The digital asset space continues to thrive and attract institutional investors, as according to PitchBook, $17 billion worth of institutional capital has poured into the sector this year alone. Moreover, 70% of institutional investors expect to invest in digital assets in the future. Since the funding in the space has exploded, traditional custodians are trying to figure out how they fit in as new players on this value chain. Custodian banks have been slow to adapt and are now struggling with managing digital asset custody. Even worse, they mix up crypto-currencies and tokenized financial securities.

Digital assets: new opportunities for custodians

It is natural that custodians need time to understand how blockchain technology works. Once that happens, the lucrative opportunities that await on the other side will become clear. Here, we listed a few benefits and opportunities:

- New safekeeping service

As digital wallets are the access points for digital assets, custodians can provide custodial wallets for investors.

- Reduced operational costs

When all investor positions are kept on the blockchain, it eliminates the need for reconciliation of depository in the process. This reduces the heavy reconciliation costs.

- Immediate services

Custodians can provide immediate value-added services such as owning the recovery process for lost security tokens, reporting, tax certification, lending services and other collateral management services to investors.

We used the word ‘immediate’ because with the blockchain, processing these services will use a single truth of information. Issuers, agents and investors can access the real-time data at any time. Services can be provided promptly by avoiding the lengthy process of flowing information throughout the traditional chain of custody and the risk of human errors.

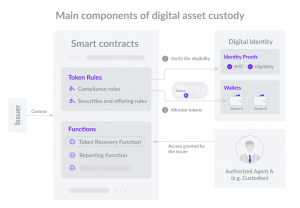

The main challenge is not regulation but the adoption of the new model

People often think the main challenge in this space is regulation, but it is actually not true. Instead, the real struggle for financial institutions including custodians is adopting new processes and new tools. When it comes to compliance, it is mostly about verifying the eligibility of investors. This can’t be performed by identifying investor wallets, as they are browsers for the internet of value, not vaults. That is where digital identity comes into play, but how does it work? Let’s take a look at the main characteristics in the blockchain-based model of custody to provide some clarity:

- Smart contracts

The smart contracts represent the asset(s) on the blockchain infrastructure. They code compliance rules into the security tokens, and only eligible investors can hold these tokens. The serious protocols for tokenized securities usually include a token recovery function that can be triggered by authorized agents.

- Tokens

The tokens that have eligibility rules embedded into themselves are permissioned tokens, and they can only be traded between eligible counterparts.

- Digital identity

Investors have a digital identity that stores verified identity proofs onchain, and smart contracts can check these proofs to verify the eligibility of investors.

- Wallets

Once the smart contract code confirms the eligibility of the investor, the permissioned tokens will be allocated to wallets associated with the investor’s digital identity. If the private key or access credential is lost, the permissioned tokens can be recoverable to another wallet. This can be processed after the verification of identity by token issuers or third-party agents.

Use cases: recovery of security tokens

It is therefore obvious that custodians need access to the token smart contracts, not to the wallets, for safekeeping investors’ assets. For example, issuers of tokenized securities using the T-REX Protocol, now recognized as ERC3643 by the Ethereum community, are able to appoint a custodian bank as the recovery agent and grant that bank access to the recovery function of the smart contracts. In practice, the security tokens can be recovered in just a few steps:

- Declare the loss of the wallet: The investor creates a request to recover their tokens to the custodian bank.

- Verify the digital identity – ONCHAINID: The custodian bank verifies the token holder’s identity with a standardized KYC process to validate the provenance of the request.

- Recover the same tokens in the new wallet: If the verification is positive, the custodian bank triggers the recovery function and the lost tokens are transferred to the new investor wallet. This new wallet will also be added to the ONCHAINID of the investor. The custodian can perform this operation even if he doesn’t have access to the investor’s wallet.

Time to embrace and explore the new technology

Traditional custodians have an important role to play in digital asset custody, but they need an updated approach. There are some quick actors who are already reacting to it and updating their model. Recently, US custodian bank State Street launched a digital finance division to expand into the space. Why? It was because of client demand. Certainly, the demand will continue to increase, and as we mentioned earlier, seven out of ten institutional investors plan to invest in digital assets.

The good thing is that the technology has matured after years of use and securing billions worth of digital assets. Custodians can implement the technology quickly and straightforwardly. It is time to move and keep up with technology in order to gain a competitive advantage, those who react slower risk falling behind the competition, or other new players enter into this space.

As Nadine Chakar, the lead of the new digital finance division at State Street, said, “This space is evolving at warp speed. I believe the winners will be those who embrace change versus those who stand back and watch – they will be disintermediated or disrupted. Business leaders, including myself, must set the tone that standing still is not an option.”