Product Focus

2023 was transformative for Tokeny, our business was booming, and we received a strategic investment from Apex Group, one of the biggest fund administrator and servicer. From a product perspective, it was also an incredible year for us as we made significant strides across critical dimensions, focusing on scalability, connectivity, security, and composability.

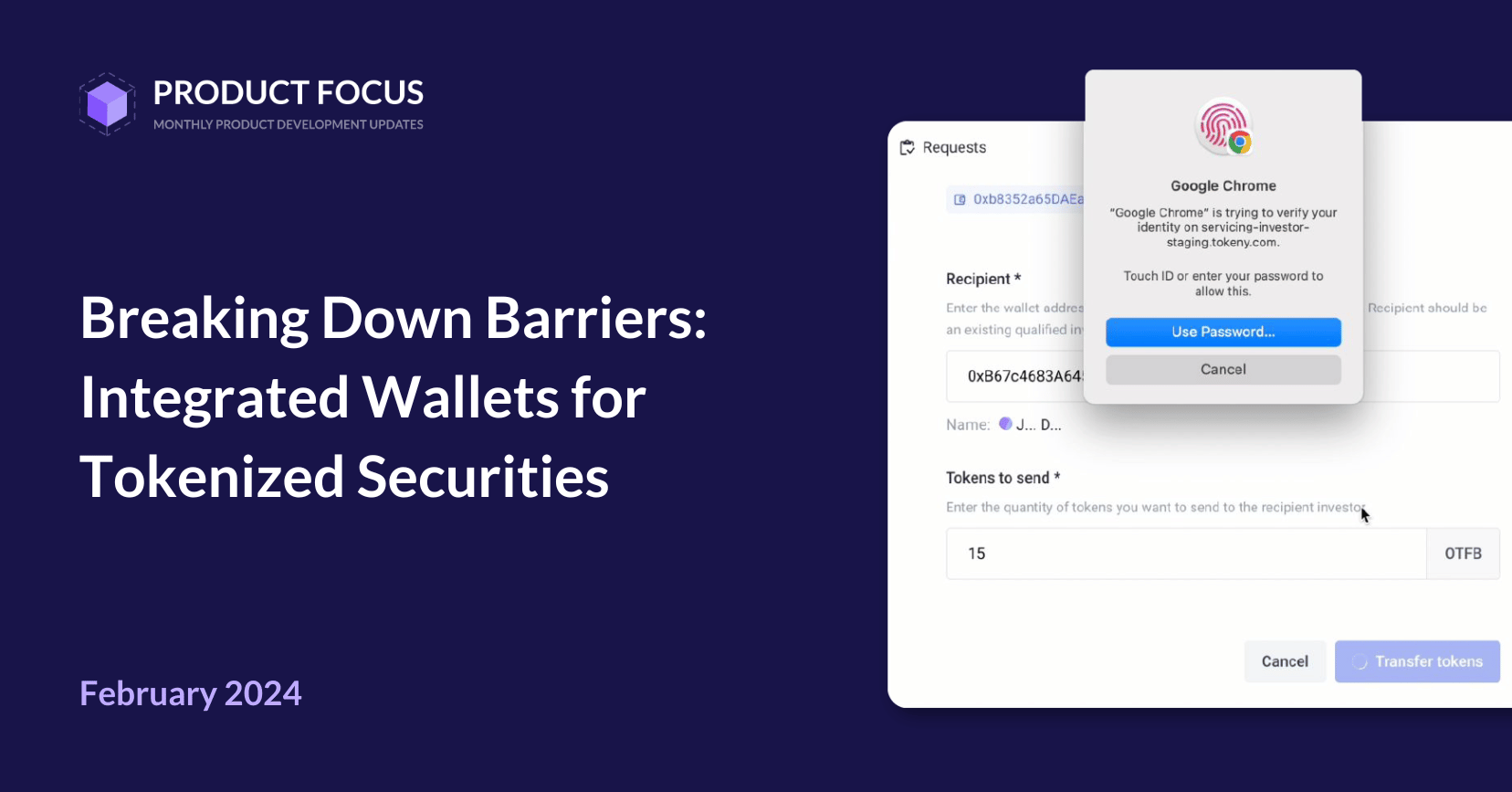

We achieved notable milestones, including the launch of the Dynamic NAV feature, the Multi-party approval transfer feature, and the Unified Investor App, ensuring scalability to meet evolving market needs. We also enabled centralized exchange connectivity and delivered a complete custody solution supporting any connected and integrated wallets, to enhance both connectivity and scalability. Regarding security, we conducted regular tests and achieved SOC2 Type I Compliance. Lastly, our network-agnostic tokenization platform supporting multi-chains further emphasizes our dedication to composability.

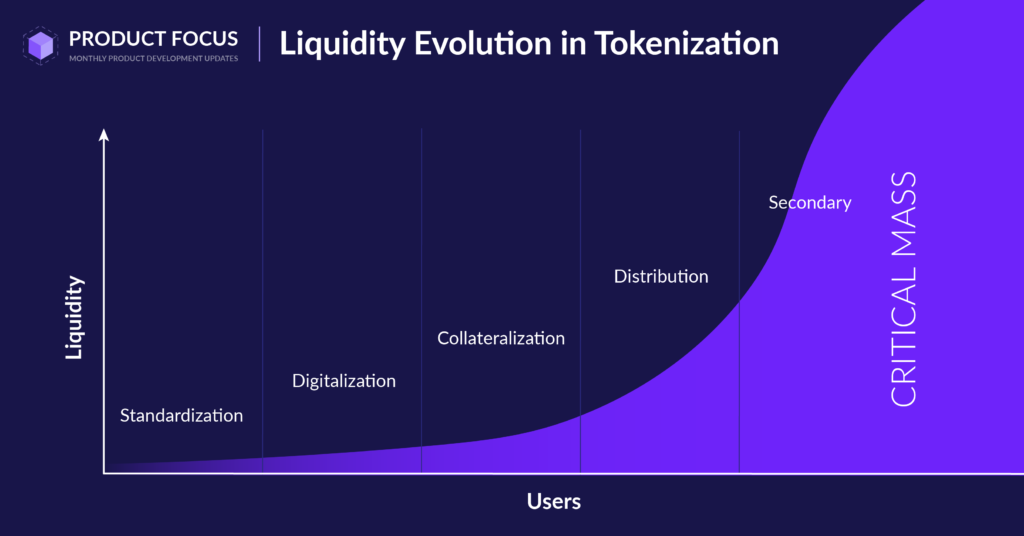

In 2024, our product vision is to continue delivering solutions that empower not only issuers, but all ecosystem participants in the tokenization journey to cultivate liquidity and accumulate more users. In our view, to achieve the liquidity endgame, we have to build it up through a few phases: standardization, digitalization, collateralization, distribution, and then reach the liquid secondary market.

Below, I’ll explain how we are turning our product vision into actionable steps to address your technical and operational pain points, smoothly transitioning to new phases, and adding value and services, all while improving liquidity for your investors.

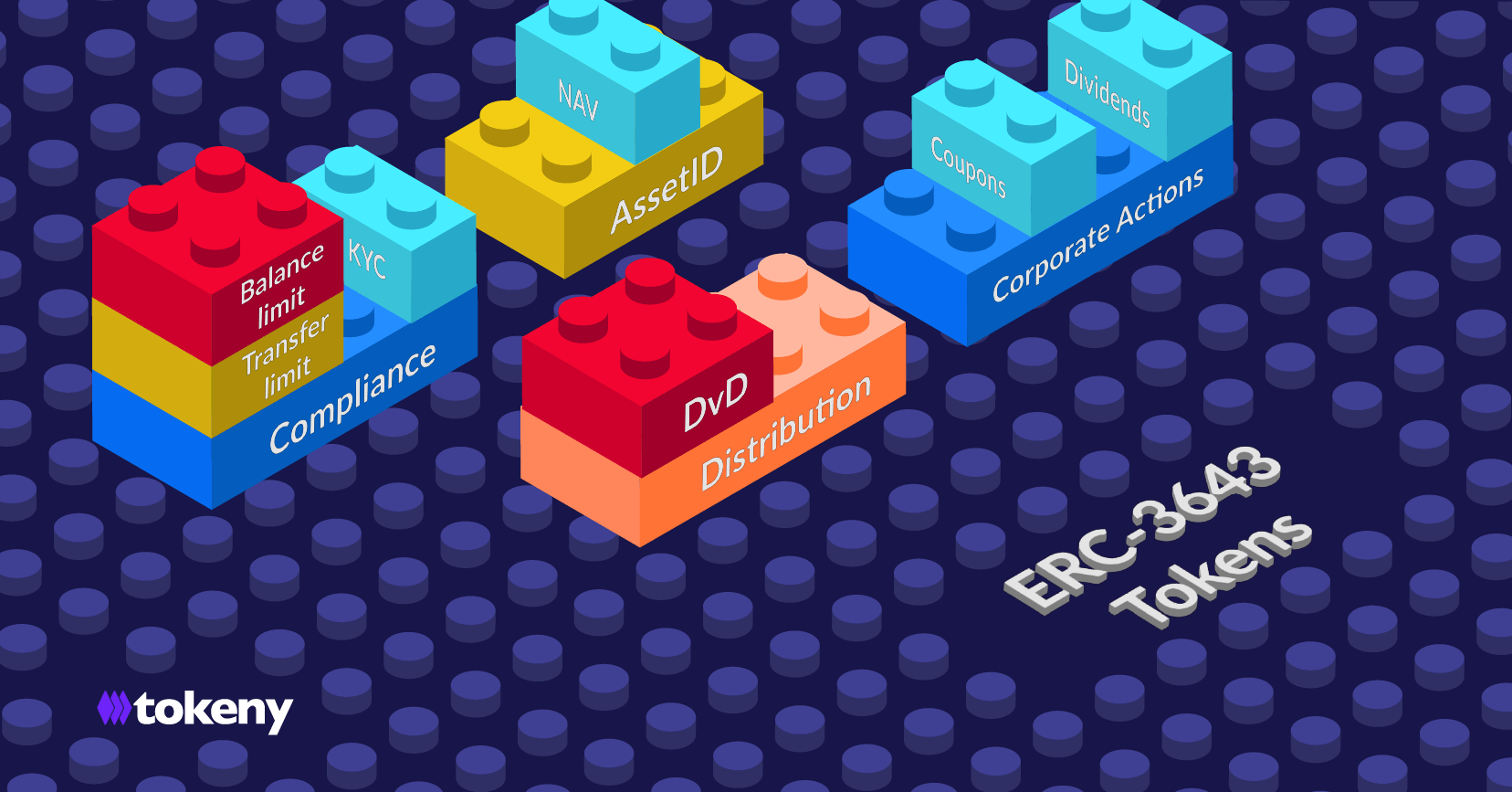

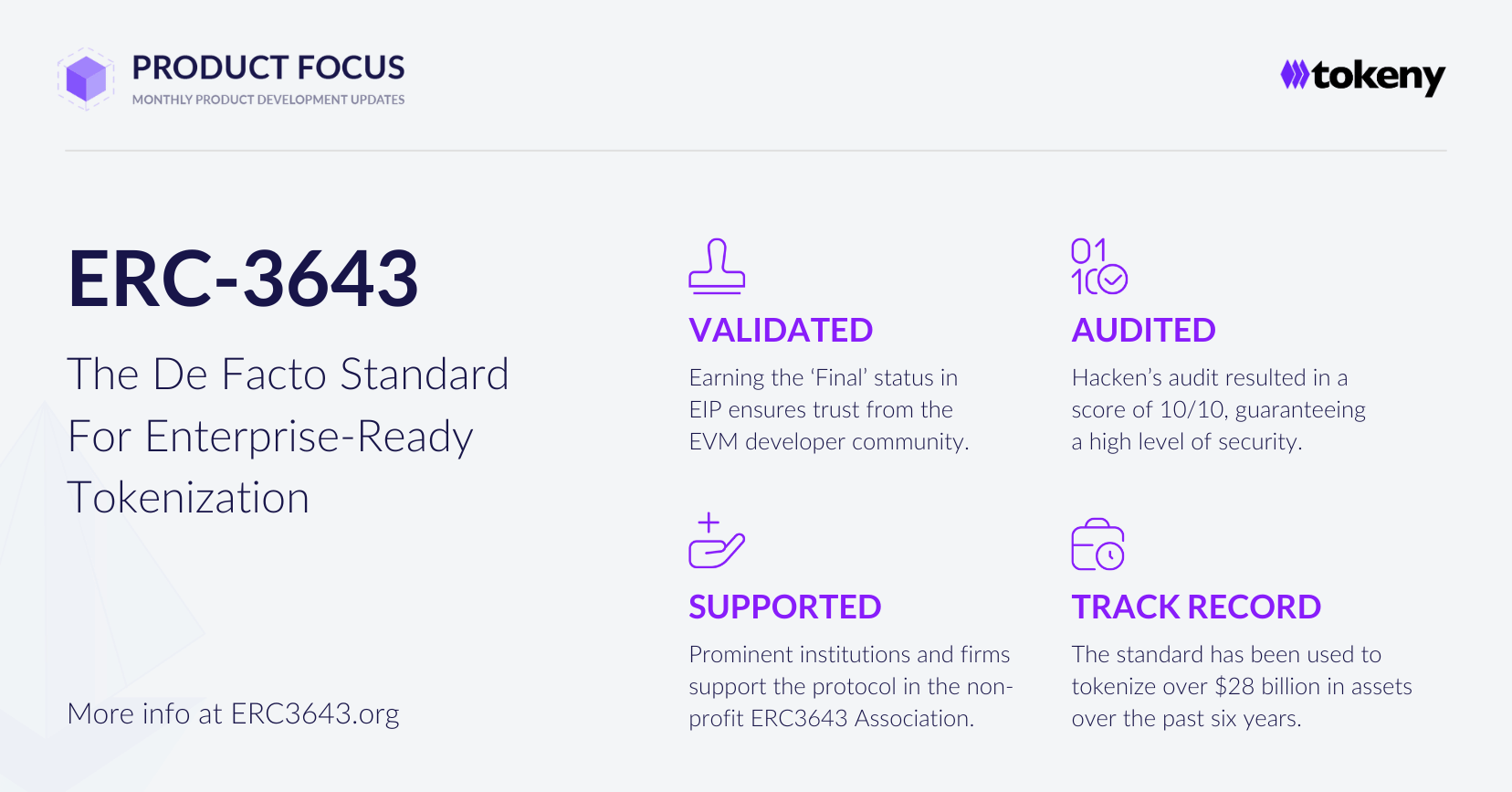

Accelerating standardization phase: The industry now embraces the official token standard ERC-3643 for compliant tokenization. We’re working closely with the ERC3643 Association to swiftly advance standardization. Our focus includes developing key tools like the ERC-3643 DApp, streamlining the effortless deployment and management of ERC3643 tokens, and setting a new benchmark for simplicity in compliant tokenization.

Digitizing real-world assets and securities en masse:

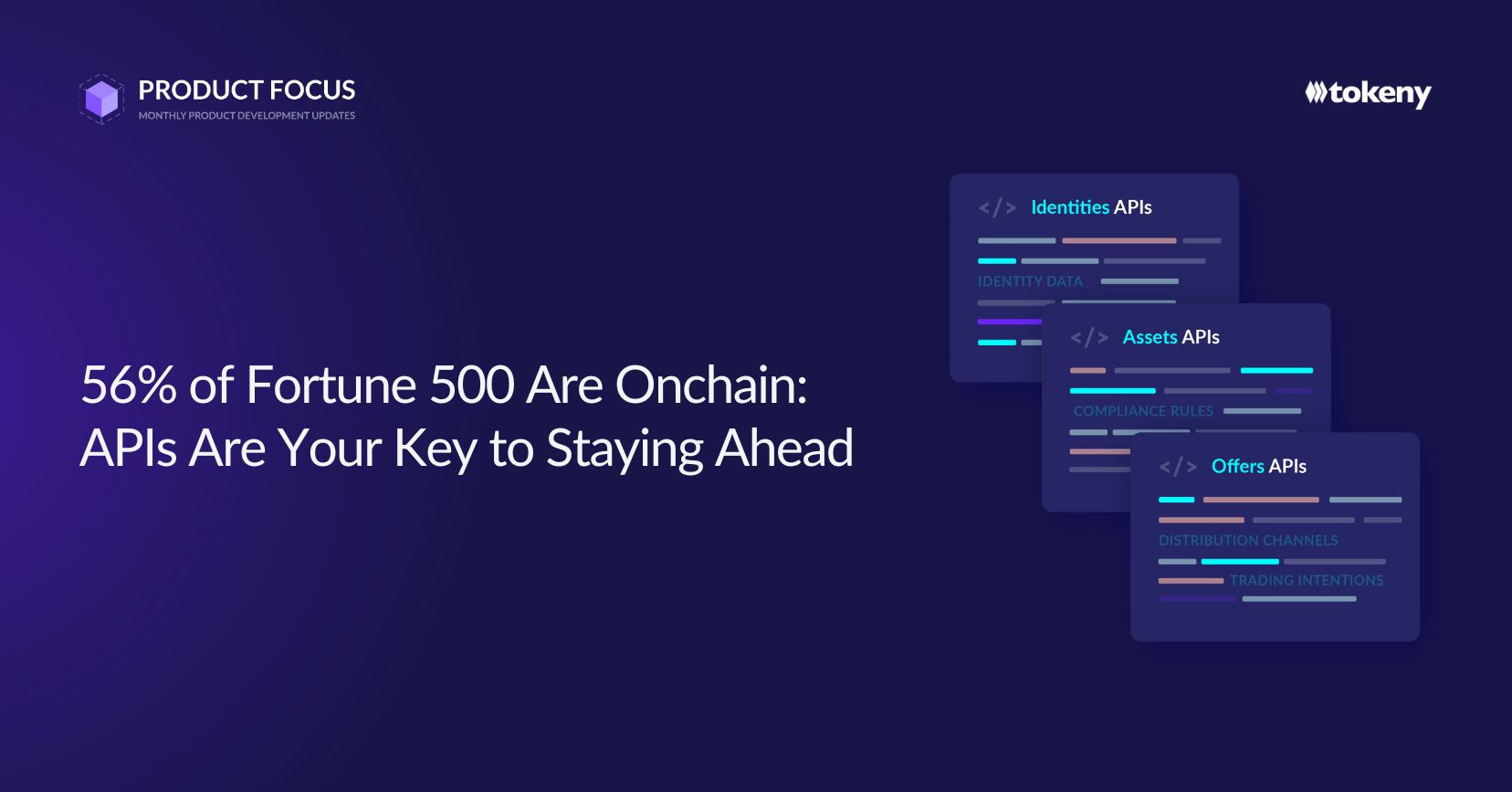

1. Speeding up time to market: While our contributions to standardization are open-source, the value of Tokeny’s solutions extends beyond smart contract deployment (more details here). We are committed to enhancing our APIs and white-label SaaS solutions. Tailored products for diverse segments, ranging from asset managers to Web3 RWA projects, are in development to catalyze the RWA wave and advance the asset digitization phase.

2. Delivering immediate benefits: Accelerating towards liquidity begins with addressing immediate pain points for institutions. Why tokenize now? It’s all about enhancing operational efficiency and streamlining processes with 3rd parties applications, to slash costs. By solving these points, we can set the stage for bringing enormous high-quality assets on-chain, laying the foundation for the critical mass needed for advanced services, and emphasizing transferability, reach, and liquidity.

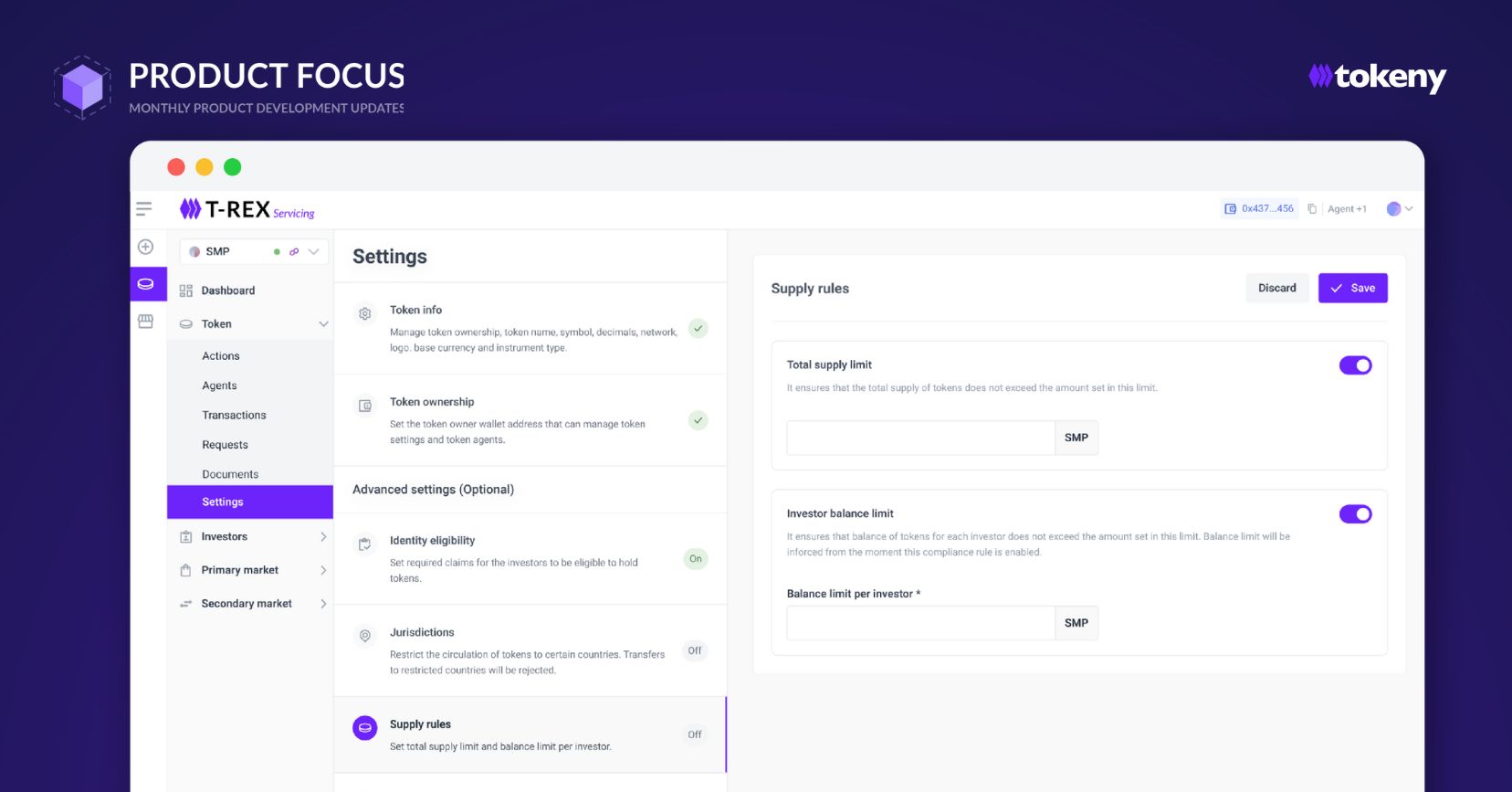

- Improved operational efficiency: Manual, human-based processes are not just time-consuming but also costly. And it is a common challenge across the entire private market. To tackle this, we’re developing features and smart contracts for various business cases, automating workflows from onboarding, and corporate actions, to secondary tradings. Automation increases operational capability, empowering institutions to reach a larger investor base.

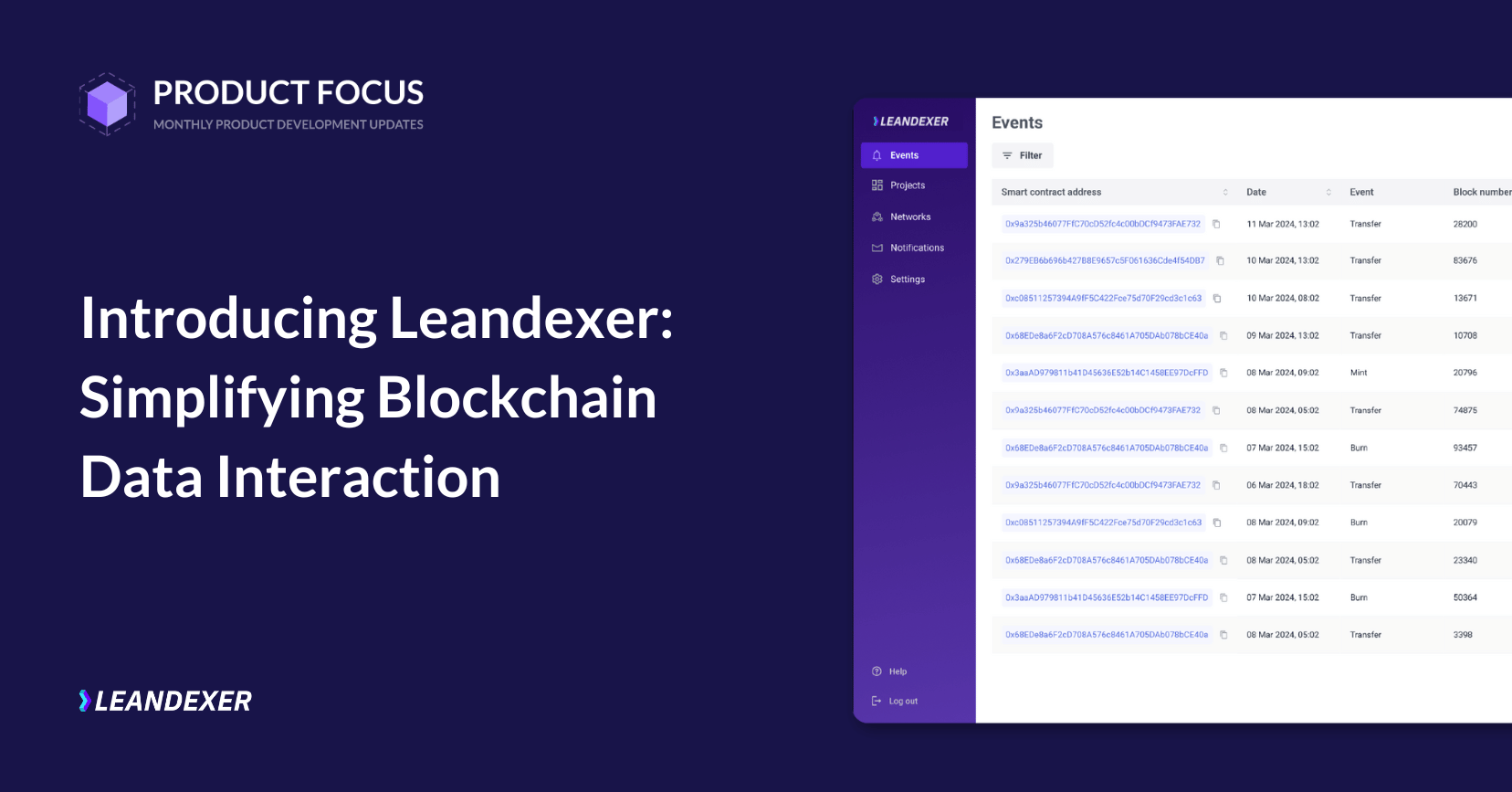

- Bridging 3rd party digital applications: Another notable challenge arises from the fragmented collaboration between various applications, each operated by different third parties. The multitude of digital applications involved in operations can create gaps when assets are brought on-chain. To address this, our products will continue to connect these disparate solutions, ensuring a cohesive operational workflow between tokenized assets and the involved providers.

3. The powerhouse for major corporations: Our strategy revolves around seamless integration into legacy systems and forming partnerships with tech providers, such as custody solutions, integrators, and financial platforms. Through strategic ecosystem integrations, we empower partners to seamlessly utilize our engine, allowing them to concentrate on their core business and sales while we manage all technical aspects.

Enabling DeFi by building a common data set for private markets: Initiated by accelerating permissioned DeFi, this month, we co-developed an open-source UI component with Dev.Pro. With this tool, DeFi is now equipped for regulated assets through ERC-3643, enabling any decentralized exchanges (DEX), automated market makers (AMMs), or lending protocol to provide compliant liquidity or collateralization for tokenized securities and RWA. Regulated entities can even launch their lending smart contracts. Our next move involves building a universal data set for tokenized securities through a product named AssetID, facilitating easy access to verifiable asset data for DeFi applications.

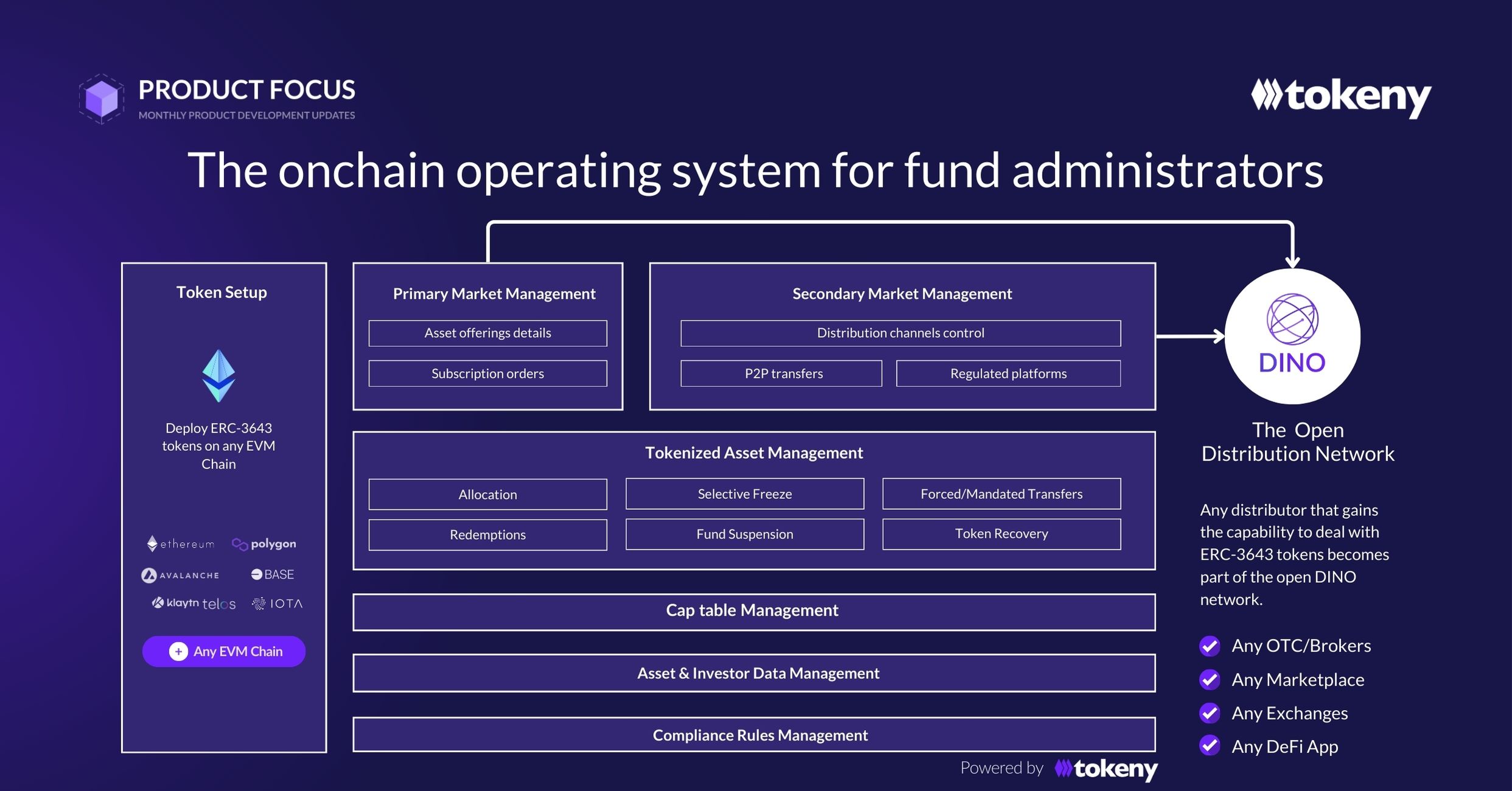

Building the distribution rails: DINO is an interoperable distribution network for digital securities that leverages the ERC-3643 standard. Our commitment to growth extends to integrating additional distribution channels into the DINO ecosystem. Compatibility with centralized exchanges (CEX) and AMMs is seamlessly established on our platform. As we eagerly await more DeFi protocols, the open-source UI component stands ready to welcome them. Think of us as a connector, ensuring a seamless convergence of all distribution rails on our platform.

Secondary market innovation: We will unveil an upgraded version of the Billboard, serving as a license-exempted P2P secondary market solution, enabling investors to seamlessly publish buy or sell intentions, just like placing an ad. Taking it a step further, we will introduce a fully decentralized version of the Billboard, entirely powered by smart contracts. This will allow counterparts to accept an offer directly on-chain, facilitating a peer-to-peer transaction. The offer can circulate across the entire distribution network, visible to all, but only eligible investors for the concerned tokens can accept it.

Exciting times lie ahead, and we look forward to embarking on this journey with you. Stay tuned for more developments throughout the year.

Subscribe Newsletter

This monthly Product Focus newsletter is designed to give you insider knowledge about the development of our products. Fill out the form below to subscribe to the newsletter.