The T-REX tokenization platform allows us to turn real estate into a liquid asset in a fast, secure, and most importantly user-friendly approach. We can split real estate into very small pieces and still manage it efficiently. We tokenize assets in a real partnership spirit with the Tokeny team that has a perfect understanding of our business case and is able to provide tailored solutions. Since we started, we can count on the Tokeny team to help us in any situation, as they are organized and efficient at providing support if we run into any issues.

The asset class that only the more affluent can afford

BlocHome is a Luxembourg-based real estate tokenization platform which addresses specifically housing. Its founding team is composed of both senior real estate professionals with decades of experience and tech-savvy entrepreneurs. They have observed that many investors struggle to take part in real estate investment opportunities because of these reasons:

- Low affordability: Investing in real estate can be very difficult for retail investors because it requires a large amount of money.

- Lengthy processes: It can easily take months to complete the process from borrowing money from a bank to getting the apartment ownership notarized.

- Lack of liquidity: The two issues mentioned above compound the liquidity problem, making it extremely hard to cash in when needed. Many investors have no choice but to sell their properties at low prices at the time when they are in desperate need of capital.

BlocHome team wants to change this status quo. Their goal is to move toward financial inclusion by making high-quality real estate projects selected and managed by experts accessible to all.

‘Slicing’ ownership of buildings made possible on blockchain

When the founding members first heard about blockchain technology, they were fascinated by the concept of peer-to-peer value transfer. After months of intensive study of this technology, they believe real estate tokenization can help them achieve their vision thanks to the following characteristics:

- Fractionalization: Assets can be divided into as many pieces as asset managers want via tokenization, providing affordable ‘slices’ of assets to their investors.

- Programmability: Compliance rules and other conditions can be coded into tokens, enabling automated compliance, facilitating the investment or secondary trading process.

- Transferability: Since compliance rules are embedded into the asset-based tokens, peer-to-peer transfers of assets are enabled, which leads to improved asset liquidity.

Preparing project and legal documentation for tokenization

“We must now take advantage of this innovative technology to make real estate investment opportunities available to everyone.” said, Jean-Paul, after the team’s research into real estate tokenization.

Meanwhile, Luxembourg’s authority has given the green light for the native issuance of security tokens in 2021. Naturally, the team decided to tokenize the first real estate called CLAPTON Residence, a luxury 8-lot residence in the heart of Luxembourg.

As Jean-Paul states “Tokenization is not a gadget, you need to have a business plan that uses the full capacity of tokenization to democratize access, to achieve low-cost, high-security, and peer-to-peer transactions. We want to develop a service culture amongst the Blochomers’ community. In the end, we will be able to use tokenization at its full capacity and separate ownership from usage and ultimately redefine housing as a service.”

The team designed a sophisticated business plan and model and then joined forces with CMS and Finimmo Luxembourg to prepare documents and provide all the information required by CSSF, the financial regulatory body in Luxembourg, for a non-regulated public offering.

Technology shield with onchain compliance built-in

While the documentation process went smoothly, the team faced technical difficulties when it came to tokenizing real estate on blockchain and embedding compliance rules into real estate-based security tokens as defined in the documentation. They realized that they needed to find technology experts to help them, and after comparing multiple providers, they opted for Tokeny’s tokenization solutions due to its unique onchain compliance approach that consists of two elements:

- Permissioned tokens: The platform uses the ERC-3643 standard to issue assets as permissioned tokens to embed eligibility and offering rules into tokens.

- Digital identities: The solution links digital identities to tokenized assets, guaranteeing asset ownership (e.g., issuers can recover tokens for investors in the event of wallet loss). More importantly, automated compliance is realized as permissioned tokens can self-check investors’ eligibility through their identities’ verifiable credentials.

“Tokeny’s solution bridges the gap between blockchain technology and the financial market with a powerful platform, allowing us to apply compliance and control on the ultra-efficient decentralized infrastructure,” Jean-Paul added.

Asset management is quicker and cheaper

As all the securities documents were ready, the process of tokenizing real estate was straightforward. Tokeny’s team was able to quickly set up the T-REX platform for them by defining their parameters and branding, as the solution is modular and white-label. Assets were brought to the blockchain in a matter of a few weeks.

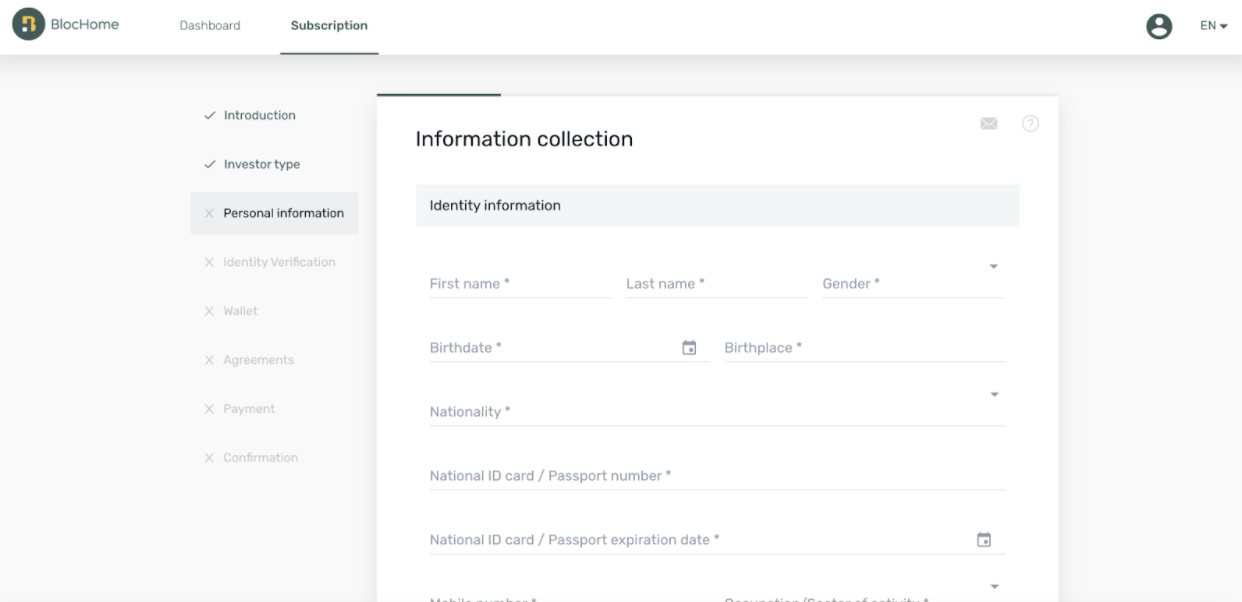

BlocHome’s investors were able to register and invest in the tokenized real estate directly via the BlocHome branded digital platform in three main steps, which are (1) creating an account, (2) completing the KYC check, and (3) transferring funds. Once the process completes, investors can check their real estate security tokens on the dashboard. The value of their holdings will be updated in their account after each independent 3rd party valuation every 6 months.

The whole onboarding process and lifecycle management of the securities are digital. The T-REX platform allowed the company to save up to 90% of the time and costs it takes to onboard investors, leading to 800 potential investors onboarded in the first month. As a result, BlocHome has attracted capital from sources it wouldn’t have otherwise reached, including small-scale investors spread across a number of countries.

More excitingly, the team is planning to add, after receiving approval from CSSF, the secondary market solution Billboard to the platform in the coming months to allow investors to find an eligible counterparty, then conduct peer-to-peer transfers whenever they want, freeing up liquidity in this historically illiquid asset. The settlement will be instant onchain and the transfers will be automatically verified.

Jean-Paul said: “We are satisfied with Tokeny’s solutions because they are designed with compliance at their core, addressing the need to comply with securities regulations required by law. We can therefore take advantage of all the benefits of blockchain technology for our investors and for us. Having them handle the technical aspect of everything lets us focus on what we do best. Together, we provide a complete digital experience to our investors.”

Ready to tokenize your assets?

Leave your details below and we’ll get back to you shortly.