As discussed in the newsletter this month that looked at CBDCs, with many stimulus packages announced, unemployment levels eclipsing those of 2008 in the US and debt rising to extraordinarily high levels, it’s no doubt we are in a time of crisis. It is difficult to find the silver lining in times such as these but one can look at history to find solace. Times of crisis often lead to significant and long lasting innovations. Could this crisis act as a catalyst for the adoption of Central Bank Digital Currencies (CBDCs)?

In 1941, Alan Turing became a huge asset for the Allies when he cracked the complex Enigma code and successfully decoded German communications. By the end of the war, Turing was working on the notion that a machine could plug into the speed and resilience of electronic technology. Hardware was developed, programming implemented and computer science was born.

Times of crisis have acted as a catalyst for innovations to be used in the wider public. In 1977, Citibank invested more than $100 million in the installation of ATMs in New York, seen as a huge gamble at the time. The decision paid off when the city was hit by a blizzard forcing banks to close. ATM use rose by 20%. However, the first ATM had opened in London ten years before, showing that innovations are sometimes adopted through necessity.

Let’s not also forget, Bitcoin was also created in 2008 as a reaction to the monetary policies implemented that year.

What innovation will come from COVID-19?

It’s very difficult to predict, but perhaps we can start by looking at the problems that have surfaced. Many small businesses in Europe and the US are at risk because they do not have enough runway money that lasts further than a month. Moreover, due to the pandemic, they may have to shift their businesses online, for which new monetary expenses may come up such as packaging and transportation (perhaps by a Courier Australia company or in another location), website development, POS system for safe transactions, etc. The issues don’t end there, online businesses may also need to implement new marketing and advertising strategies to improve sales and generate money so that they can keep the company running. If this isn’t possible, companies may need to fire a few of the employees as they may not be able to provide enough salary to the employee for a dignified living. To cope with such a financial crisis, employees may need to create a diverse source of income like stock market dividends, bonds, and games (if interested, check out real money earning games).

Because of this financial worry, taxes may also be concerning to these businesses as they have to make sure they are paying on time and the right amount. So they may utilize the resources of small business accountants Birmingham services or services within their location, to give them that support during this unbalanced time. In response to these monetary issues, the UK announced the CBILS scheme, and in the US small businesses have been allocated a total of $350 billion. In France, hardship grants of up to €1,500 a month have been made available to small business owners. However, central banks either cannot administer this funding fast enough or look to a third party to do so. In the UK many have not received the funds and in the US the packages are administered by fintechs such as PayPal, Intuit, and Funding Circle, services that come at a fee for central banks. Due to infrastructure, central banks across the world are either struggling to send funds to companies in a timely fashion or are hit by fees from the private sector to do so.

Could CBDCs be a solution to recently encountered problems?

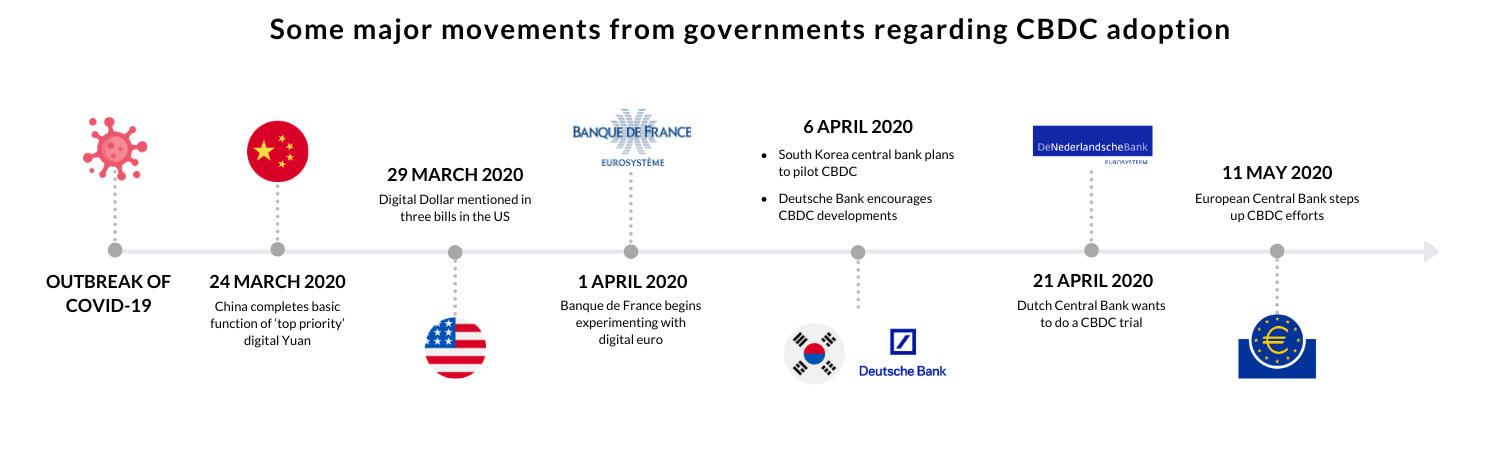

What could be a solution? CBDCs. Central banks need a solution to bring efficiency with the transfer of value, and CBDCs bring this by utilising a shared infrastructure. CBDCs are gaining significant momentum, too. Since the outbreak of COVID-19, there have been some major movements from governments regarding CBDC adoption:

- 24 March: China completes basic function of ‘top priority’ digital Yuan

- 29 March: Digital Dollar mentioned in three bills in the US

- 1 April: Banque de France begins experimenting with digital euro

- 6 April: Deutsche Bank encourages CBDC developments

- 6 April: South Korea central bank plans to pilot CBDC

- 21 April: Dutch Central Bank wants to do a CBDC trial

- 11 May: European Central Bank steps up CBDC efforts

This is not an exception, either. CBDCs were building momentum before the outbreak. According to a 2019 report issued by the Bank for International Settlements (BIS), a Switzerland-based organization representing 62 of the world’s central banks, 70% of financial authorities worldwide were researching the potential effects that CBDCs could have on their economies.