What is RWA?

In the blockchain world, Real World Assets (RWA) refer to tangible, physical assets with economic value, such as real estate, gold, vehicles, and art. Tokenizing these assets offers three main benefits: it opens the door for more people to invest by lowering barriers to entry, enables easy transferability—similar to sending a PayPal transaction—and allows the assets to be used in decentralized finance (DeFi) applications, such as providing liquidity in an AMM or using them as collateral to borrow tokenized cash.

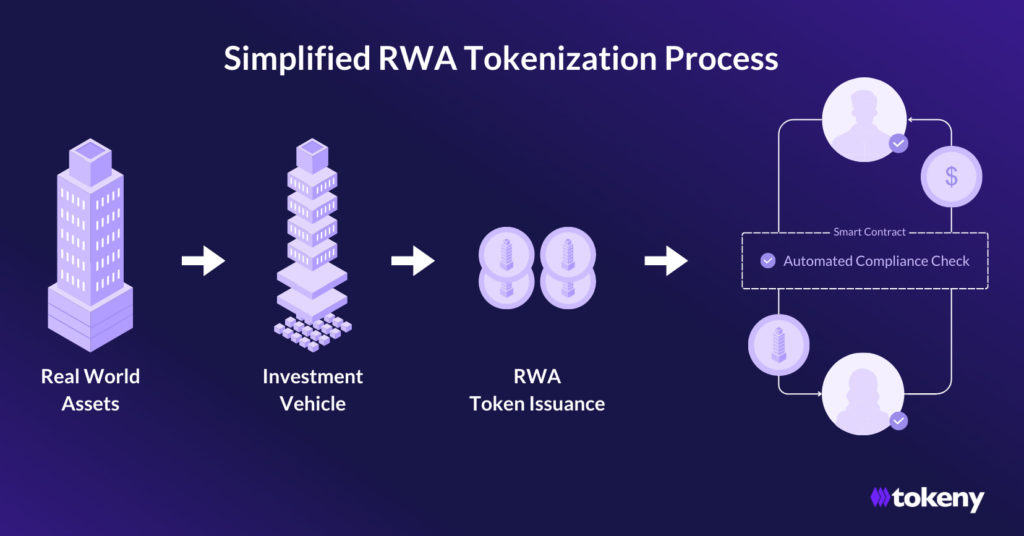

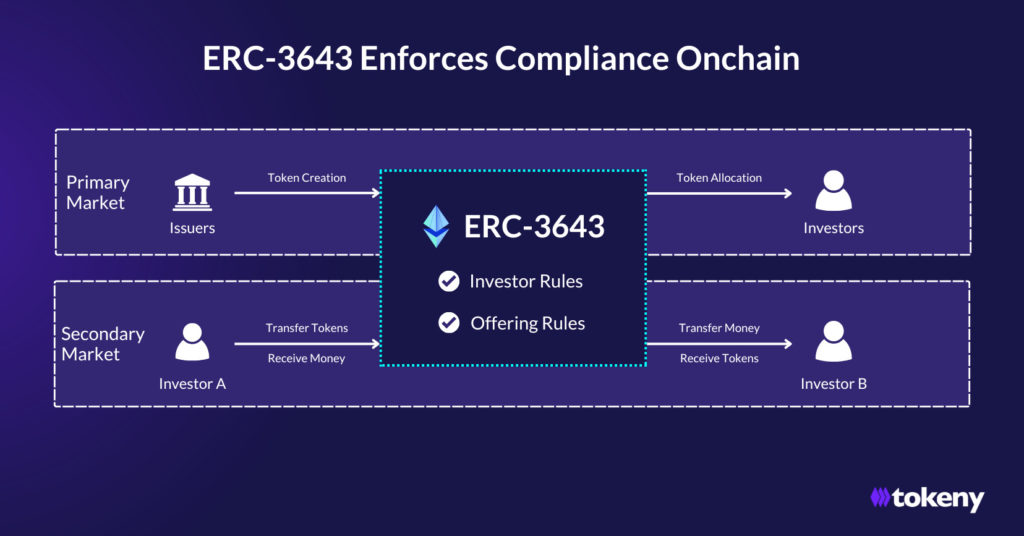

To fractionize the ownership of these RWA, it often turns the assets into financial instruments. Typically, this involves creating an investment vehicle like a Special Purpose Vehicle (SPV) to hold the underlying asset. Tokenization is the process of representing ownership of financial instruments such as shares or debts of the SPV as tokens on a blockchain, allowing for digital purchase, self-custody, easy transfers, and usage of assets. These tokens represent securities and must comply with strict regulatory rules, only qualified investors meeting regulatory conditions can trade and hold them.