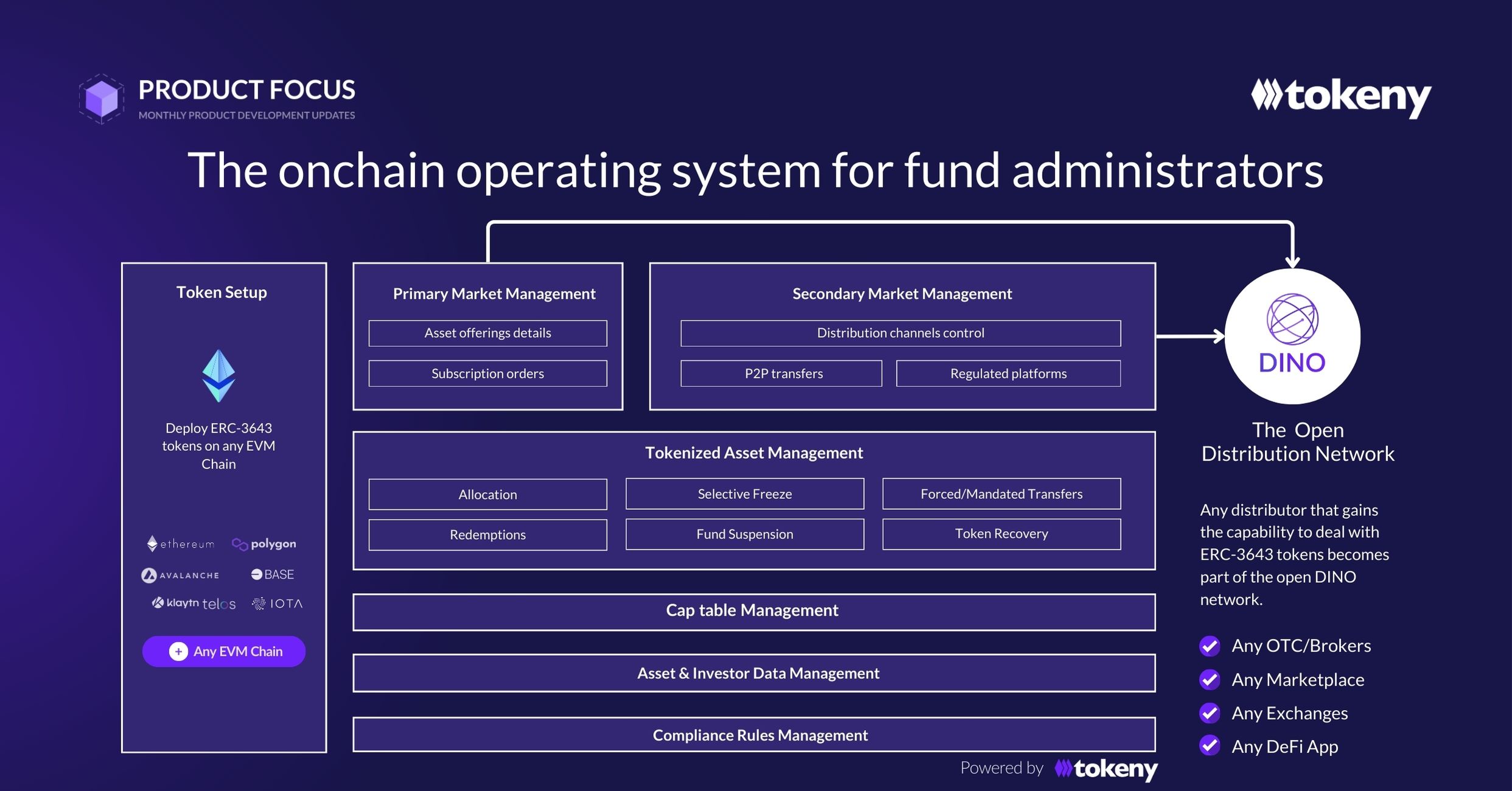

We discuss how our platform empowers fund servicers to act in onchain finance.

Tokeny Events

RWA Summit New York

October 22nd – 23rd, 2024 | ?? USA

Smartcon

October 30th – 31st, 2024 | ?? Hong Kong

Fintech Festival Singapore

November 6th – 8th, 2024 | ?? Singapore

The Digital Money Event

October 23rd, 2024 | ?? United Kingdom

Digital Assets Week Singapore

November 4th – 5th, 2024 | ?? Singapore

ERC3643 Association Recap

Press Release

ERC3643 Association Leads RWA Tokenization Standardization with 78 Industry Leaders.

Subscribe Newsletter

A monthly newsletter designed to give you an overview of the key developments across the asset tokenization industry.