In our previous article, we defined the concept of DeFi and how it differs to the infrastructure that’s commonly used today. As discussed, there are clear advantages in using a decentrlized infrastructure for financial markets, particularly in regards to investor onboarding. The basis of this article will be to discuss how firms can improve capital markets infrastructure, specifically compliance obligations, by leveraging decentralized technology.

Applying decentralized technology to capital markets is a highly complex matter in regards to compliance. Regulations that govern the world of financial securities differ from country to country and every year are becoming stricter and stricter. This is an area the financial industry, particularly banks, are facing significant challenges with. Globally, within banking, $270 billion is spent per year on compliance. This attributes to 10% or more for most bank’s operating costs and is a number that could double by 2022. These compliance obligations eat into profitability due to fragmented systems and poor reporting methods. Each bank is required to store sensitive information on their customers, something that requires much resource to ensure data is kept securely.

The difficulty for banks to keep up with these measures is plain for all to see. In 2019, Deutsche Bank cut over 18,000 jobs and announced a €13 billion investment in a technology and innovation division. In January 2020, six Eurozone banks fell below the European Central Bank’s capital requirements. One of the biggest banks in the world, HSBC, cut 35,000 jobs worldwide as profits fell by a third. Driven by traditional banks’ shortfalls, there has been a focus on new technology in a bid to alleviate problems such as ultra-low interest rates, inefficient cost structures and fines for misconduct that have squeezed margins.

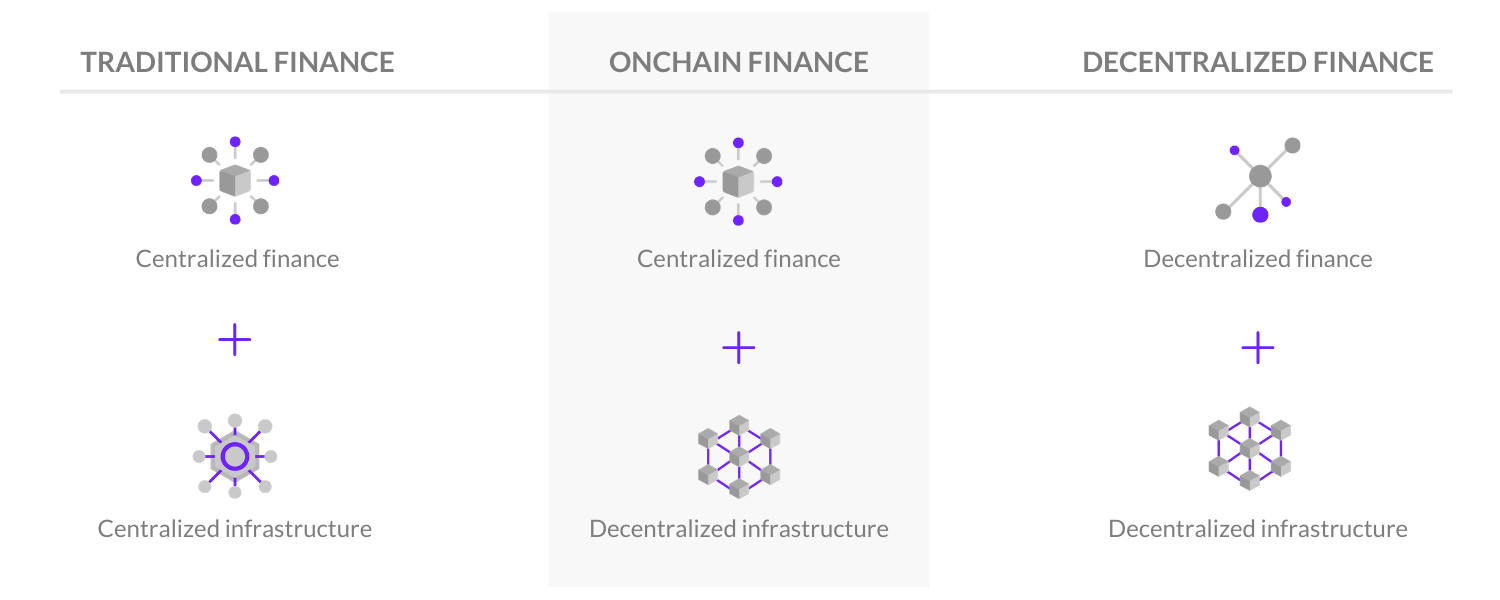

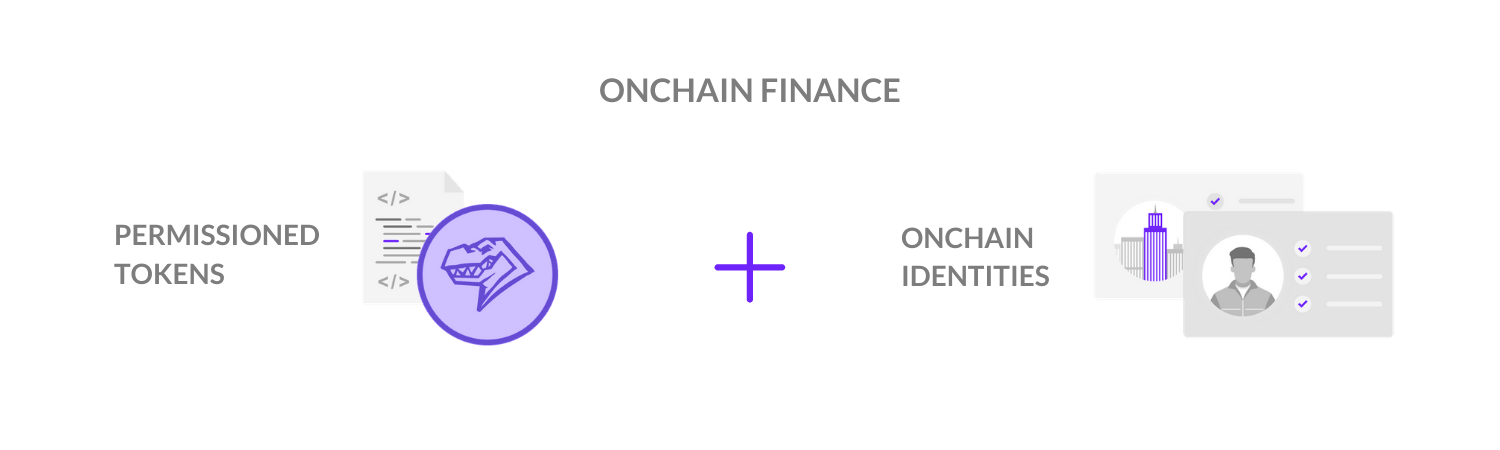

Blockchain technology will eventually solve these problems. However, as we discussed before, if industry players are to benefit, the appropriate tools need to be built on top of this new infrastructure to ensure the rules and regulations are complied with. This is the concept of Onchain Finance, which means applying compliant finance on a decentralized infrastructure.