On July 18, 2025, President Trump signed the Guiding and Establishing National Innovation for U.S. Stablecoins Act, better known as the GENIUS Act (S. 919), into law. It marks a foundational shift in U.S. financial policy: for the first time in the U.S., stablecoins would be regulated under a dedicated and bipartisan federal framework, distinct from digital securities or unregulated digital assets.

What Institutions Need to Know About the Stablecoin GENIUS Act to Accelerate Their Tokenization Strategy

What is the GENIUS Act?

The GENIUS Act defines payment stablecoins as digital assets:

- issued for the purpose of payment or settlement (including margin/collateral),

- redeemable at a fixed value (e.g., $1),

- and backed 1:1 by permitted reserve assets.

- does not offer a payment of yield or interest.

The bill outlines detailed requirements for issuers, including:

- Reserve Composition: Only highly liquid and safe instruments are permitted, which include:

- coins and currency,

- insured deposits held at banks and credit unions,

- short-dated Treasury bills,

- repurchase agreements (“repos”),

- reverse repos backed by Treasury bills,

- money market funds invested in certain of these assets,

- central bank reserves,

- and any other similar government-issued asset approved by regulators.

- Reserve usage restriction: Issuers would be restricted to using reserve assets for certain activities, including to redeem stablecoins and serve as collateral in repos and reverse repos.

- Redemption and disclosure: Issuers must maintain public redemption policies and report regularly on outstanding supply and reserve composition.

- Risk oversight: Issuers above $10B must submit audited financial statements, and all are subject to Bank Secrecy Act compliance and risk management tailored by federal/state regulators. Issuers under $10B may be supervised at the state level, provided the regime is “substantially similar” to the federal one.

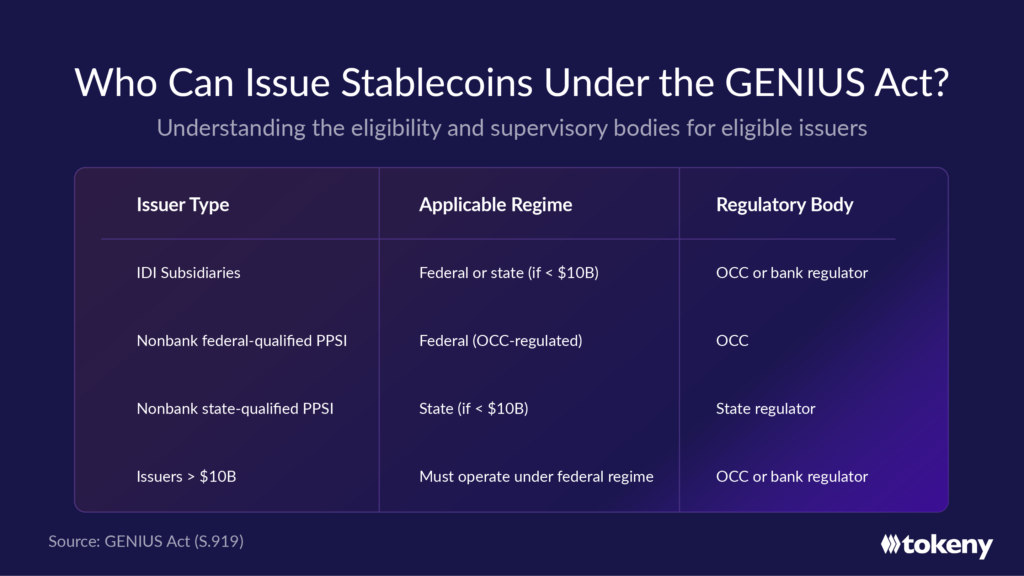

Who can issue stablecoins?

Under the proposed text, stablecoins may be issued by:

- Subsidiaries of insured depository institutions (IDIs),

- OCC-regulated nonbank entities, and

- State-regulated entities under $10 billion in issuance.

Nonbank issuers can start under state law, but must graduate to federal oversight once they exceed the $10 billion threshold.

If a foreign-issued stablecoin is not licensed in the US, it can still be traded on US secondary markets, but only if:

- The foreign stablecoins have the technological capacity to freeze transactions, and

- They can comply with lawful orders from the U.S. Treasury Department (e.g., sanctions, asset freezes, law enforcement actions).

These definitions ensure any proposed issuer knows exactly which rules and supervisors apply.

Are permissioned stablecoins the answer to compliance requirements?

As mentioned in Myth vs. Fact: The GENIUS Act by the U.S. Senate Committee: “The GENIUS Act requires all stablecoin issuers, including foreign issuers, to have the technological capability to freeze and seize stablecoins and also comply with lawful orders. It also requires all permitted payment stablecoin issuers to comply with U.S. anti-money laundering (AML) and sanctions requirements, including implementing AML and sanctions programs and annually certify compliance with the bill’s AML provisions. This is a higher reporting obligation than what banks are currently subject to.”

This means stablecoin smart contracts and infrastructure must support:

- Transfer freezes or reversals, under compliance or court orders.

- AML/sanctions screening and reporting capabilities.

- Annual certifications confirming they meet AML program standards.

This legislation effectively requires stablecoin issuers to consider deploying permissioned tokens, using frameworks like ERC-3643, to sophisticatedly meet obligations such as AML compliance, transaction freezing, and holder traceability.

This legislation effectively requires stablecoin issuers to consider deploying permissioned tokens, using frameworks like ERC-3643, to sophisticatedly meet obligations such as AML compliance, transaction freezing, and holder traceability.

While this may contrast with the open-access ethos of Web3, it reflects what institutional players need to safely and legally engage with stablecoins in regulated environments. For banks, custodians, and asset managers, having granular control over who can hold and transfer stablecoins is not optional, it’s essential for satisfying legal, operational, and reputational obligations.

ERC-3643, the market technical standard for permissioned tokens, with its identity-linked permissioning and built-in compliance logic, offers a proven path forward for stablecoin issuers who want to meet GENIUS Act requirements while preserving blockchain-based efficiency and interoperability.

Why This Is a Major Development

While stablecoins have been widely used by crypto users in the Web3 space for trading, institutional players have been reluctant to accept stablecoins as a payment method for tokenized securities, primarily due to regulatory uncertainty and unfavorable accounting treatment (e.g., SAB121).

As a result, true atomic settlement, where both securities and cash move instantly onchain, has faced slow adoption. In many cases, traditional bank transfers are still used, introducing friction, delays, and manual reconciliation steps.

Together, the GENIUS Act and SAB 122 lay the foundation for institutional adoption of stablecoins in the United States. The GENIUS Act establishes a federal framework for issuing compliant, fully backed stablecoins, while SAB 122 (which reverses SAB 121) enables banks to custody digital assets without classifying them as on-balance-sheet liabilities. With these regulatory clarifications, stablecoins can serve as the onchain cash leg for financial institutions, unlocking real-time settlement, composable services, and broader integration with capital markets and DeFi services.

As these frameworks take effect, we expect to see:

- More banks issuing stablecoins under federal or state-regulated regimes in the U.S..

- U.S. institutions accepting stablecoins for subscription, redemption, and settlement of tokenized securities.

- Accelerated institutional adoption of tokenized securities, driven not only by the ability to enable atomic settlement, but also by the opportunity to introduce innovative onchain features, such as Delivery-vs-Payment (DvP) transfers between qualified investors to improve liquidity, or integrating DeFi-based services

These developments allow institutions to offer smarter and more competitive products and position themselves at the forefront of onchain finance.

These developments allow institutions to offer smarter and more competitive products and position themselves at the forefront of onchain finance.

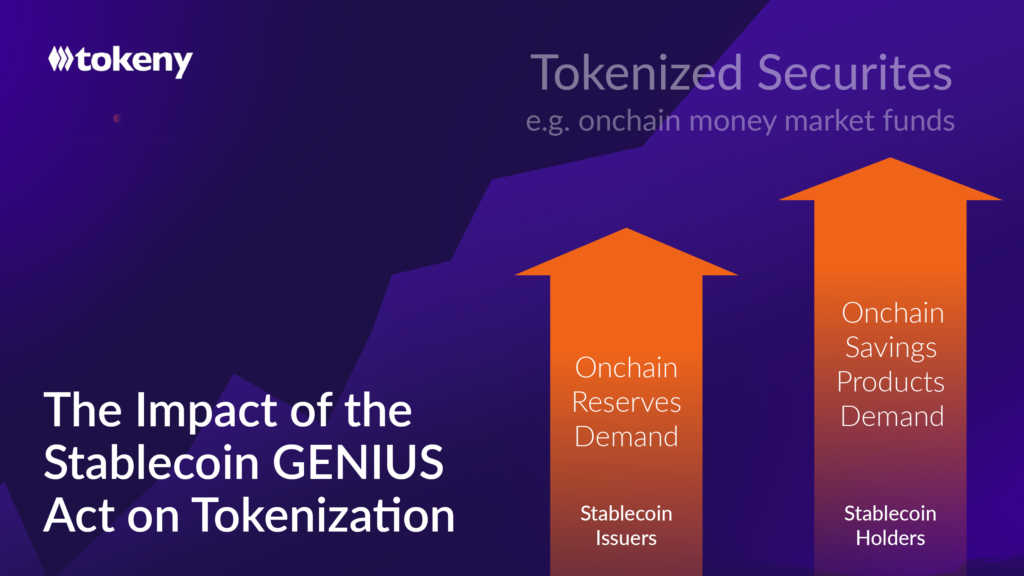

From Tokenized Cash to Tokenized Securities

As trusted digital dollars become more widely available, the focus will naturally shift toward the transparency and composition of the reserves backing them. To enable real-time proof of reserves and redemption, these reserve assets themselves should be tokenized and made verifiable onchain.

At the same time, since payment stablecoins are prohibited from offering yield under the GENIUS Act, stablecoin holders will increasingly look for onchain and yield-generating alternatives.

This makes the tokenization of money market funds (MMFs) and other short-duration instruments especially timely, serving a dual purpose:

- as onchain compliant reserve assets for stablecoin issuers, and

- as onchain savings products for stablecoin holders seeking yield in a secure and regulated way.

A recent example we supported is the tokenized MMF by Fasanara Capital, a London-based asset manager overseeing $5 billion in assets. The project was delivered in collaboration with Apex Group, Chainlink, Fireblocks, and Polygon. Seeking to comply with regulations while ensuring open interoperability, it leverages the ERC-3643 market standard via our T-REX Platform.

The fund was launched with onchain compliance controls, integrated cap table management, real-time redemption capabilities, and real-time NAV feeds, demonstrating how tokenized funds can operate efficiently, transparently, and securely within a regulated framework.

There are a few key benefits of tokenized funds:

- Instant and 24/7 subscription and redemption

- Real-time collateral deployment (e.g., in repo markets)

- Reduced operational risk through smart contract automation

- Seamless integration with DeFi protocols and traditional financial infrastructure

A Call to Action

A new chapter in finance is unfolding, and it’s happening now. With the GENIUS Act in place and onchain infrastructure finally ready for institutions, the opportunity to lead has never been clearer.

Yet, in a market filled with noise and emerging players, success will come to those who choose partners with a proven track record. The right guidance can help you avoid costly missteps, accelerate your learning curve, and ensure you don’t get trapped in new silos onchain.

At Tokeny, now part of Apex Group, we bring more than seven years of experience building enterprise-grade tokenization solutions. We work closely with our clients to provide the knowledge, technology, and operational support they need to move with speed and confidence.

If you’re exploring how to tokenize your assets or operations, our team is here to guide you through the process, from strategy to execution, and help you unlock the full potential of onchain finance.