The growing interest in security tokens

Capital markets are advancing into a digital-first world and financial institutions have never been so enthusiastic about investing in digital assets. According to a study conducted by the Frankfurt School of Finance and Management, Plutoneo, and Tangany, the European security token market is expected to grow approximately 81% annually over the next five years, and is projected to reach €918 billion by 2026. Its market volume could surpass the cryptocurrency industry in the next five years.

Identifying wallet owners is a regulatory obligation

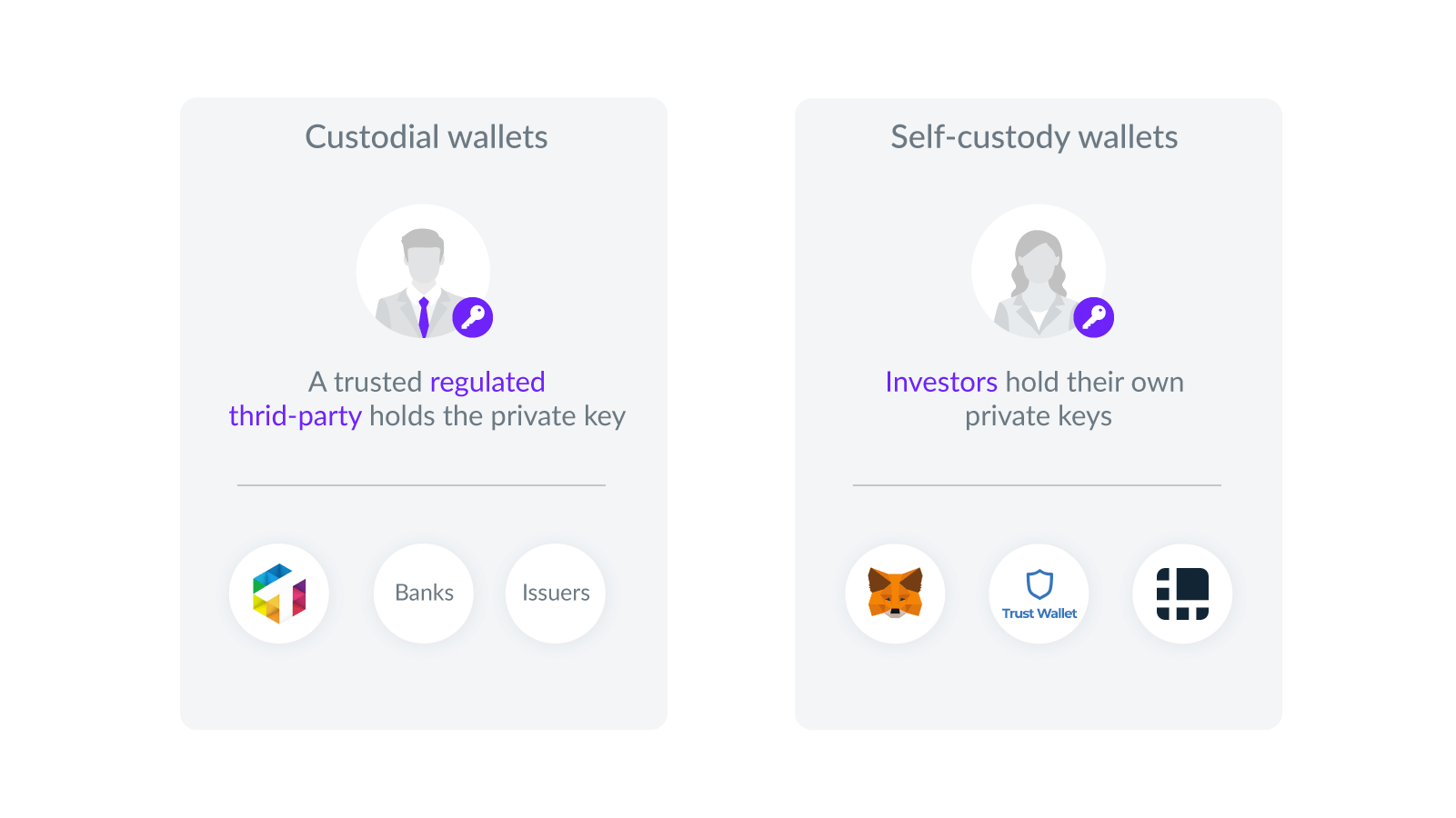

Security tokens are becoming popular and are likely to become a major investment option in the future as the interest keeps growing. However, the change in market infrastructure does not change the fact that securities need to comply with financial regulations. In the tokenization world, investors hold their assets in blockchain wallet(s). Therefore, it is critical for issuers to be able to identify who the wallet owner is and whether this owner is eligible to own the security. Blockchain identities solve this legal problem for issuers. Digital identities not only allow issuers to address compliance issues, but also enable protection for investors through recovery processes.

Digital identities enable the recovery of security tokens

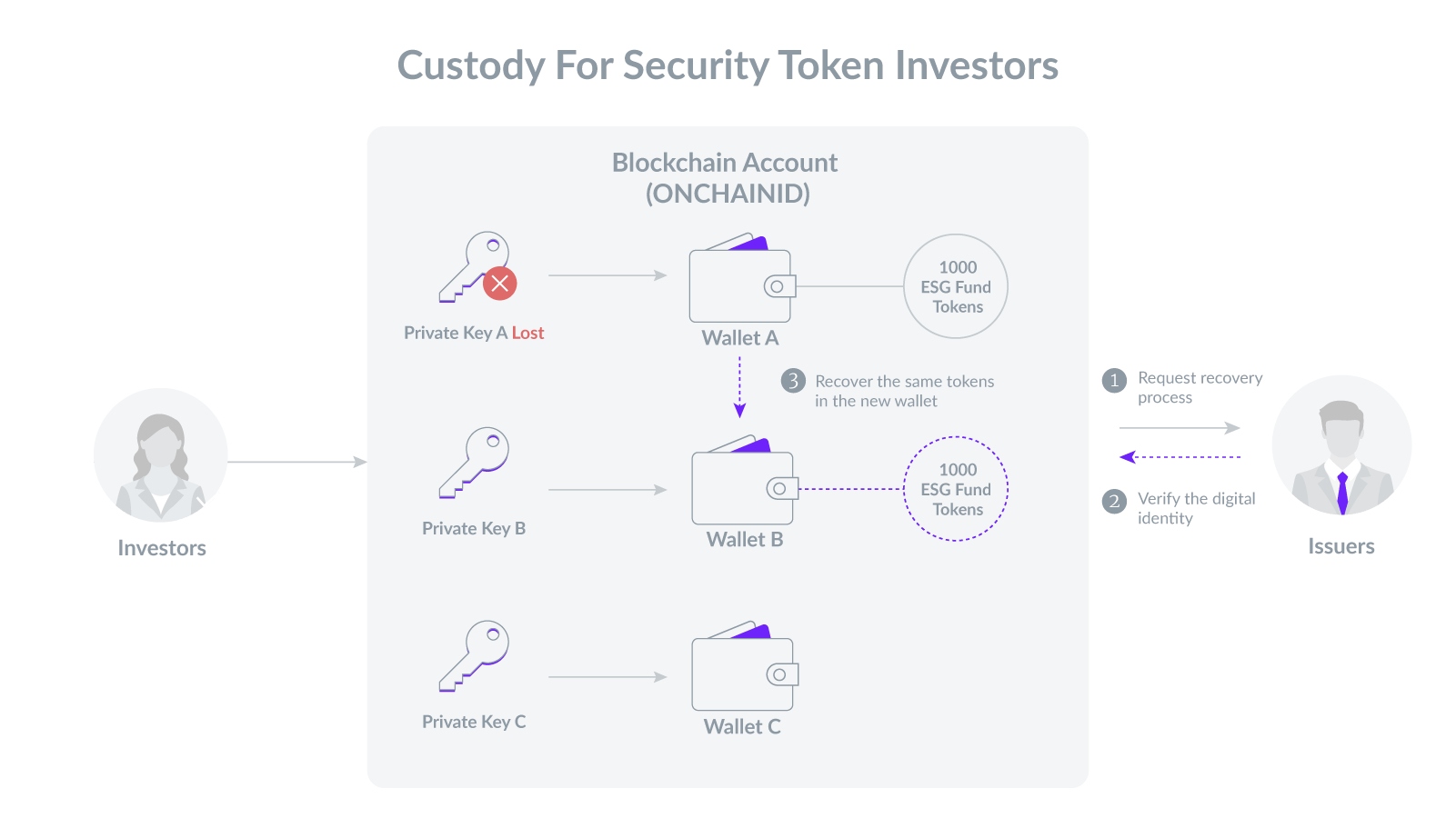

If a cryptocurrency holder loses their private key or wallet access credentials for their self-custody wallet, the assets (Bitcoin etc.) are lost and cannot be recovered as most cryptocurrencies are decentralized and controlled by algorithms. Unlike cryptocurrencies, security tokens are controlled by issuers who are liable to their investors by law. As each investor is identified on the blockchain by his/her self-sovereign digital identity instead of the wallet, issuers can recover security tokens to the investor’s new wallet after confirming his/her identity. The traceability of ownership is recorded on the blockchain.

For example, issuers of tokenized securities using the T-REX open source protocol are able to trigger a recovery function present by default in the suite of smart contracts. In practice, the security tokens can be recovered in just a few steps:

- Declare the loss of the wallet: The investor creates a request to recover their tokens to the issuer (or its agent).

- Verify the digital identity – ONCHAINID: The issuer (or its agent) verifies the token holder’s identity with a standardized KYC process to validate the provenance of the request.

- Recover the same tokens in the new wallet: If the verification is positive, the issuer triggers the recovery function and the lost tokens are transferred to the new investor wallet. This new wallet will also be added to the ONCHAINID of the investor.

Therefore, issuers and securities custodians can fulfil their securities restitution obligations, whilst investors can participate in tokenized investment opportunities with greater confidence.