Product Focus

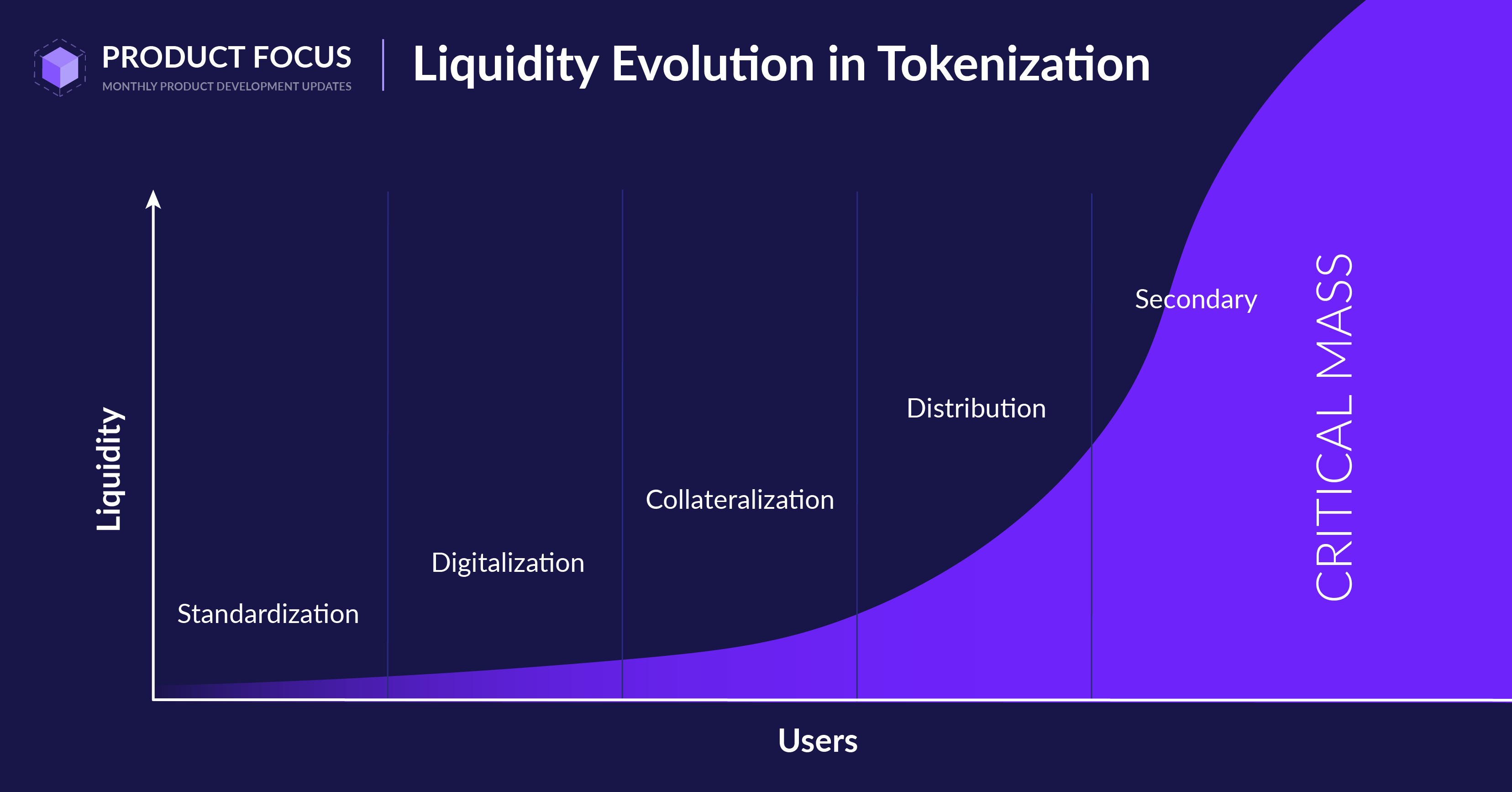

This year has been a journey of innovation, growth, and achievement. At the beginning of this year, we set out to achieve four objectives: accelerating the standardization phase; digitizing real-world assets and securities at scale; enabling DeFi through a unified data layer for private markets; and building distribution rails to streamline access and adoption.

Let’s look back on the remarkable progress we made together.

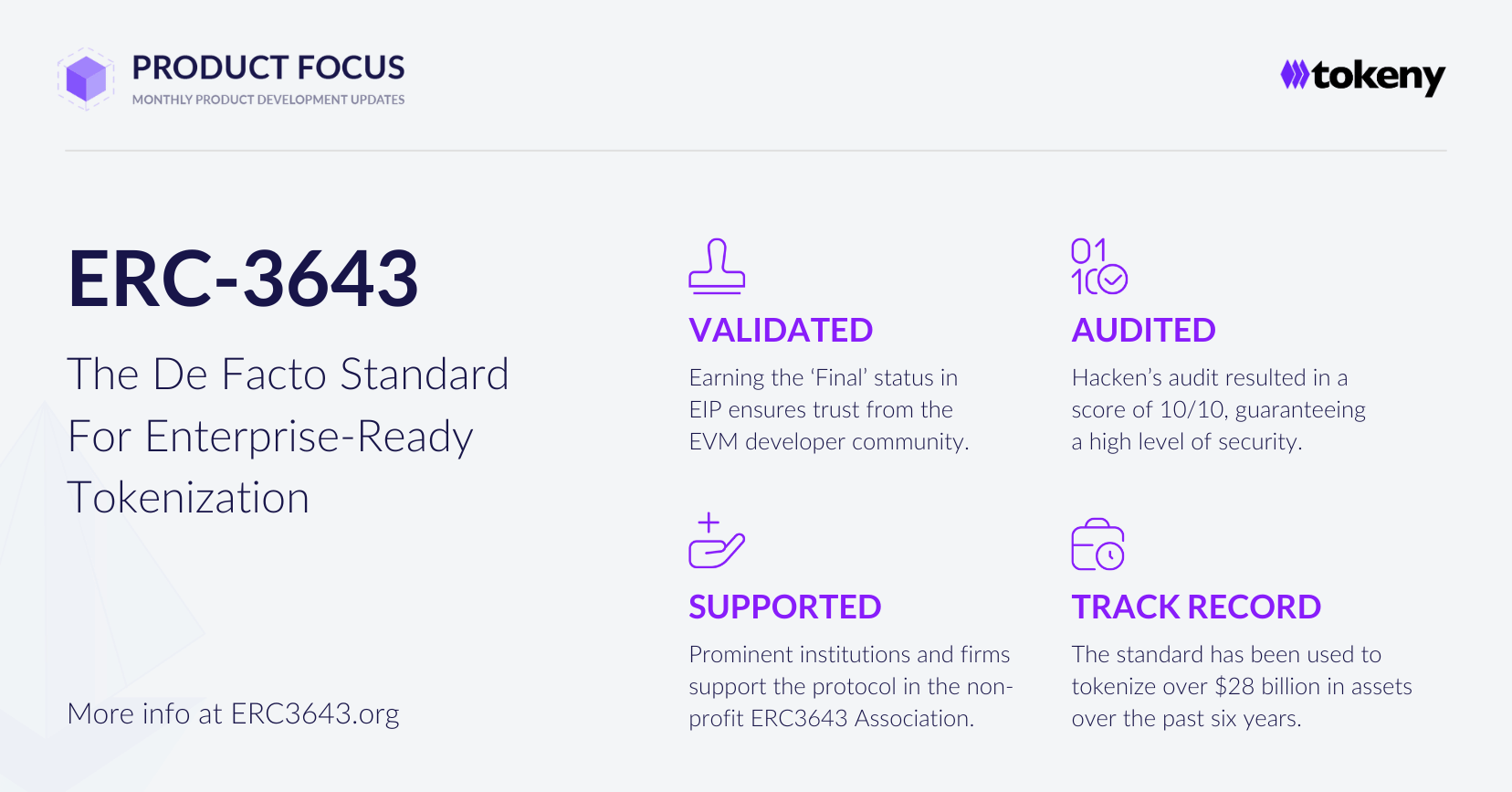

ERC-3643 is now the official standard, recognized globally

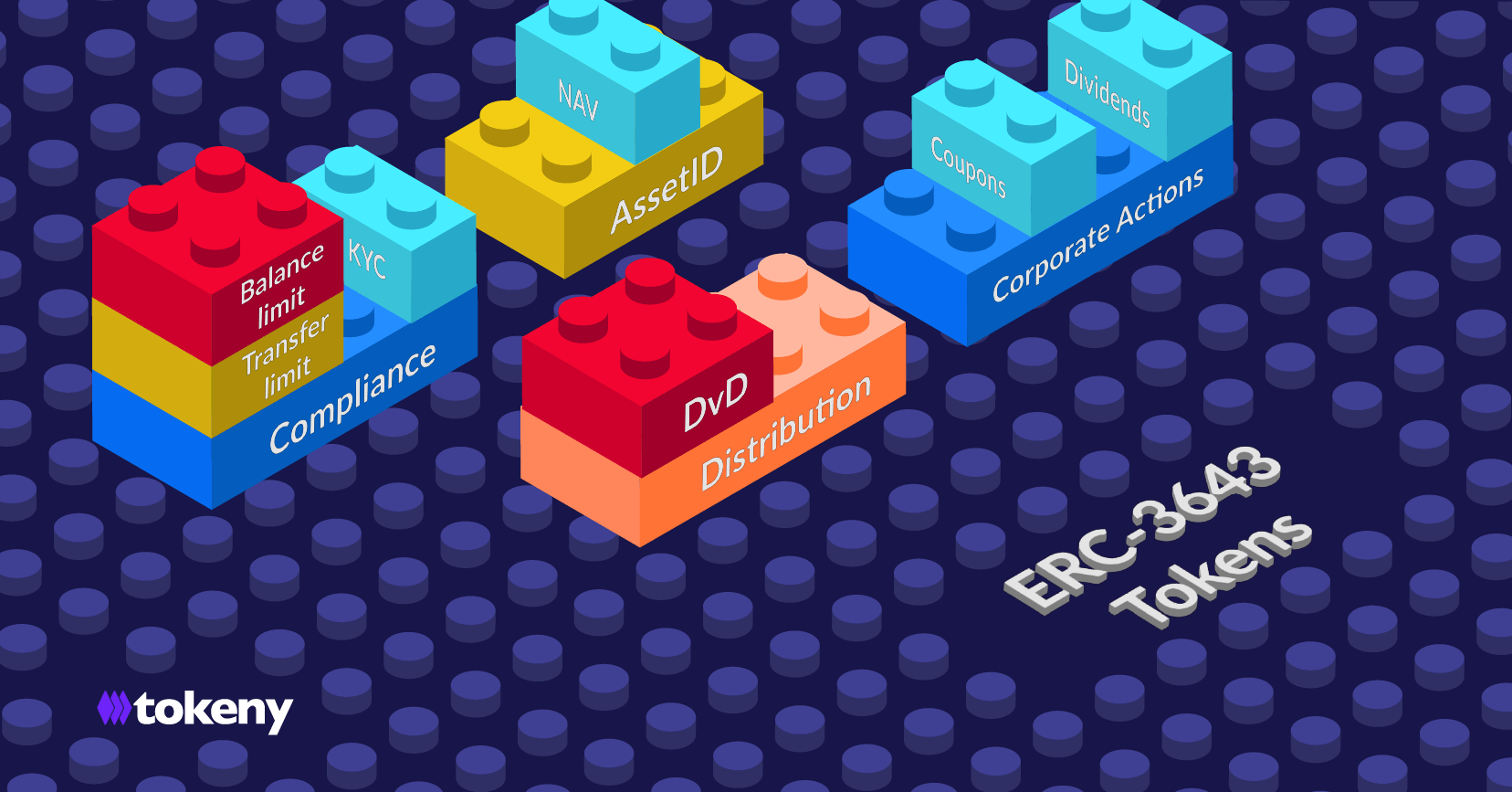

The ERC-3643 open-source standard has emerged as the cornerstone of the tokenization industry, serving as the motherboard for building diverse use cases. We have actively worked with 92 industry leaders in the ERC3643 Association to advance the standard by contributing to concrete projects.

Moreover, ERC-3643 has gained significant traction from large organizations, being used or referenced in industry reports by ABN AMRO, Citi, JPMorgan Chase, ESMA, BCG, KPMG, and Deloitte. Recently, it was recognized by the Singapore regulator MAS for enforcing compliance for tokenized funds and debt in the Project Guardian.

An Onchain Operating System Ready for Scale

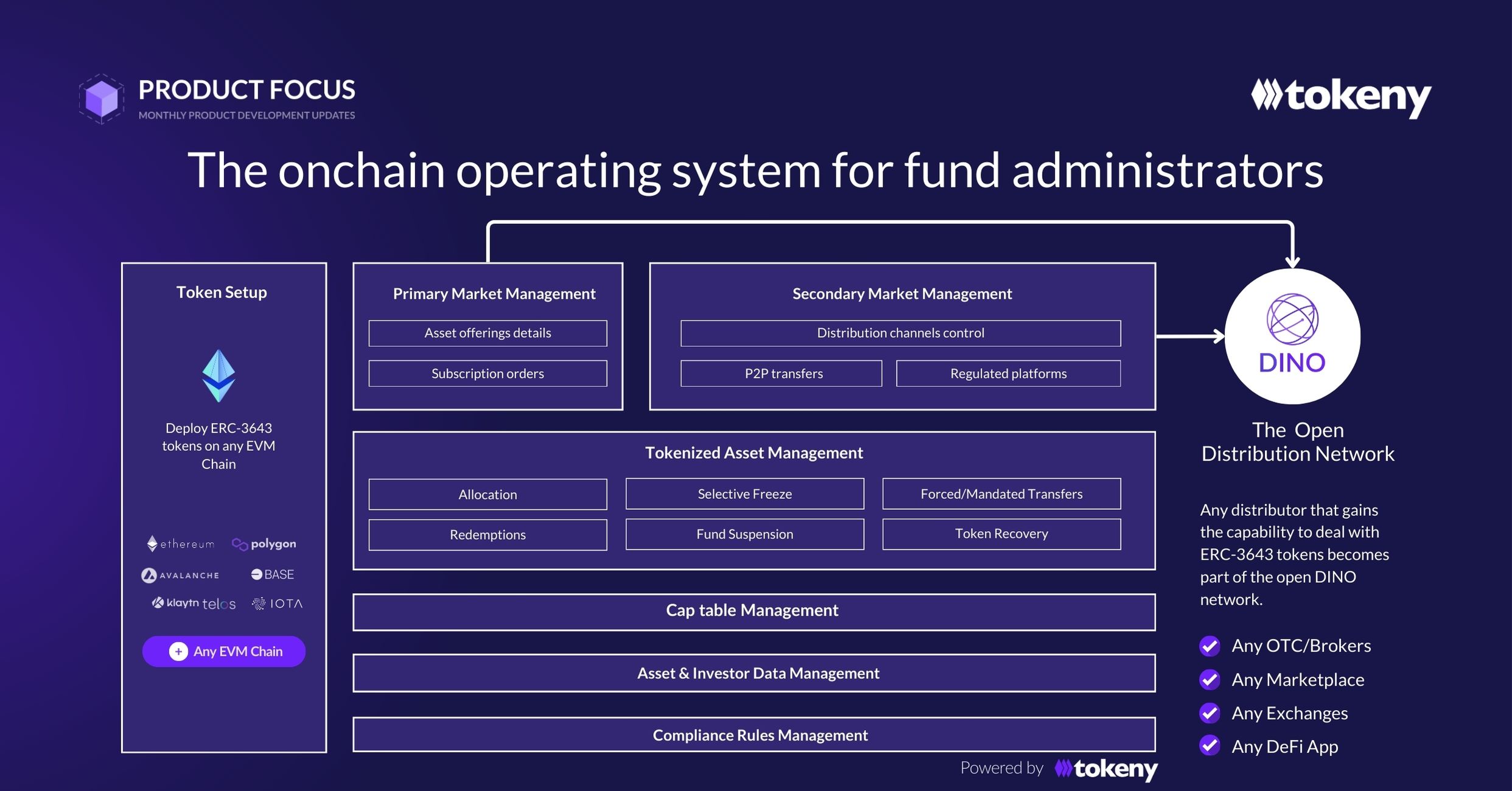

On the products side, our solutions are now ready to empower asset issuers to tokenize assets at scale. To reach critical mass, asset managers need a tech toolbox that allows them not only to tokenize assets onchain but also to manage and distribute them while working seamlessly with all stakeholders using different tools and systems.

Our products provide exactly that. We’ve redefined our product positioning as an onchain operating system to make our product’s value proposition clear. We provide an orchestrated platform that unifies and automates workflows with all necessary service providers, whether onchain or offchain. Our added value lies in the most robust technology, a well-connected ecosystem, and expertise gained from 7 years of real-world practices.

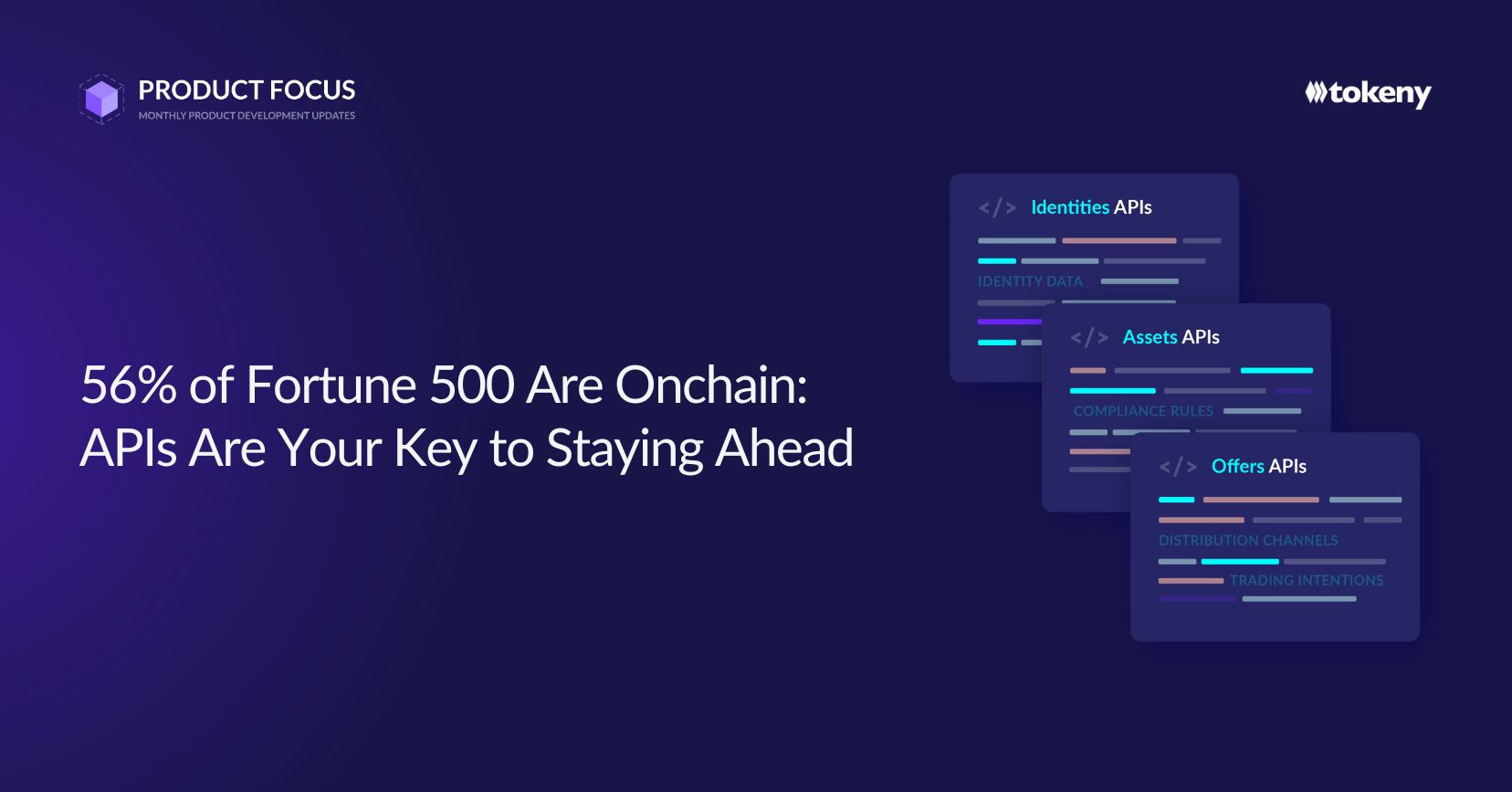

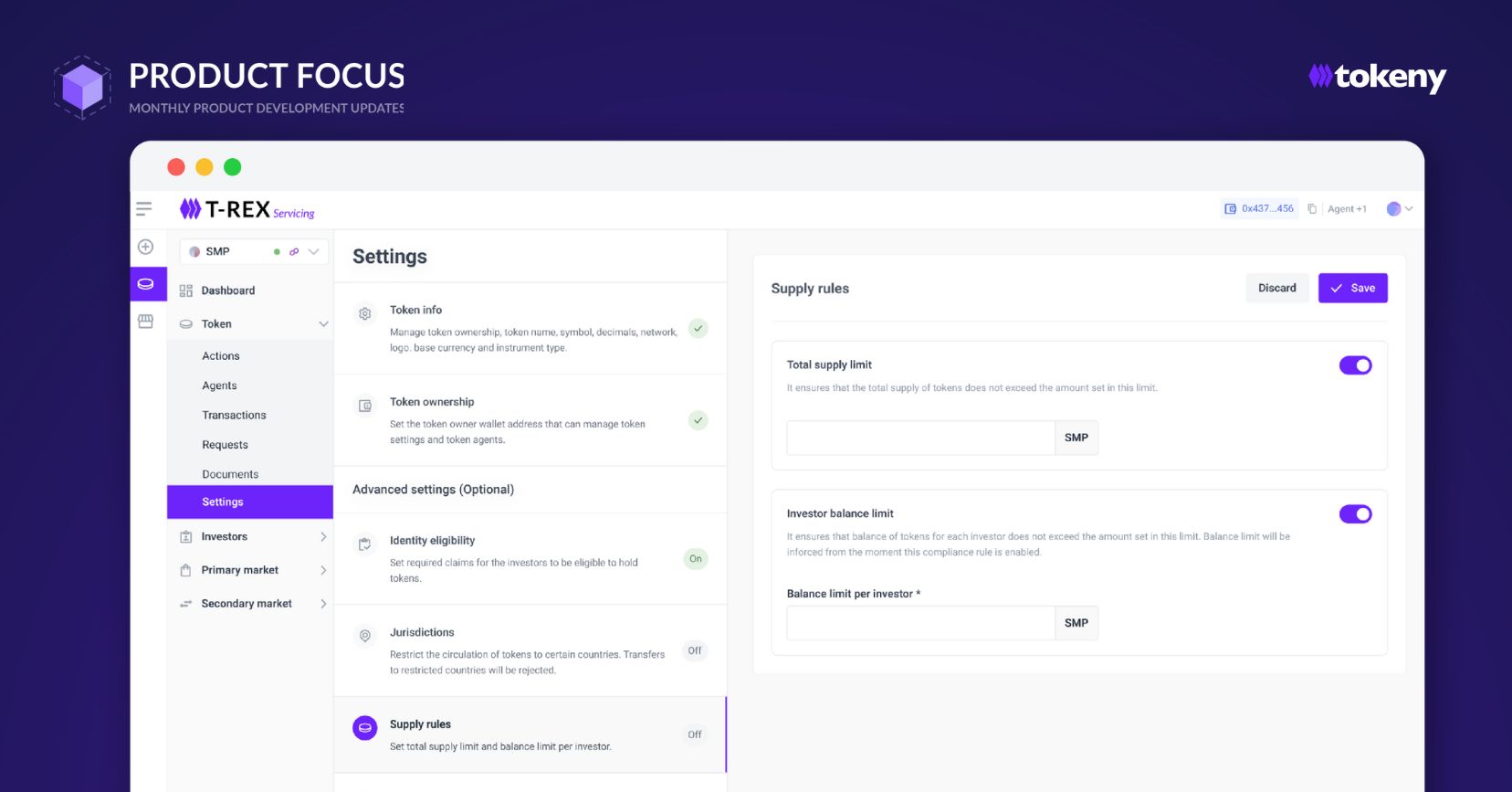

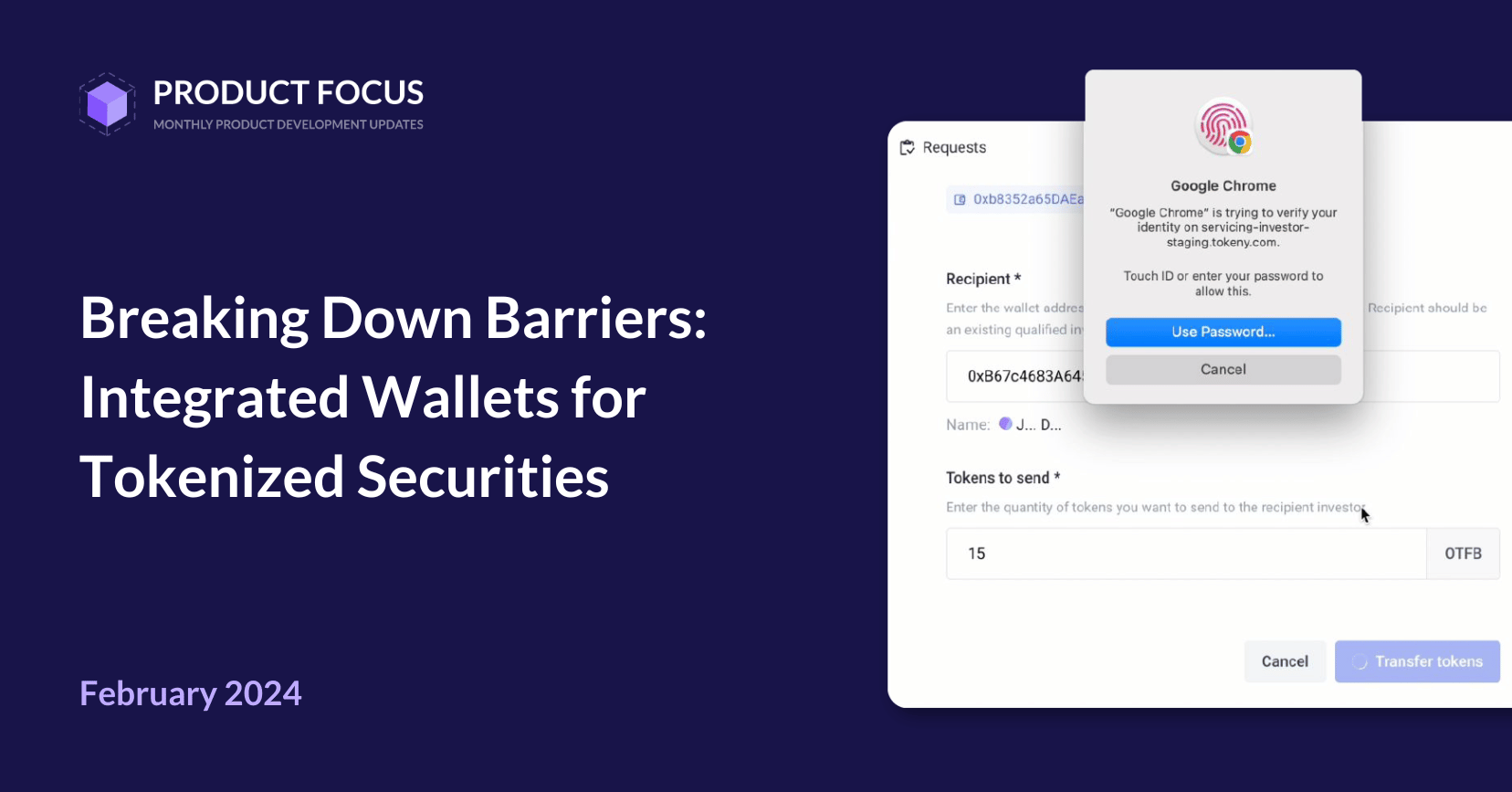

Our product is designed to serve diverse business needs, on any EVM blockchain, for any assets, in any jurisdiction. The T-REX Platform, a no-code tool, empowers businesses to tokenize, manage, and distribute assets without requiring IT resources, while the T-REX Engine, an APIs solution, is designed for advanced projects integrating onchain operational capabilities directly into their existing workflows.

Our product enhances onchain compliance setup. Controlling tokens requires asset managers to configure token settings through token smart contracts. Our products allow asset managers to configure and customize compliance rules anytime, such as eligibility rules, transfer restrictions, and enablement of distribution.

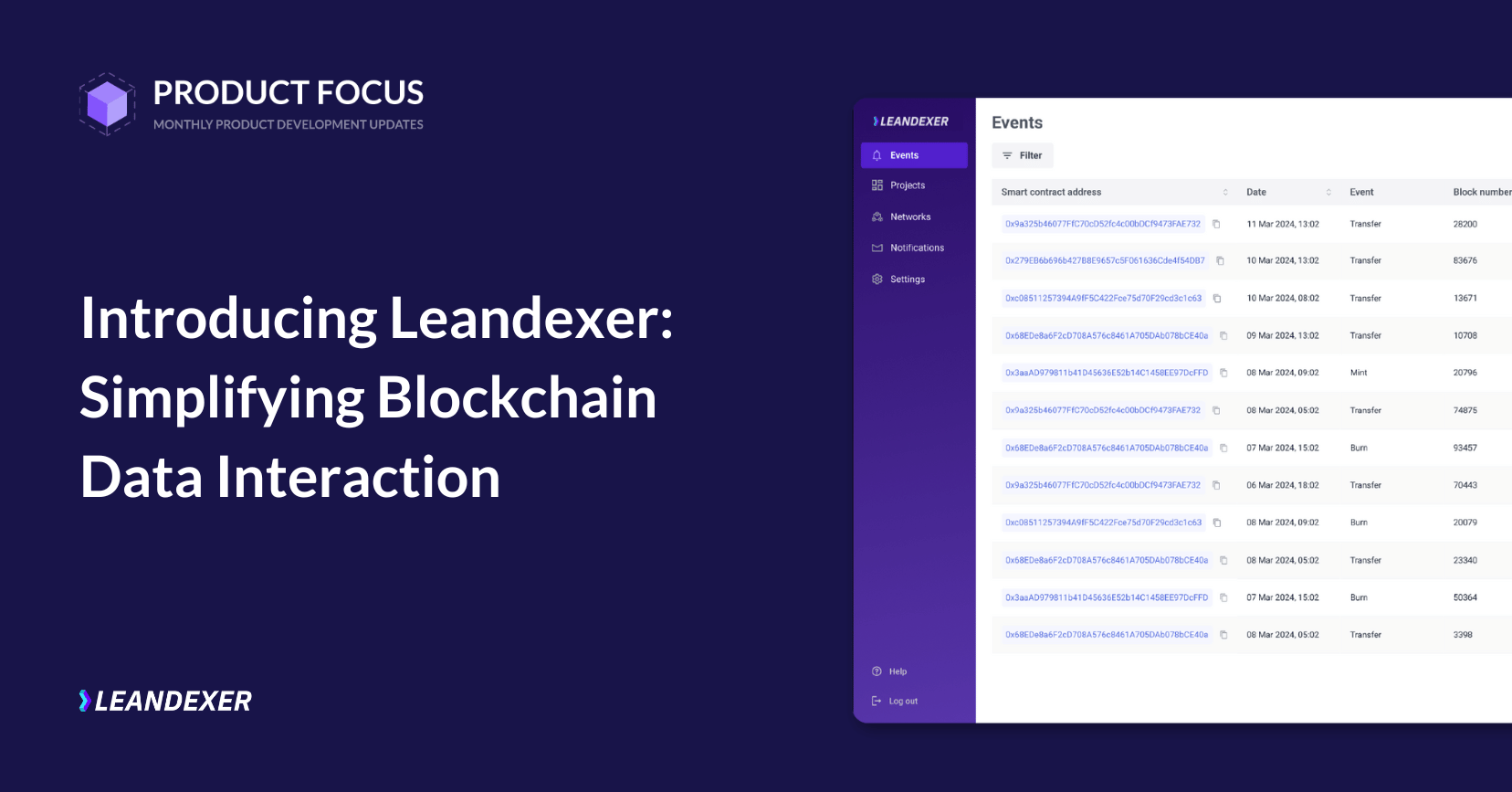

Enabling DeFi via onchain data management and shared liquidity catalog

Assets issued with ERC-3643 automatically receive an AssetID smart contract. This built-in onchain asset identity enables data enrichment like NAV, ESG proofs, and ratings. ERC-3643 tokens are accessible through a shared onchain catalog with a unified data set, allowing seamless DeFi interaction while adhering to built-in compliance rules.

Step by step, we have started creating a unified Catalog of tokenized assets that includes token data, asset data, stakeholder data, and offering data. This catalog will enable distributors (regulated exchanges, OTC platforms, dApps, neobrokers, etc.) to easily select assets for distribution to their respective audiences.

To maximize transactions and interoperability between distributors, we have also created DINO, a shared liquidity protocol on the blockchain. DINO is a decentralized network enabling the distribution of compliant tokenized assets. The system leverages blockchain technology to revolutionize the publishing and settlement of digital assets, transforming how issuers, their distributors, and investors conduct transactions.

At its core, the system enables parties to post and browse trading intentions, known as Offers, via token-specific distribution smart contracts. This innovation ensures that all offers are transparent and accessible on the blockchain, creating a continuous live feed of available trading intentions for all participants to see. It is now ready for prime time. 2025 will be epic!

The Foundation is Built: What’s Next for Tokenization?

This year, we’ve built a solid foundation for onchain finance with all the essential building blocks. 2025 will be a year of accelerating institutional adoption as the buy-side begins to fully benefit from the tokenization format. We will see more and more applications leveraging compliant tokenized assets, and Tokeny is ready to lead this transformation. Thank you for being with us on this journey.

We wish you a great holiday season and a happy new year!

Xavi Aznal

Subscribe Newsletter

This monthly Product Focus newsletter is designed to give you insider knowledge about the development of our products. Fill out the form below to subscribe to the newsletter.