Cryptocurrency markets have been adversely affected by FTX’s collapse. As a technology provider, at Tokeny, we were unaffected by this catastrophe. As securities issuers, our customers were not either. Taking a broader view of the tokenization market, this event could have a positive impact, as investors are looking for less volatile, real-value backed assets such as tokenized securities. The increasing need for DeFi services that eliminate investor deposit abuse could also lead to the rapid development of institutional DeFi to bring transparency, stability, and security to a wounded market.

On 2nd November, CoinDesk reported that FTX’s sister hedge fund Alameda was dangerously holding $5.8B FTT at that time, which was about 40% of its total assets, $14.6B, to back their loans, raising liquidity concerns.

As rumors spread, Binance CEO CZ announced they would sell their $2.1B FTT on 6th November. The market meltdown kicked off. People panicked to sell their FTT as prices continued to fall, while withdrawing their funds from FTX over fears about whether they had sufficient capital. Within 72 hours, FTX saw roughly $6B withdrawal requests.

The fears turned out to be true, as FTX has lent about $10B of funds out of $16B to Alameda with the use of customer deposits. Consequently, it struggled to meet the enormous withdrawal demand and had frozen withdrawals on 8th November. On 11 November, the company declared bankruptcy after failing to find a bailout package of $9.4 billion.

Turning into decentralized exchanges

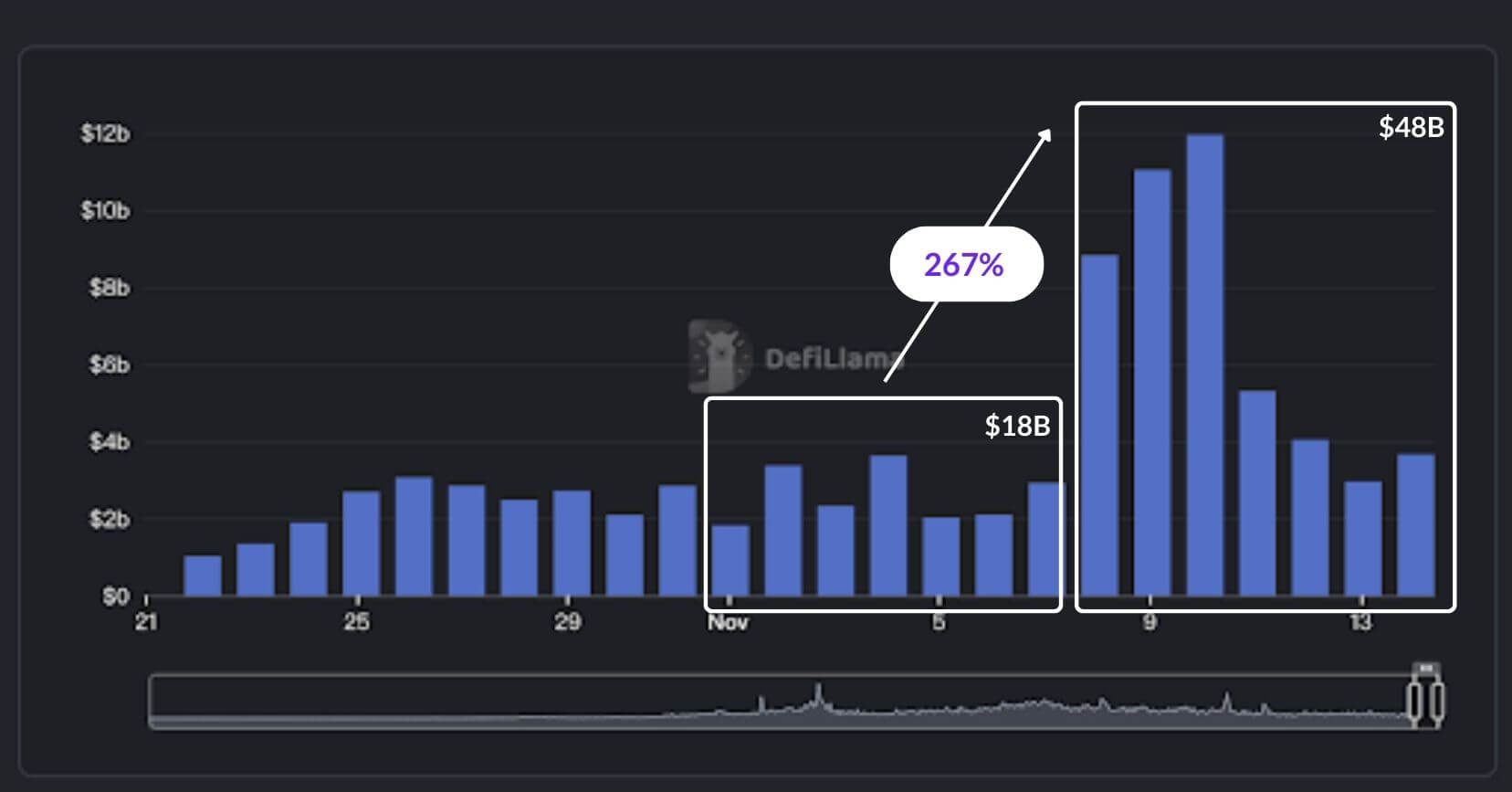

Investors are moving into decentralized exchanges. Within a week since 8th November, about $48B worth of volume has been traded in decentralized exchanges, up 267% from $18B the week before, according to DeFiLlama.

Unlike centralized exchanges, decentralized exchanges do not require deposits to begin trading, instead, users simply swap assets directly in liquidity pools. Liquidity pools are funded by liquidity providers, or yield farmers, whose deposits are governed by smart contracts and cannot be touched, preventing any misconduct with the funds.

Tokenized securities as the ideal alternative

Due to events like FTX, the cryptocurrency market has become more volatile and riskier. People are seeking alternatives that are more stable. One of the best options is tokenized real-world assets and securities for the following reasons:

-

- Real-value backed: Unlike cryptocurrencies that are created out of thin air, tokenized securities are backed by real assets.

- Highly regulated: Since tokenized assets fall within the scope of securities, they are strictly regulated like their traditional equivalents. Investors, therefore, benefit from the highest level of protection from unforeseen events under the supervision of the authorities.

- Transparency: Operations performed by asset issuers following governance decisions are visible on the blockchain and can be tracked. Fund reserves and usages can be audited frequently by trusted third parties, providing immutable and real-time data to improve transparency and enhance trust.

- Recoverability: They say: “not your keys, not your tokens.” People started asking for self-custody of their digital assets. With tokenized securities, as required by law, tokens are tied to the identity of the holder, even allowing recovery of tokens in the event of wallet loss, enhancing the security of self-storage of digital securities.

Push institutional DeFi to develop

Bank runs occur not only in the cryptocurrency world, but are seen in traditional capital markets as well. DeFi holds the answer to solve this problem by providing transparency for market participants. Instead of relying on a centralized entity, everything is ruled by smart contracts which automatically and strictly follow predetermined rules to execute. E.g. the loan will be automatically liquidated when the collateral backing it falls below a preset threshold; In the event that the loan is not repaid on time, liquidation will occur, automatically.

The demand for better security and transparency will drive both retail and traditional investors into DeFi. Institutional DeFi or permissioned DeFi will be required as investors, especially institutional investors, do not want to deal with sources of funds associated with money laundering, terrorism and other illegal acts. The development of permissioned DeFi will ultimately bridge tokenized real-world assets with DeFi.

There is always a positive outcome to any disaster, leading to innovation and maturing the market, cleaning up the bad players, and allowing solid solutions and problem-solving applications to emerge and thrive. We believe this one will be no different.