Are Banks Missing Out on the Digital Money Revolution?

Digitalization continues to accelerate our everyday life, affecting people, businesses, governments and financial institutions. The Covid-19 pandemic acted as a catalyst that revolutionized the way people work, purchase, and invest. The hype around non-fungible tokens (NFTs) and decentralized finance (DeFi) is evidence of the growing interest in investment opportunities brought by blockchain technology. According to a recent report, security tokens are seen as the next blockchain wave and are predicted to reach a market of €918 billion by 2026.

Naturally, the demand for these new means of investment has pushed digital money into the spotlight. Why? Because the cash leg must be on the same infrastructure as the securities in order to allow a real transition to a decentralized network. While most banks are still waiting for central bank digital currencies (CBDCs) to show the way, stablecoins issued by crypto players have reached a record-high trading volume at $766.02 billion in May, up 51.9% from the previous month, and nearly 15x greater than one year ago.

CBDC vs Commercial bank digital money vs Stablecoins:

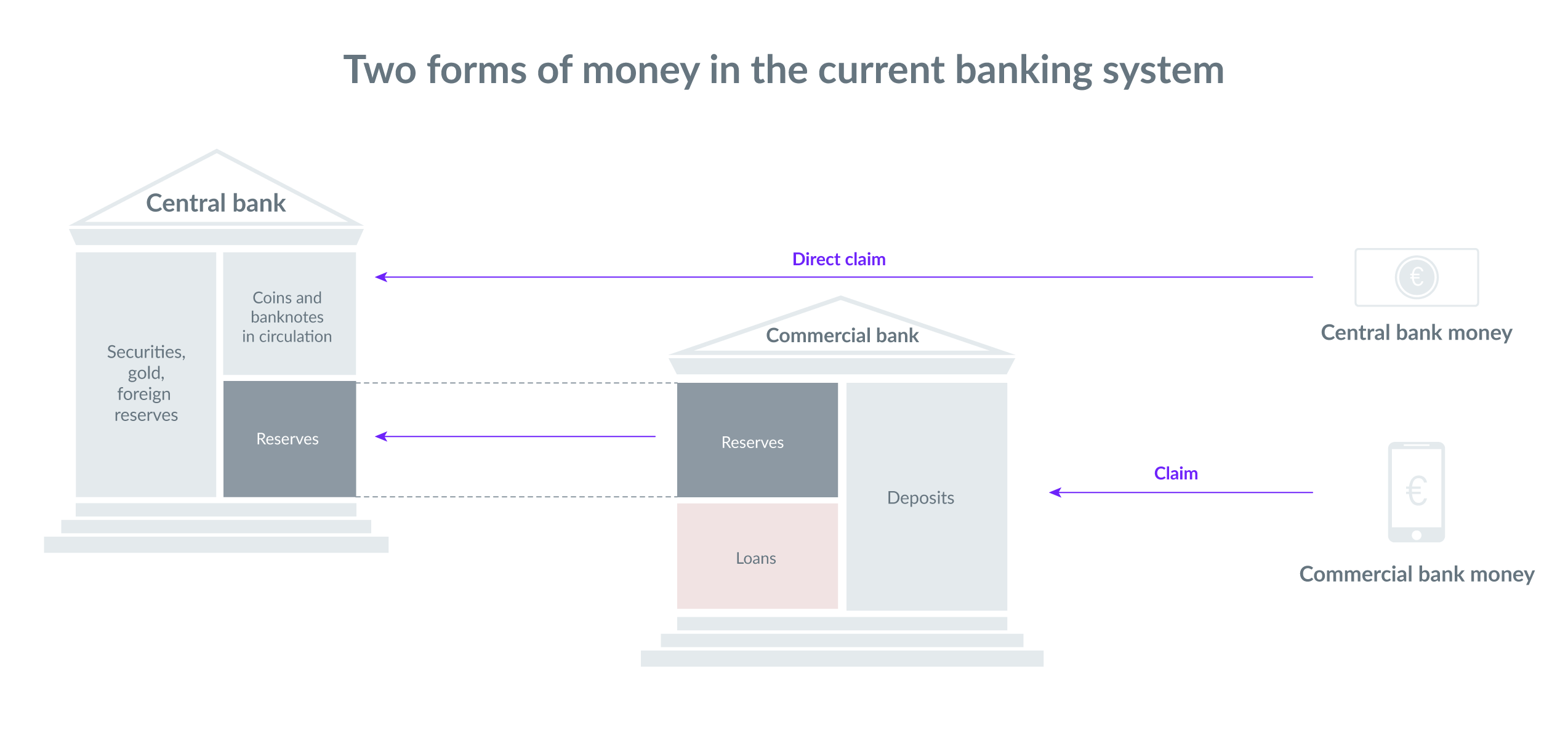

First, let’s take a deeper look at the two forms of money in the current banking system: central bank money and commercial bank money. Central bank money is made available to the public in the form of cash and to commercial banks in the form of central bank reserves. Private money is deposited into commercial banks, and banks are required to hold a certain percentage of these deposits at the central bank as a cushion. The rest of the deposits are used to grant loans to individuals and companies, where commercial bank money is created at this point. Therefore, in traditional finance, commercial banks act like trusted entities to not only provide essential services to customers, but also help create capital and liquidity in the market.