We are off to a great start this year as we teamed up with Inveniam to unlock asset liquidity via tokenization. The partnership comes alongside a €5m investment from Inveniam, Apex Group, and K20 Fund.

Assets tokenized and priced

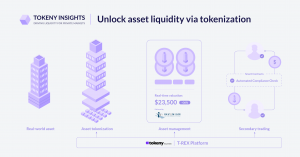

The most exciting part about this partnership is that Inveniam’s data solution complements the ERC3643 ecosystem by providing tokenized assets with a valuation reference, which will fully unlock private market asset liquidity.

Covering the entire value chain of tokenization

As a result of this collaboration, securities tokenized through the ERC-3643 standard will be enriched with timestamped valuation data linked to their underlying assets. The result? High functioning securities that will unlock liquidity:

- Issuance: We provide the enterprise-grade white-label tokenization platform – T-REX Platform – to help asset managers compliantly bring assets to blockchain.

- Asset management: Tokenized assets and investors are managed via our T-REX platform. In addition, tokens are enriched by real-time data regarding asset valuation delivered by Inveniam.

- Secondary trading: Peer-to-peer transfers and connectivity with centralized or decentralized trading platforms are available through our platform. With trusted pricing references provided by Inveniam, investors can then make fair deals with confidence.

Accelerating the tokenization adoption

By addressing the two biggest issues in private markets, which are pricing discovery and compliance, we are now making private market assets more accessible and liquid together with our partner Inveniam.

Additional value to the market will accrue as the partnership will ultimately enable Apex Group, Inveniam’s fund administration partner, to deliver end-to-end cutting-edge services to a broad ecosystem of private asset owners. For more info, please read the full announcement: click here.

Tokeny Spotlight

PRESS RELEASES

Tokeny Receives A Strategic Fundraise From Inveniam, Apex Group, and K20 Fund

Market Insights

Aave launches its permissioned DeFi platform Aave Arc

Aave has launched its permissioned DeFi platform for institutions. Fireblocks is the first whitelister of the platform.

The Block

JPMorgan: 2022 Could Be ‘Year of the Blockchain Bridge’

“If 2021 was the year of the NFT, we see 2022 as possibly the year of the blockchain bridge…or the year of financial tokenization,”

Blockworks

PayPal confirms that it is ‘exploring’ a stablecoin

The Block reported last May that PayPal was holding exploratory conversations about a stablecoin.

The Block

Compliance In Focus

European Markets Regulator Seeks Feedback on Regulation of Tokenized Securities

ESMA wants to explore whether existing regulatory standards need to be amended.

Coindesk

Subscribe Newsletter

A monthly newsletter designed to give you an overview of the key developments across the asset tokenization industry.