Product Focus

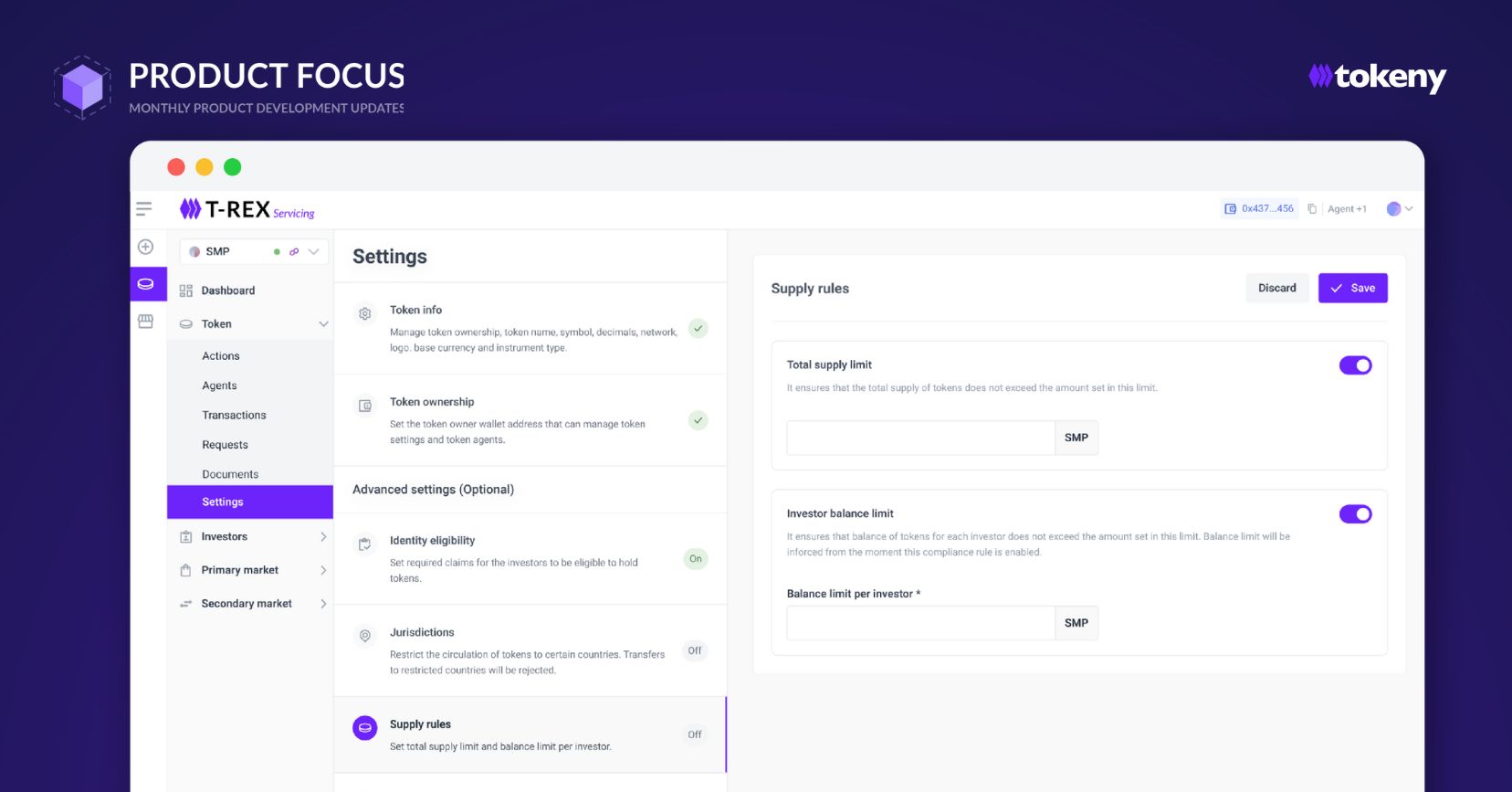

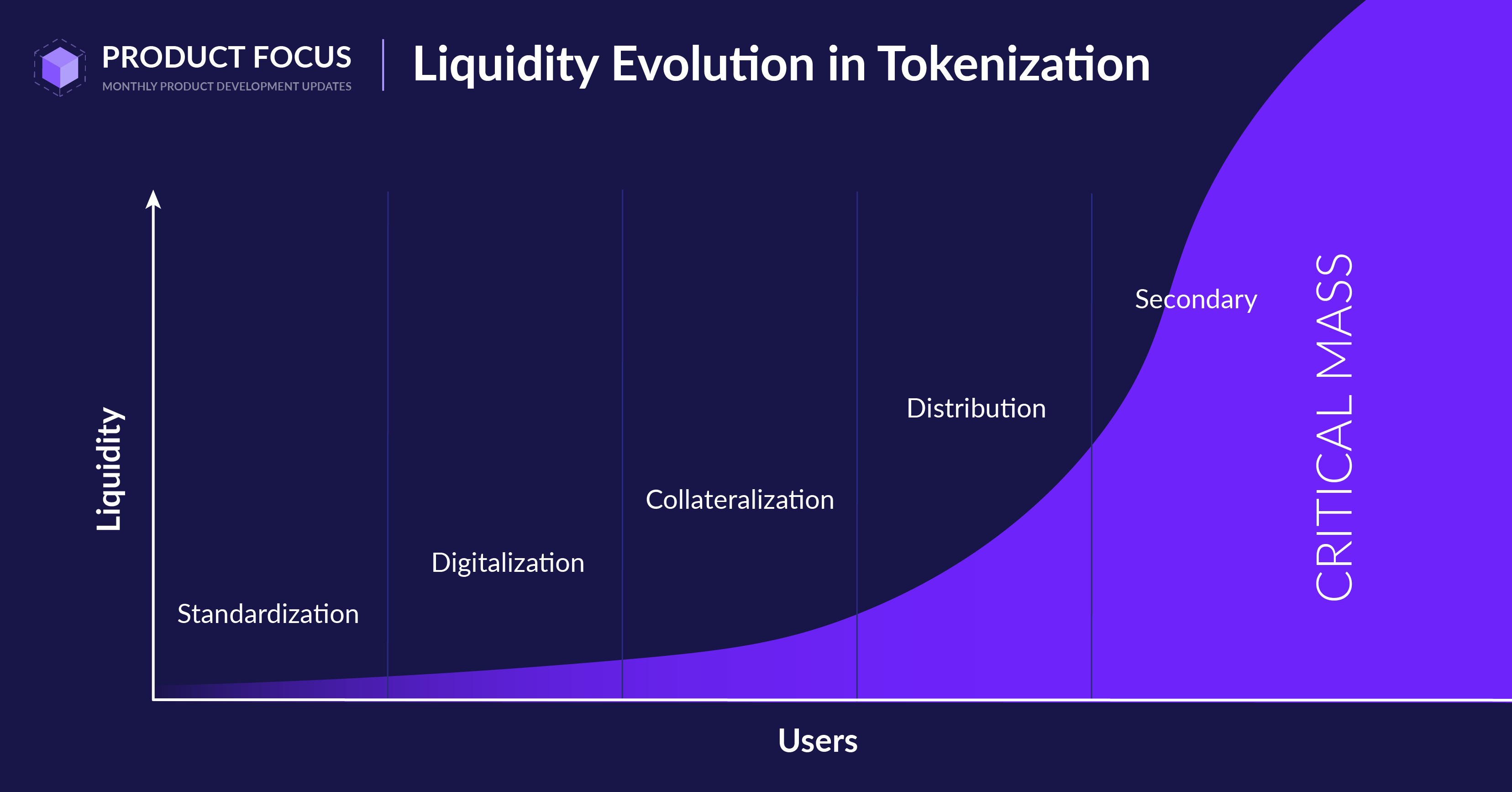

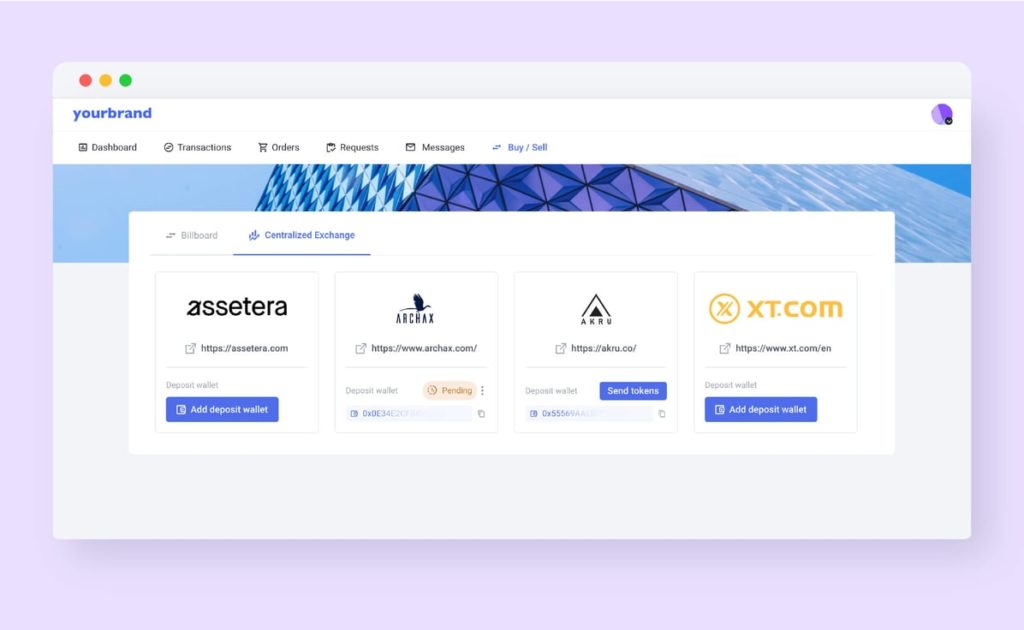

As a tokenization platform using mainly public blockchain networks, enabling more liquidity features is one of our priorities. Today, we’re proud to introduce the Centralized Exchange (CEX) feature to our T-REX platform to facilitate liquidity. This makes your ERC3643 tokenized securities technically compatible with any centralized exchange using the same blockchain network as your tokenized securities.

The CEX feature complements our innovative bulletin board solution Billboard to provide additional liquidity solutions to issuers. Once activated, investors can trade their digital securities on centralized trading platforms such as exchanges, ATS, or MTF.

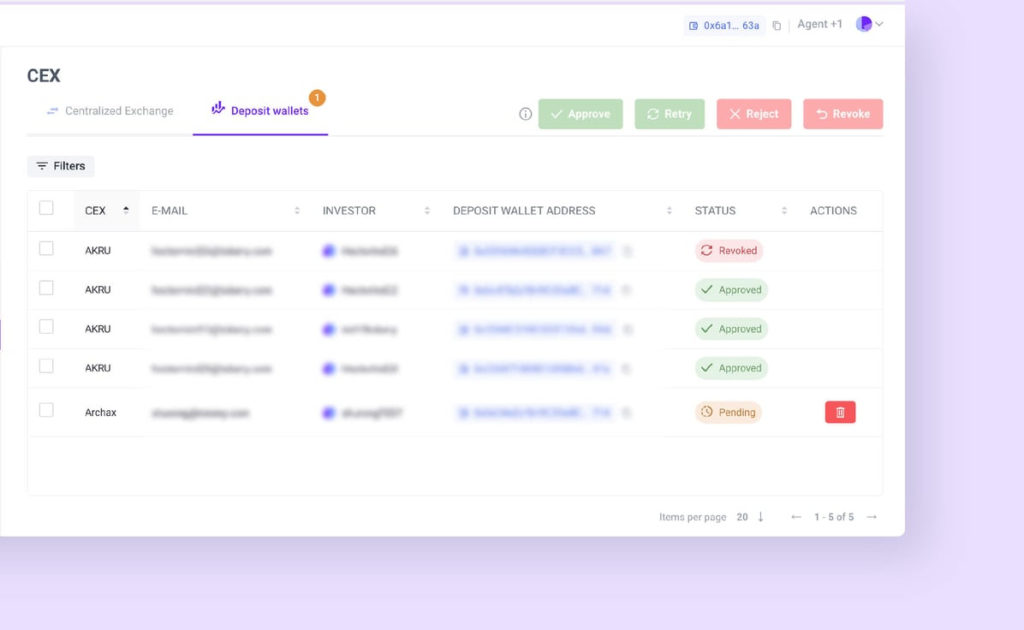

(Note: The trading platforms listed in the screenshot below are examples)

Here is how it works:

1. Sign a commercial agreement: As an issuer, you have the responsibility to ensure that the trading venues are in compliance with your securities. You and the trading venues must sign a commercial agreement enabling the listing of your tokenized securities in their exchange or network.

2. Allow trading venues: Simply enable the ‘Is Allowed’ button for exchanges you have an agreement with.

3. Add deposit wallets: Each of your investors can view enabled exchanges on their Investor Portal dashboard under the ‘Buy/Sell’ module and add their deposit wallets provided by the respective trading venues.

4. Approve deposit wallets: You’ll receive a new request to approve the deposit wallet via your ‘Deposit wallets” module.

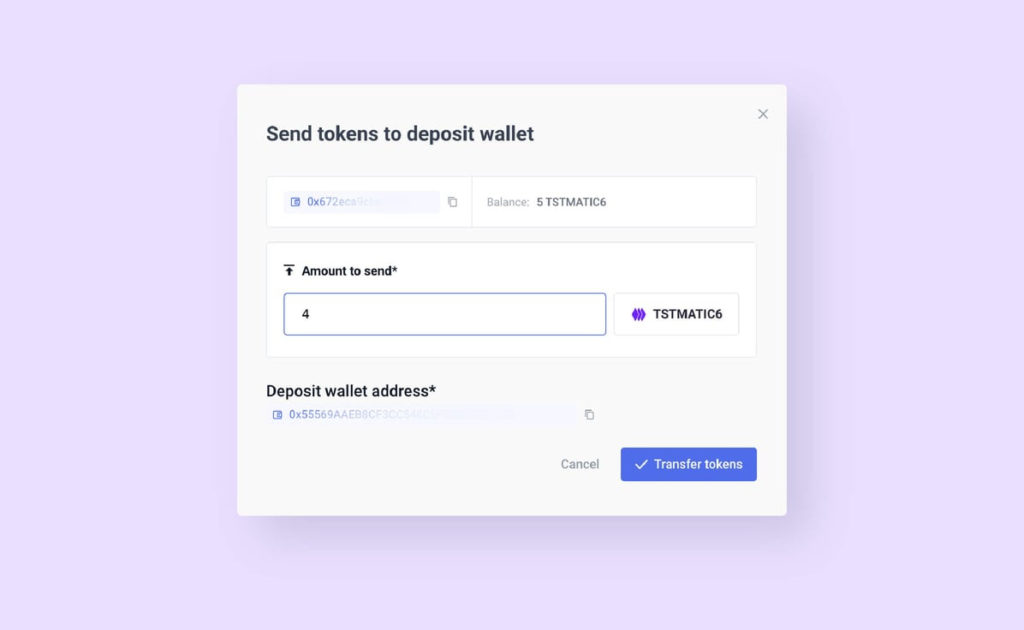

5. Transfer tokenized securities: Once the deposit wallet address is approved, investors can transfer their tokenized securities to the deposit wallet.

6. Trade on CEX(s): Transfers take only a few seconds, depending on the network. Once completed, tokenized securities will be managed by the exchange and available for trading on their platforms.

The rollout of the CEX feature marks a momentous milestone for us, and we couldn’t have achieved it without the dedication and tireless efforts of our developers. We are committed to continuously expanding our features to support more secondary market solutions, such as decentralized exchanges and collateralization DeFi protocols, bridging tokenized real-world assets (RAW) to DeFi to unlock the full potential of tokenized securities.

Subscribe Newsletter

This monthly Product Focus newsletter is designed to give you insider knowledge about the development of our products. Fill out the form below to subscribe to the newsletter.