New Standards for a New Era

The security token industry requires common technical standards to benefit from the underlying shared network. Of these, the Ethereum network has so far been the most active, resilient and offers the best interoperability through smart contracts. The ERC-20 standard on the Ethereum network showcased a significant and important innovation in regards to the seamless flow of capital from one peer to another, but it doesn’t allow for the enforcement of transfer rules and compliance regulations that exist in capital markets.

In light of this, several standards were proposed to enforce these rules. And T-REX Protocol was the first and only permissioned token standard that has been officially recognized by the Ethereum community, known as ERC-3643. For these standards to take advantage of the blockchain’s interoperable nature, it’s fundamental they are open source and audited.

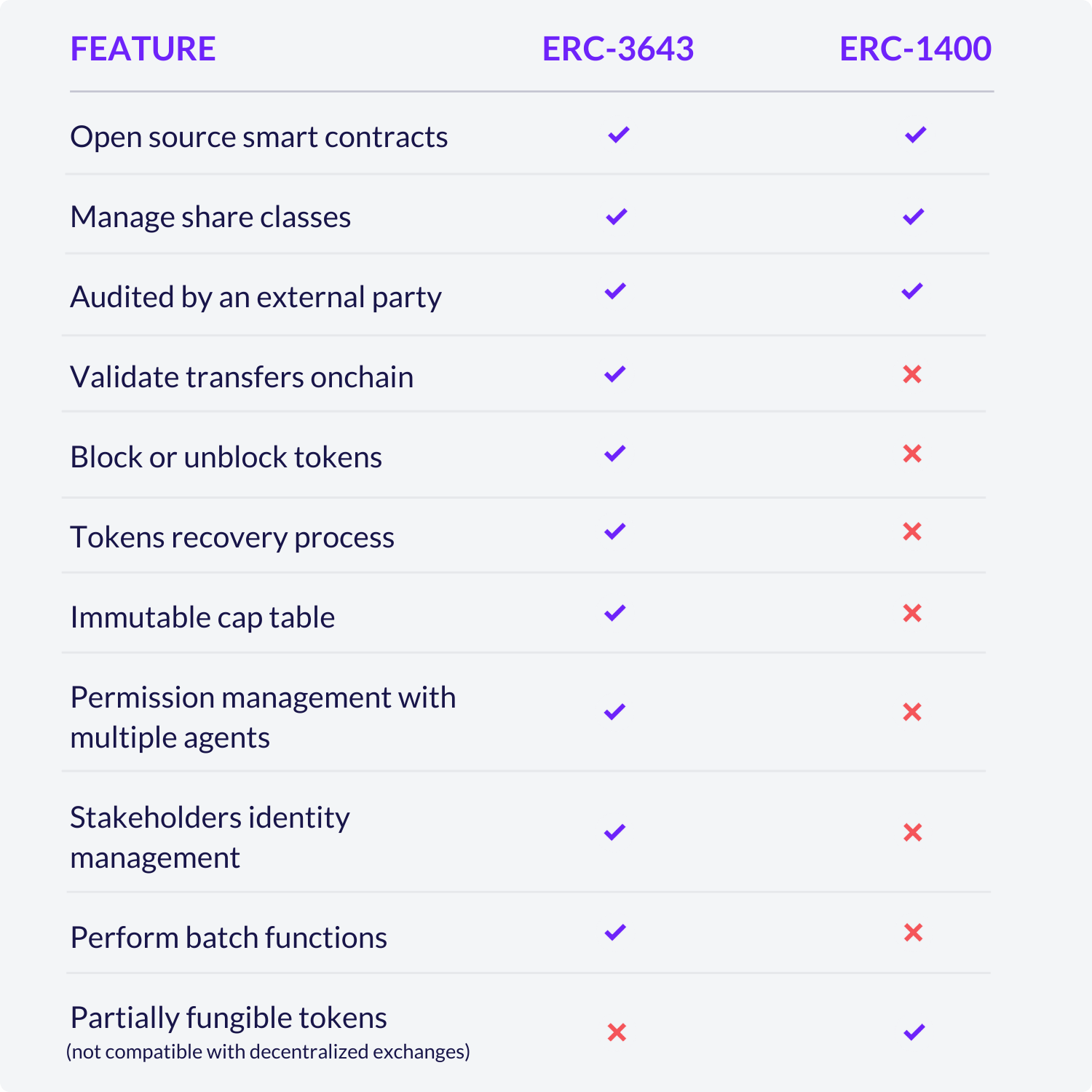

The two main security token standards in the market are the ERC-3643 (ex-T-REX) and the ERC-1400. They use a different approach but can enrich each other thanks to the code’s composability. Both of the standards enable the enforcement of compliance rules and the control of transfers to eligible investors.

The ERC-3643 manages compliance by leveraging the security of the blockchain with an automatic validator system. This system applies the transfer rules related to users (identities) and those related to the offering. The issuer of the securities, or its agent, always keeps control of the tokens and the transfers. ERC-1400 is another approach where each trade must be validated by a specific key generated offchain.