For a long time, gas fees have been a huge issue for public blockchain users; especially within the Ethereum mainnet in the past 12 months. While crypto users complain about the high and unstable gas fees preventing them access to DeFi, financial institutions are struggling to quantify their future costs and how they will add crypto tokens to their balance sheet if they enter the public blockchain space.

What are gas fees?

First, let’s walk you through some basic knowledge of gas fees. Gas fees are the cost of transactions on the blockchain. More precisely, they are the fees you pay as a blockchain user to reward the individuals and companies securing the network.

Currently, Ethereum uses a consensus protocol called Proof-of-Work (PoW). It is an algorithm that sets mathematical computations for miners to solve. Once those puzzles are solved by miners, new transactions will be encoded into a block and added to the blockchain. When a miner finds the correct answer, they can produce a block and receive gas fees as a reward. Miners are the individuals and companies that participate in this process with powerful computers. Furthermore, their computers often conduct the ‘trial and error’ method to find the solutions. It requires strong computation power that runs day and night, all around the world.

Gas fees are unpredictable and complex

As each block space is finite, miners will obviously pick the highest gas fee bid transactions to prioritize. Therefore, you will need to overbid on gas fees to get the transactions validated quickly. Your transaction is therefore in competition with others, and also depends on the value of the crypto token you must use to pay (e.g. ETH on Ethereum). Paying for the infrastructure only when you use it is great, but not being able to predict how much you will have to pay is obviously an issue. It is difficult to define operational costs and how to recharge them to clients. Basically, it requires a whole process for institutions to buy crypto at a reasonable price, store them in secure wallets, and, at the same time, make them available for their employees when they perform actions on security tokens. On the other hand, some institutions are not even allowed to buy and keep crypto due to regulation or their own risk policies, or accounting difficulties.

Tokeny made gas fees disappear

For a long time, we’ve been looking for solutions to solve the gas fee issues. Because we believe that public blockchains are valuable as ecosystems, we didn’t want to start issuing security tokens on private or nascent blockchains. Obviously, our customers were not alone in facing these gas fees issues, millions of users and developers needed to fix this as well. That’s mostly why amazing new solutions came up recently in the market, such as sidechains, layer 2 solutions and other technical improvements, leveraging the decentralization of Ethereum but validating transactions differently, mostly with Proof-of-Stake mechanisms.

After long research, tests and discussions with people involved in the industry, we decided to make our EVM compatible platform evolved in order to issue, manage and transfer security tokens on the Polygon network. In April, we partnered with Polygon, a layer 2 protocol building and connecting Ethereum-compatible blockchain networks. With Polygon, the gas fee has been reduced by over 10,000 times. It now costs less than $0.01 per transaction.

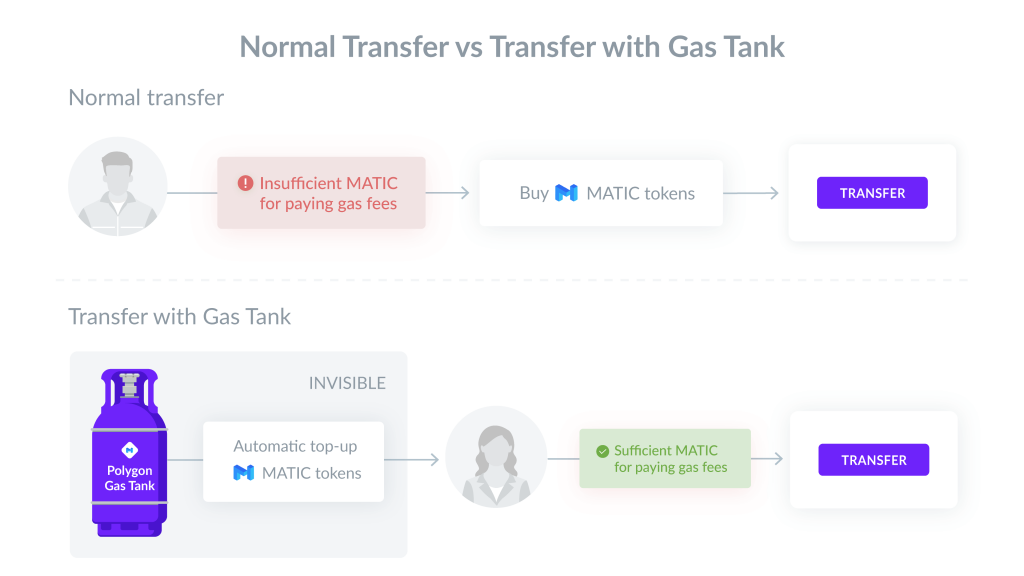

While the cost of transactions is no longer the issue as the gas fees become so low, the complexity of the process remains. Users still need to go to cryptocurrency exchanges to buy MATIC – the crypto token used to pay the gas fees on Polygon. The problem with this process becomes more complicated for financial institutions, as some don’t even know how or where their balance sheets will include these crypto-costs going forward.

It was therefore clear to us that the key to getting traditional players and investors to embrace tokenized securities is to provide them with a better user experience by making the gas fee process disappear. To achieve this goal, we have developed a solution called the “Polygon Gas Tank”. Basically, the system monitors the balance of MATIC tokens in issuer’, agents’ and investors’ wallets. When it falls below the balance threshold, the Polygon Gas Tank will top up the wallet with more MATIC tokens automatically, and for free. As a result, our users always have enough MATIC tokens to cover their gas fees. In other words, we’ve got this covered, users don’t need to pay any blockchain transaction fees anymore.