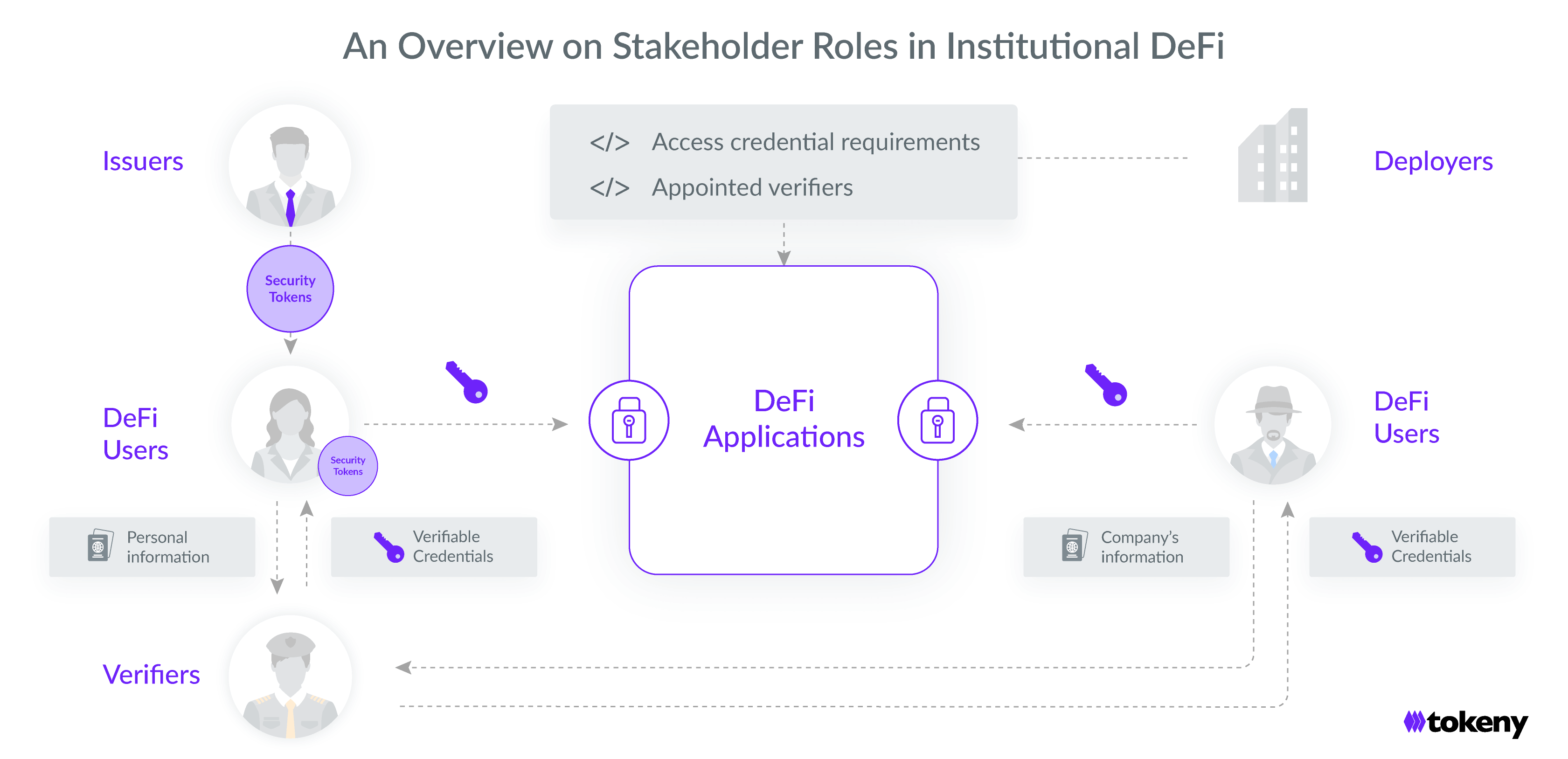

Building Institutional DeFi: A Guide to Stakeholder Responsibilities

We previously explored the necessary requirements for compliantly bringing tokenized real-world assets (RWA) and securities to DeFi. To achieve this, DeFi protocols must be designed to restrict participation rights to prevent illegal funding resources. Moreover, the availability of trusted data oracles is crucial to provide pricing data for private assets, and trading venues must be accessible to ensure minimum liquidity.

Fortunately, the emergence of innovative solutions such as ComplyDeFi and the DINO distribution network has made it possible for the current tokenization market to fulfill all of these necessary requirements. However, for the development of institutional DeFi to succeed, it is crucial for stakeholders to understand their roles and responsibilities. Below, we have listed some key roles that are usually required: