Originally published in the GDF Annual Report 2024, published in February 2025

Breaking the Silos: The Path to Shared Liquidity with ERC-3643

Authors

Liquidity drives markets. Yet, in tokenized real-world asset (RWA) and securities markets, liquidity remains trapped in silos, unable to reach its full potential. Distributors operate as isolated ecosystems, and investors are limited to closed networks. As financial services progress on-chain, the question underpinning how to better facilitate this adoption is clear: how do we unlock true liquidity and scale the market?

Authors

Luc Falempin

CEO at Tokeny

Daniel Coheur

CCO at Tokeny

The pain of siloed liquidity

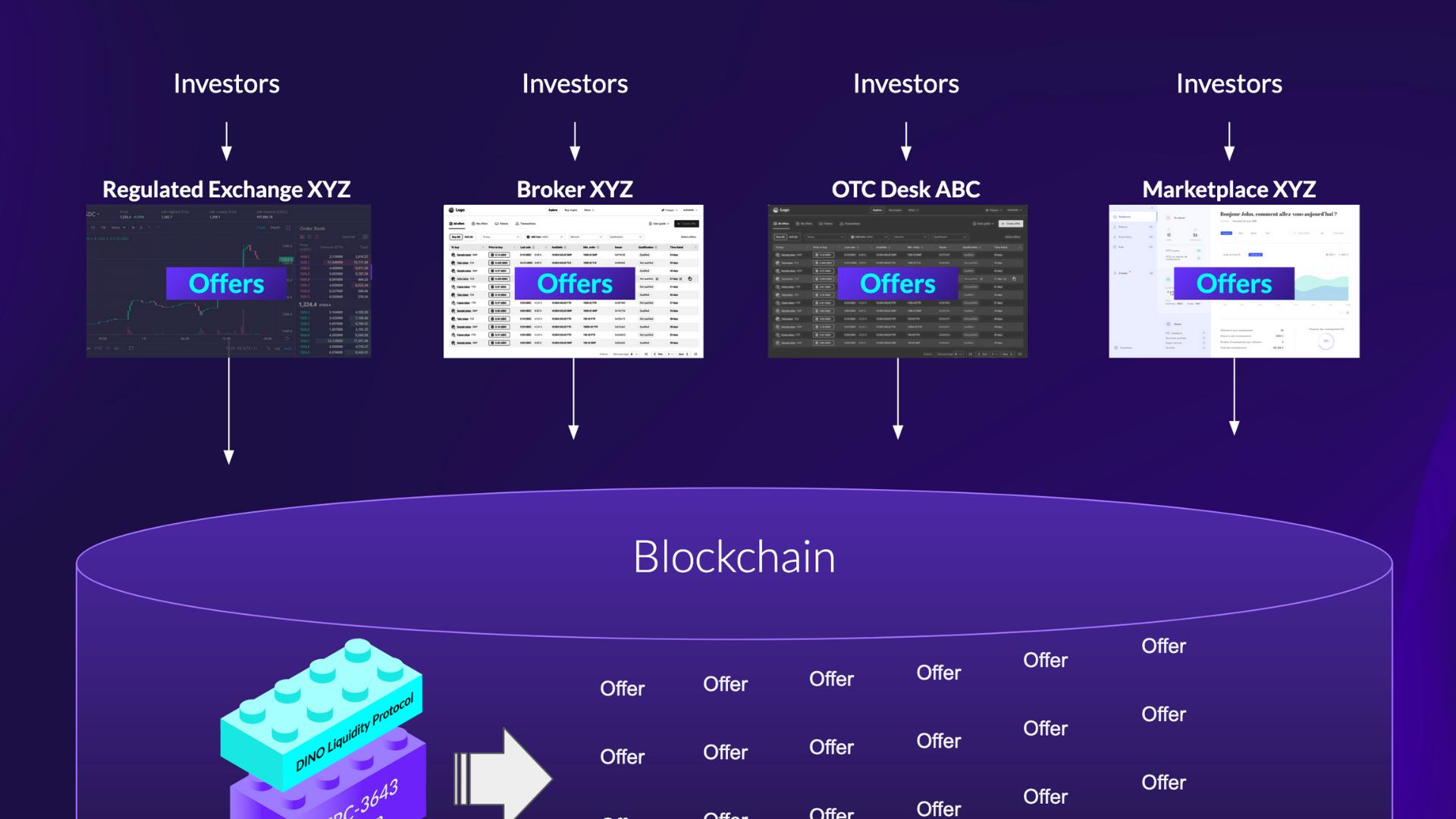

Today, tokenized markets operate in isolation. Distributors list assets on their platforms, but each platform functions as a closed ecosystem, limiting liquidity to its internal investor base. An investor placing an offer on one distributor’s platform relies entirely on that platform’s order book to find a counterparty.

This fragmentation stifles market activity. Offers go unmatched, trades are delayed, and assets remain underutilized. Tokenization and its underlying technology promises to solve these inefficiencies, rather than exacerbate them. The issue is not with the concept of tokenization, but in evolving our understanding of how liquidity functions on-chain – a paradigm fundamentally different from anything we have seen before.

Shared liquidity is the future

On-chain liquidity is supposed to be shared. It breaks down silos, creating a global marketplace where offers flow seamlessly across platforms. Distributors still maintain their unique platforms and investor relationships but can now tap into a dynamic and giant order book shared by the entire ecosystem.

The benefits of shared liquidity are profound:

- For investors: Access to a global pool of liquidity without leaving their trusted distributor’s platform. They see more opportunities,experience faster transactions, and benefit from a more vibrant market.

- For distributors: An expanded role as enablers of global liquidity. They can curate assets fort heir investor networks while participating in a larger and more active ecosystem.

- For issuers: Increased market activity and visibility for their assets, unlocking value and accelerating adoption.

ERC-3643: The open-source standard enabling market liquidity

The ERC-3643 standard enables shared liquidity by allowing issuers to issue, manage, and distribute permissioned tokens. It enables compliance, composability, and interoperability.

- Built-in compliance: Compliance is embedded directly at the token level. ERC-3643 tokens include transfer restrictions and identity-based validation, ensuring that only eligible investors can participate. Unauthorized users and transactions will be denied automatically.

- Interoperability: ERC-3643 is built on top of ERC-20, making it interoperable directly with the entire EVM ecosystem. It brings a standardized compliance layer to ensure seamless and compliant interaction across platforms.

- Composability: ERC-3643 is modular and adaptable. It can add additional functionalities by combining them with other smart contracts, such as the DINO liquidity protocol, which allows investors (directly or via distribution platforms) to publish Delivery vs. Delivery (DvD) offers on- chain.

Shared DvD offers: Redefining liquidity as we know it

The DINO liquidity protocol transforms the blockchain network into a distributed marketplace, where distributors connect and seamlessly transact together, without sharing their clients.

The most fascinating aspect of the shared order book is the self-executing DvD smart contracts that power ERC-3643 token offers, enabling complete on-chain automation. By redefining liquidity and breaking down silos, they transform blockchain into a seamlessly interconnected global marketplace.

Once investors publish a DvD offer, it instantly becomes visible across all distribution platforms. When a buyer accepts the offer, whether on the same platform or a different one, the DvD smart contract verifies everything:

- Eligibility: The buyer’s onchain identity is validated to ensure compliance.

- Compliance rules: Transfer restrictions and conditions are automatically enforced.

- Balance check: The buyer’s wallet is checked to confirm sufficient funds.

Once all conditions are met, the transaction is settled instantly, without counterparty risk or intermediaries.

“This is not only a faster way to trade, but also a completely new experience. Investors can participate in secondary trading with the simplicity and speed of an e-commerce transaction. Click. Trade. Done.”

Luc Falempin, CEO at Tokeny

“This is not only a faster way to trade, but also a completely new experience. Investors can participate in secondary trading with the simplicity and speed of an e-commerce transaction. Click. Trade. Done.”

Luc Falempin, CEO at Tokeny

Shared Standards, Shared Success

The tokenized markets are advancing rapidly, driven by the adoption of shared standards that foster trust, compliance, and operational efficiency. ERC-3643, supported and recognized by major financial and regulatory institutions like ABN AMRO, DTCC, Fasanara, ESMA, Citi, JPMorgan Chase, Global Digital Finance, and Deloitte, has emerged as a cornerstone of this progress and exemplifies industry collaboration in creating a unified framework for issuers, distributors, and investors. Its success underscores the importance of standardization in unlocking liquidity, reducing market fragmentation, and enabling a more efficient, interconnected financial ecosystem.