Product Focus

We hope you are well. For the first edition of our Product Focus newsletter in 2023, we would like to share our main product development priorities for this year. Our focus is on four key areas: scalability, connectivity, security, and composability.

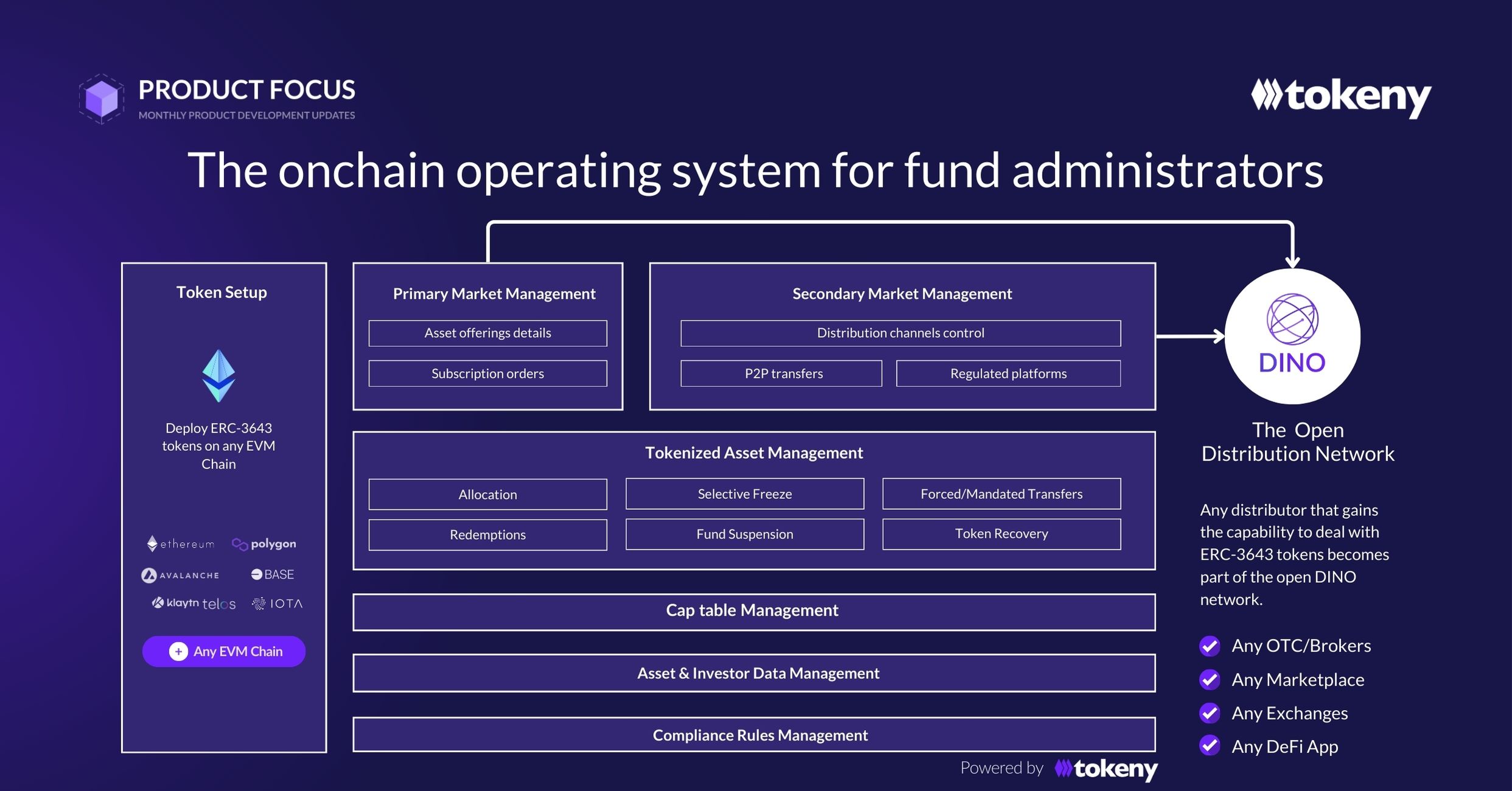

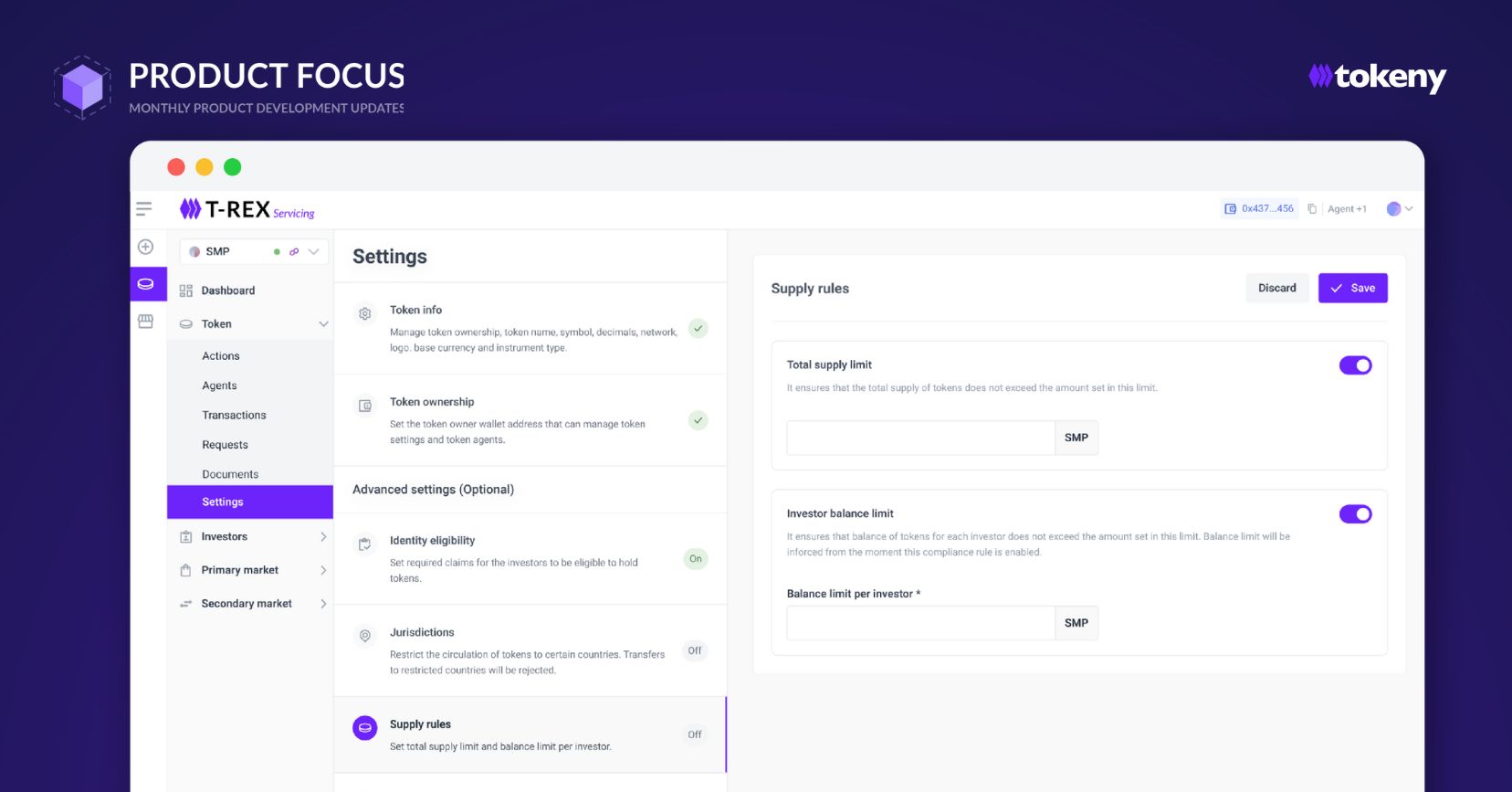

Scalability empowers asset owners to efficiently tokenize and manage real world assets (RWAs) and securities, reducing costs and improving accessibility. Our self-service SaaS platform already allows our customers to start tokenization without any tech support. This year, we are taking it a step further by enabling issuers to manage advanced settings directly via the Servicing platform. We are also enhancing the UX and adding multiple new features, which will lower operational costs and increase investor access to digital securities.

For example, we are working on several features to enable large-scale operations for open-ended funds, such as REITs and UCITs. By simplifying blockchain tools for traditional investors and offering fractionalized assets at affordable prices, tokenized asset issuers can boost the accessibility of assets with automated workflows.

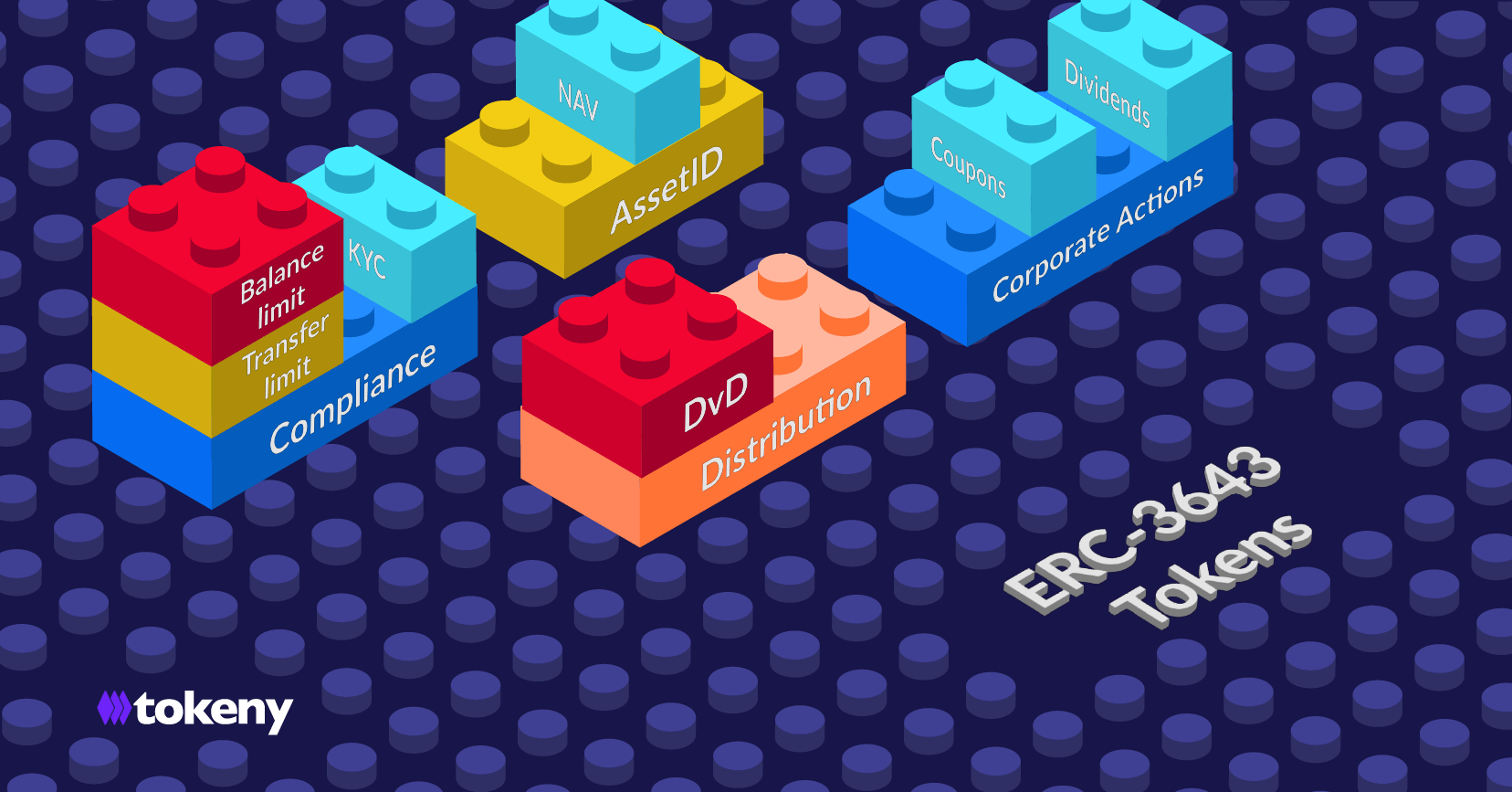

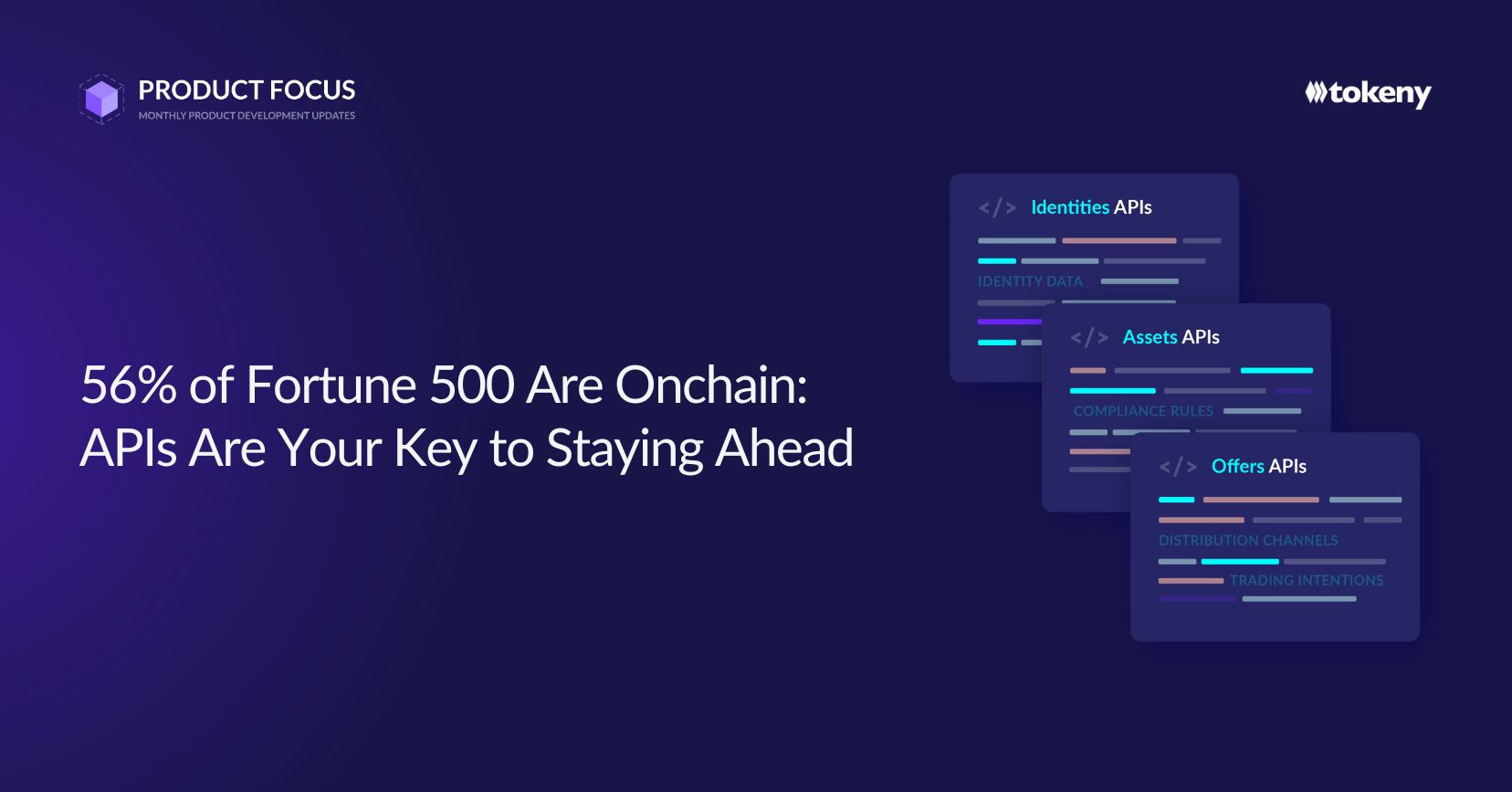

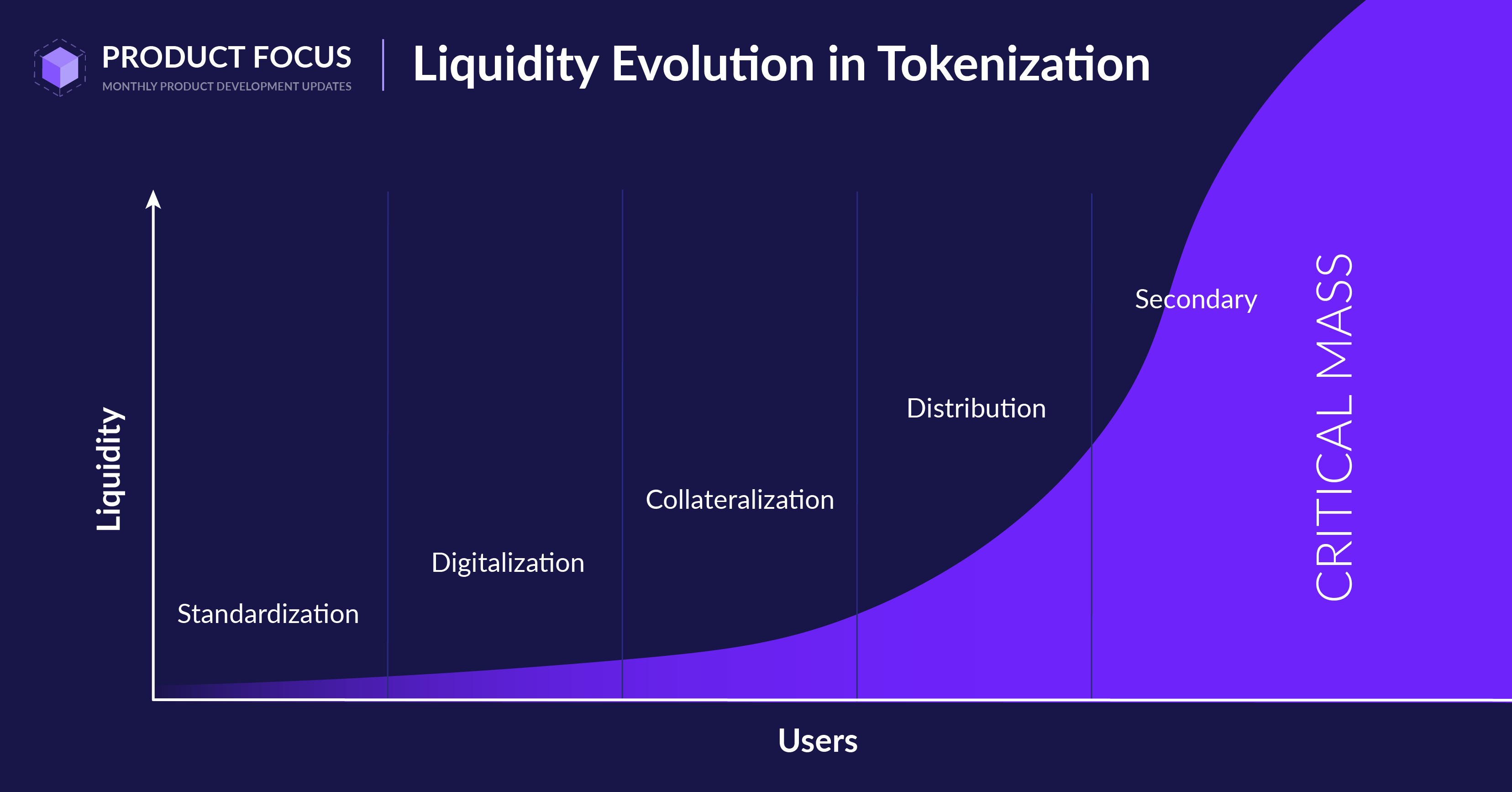

Connectivity ensures that tokenized assets are interoperable with the necessary service providers and market solutions to enrich data and facilitate liquidity. Our solutions use the token standard ERC3643. As it is now widely adopted, the number of ecosystem players is rising. Our role is to ensure that our customers can easily connect to any service provider, for example, valuation agents, centralized exchanges, decentralized exchanges, as well as DeFi protocols to not only improve liquidity but also to open up new revenue streams (e.g. DeFi services, Billboard ads, etc.).

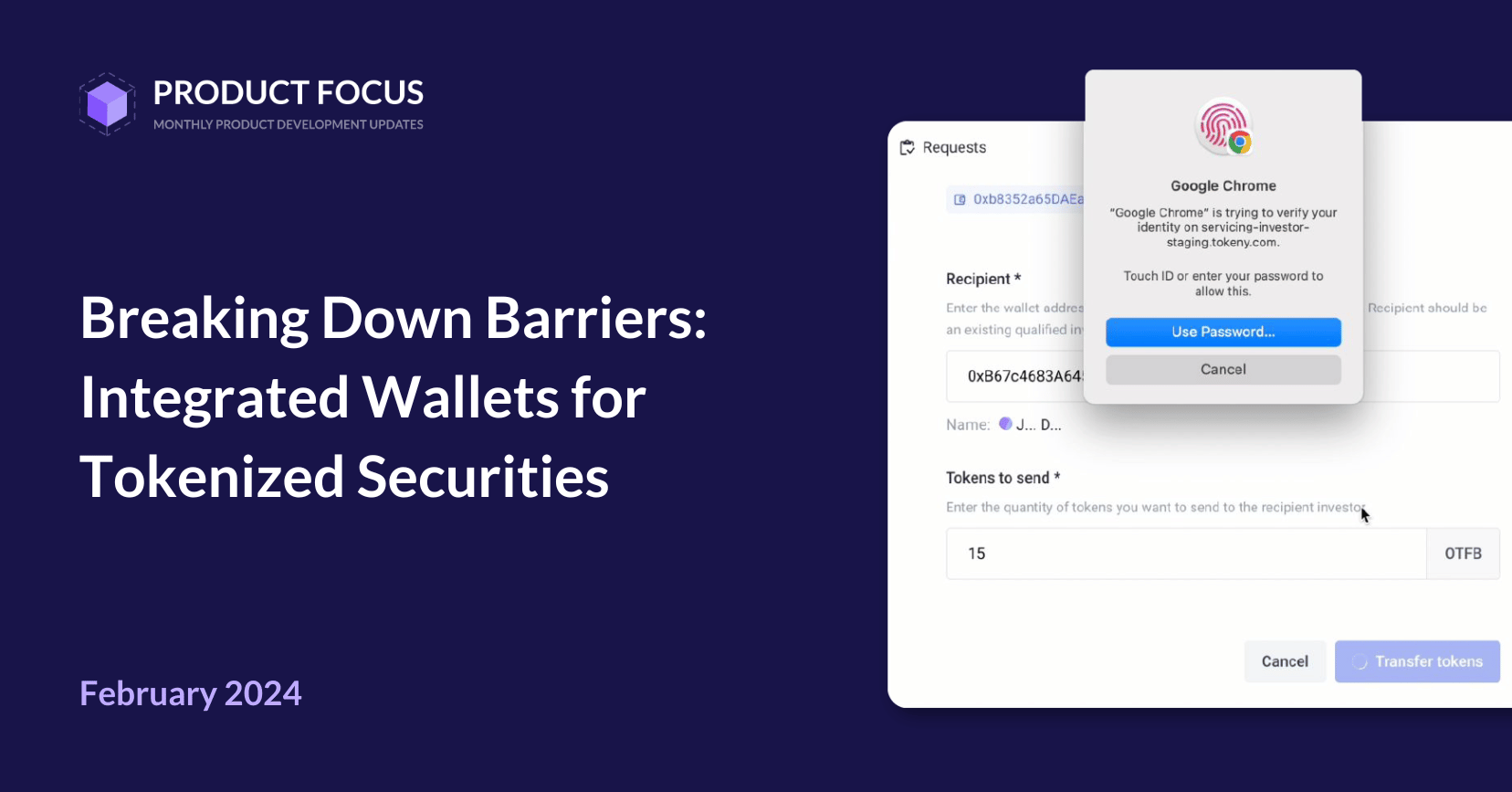

Security is a top priority to keep data and assets safe from potential vulnerabilities. To continue protecting our customers from any form of technical risks and data breaches, we are taking a multi-pronged approach by conducting more thorough security tests and audits, obtaining certifications such as SOC2, and improving extra measures such as 2FA authentication. In addition, our solutions will be compatible with the upgradable ERC3643 V4 to ensure that issuers always have full control over their assets as it provides the capability to fix any vulnerabilities that may arise.

Composability guarantees that issuers’ tokenized assets will never be blocked on one single blockchain network, providing a future-proof tokenization approach. Thanks to the portability of ERC3643, tokenized assets can switch to any EVM blockchain. Currently, our solution is already multi-chain, supporting Ethereum and Polygon. This year, we plan to integrate with more EVM blockchains based on market demand. We’ll also provide services to bridge assets from private networks to EVM public blockchains as institutions transition from private networks to public ones.

Our outlook for the coming year is exciting, and we look forward to continuing to receive your support as we strive to improve our products in order to assist you in achieving your tokenization goals.

Subscribe Newsletter

This monthly Product Focus newsletter is designed to give you insider knowledge about the development of our products. Fill out the form below to subscribe to the newsletter.