The Knock-on Impact of NFT Tokens Going Mainstream

As we’ve seen with the recent activity amongst crypto tokens and now with NFTs, 2021 is shaping up to be the year blockchain-based tokens go mainstream.

The flavour of the month is Non-Fungible Tokens (NFTs). They have hit the headlines as major artists and celebrities around the world announced their plans to use tokens to represent their creations. People are willing to pay big bucks for these NFTs, with one collector even selling a digital artwork of Joe Biden and Donald Trump nude for $6.6 million! Popular musicians such as the Kings of Leon and Lindsay Lohan have also jumped on the bandwagon.

But, What Are NFTs?

NFTs are blockchain-based tokens with unique identification codes and metadata that distinguish them from each other. Unlike cryptocurrencies, they cannot be traded or exchanged at equivalency. In the world today, non-fungible items are typically items such as real assets, diamonds, collectable cards or even artwork. NFTs are digital representations of these items with code that verifies their authenticity. Just as diamonds may come with an accepted certificate of authenticity, NFTs digitally associate authenticity and rights to assets or items, such as digital art. In the same way jewellers accept certificates of authenticity for diamonds, consumers are beginning to accept NFTs as acceptable authentications of digital art.

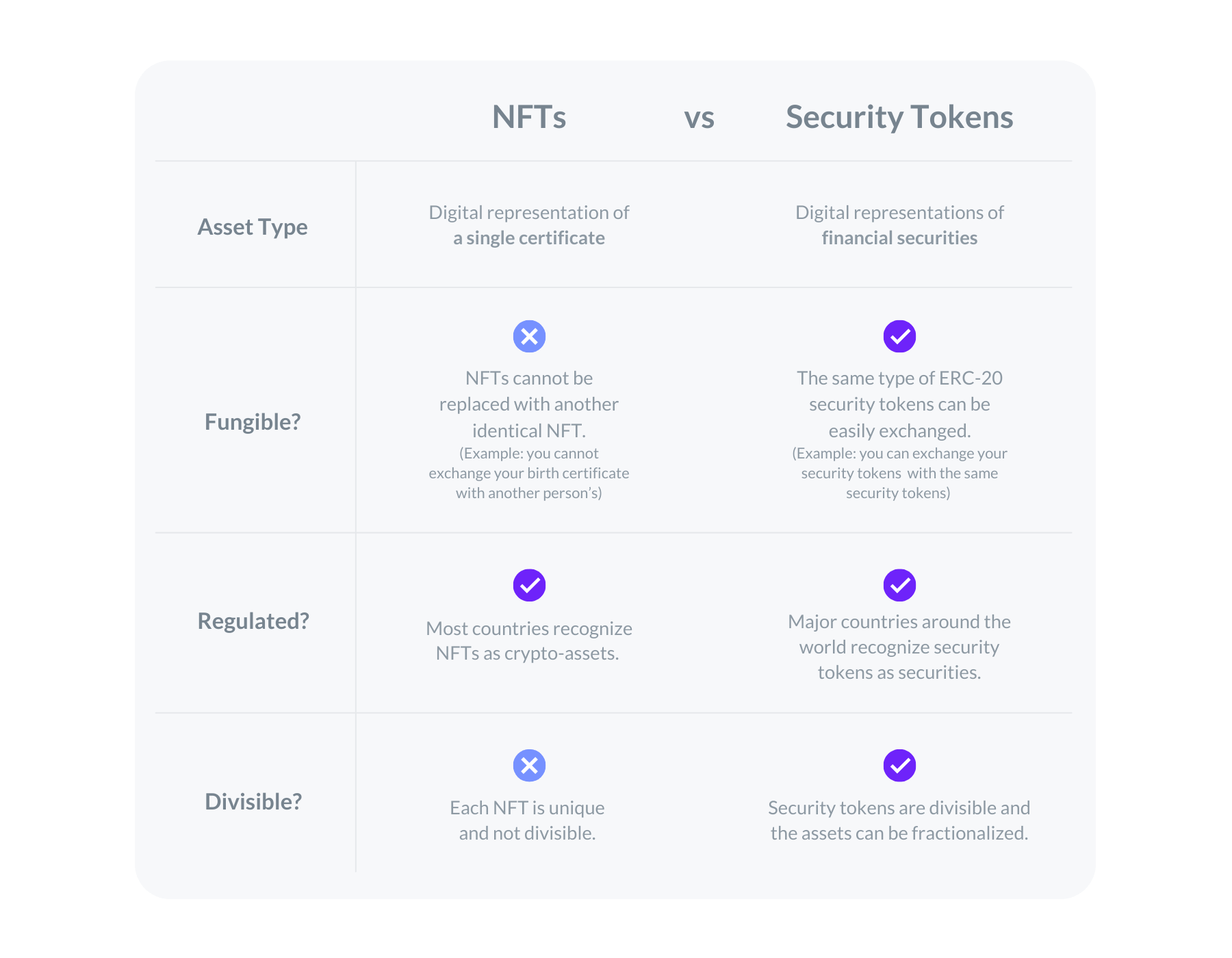

NFTs vs Security Tokens

This notion of associating authenticity and/or rights to an item is also applied in the realm of security tokens. In the same way NFTs associate rights with digital certificates (tokens), security tokens associate rights on the asset, i.e. ensuring that only eligible investors can hold the specific token. Whilst NFTs and crypto-tokens are going mainstream as we speak, the security markets will naturally move more slowly due to the surrounding regulation. That being said, we can see an acceleration occurring with security tokens, encouraged by all the legislation passed recently.