Product Focus

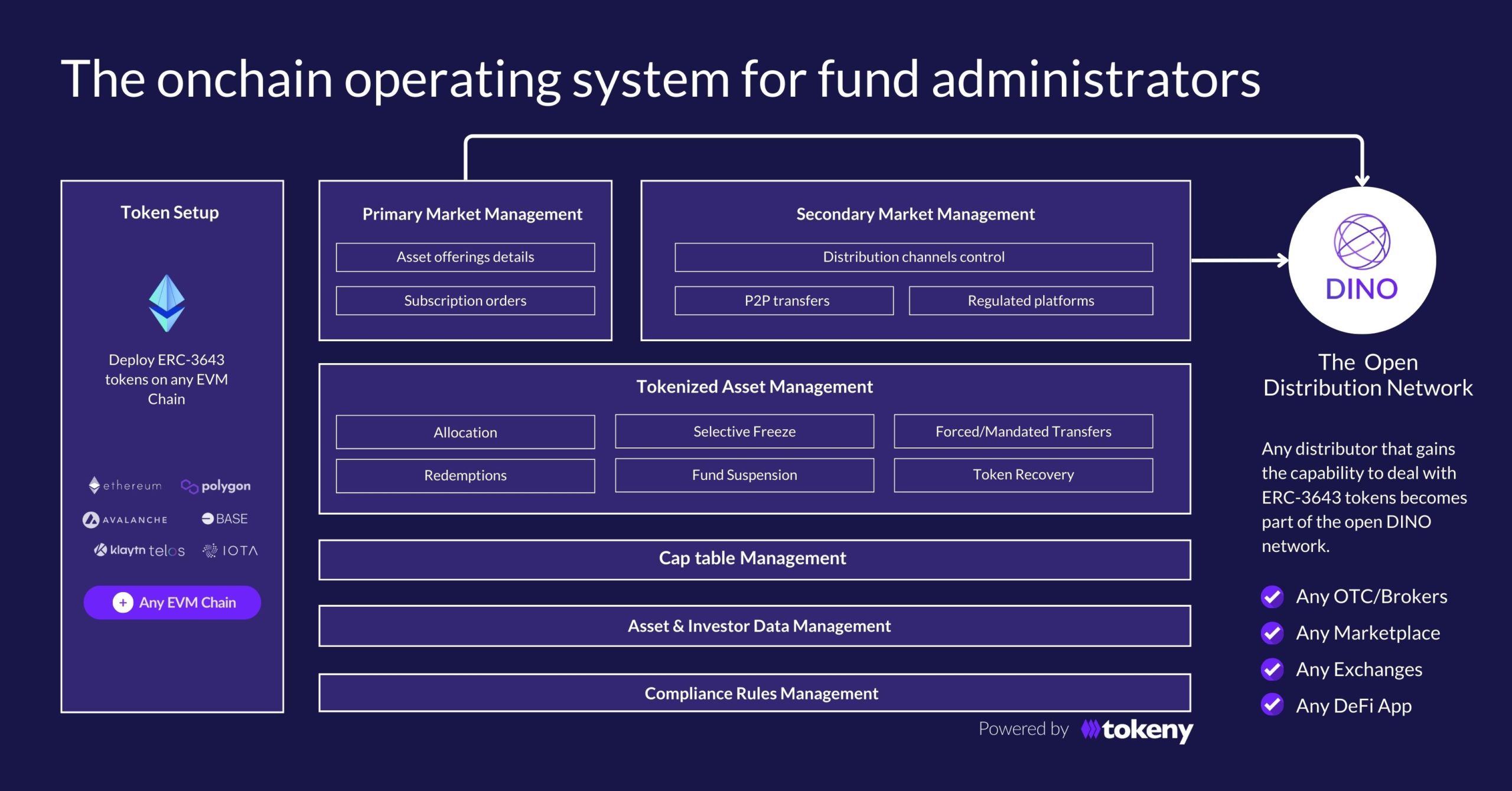

In previous product newsletters, we focused mainly on the technical features we’ve developed. In this edition, we’d like to highlight how our onchain operating system is utilized by one of the most crucial stakeholders in tokenized funds: fund administrators.

Fund administrators aiming to manage tokenized funds need onchain tools to handle onboarding, compliance, asset management, and secondary market operations seamlessly. Tokeny provides a complete suite of solutions, offering the necessary tools for investor onboarding, token issuance, compliance rules management, full lifecycle fund servicing, and secondary market functionality—ensuring a smooth transition to onchain fund management.

How Our Products Meet Fund Adminstrators’ Needs at Each Stage:

Onboarding: Fund administrators require a streamlined onboarding process with KYC checks and secure payment collection. Our Investor App, part of the Tokeny Platform, offers a comprehensive solution for collecting investor information, conducting digital verification, and supporting payments in a fully integrated and digital manner.

Onboarding |

|

| Needs | Solutions |

| Allow easy browser of offers | List asset offers and details of assets |

| Collect investor info | Customizable form fields and digital workflows |

| Digital verification and signing | Integrated digital verification and signing tools (e.g. SumSub, DocuSign) |

| Automate calculation | Automated calculation of exchange rates and fees |

| Collect payments | Support multi-currencies and all payment methods from fiat to onchain cash and crypto |

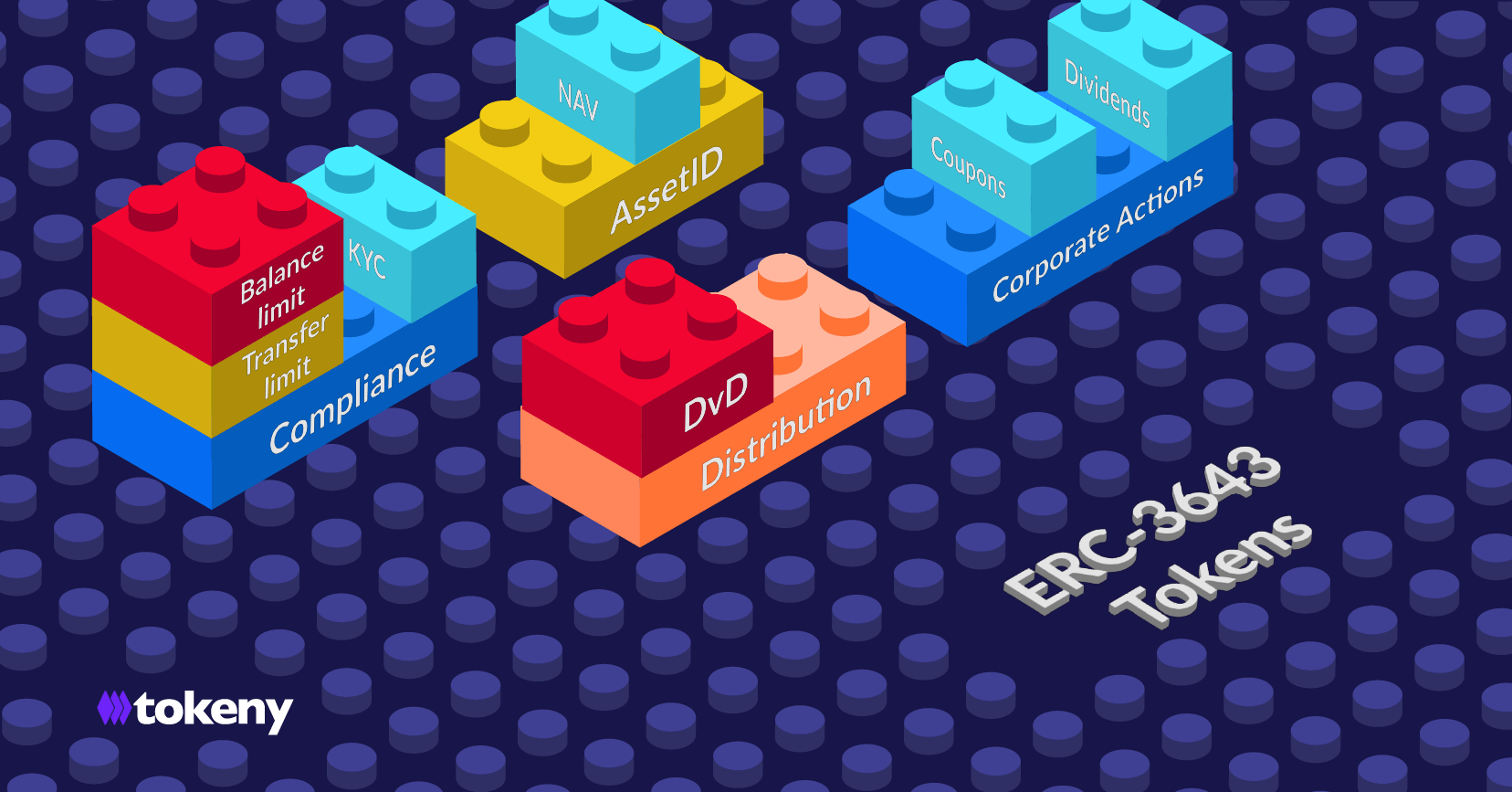

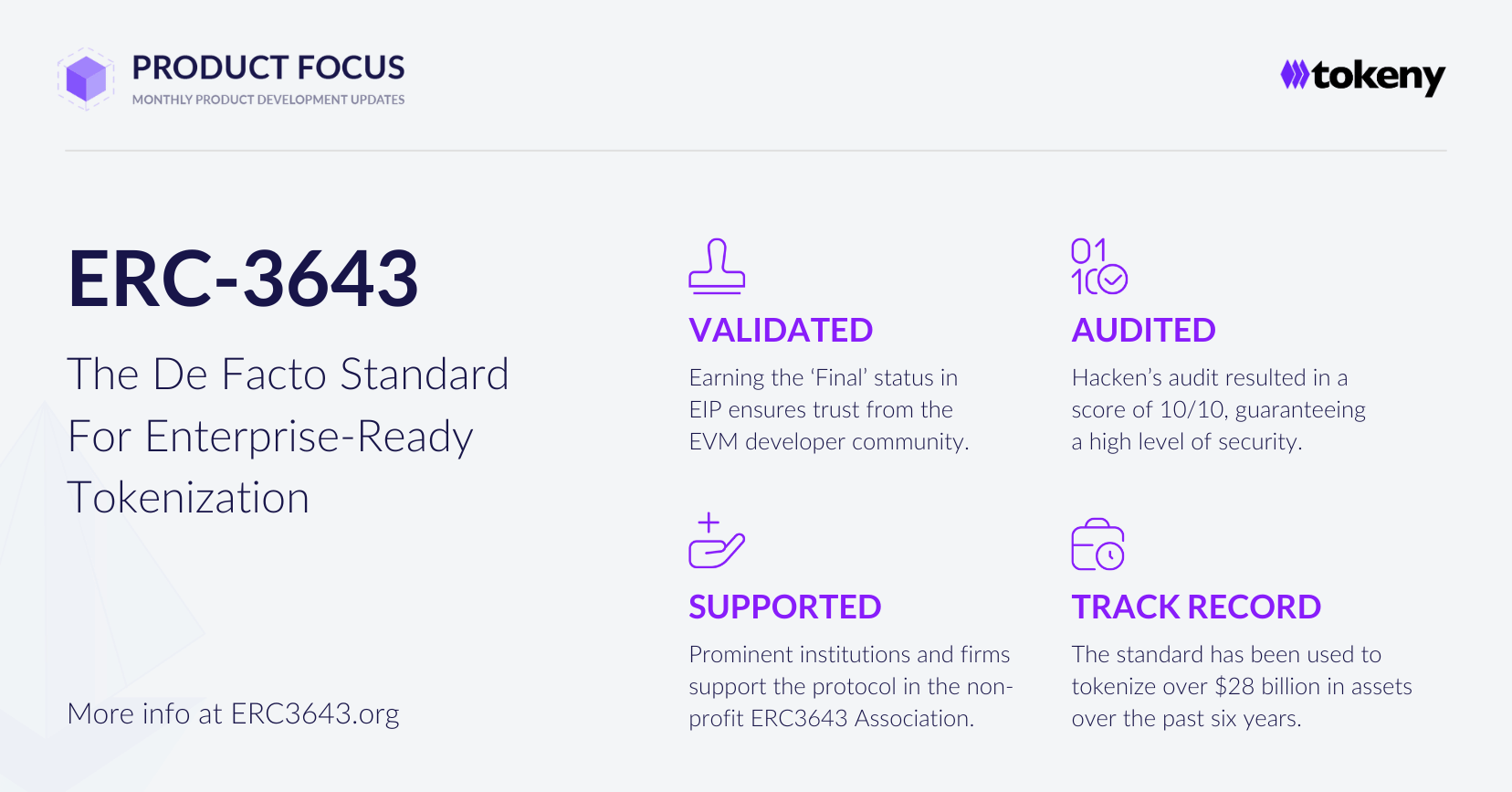

Issuance: Fund administrators need to represent assets onchain in a compliant manner. Tokeny Platform (turnkey solution) or T-REX Engine (APIs) allows them to tokenize assets on any preferred blockchain with upgradable smart contracts.

Issuance |

|

| Needs | Solutions |

| Flexible blockchain support | Support any EVM chain with a switch chain feature |

| Represent assets onchain | Token detail setup and one-click token deployment |

| Compliance setup | Set investor rules and transfer restrictions |

| Upgradability | Upgradable smart contracts |

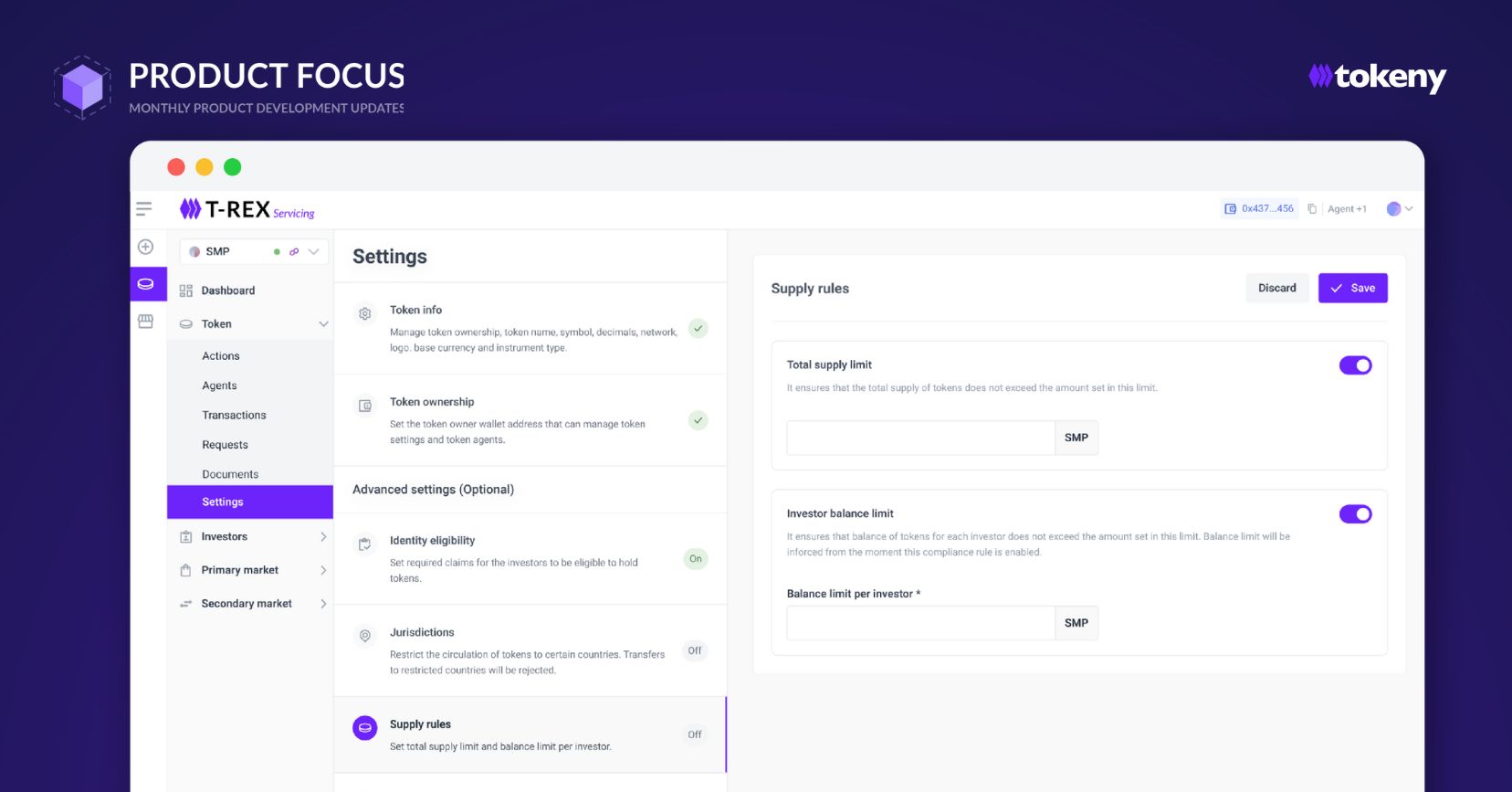

Servicing: Managing onchain funds requires full lifecycle servicing, from compliance to investor relations. T-REX Platform or T-REX Engine enables managing KYC/AML, investor data, cap tables, and token controls, automating many operational tasks while keeping real-time records of ownership.

Servicing |

|

| Needs | Solutions |

| KYC/AML Management | Onchain Qualification of investors and automated onchain compliance validation |

| Private Market Management | Order management for subscription and redemption |

| Tokenized Assets Management | Selective freeze of tokenized assets, suspension of all tokenized assets, mandated transfers, redemption, or token recovery |

| Data Management | Manage offering details, identities, and investor details |

| Cap Table Management | Real-time ownership records, check positions at any time |

| Investor Relations | Built-in email notification tool |

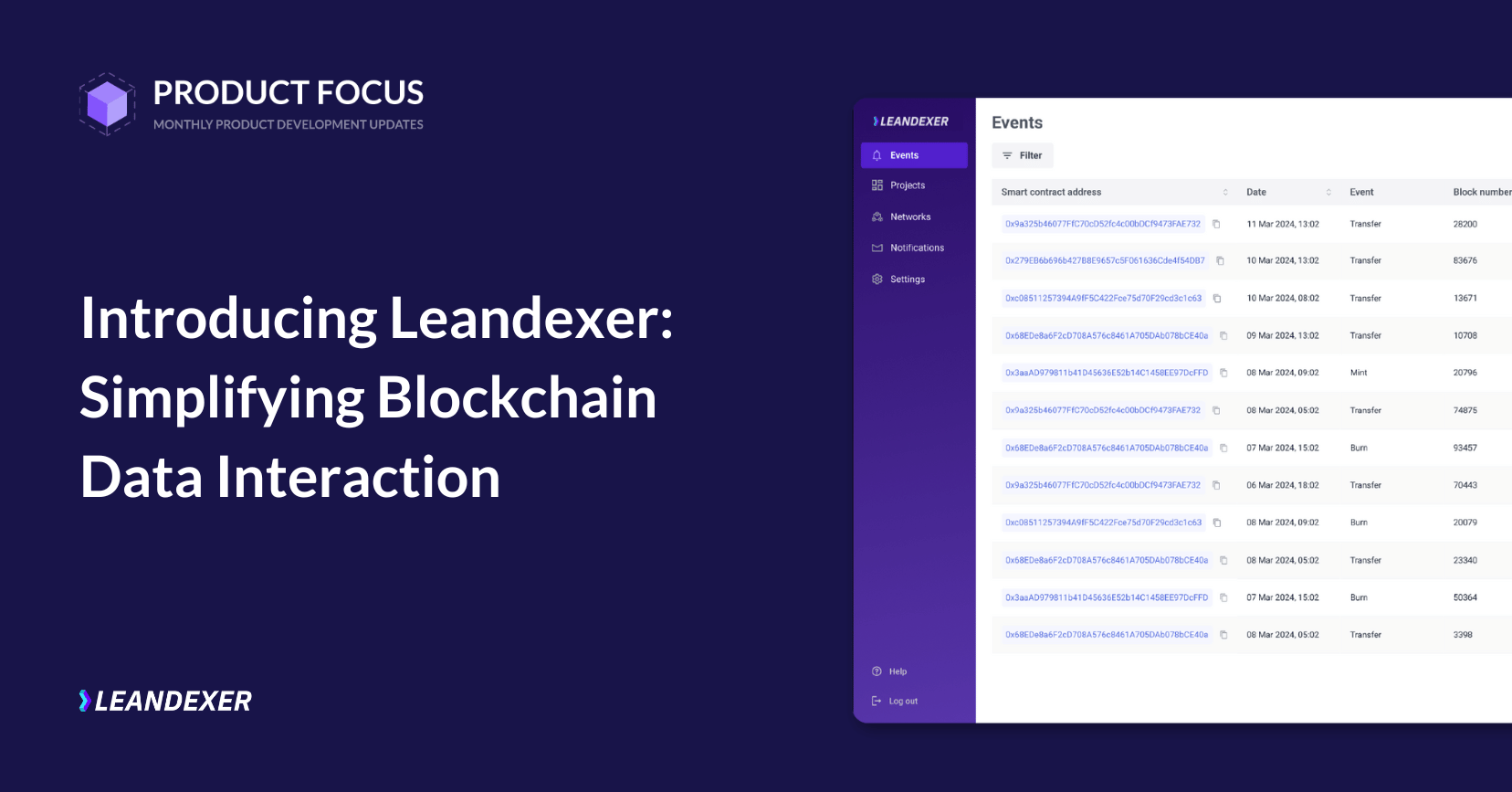

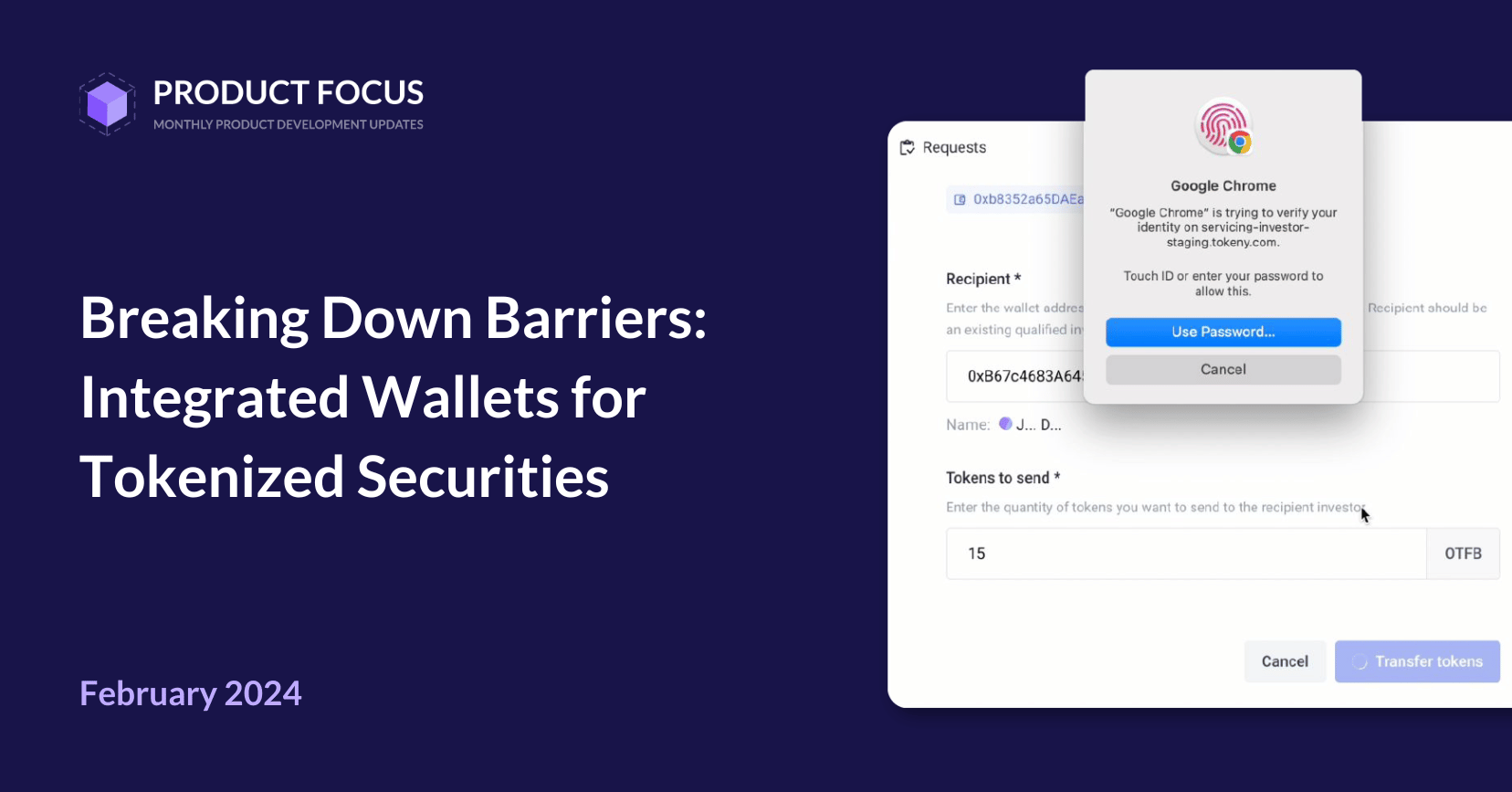

Secondary Market: Handling secondary market operations is key to increasing liquidity. Tokeny Platform or T-REX Engine empowers fund administrators to control distribution channels, approve peer-to-peer trades, and verify deposit wallets for compliant trading.

Secondary Market |

|

| Needs | Solutions |

| Automate operations | Advanced transfer functions (DvP, etc.) |

| Distribution channel control | Authorize distribution channels |

| Secondary transfers | Authorize and approve peer-to-peer trades and trading intention offers. |

Tokeny’s solutions empower fund administrators to reduce operational friction and ensure full control over compliance, distribution, and data management, all in real-time.

We are excited to work with leading fund administrators globally and look forward to helping more fund administrators accelerate the adoption of onchain finance.

Xavi Aznal

Subscribe Newsletter

This monthly Product Focus newsletter is designed to give you insider knowledge about the development of our products. Fill out the form below to subscribe to the newsletter.