Product Focus

While the blockchain narrative fundamentally revolves around decentralization and empowerment of the individual, the realities of dealing with real-world assets and securities introduce a layer of complexity.

Particularly in financial markets – a heavily regulated industry due to the high risks involved – there are stringent guidelines and regulations that ensure the protection of all stakeholders.

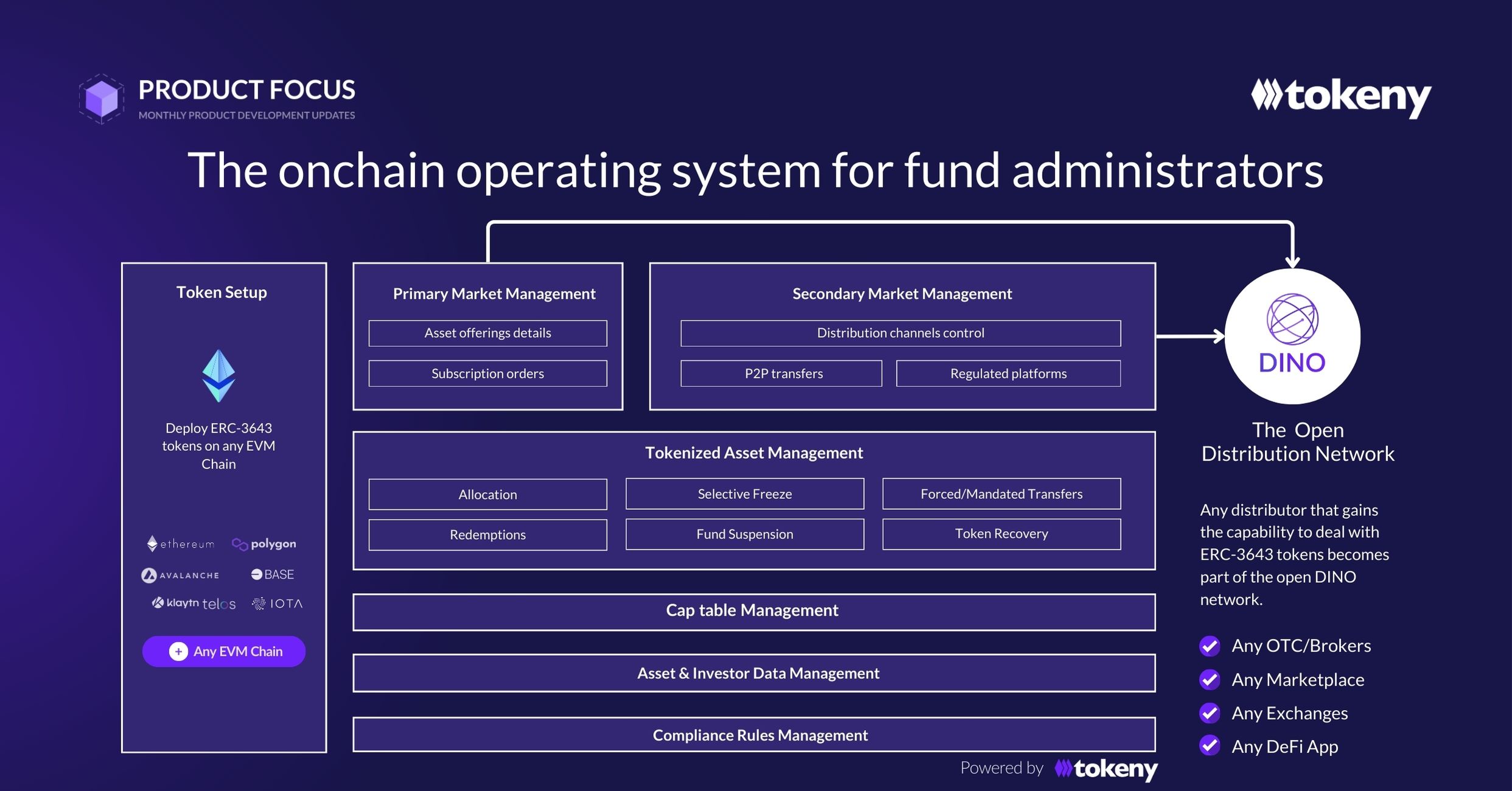

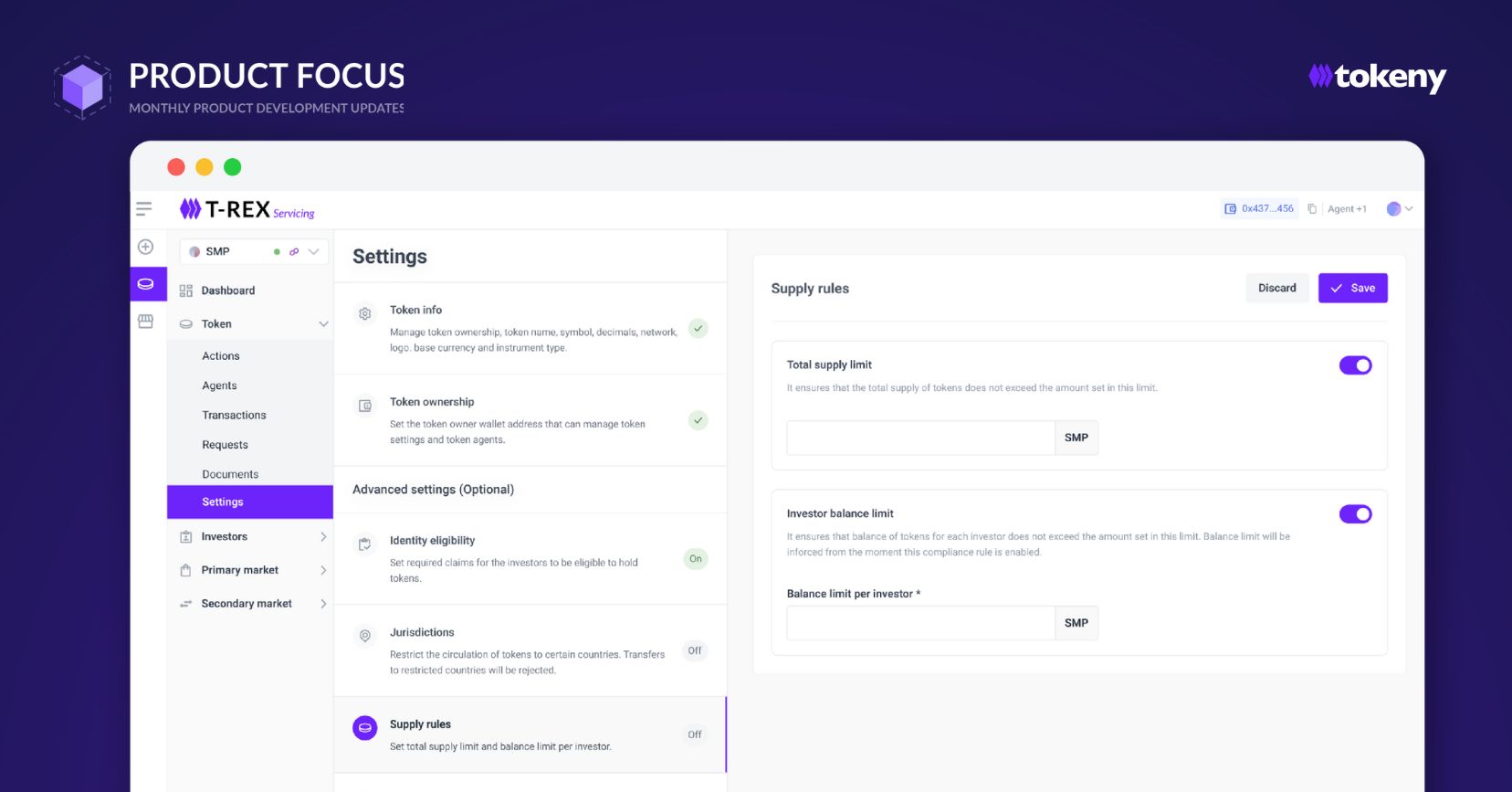

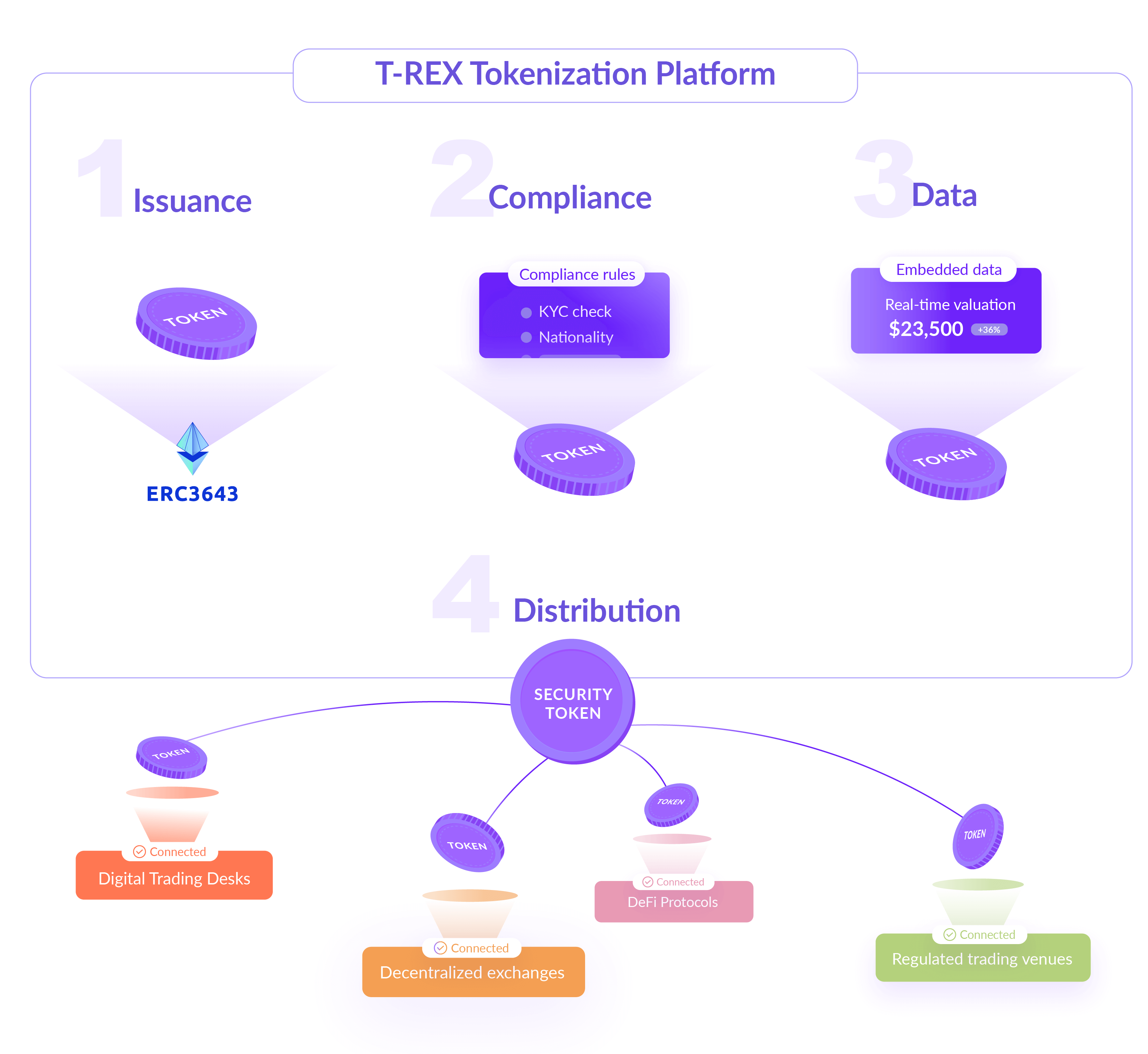

At Tokeny, we efficiently navigate these two critical aspects – the vast potential of open blockchain infrastructure and the intricate details of securities laws. Our comprehension of these dual facets has led to the creation of T-REX, a platform designed to ensure compliant participation in this fast-evolving space.

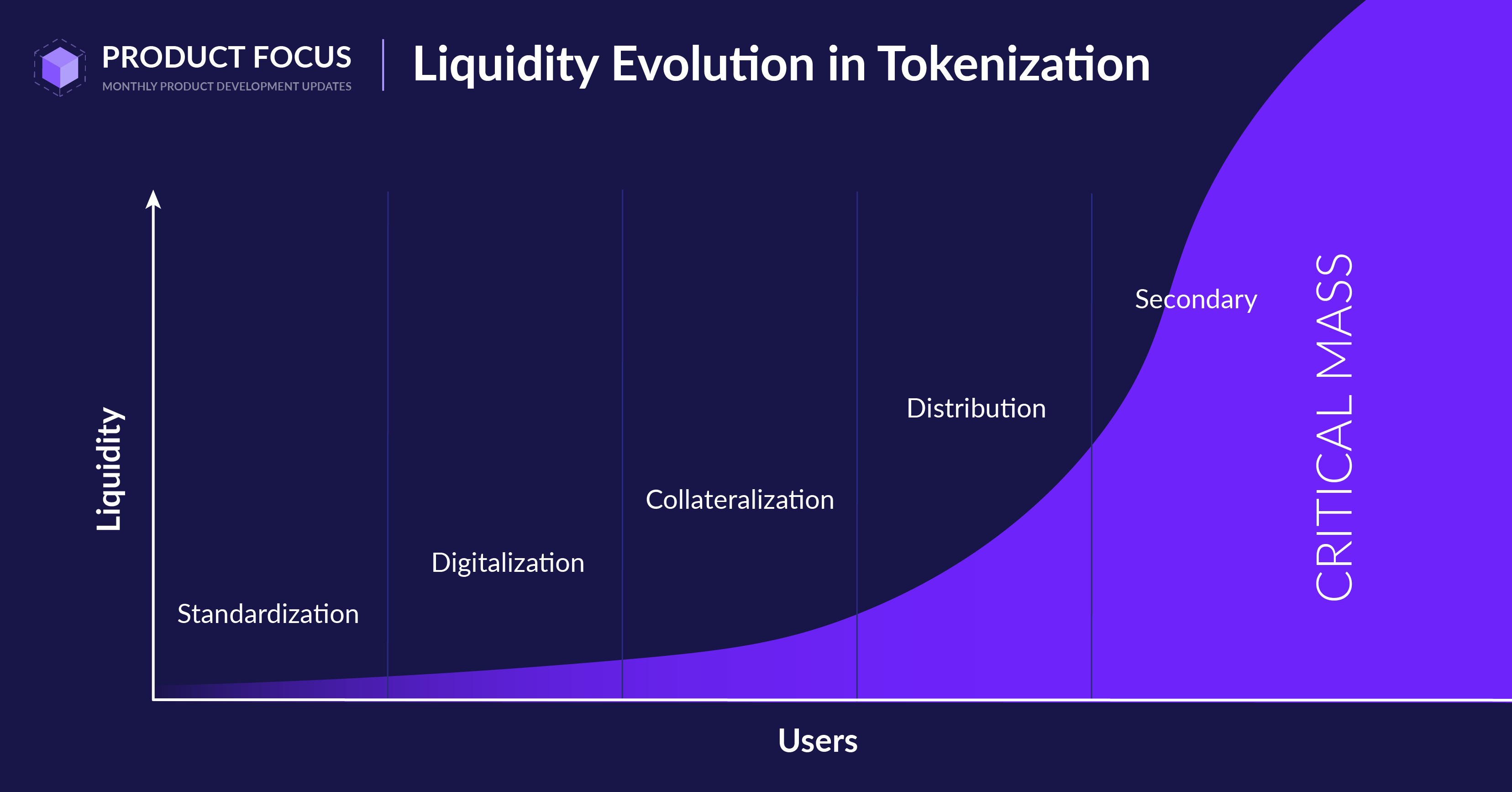

Liquidity is one of the most enticing features that blockchain offers, prompting issuers to tokenize their assets. However, it’s essential to understand that tokenization alone doesn’t spontaneously generate healthy liquidity. The main takeaway is that while tokenization itself doesn’t guarantee liquidity, the opportunities provided by blockchain technology certainly can.

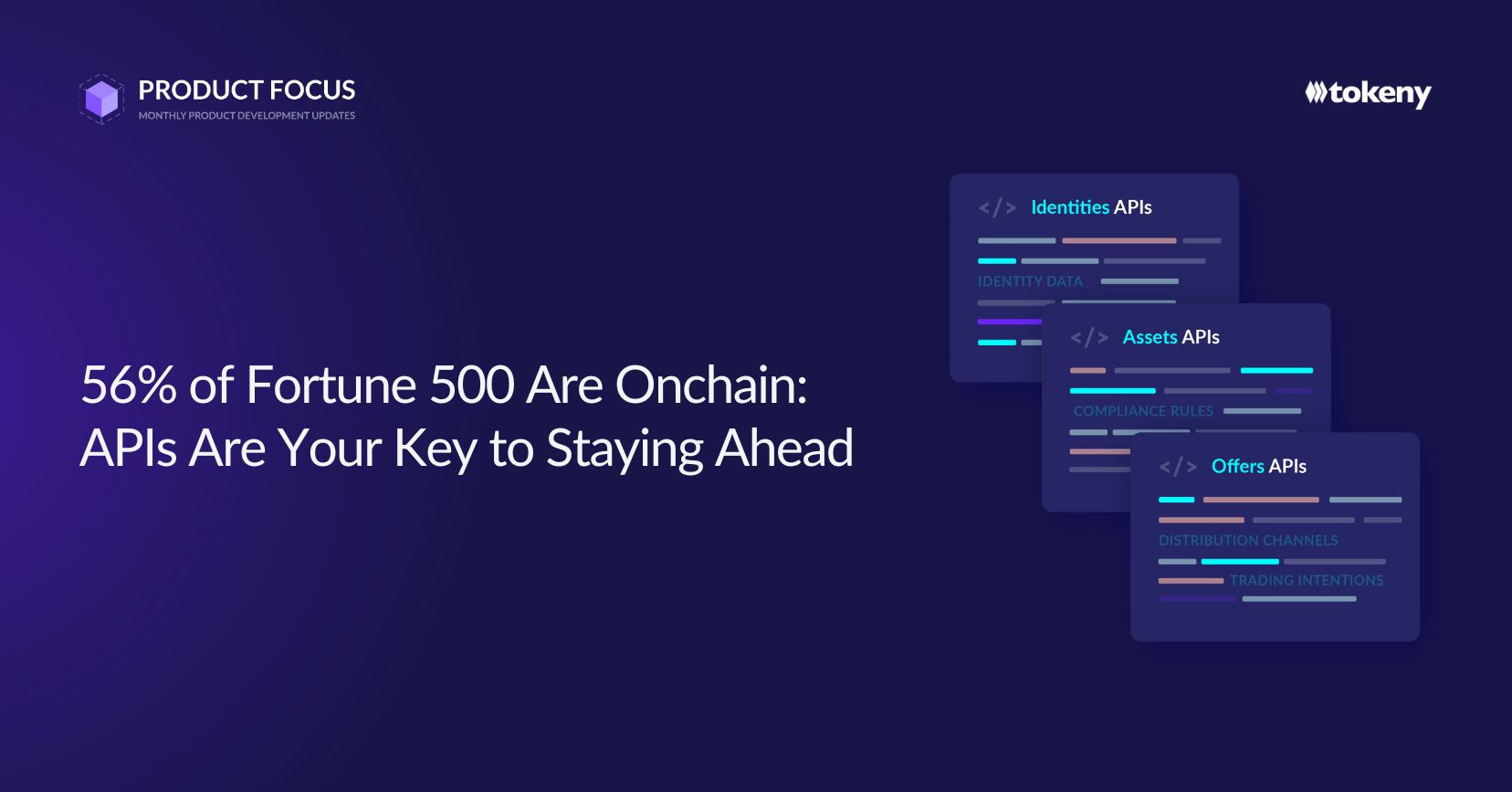

We at Tokeny are on a mission to create an open, standardized platform that will become the launchpad for highly-functional digital securities, offering the largest catalog of liquidity solutions for compliant security tokens.

In order to leverage a global ecosystem of liquidity providers to its fullest potential, several foundational activities should be performed:

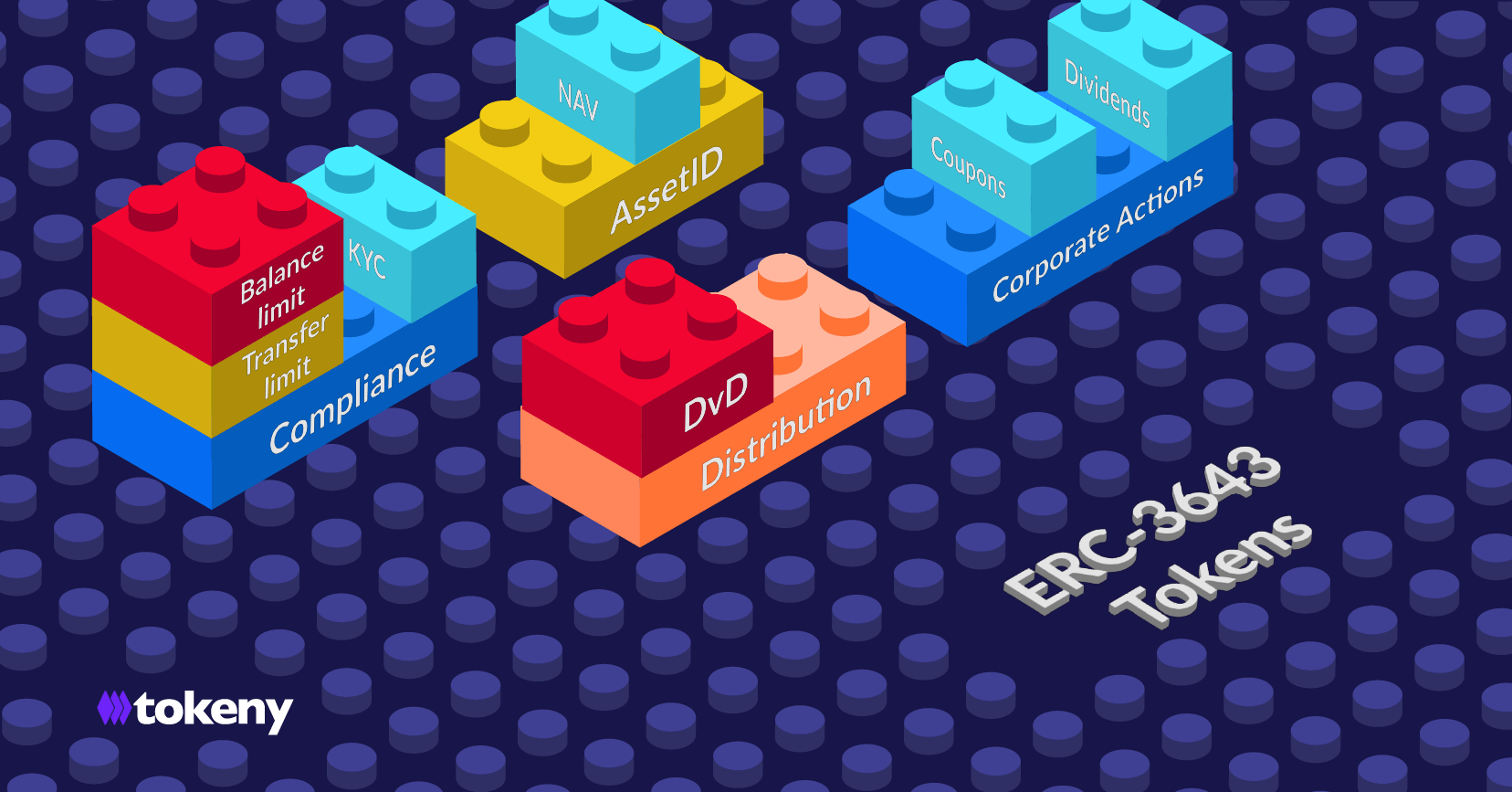

- Tokenize the asset on an EVM-compatible blockchain network and the ERC3643 standard. These are the main technical components used by the DINO distribution network;

- Encoding compliance rules in the token smart contracts to track ownership and eligibility of investors;

- Embedding asset data, mostly valuation data, which serve as reference points for price discovery and asset credibility on trading venues.

Once these key steps (issuance, compliance, and data) are taken, the tokenized assets may be “published” to the network and made available for any trading venue of the ecosystem.

The necessary infrastructure, including compliance and data, is already in place thanks to the blockchain and the built-in features of the tokens. Only the discoverability is missing: This is the role of distributors and trading venues in a DLT-based financial system.

As an issuer, you now have the capability to increase the visibility and distribution of your securities through all ERC3643 compatible liquidity solutions. This, of course, is assuming that your use of these solutions is legally permitted.

Moreover, as your assets are tokenized, our platform also provides significant benefits with its automatic cap table updates for each transaction, no matter its origin.

For example, an issuer might list their token on both a South Korean centralized exchange and a decentralized exchange like Uniswap. All of these transactions will be settled on-chain and accurately recorded on their DLT-based cap table. They can then easily access this data through Tokeny’s T-REX platform since every transaction happens on the same shared IT infrastructure.

Tokenizing an asset enables the centralization of all the trading activity of the asset in a single ledger accessible by all authorized trading venues and distributors.

Here are a few examples of the types of liquidity solutions an issuer has at their disposal:

- Digital Trading Desks/Bulletin Boards:

- With our ‘Billboard’ solution, issuers enable investors to post buy or sell intentions for shares. Interested parties can accept and execute trades securely on the blockchain, with no counterparty risk, thanks to atomic swaps.

- These bulletin boards are accessible on the investor portal of the token and/or on any digital asset marketplace(s) proposing these tokens to their audience of investors.

- Regulated/Centralized Exchanges:

- Issuers can also enable their token to be traded on a regulated trading venue, which has the legal approval to operate with digital securities; however, it’s important to note these platforms are still very much the legacy infrastructure and are, in most cases, still restricted to utilizing off-chain order books and settlements.

- Decentralized Exchanges:

- Like Uniswap or Quickswap you can use an automated market maker (AMM) to execute a trade without a counterparty via liquidity pools.

- An Automated Market Maker (AMM) like Uniswap allows users to trade directly with a pool of funds (called a liquidity pool) rather than another person.

- This is possible because other users deposit, or ‘stake’, their tokens into these pools and earn fees in return. So, if Investor A wants to swap their Security B for Stablecoin C, they can do so instantly, as long as both tokens are in the same pool.

- DeFi Protocols:

- Investors can leverage and collateralize these highly-functional securities via DeFi protocols while retaining ownership. This enables seamless deposits and withdrawals, and guarantees lenders thanks to auto-liquidation systems.

As you can clearly understand now, liquidity is the holy grail of asset tokenization. In order to achieve healthy and sustainable liquidity, using a powerful token standard, enriching tokens with compliance rules and data, and having accessibility to a network of distribution providers are all integral components.

Thanks for reading, stay tuned for next month’s edition!

Subscribe Newsletter

This monthly Product Focus newsletter is designed to give you insider knowledge about the development of our products. Fill out the form below to subscribe to the newsletter.