Product Focus

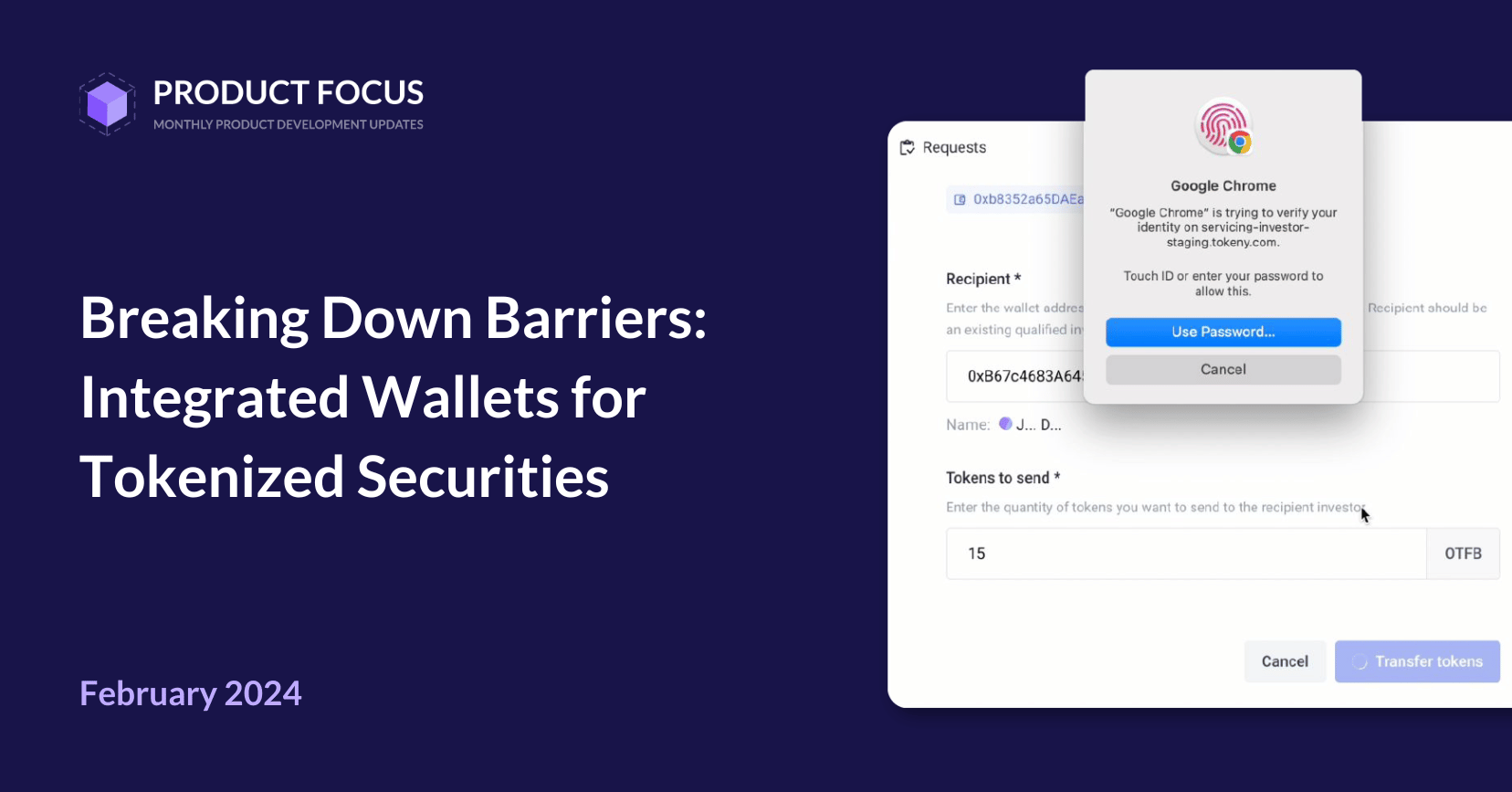

Everywhere you read about the benefits of tokenization, you will hear about a broader access to investment opportunities, fractionalization, and democratization. It is true that security tokens, as a digital form of securities, are much easier to manage for issuers, their agents, and their investors. Therefore, it becomes possible to propose offerings to hundreds or thousands of investors without the hassle.

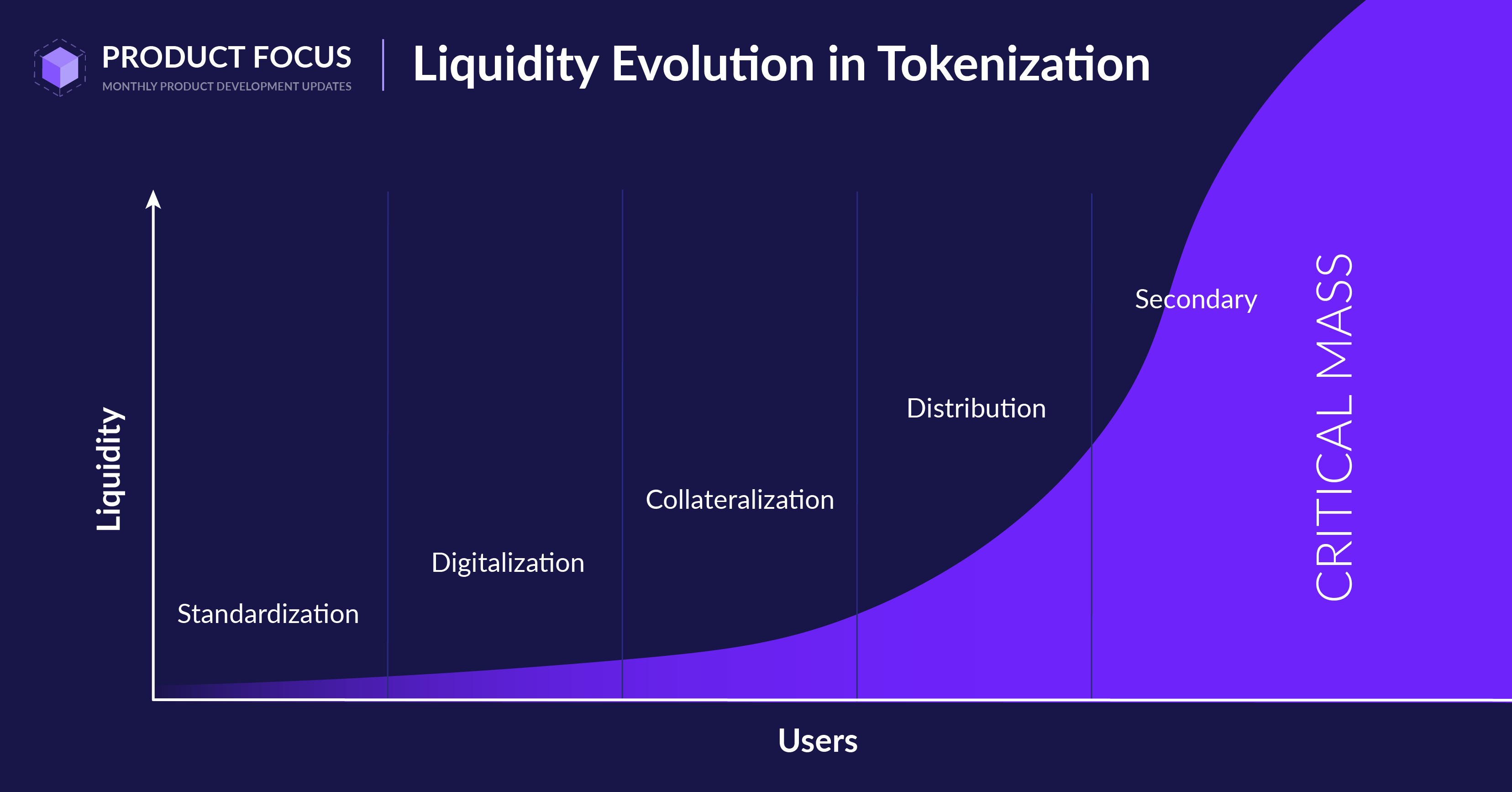

However, it is not because you tokenize an asset that investors will rush to buy it. When you launch a website, the traffic is not coming magically, it is the same for digital securities. Tokenization brings the investment infrastructure and automated compliance, but it doesn’t bring the audience.

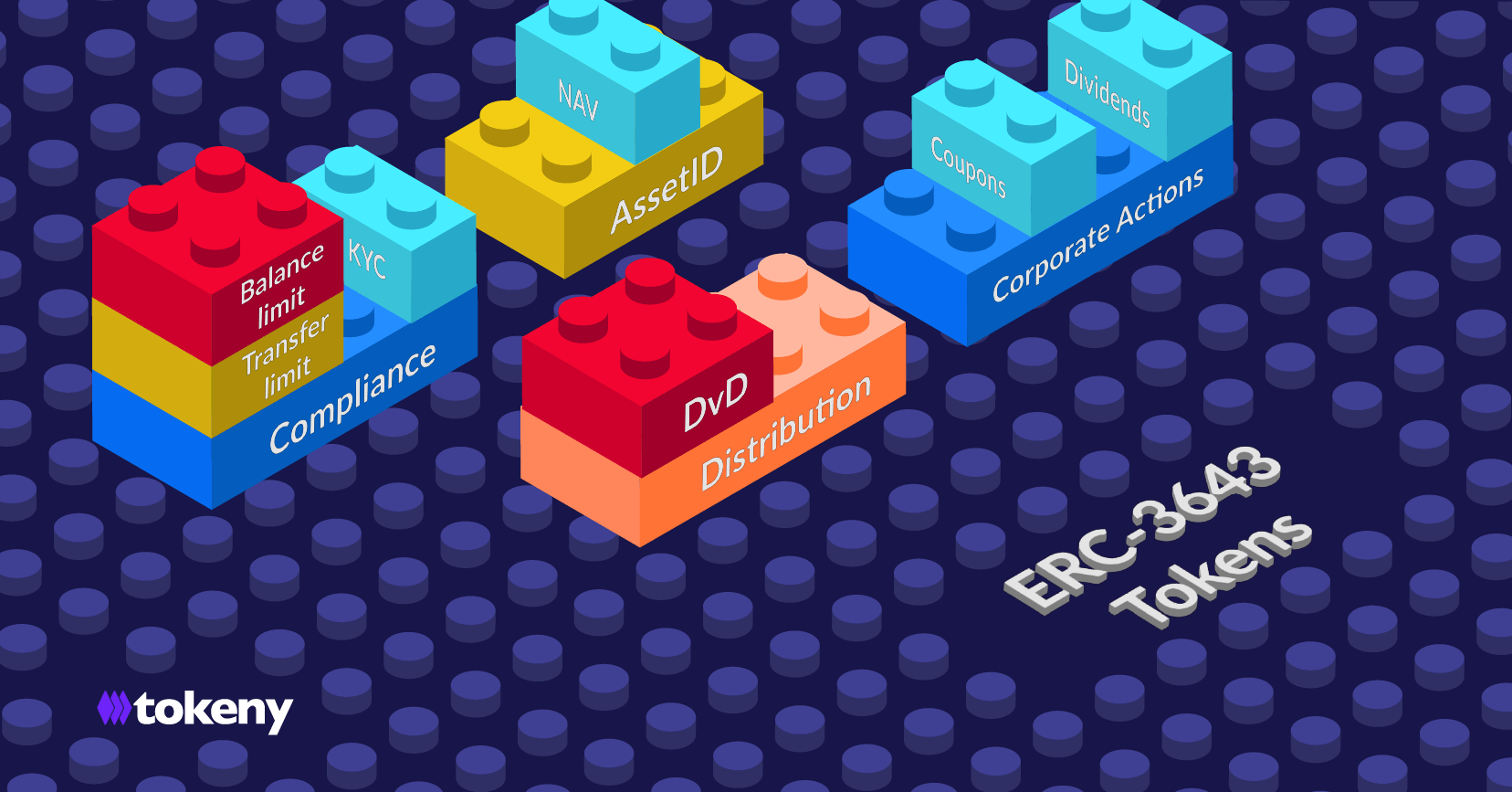

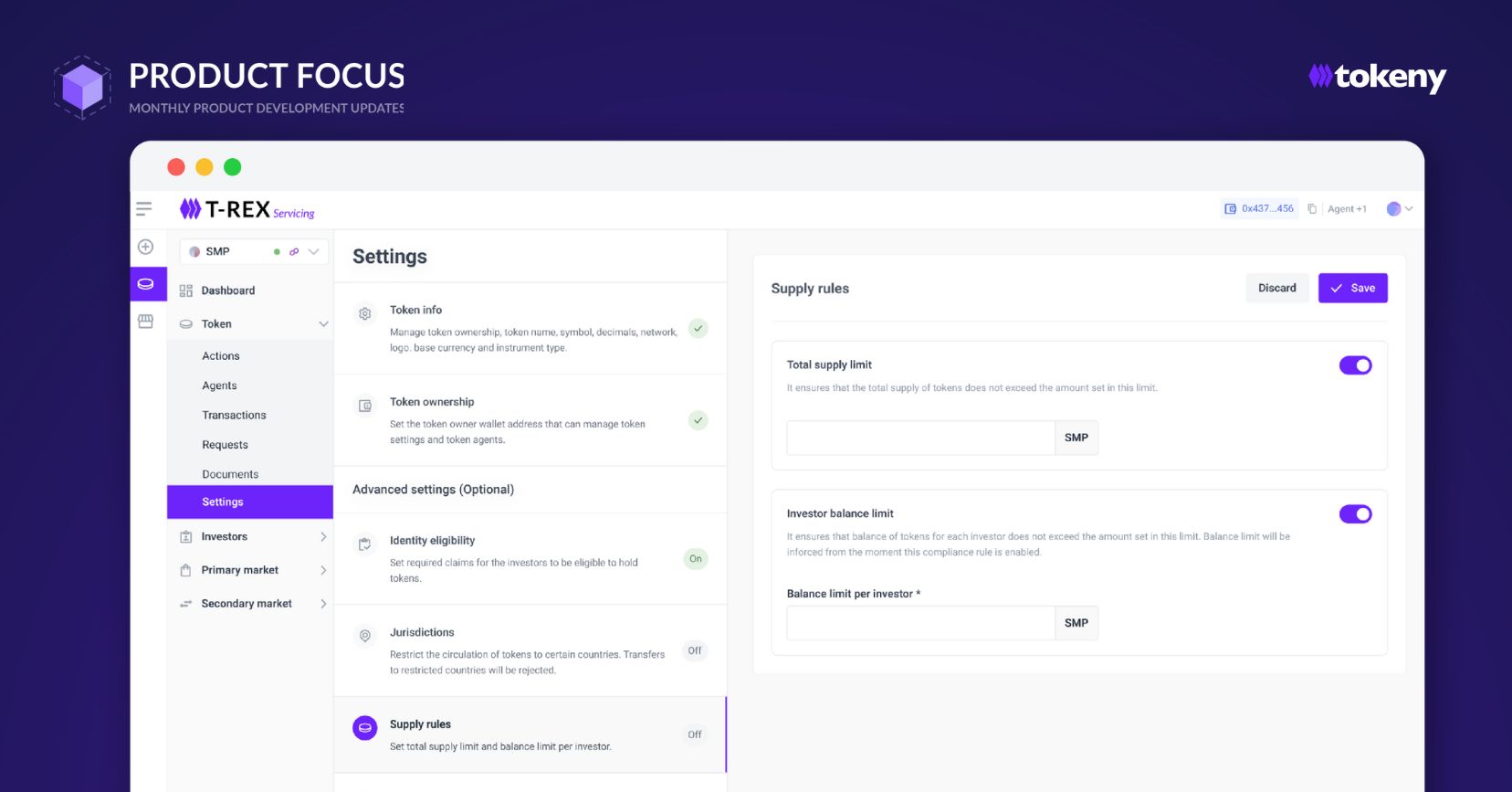

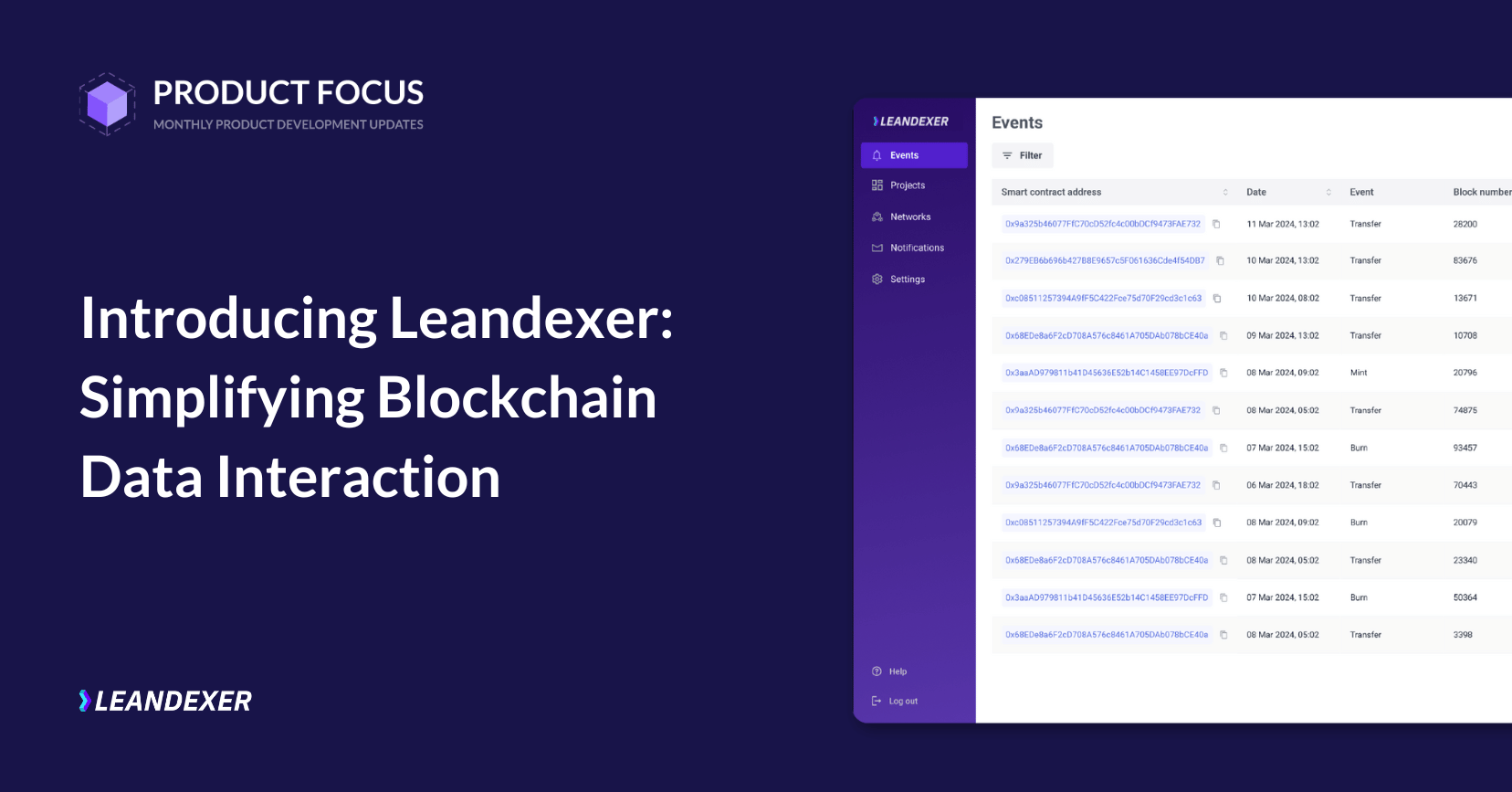

To tackle this issue, we are building day after day a complete ecosystem around the tokenization protocol we launched on the market years ago. Assets tokenized with the ERC3643 standard are immediately interoperable with all the service providers of the ecosystem, including dozens of liquidity providers, opening access to investors.

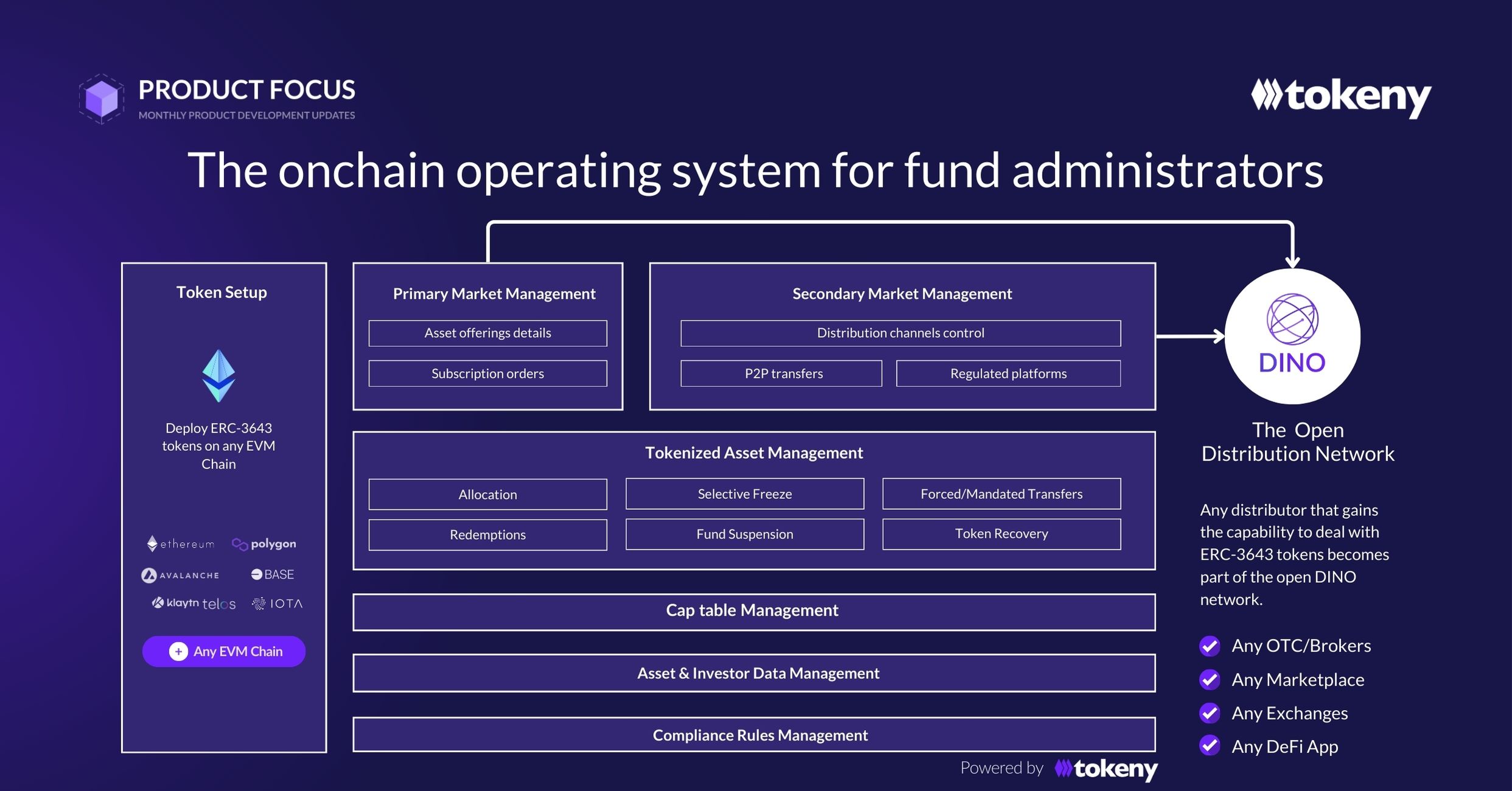

Depending on the assets tokenized, the targeted investors, and the objectives of the issuers, different types of liquidity venues can be made accessible for a token, and all embedded data and compliance rules are made available to liquidity providers. All stakeholders are included in the distribution network DINO which covers both primary and secondary markets. With over $28 billion of tokenized securities, DINO is already the world’s largest distribution network for tokenized securities.

Large financial institutions, banks, asset managers, broker dealers, securities distributors, advisory firms, market makers and exchanges are joining the DINO. They access the largest catalog of tokenized securities and are able to tokenize new assets as well.

Step-by-step, a galaxy of trading venues and distributors emerges consisting of digital trading desks (OTC, Billboard, etc.), regulated trading venues (ATS, MTF, exchanges, etc.), decentralized exchanges, and DeFi protocols.

Last month, Ownera, a global liquidity network backed by J.P. Morgan, was integrated to DINO, alongside Assetera, an EU-regulated trading platform. An ATS will soon announce the addition of DINO to cover the U.S. jurisdictions. Many more are preparing for integration into DINO in 2023.

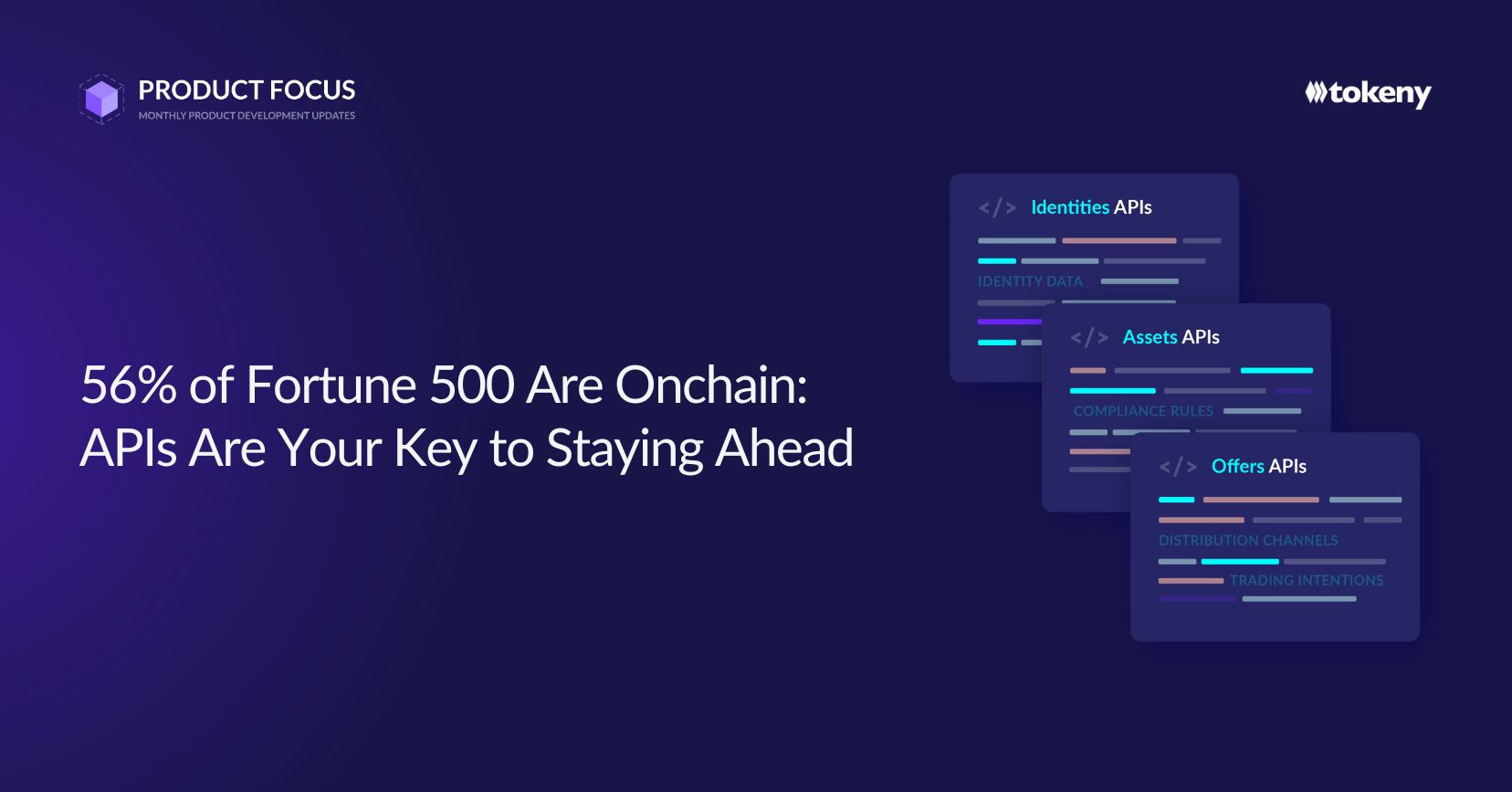

As the ecosystem continues to grow, we are improving the scalability of our products to enable thousands of digital securities to access DINO, as well as helping liquidity providers join DINO with easy-to-integrate APIs.

Subscribe Newsletter

This monthly Product Focus newsletter is designed to give you insider knowledge about the development of our products. Fill out the form below to subscribe to the newsletter.