March 2025

With MiCA in Europe, and the STABLE draft law in the USA, regulators are drawing a hard line: no yield from stablecoins. But capital doesn’t sit still, it’s moving to tokenized money market funds (MMFs).

JP Morgan’s recent analysis forecasts massive growth potential in what they broadly term “yield-bearing stablecoins”, a category that includes tokenized MMFs and Treasury (T-bills) products. However, this terminology requires clarity in light of emerging regulations.

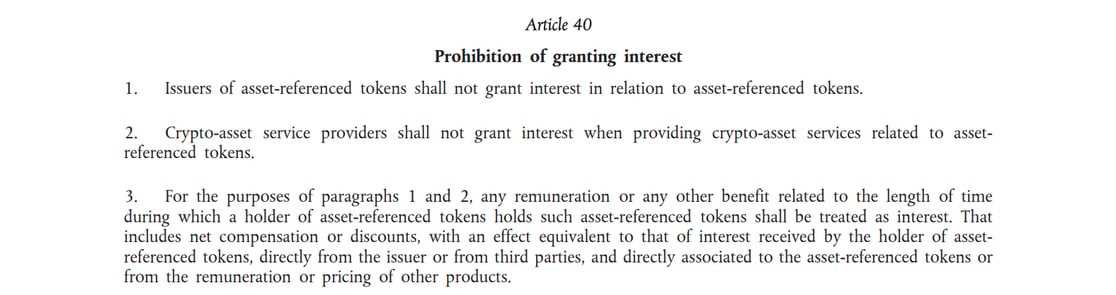

In the EU: The Markets in Crypto-Assets (MiCA) regulation explicitly prohibits stablecoin issuers from offering interest. Article 40 states that “issuers of asset-referenced tokens shall not grant interest” and broadly defines interest to include any remuneration based on holding duration.

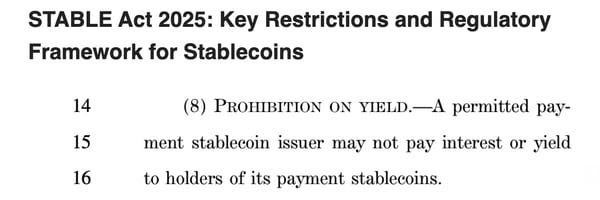

In the US: The proposed STABLE Act of 2025 similarly prohibits stablecoin issuers from paying interest to holders.

What JP Morgan classifies as “yield-bearing stablecoins” are more accurately described as “on-chain cash alternatives”, primarily tokenized MMFs and T-bills products. These instruments:

- Are properly registered as securities

- Provide transparent yield from underlying assets

- Operate within existing regulatory frameworks

- Must ensure the proper identification of investors

The regulatory prohibition on stablecoin yield is creating a clear market split that will accelerate:

- Stablecoins will continue serving as efficient payment and trading instruments

- Tokenized MMFs will capture the majority of yield-seeking capital in the digital asset space

JP Morgan estimates that tokenized MMFs and T-bills make up just 6% of the stablecoin ecosystem today but could grow to 50%. The future is clear: if stablecoins cannot legally provide yield, we will see exponentially more MMFs on-chain.

However, tokenizing MMFs is just the first step in meeting market demand. What will truly set them apart is their ability to interact with DeFi applications, unlocking utility that traditional MMFs simply can’t offer, such as instant collateralization.

The key is leveraging permissioned token frameworks like ERC-3643 to ensure both regulatory compliance and composability with DeFi apps.

The race is already on, with asset managers like BlackRock, Fidelity, and Fasanara leading the charge. Are you ready?

Tokeny Spotlight

XDC RWA Accelerator

Tokeny is selected from over 100 projects for the XDC Network RWA Accelerator program.

Achieved SOC2 Type II

We are proud to announce that Tokeny has achieved SOC2 Type II compliance.

Press Release

Yooro and Tokeny partner to simplify private market investments for EU, UK, Swiss, and UAE Investors via tokenization.

HEC Liege

Our COO, Mathieu Cottin, delivered an executive course on Blockchain and Tokenization

GDF Tokenization Forum

Our CCO, Daniel Coheur, hosted the panel discussion, highlighting key use cases in RWA tokenization

Tokeny Events

Ripple Roadshow: Paris

April 7th, 2025 | ?? France

Token2049 Dubai

April 30th – May 1st, 2025 | ?? United Arab Emirates

Paris Blockchain Week

April 8th-10th, 2025 | ?? France

ERC3643 Association Recap

DTCC announces joining the ERC3643 Association

With major institutions like DTCC on board, silos won’t be rebuilt. Institutional standardization is here.

The HBAR Foundation joins the ERC3643 Association

The HBAR Foundation brings massive energy from the Hedera ecosystem, fueling scalable and compliant RWA tokenization with the ERC3643 standard.

Subscribe Newsletter

A monthly newsletter designed to give you an overview of the key developments across the asset tokenization industry.