Tokenization is the first step for real-world assets in DeFi

Before delving into our newsletter, I would like to share with you a great announcement from our team: We are pleased to have integrated our solutions with Fireblocks – an enterprise-grade platform for moving, storing, and issuing digital assets, who serves over 1,300 financial institutions. This integration will enable Fireblocks to provide a turnkey tokenization solution for its customers with the ability to deploy and manage permissioned tokens such as digital securities, stablecoins and loyalty tokens.

We’re very excited about this partnership as tokenization continues to storm into the financial and business development strategies of financial institutions, and this kind of ready-to-use solutions will be the catalyst for the tokenization prosperity. However, while more financial instruments and real-world assets are being brought to blockchain, the full potential of tokenized securities lies post-tokenization.

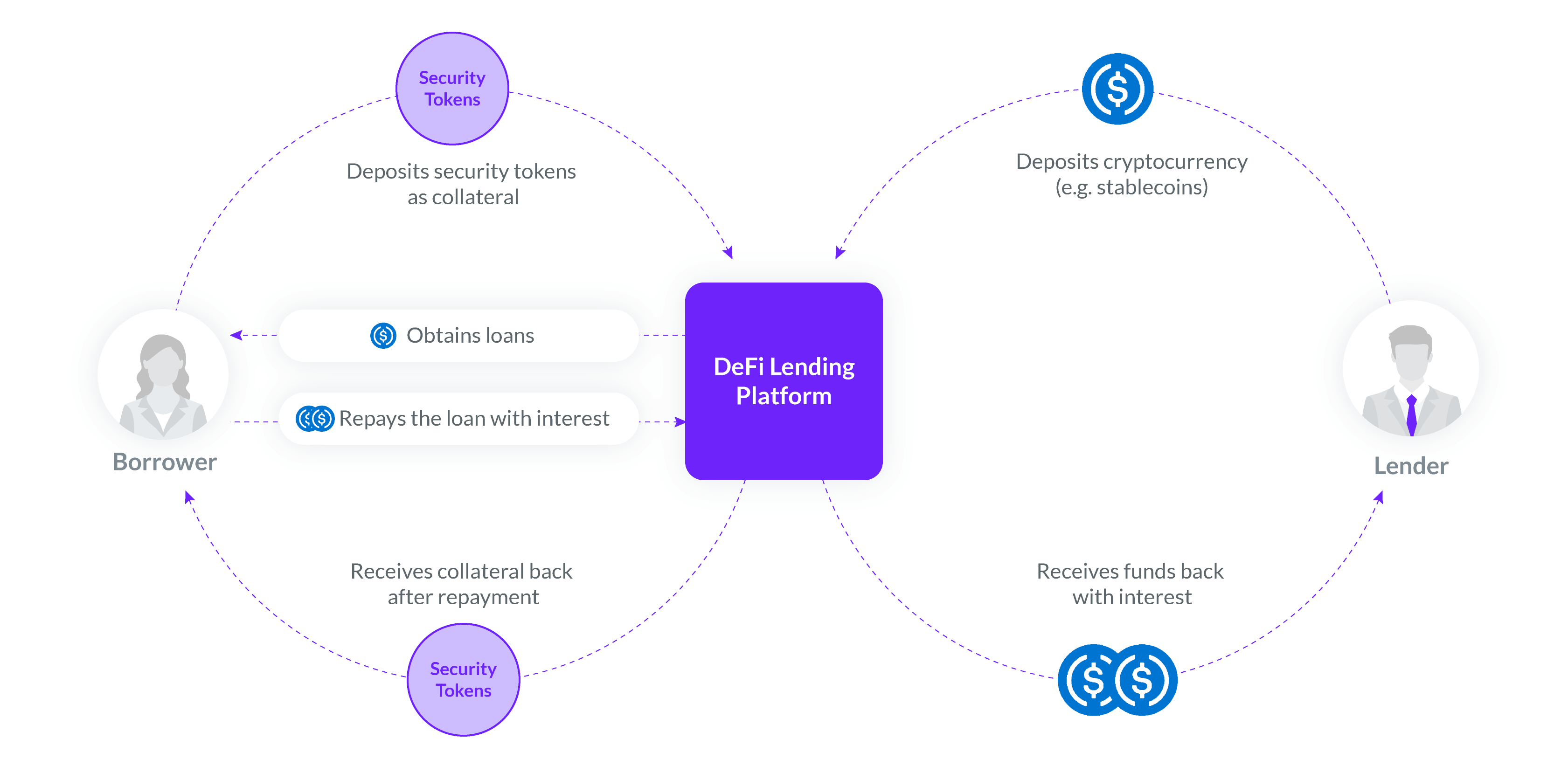

Collateralization is currently the main DeFi use case

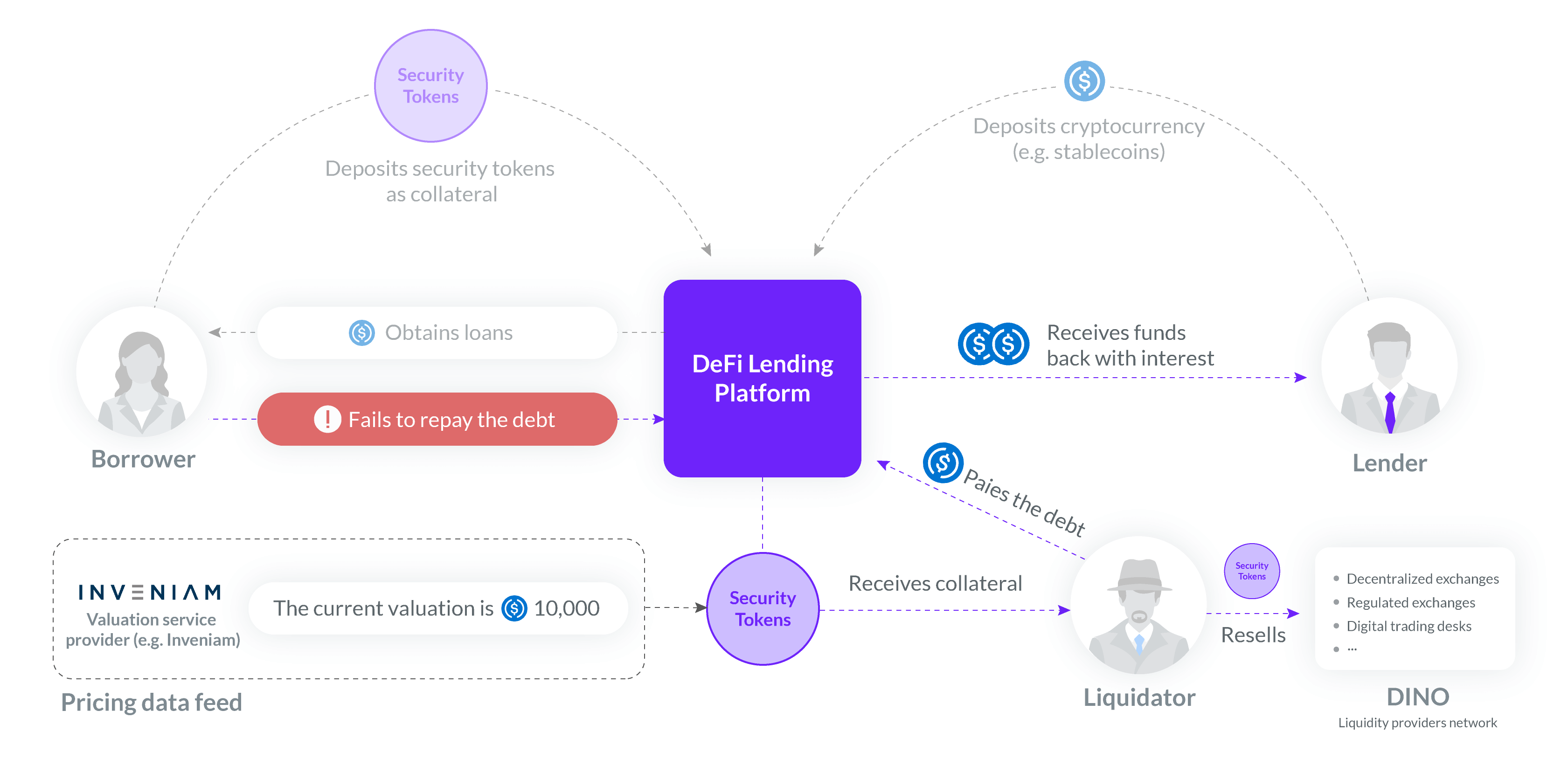

It allows users to easily obtain a loan with their cryptocurrency as a collateral from someone else in an investor pool. The whole process takes place on a DeFi platform, run via smart contracts, without any intermediary. However, the same can not be said for tokenized securities yet, due to compliance, valuation, and liquidity issues.

While the traditional finance concept of allowing borrowers to use something valuable as the guarantee to obtain a loan remains the same, in DeFi the trustee is replaced by smart contracts. Instead of middlemen performing manual operations, the codes themselves will execute actions when all conditions are met.