Global trends

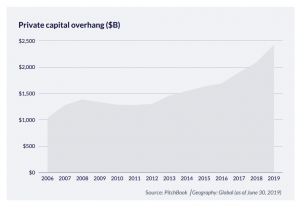

Since the financial crisis of 2008, as indicated in the chart from Pitchbook, private markets have grown steadily and consistently, with private capital funds having raised nearly $5tn since 2012.

Although there seems to be a spate of tech companies filing IPOs in August 2020, the appetite for private opportunities is undeniable, and its consistent growth hasn’t shown any signs of losing impetus.

Opportunities in private markets

It’s clear that private markets have become very attractive for institutional investors, but what opportunities lie ahead for market participants? Here are three that we believe are interesting for issuers and investors:

New regulation

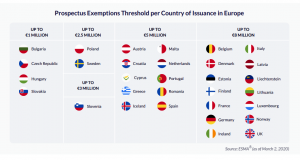

Governments across the globe are in a prime position to drive more activity in private markets, and have implemented regulation to encourage this. In Luxembourg specifically, companies can opt for an exemption from the prospectus regulation if the offering does not exceed €8 million. The issuer needs to publish a lighter prospectus and they are able to raise funds publicly. This is part of the Prospectus Regulation that is in force across the EU, with member states differing in terms of fundraising amounts. The regulation has allowed issuers in the region to lower the legal costs of capital formation and allow their offering to be more accessible to a wider range of investors. In 2013, the SEC issued new final regulations allowing specific types of offerings to openly solicit the offering to prospective investors without needing to register the securities with the SEC, making it easier to raise funding privately. Naturally, regulation has and will continue to be a driver for private markets.

New technology

Technology will continue to advance capital markets by creating new business propositions for market players and new models that are more accessible for the industry. In recent years there has been a rise in financial services such as crowd-funding, peer-to-peer lending, digital currencies, mobile banking and challenger banks that have all disrupted the status quo. Private markets are not immune to this. In fact, we believe they are very fertile to technological advancements as the market is extremely fragmented and heavily reliant on paper-based processes. Due to this there is a real lack of infrastructure and poor processes pervade the industry. As a result, the private market sector presents significant opportunities for process streamlining, efficiency gains and operating model transformation. For many, implementing new technology is becoming a necessity as increasingly strict regulatory reforms make it difficult to comply with regulatory safeguards whilst firms try to protect profit margins. The companies that ignore new technology and fail to adapt will be left behind by the ones that succeed in doing so.

New networks

Private markets are by definition not organised, face limited transparency and lack interoperability. Indeed, these private market opportunities are only accessible to a small percentage of investors that are usually of close proximity to the offering. Contact management functions are still very paper based and firms still use files or cards to manage and keep track of their investors. This leads to an uneven playing field as big investors with the important broker dealer relationships hold significant advantages and get information much faster than others. Herein lies an opportunity for market actors within private markets to develop a new and more global approach through an efficient networking system. A more global and interoperable approach will be beneficial for the whole ecosystem as issuers will be able to raise capital more efficiently and investors will be able to find the opportunities that fit their mandate more effectively.

Challenges in private markets

Despite the upward trajectory across private markets, and the significant opportunities that lie ahead, the industry still suffers from well known challenges. As referred to previously, the infrastructure from the initial investor onboarding to the secondary trading of private securities is notoriously manual and cumbersome.

In the primary issuance and regards to investor verification, KYC & AML checks are slow and expensive for market operators to perform. In a typical private placement, investors are verified multiple times by the various actors involved in the offering. These checks are processed every time the investor participates in a new offering from the same service providers. Due to these KYC & AML checks involving much manual intervention, they are slow and costly. The process of verification occurs in the primary issuance and also each time the security is traded in the secondary markets.

The secondary markets are arguably the stage of the security where the infrastructure brings the most difficulties. Due to a highly fragmented industry, secondary markets are largely composed of siloed and disconnected OTC networks. However, they come with difficulties as they are built on an infrastructure that is private and fragmented. As a consequence, the market suffers from poor transferability, with assets thinly or even never traded. Trust is implemented by analogue and arduous processes. This is in direct contrast to what’s seen in public markets, where efficiencies lie in the effective distribution of information from a centralized party.

As a consequence of the above, the secondary market suffers from three core problems:

Poor asset discovery

The lack of connectivity between private market participants makes it difficult for investors to find the right opportunities and for trading to function effectively. OTC platforms generally provide secondary market access to unlisted securities but these networks are very limited and have low trading volumes. In these markets there are multiple disconnected service providers with not much activity so it is difficult for investors to trade. Fundamentally, this leads to a secondary market that has not been improved by digital technology and one that is still heavily reliant on personal networks.

Poor price discovery

The fragmented infrastructure makes it very difficult for there to be a transparent party that collates volume and facilitates price discovery, much like the role of an exchange in public markets. Poor price discovery and general asset information leads to delays and inevitably concerns around asset quality and it is no surprise that investors demand larger risk premiums. This affects the industry as a whole, and attractive valuations were a concern for 36% of investors attempting to achieve target allocations to private markets in 2019.

Illiquid market

The poor transferability of information and localised market inevitably leads to an illiquid market. Information is often unavailable and outdated, leading to trading difficulties as prices are decided on an ad-hoc basis and often result in wide bid-ask spreads. Moreover, there are often long lockup periods for private investments, and on the rare occasion where there aren’t restrictions, fees from broker dealers usually dissuade investors from parting with their investment, hereby locking up value. These infrastructure related challenges combine to create a market that is highly illiquid, which is a barrier to entry for many investors. When investors have significant exposure to illiquid investments it can be difficult to manage liquidity needs, and of course this is worsened in times of recession.

The problems in private markets are directly related to the infrastructure they operate on. Through blockchain technology, market actors can overcome many of these challenges and improve data transparency, broaden market access and increase asset liquidity.

We discuss how in the ebook we published with PwC, click the bottom below to download: