Product Focus

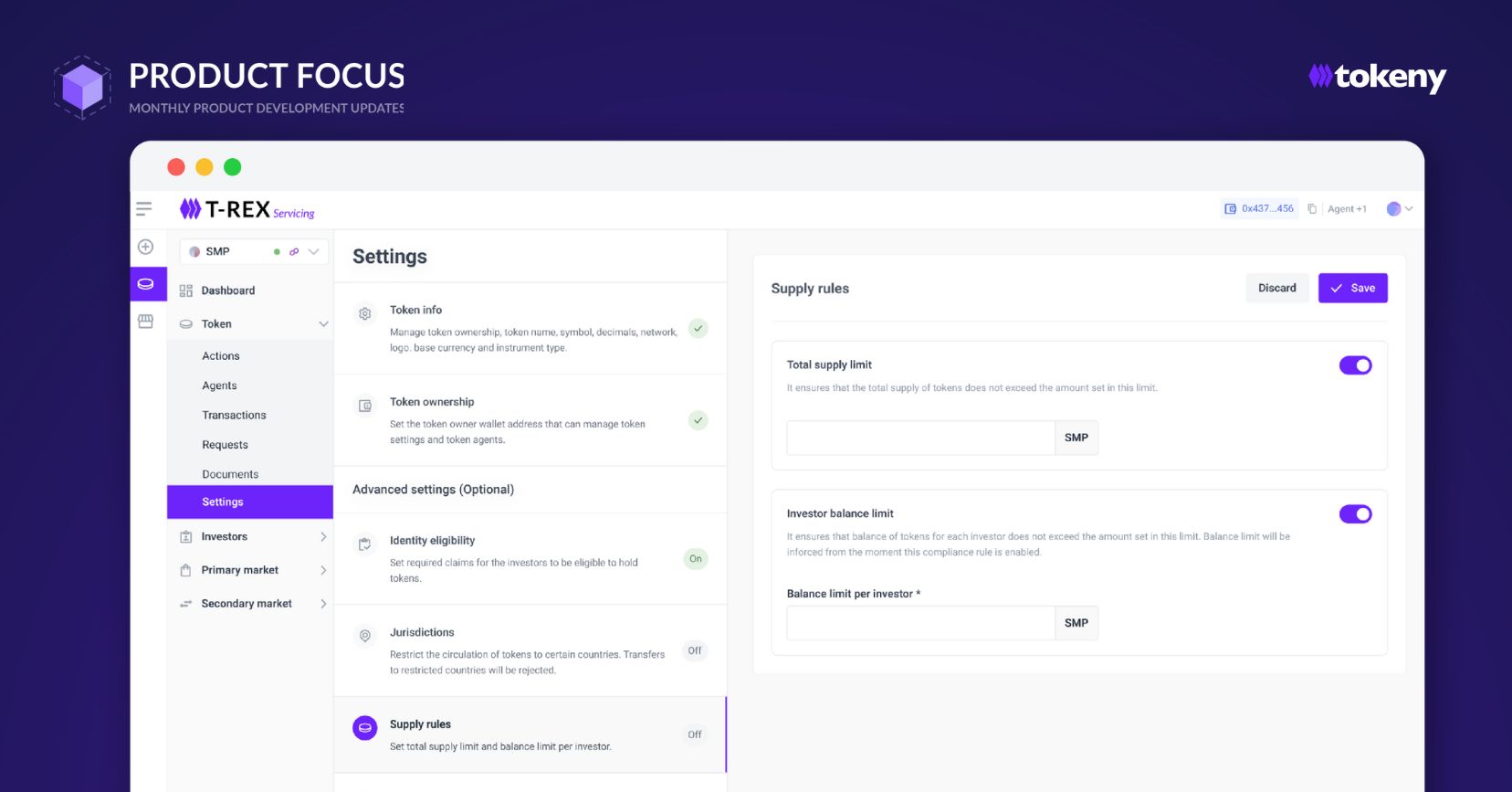

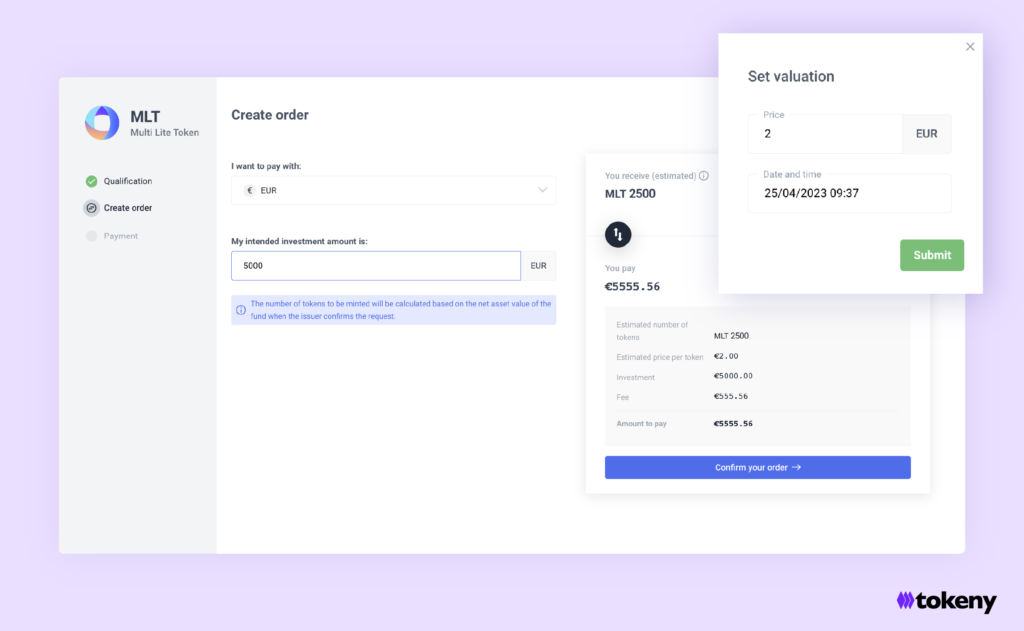

We are excited to unveil our latest Open-Ended Subscription solution for the subscription module. It enables tokenization of open-ended investments by allowing issuers to dynamically update the valuation of tokenized securities for their offerings.

What is the Open-Ended Subscription solution?

The Open-Ended Subscription is a primary market solution tailored for securities that are continuously available for investors to acquire. These securities are subject to periodic fluctuations in share prices, typically on a daily basis for UCITS or REITs, thereby enabling investors to redeem their shares directly from the issuer upon exiting.

The solution provides issuers with the ability to update prices for tokenized shares using our compliant, blockchain-based infrastructure. As a result, open-ended financial instruments can offer investors an e-commerce-like experience.

We have listed a few benefits below:

- Direct Distribution: Investors can directly visit the investment offering website, complete qualification, and place orders. This reduces distribution fees by avoiding intermediaries between the issuer and the end distributor.

- 24/7 Subscriptions: Investors can seamlessly invest in tokenized securities whenever they please on the platform.

- Digital Experience: The subscription process is fully digital, encompassing document signing and payment processing. Back-office automation facilitates seamless management of subscriptions for thousands of investors, eliminating operational hassles.

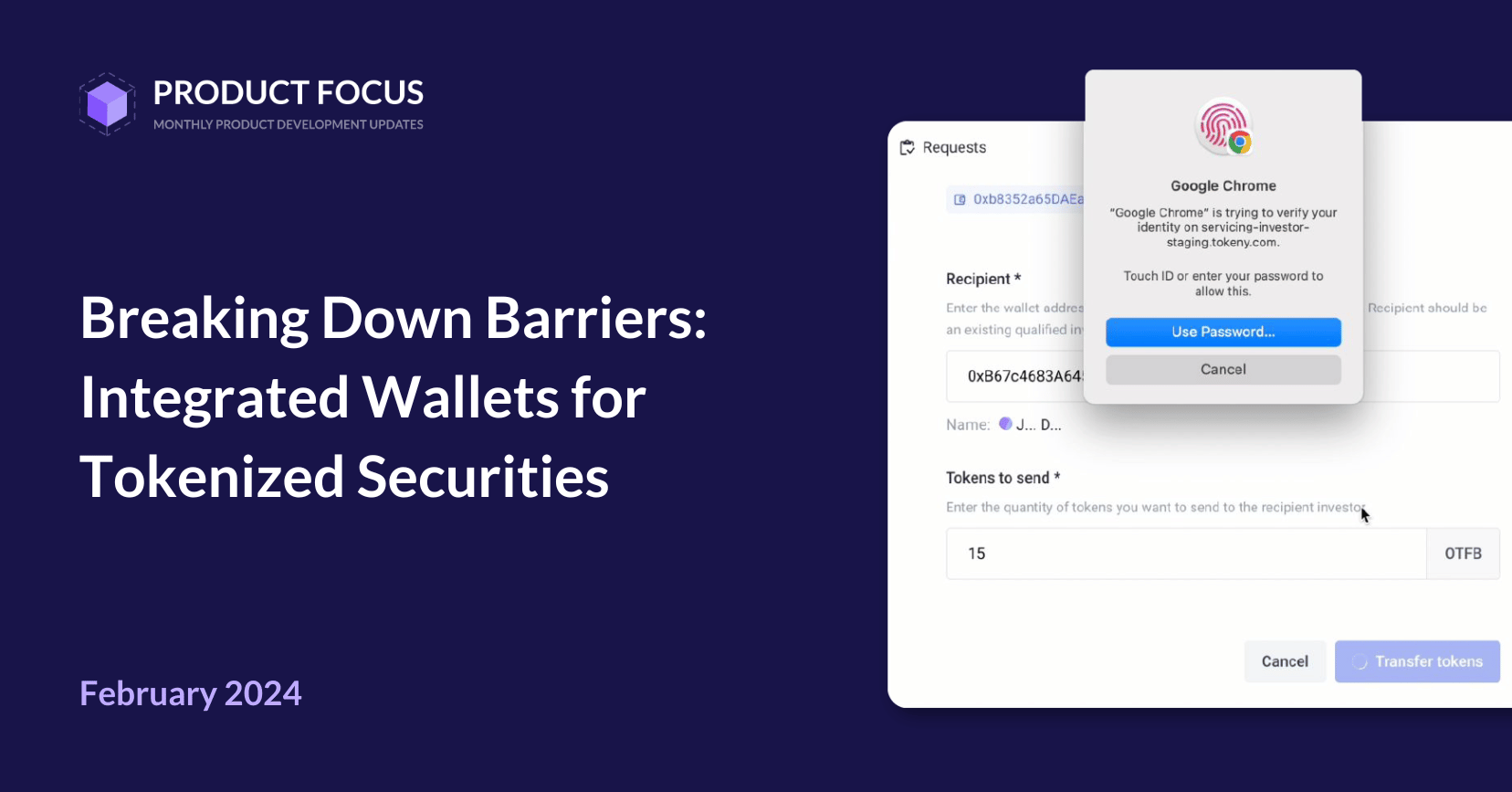

- Real-time Allocation: Once the new valuation is set, investors receive their tokenized securities directly minted into their wallets.

What are the use cases and ultimate benefits?

This solution is ideally suited for open-ended investment offerings, such as UCITS, REITs, mutual funds, hedge funds, and ETFs. In most instances, these open-ended funds require updating the NAVs of shares to accurately represent the value of the fund’s underlying securities at the close of each trading day.

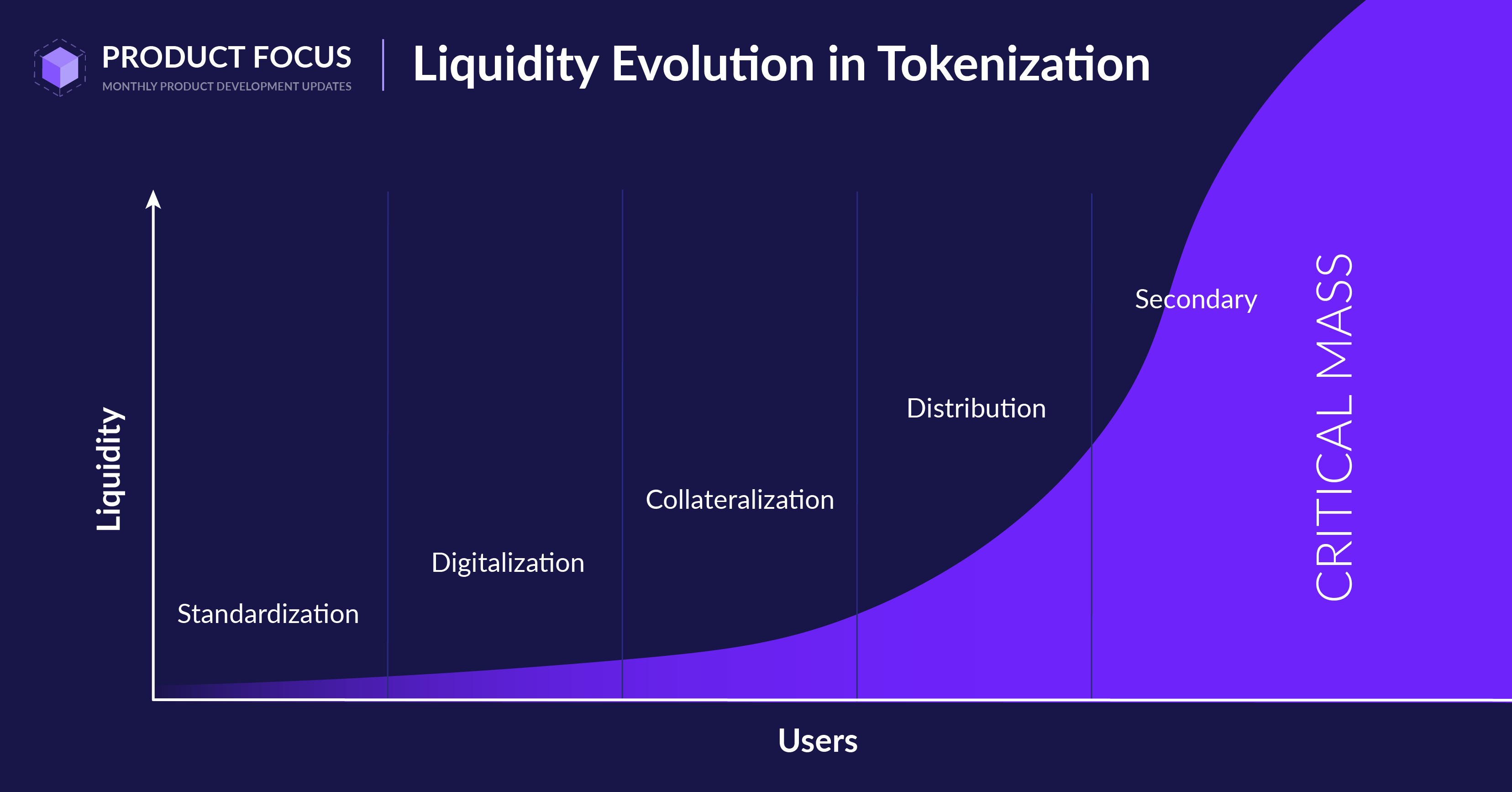

The new solution empowers fund managers to execute NAV updates directly on their tokenization platform. While the traditional financial industry has already well-established processes for NAV updates, the true advantage resides in the digital, transparent, and real-time experience provided to investors throughout the subscription process. Furthermore, the advantages extend post issuance, allowing investors not only to use these tokenized assets in DeFi as collateral for borrowing, but also to deposit them in a liquidity pool for earning extra yield.

Moreover, this solution serves as a crucial facilitator for tokenizing open-ended funds or other assets that necessitate frequent NAV updates during primary offerings. In doing so, it enables access to global investors, reduces costs, and enhances liquidity.

Subscribe Newsletter

This monthly Product Focus newsletter is designed to give you insider knowledge about the development of our products. Fill out the form below to subscribe to the newsletter.