In this article I will explain the definition of DeFi and what benefits this new concept will bring to capital markets. Alongside CBDCs, to the pandemic that’s currently sweeping across the world and causing global markets to crash, we expect Decentralized Finance (DeFi) to make big advancements within capital markets over the next year. The recent crash could work as a catalyst for the adoption of DeFi as companies will be forced to reduce cost and look for efficient solutions. But what is the definition of DeFi and how can capital market rules and regulations work on a public infrastructure?

What is the definition of DeFi?

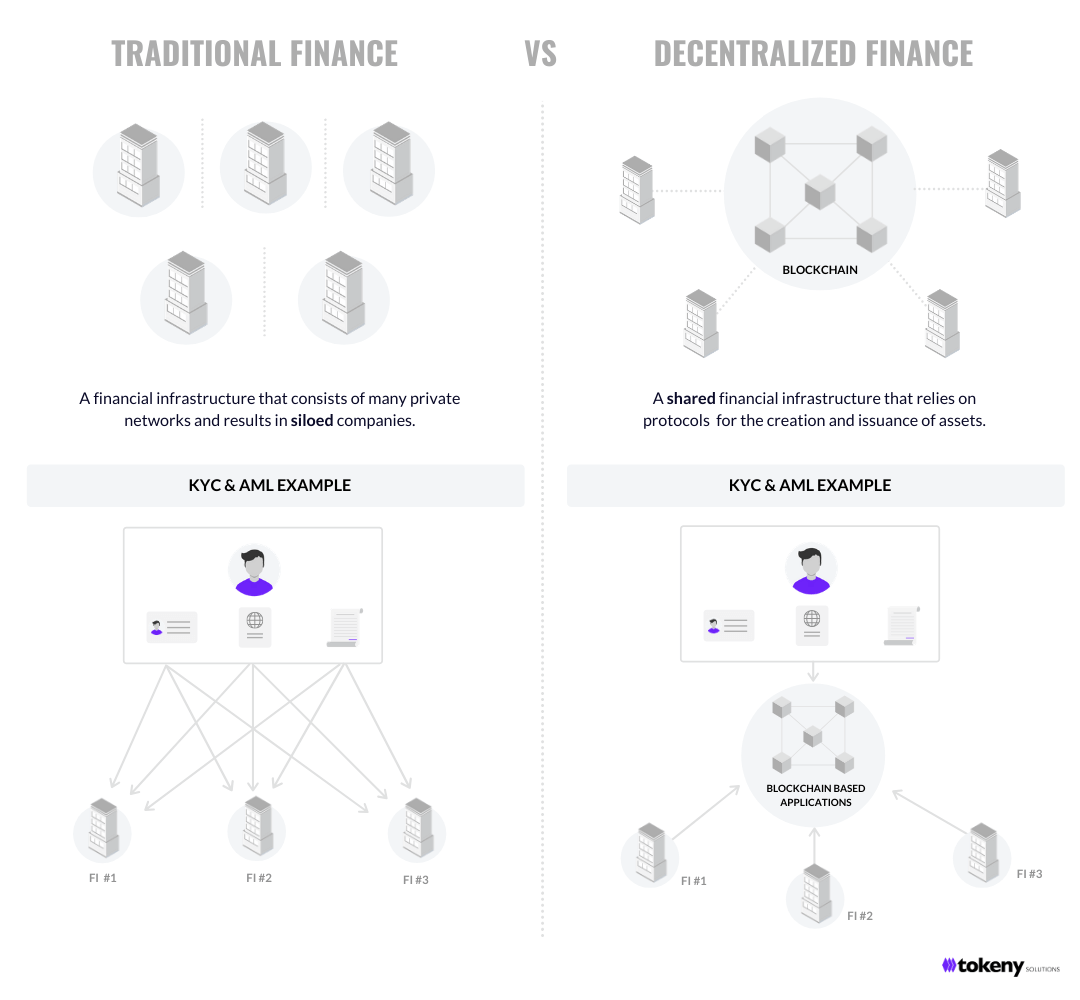

The definition of DeFi is a concept of a financial ecosystem living digitally on a shared infrastructure. In this world, typical financial services such as borrowing, lending and trading exist, but they operate on a public network, meaning it’s accessible to anyone with an internet connection. Open-source protocols or modular frameworks are relied upon for creating and issuing assets on this network, much like email exists today.

How does this differ to what exists today?

Capital markets, and in particular private markets, currently operate on an infrastructure that consists of many networks that are private, resulting in many companies that are disconnected and siloed. This leads to each company having their own method for certain procedures. Let’s take the example of KYC & AML. Every time an investor wants to subscribe to an offering, they are required to go through KYC & AML checks. Due to companies operating in silos, each party needs to verify the investor due to compliance obligations, so the investor will need to have this check performed each time they wish to subscribe to an offering. This costs money and is a labour intensive process.

In a DeFi world, investors can store signatures or crypto-graphic hashes on the shared infrastructure, proving that the data they are providing is valid and has been checked by a trusted party. In this KYC & AML example, the only shared data is the hash or signature, not the personal information, and can only be accessed by authorized parties. Needless checks don’t need to be processed every time an investor wants to subscribe to an offering, one check is essentially saved and shared as the investor pleases. This process in particular could save the industry around $160 million annually in cost saving, according to Goldman Sachs.