In the previous article, we have defined the purpose and the stakeholders in the ecosystem of a digital asset marketplace (DAM). Now, we will look at the three main services that DAM Operators can implement and offer to investors and issuers in the primary market.

1. Digital Distribution and Placement

The main value proposition of the marketplace is to bring Investors to the Issuer. Through the use of a digital platform, the Issuer is able to facilitate this and can deliver these investment opportunities to its user base.

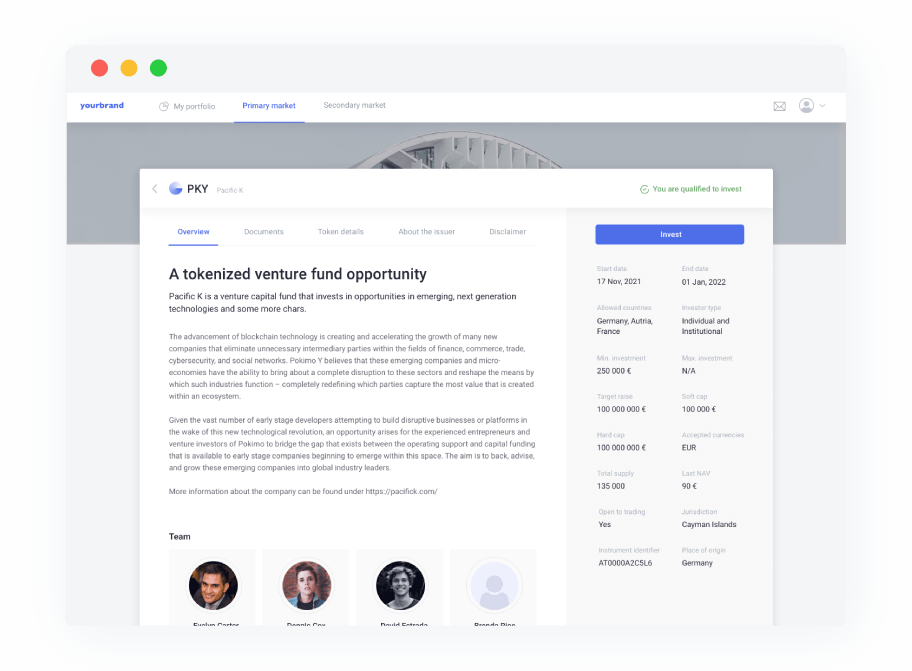

Once the Issuer’s offering is created, the project is displayed to the relevant users in the marketplace. The digital platform must help Investors to discover the offering, assess the opportunity, and invest if they are eligible and interested. The Issuer receives subscription requests and it’s their responsibility to approve or reject them. In order to make it manageable, the DAM must propose a complete administration panel where the Issuer can easily view potential Investors and approve or reject them based on their validity.

The marketplace Operator may also be able to provide some management services and act as an agent for the Issuers. They will therefore verify the applicants of the offering to review their appropriateness in connection with the financial product. The payment of these orders need to be verified as well: even if payments are automatically reconciled, a paying agent must review them and potentially change exchange rates, proceed adjustments, refunds and capital calls. Finally, the Operator can propose direct support to Investors if appointed by the Issuer to do so. The marketplace should therefore provide communication tools between the Issuers and its potential Investors.

2. Onboarding of Investors

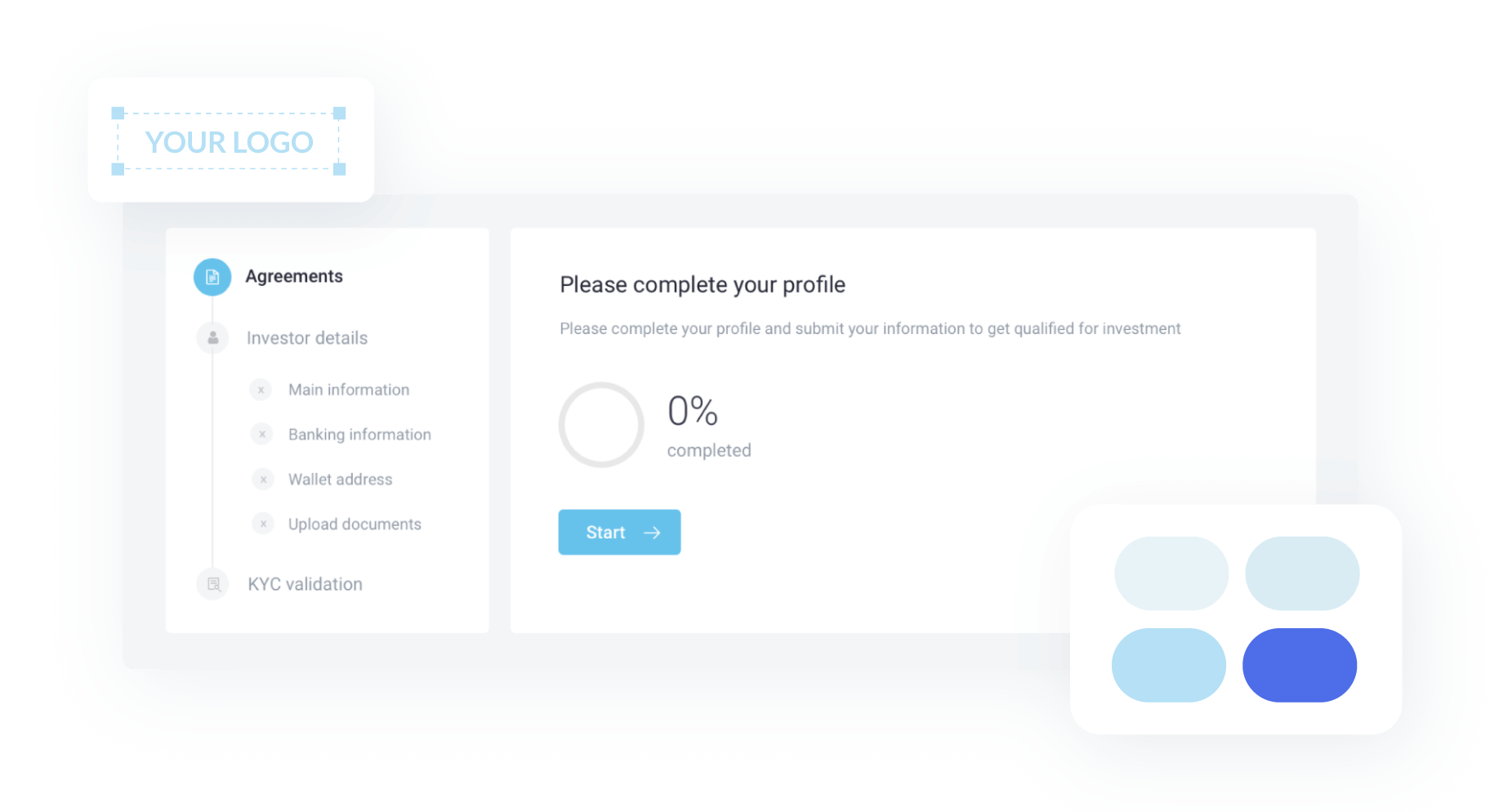

Issuers must collect a set of information and documentation from their investors in order to comply with legal obligations. At any point of time, they are supposed to know who their investors are and ensure that only eligible Investors hold their securities. Numerous regulations about the identification of Investor KYC and AML must be applied.

In traditional finance, the onboarding of investors is very manual and several intermediaries need to share personal information of the Investors as none of them works on the same IT system. Collaboration is complicated, especially with sensitive information. Online platforms can digitize this onboarding process. We saw the power of digital onboarding with the rise of Neobanks: They were able to get thousands of new clients by verifying their identities and creating accounts directly from smartphones. The rise of efficient digital KYC services aided this onboarding method. Today, onboarding solutions exist and can help Issuers or digital platforms scale their user base rapidly and drastically reduce their costs.

In order to deal with private securities, a DAM must verify the identity of its users, and propose to its Issuers that they can rely on these verifications. The DAM can provide the online onboarding interface, with its branding, managing different workflows depending on the type of Investors (individuals, corporate), their status (accredited, qualified, retail, etc.), and their jurisdiction. In this onboarding process, Investors fill in their information and upload their supporting documents to the platform. After this, verifications are performed to generate a risk score allowing the Issuer to decide if an Investor is a suitable owner for its securities.

3. Issuance and Allocation of The Security Tokens

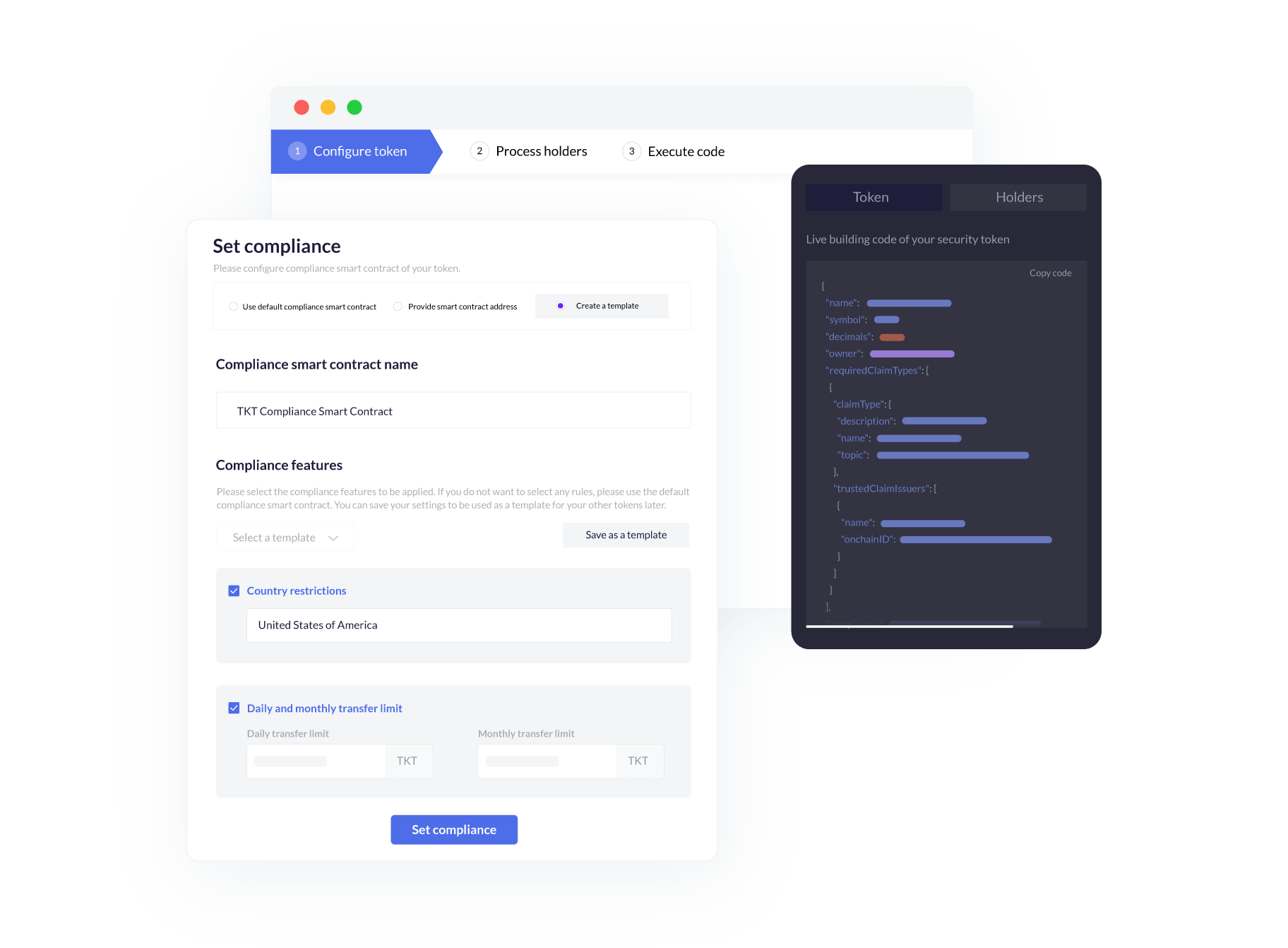

In order to fully access the private markets infrastructure, the securities must be represented on the blockchain network chosen by the Issuer and/or the marketplace. This representation is performed by the deployment of several smart contracts and the generation of tokens (digital keys issued on the blockchain thanks to the smart contracts).

As it could be complex for Issuers to issue digital securities, and because the purpose of a marketplace is to provide the IT and regulatory framework to its users, the marketplace must provide the needed tools and services to create the security tokens.

More precisely, the marketplace must use, or impose to its users, a reliable and proven security token protocol. The DAM proposes fully-managed services or self-services to Issuers in order to deploy the needed smart contracts and allocate security tokens to investors.

Issuers must receive the following:

We’re looking forward to explaining more in the next article. If you can’t wait, this is an excerpt taken from the ebook we published with CoinTelegraph, download here.